ID: PMRREP14734| 218 Pages | 23 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

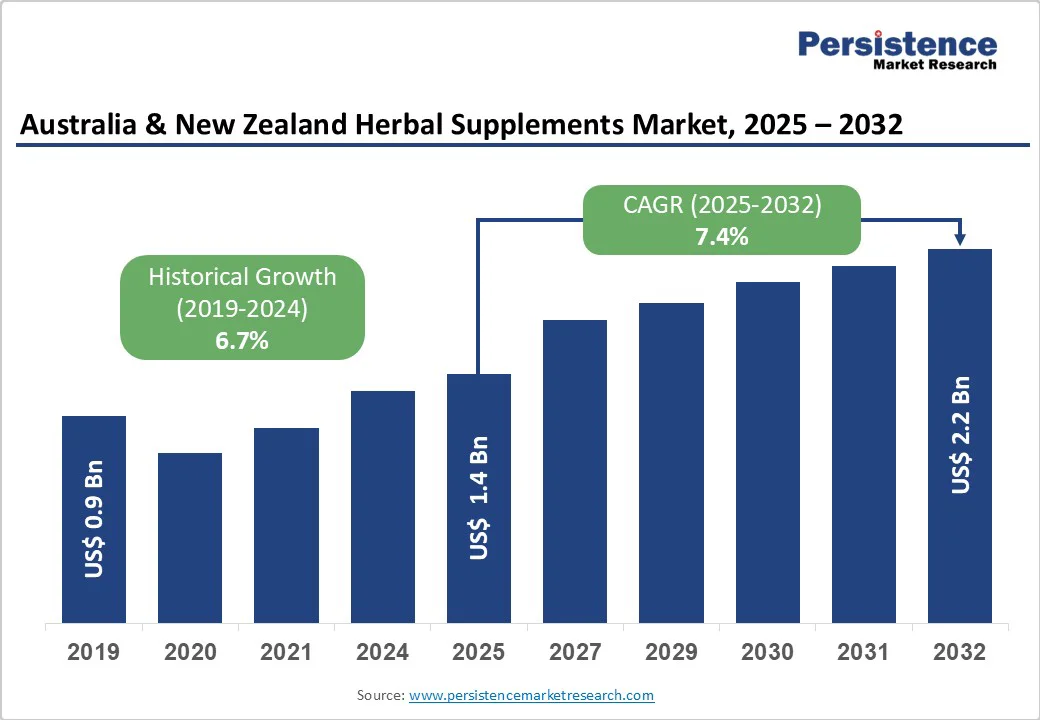

The Australia & New Zealand herbal supplements market size is likely to be valued at US$1.4 Billion in 2025 to US$2.2 Billion by 2032, growing at a CAGR of 7.4% during the forecast period from 2025 to 2032, driven by the increasing awareness about natural health solutions, rising prevalence of chronic diseases, and a shift toward preventive healthcare.

Consumers are increasingly choosing herbal supplements for immunity, wellness, and specific health needs like cardiovascular and joint support, with the organic and sustainable product trend and strong regulations driving market growth.

| Key Insights | Details |

|---|---|

| Herbal Supplements Market Size (2025E) | US$1.4 Bn |

| Market Value Forecast (2032F) | US$2.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.7% |

A major driver for the herbal supplements market in Australia and New Zealand is the growing awareness about health and wellness among consumers. With increasing cases of lifestyle-related diseases such as diabetes, hypertension, and heart disorders, people are turning toward natural and plant-based remedies for long-term health benefits. For instance, according to the Australian Bureau of Statistics (ABS) published in 2023, in Australia, nearly 46.6% of adults live with at least one chronic condition (arthritis, asthma, back pain, cancer, heart disease, diabetes, etc.).

Consumers are showing a strong preference for herbal supplements that support immunity, digestion, and chronic disease management. Government initiatives and public health campaigns promoting preventive healthcare are also influencing people to adopt herbal supplements in their daily routine.

The rising elderly population, especially the baby boomer generation, is boosting the demand for products that help maintain bone strength, joint flexibility, and heart health. The popularity of organic, chemical-free, and sustainably sourced botanicals is pushing manufacturers to develop safer and more effective products. Moreover, strong export demand from China, Europe, and Southeast Asia has positioned Australia and New Zealand as key suppliers of premium herbal products, further accelerating market growth across the region.

Despite steady growth, the herbal supplements market in Australia and New Zealand faces several key restraints. Regulatory challenges and varying quality standards across regions make it difficult for manufacturers to maintain consistency in production and exports.

Although both countries have strict quality control systems, the absence of alignment with global regulations creates trade barriers. Many herbal supplements are also not clinically tested or approved for efficacy, leading to consumer doubts about their effectiveness.

The growing number of low-quality or adulterated products has further weakened consumer confidence. Additionally, a common misconception that herbal supplements can completely replace prescribed medicines creates resistance among healthcare professionals.

Limited scientific data supporting certain herbal claims adds to this hesitation. Beyond regulatory and perception issues, environmental factors such as climate change, inconsistent crop yields, and pandemic-related disruptions have affected raw material availability, causing supply chain issues.

The herbal supplements market in Australia and New Zealand offers strong opportunities, especially through innovations in personalized herbal medicine. Companies can create customized herbal products based on individual health needs, supported by advances in digital health and AI technologies. This approach appeals to health-conscious consumers who prefer solutions tailored to their lifestyle and wellness goals. Sustainability and ethical sourcing also present key opportunities.

Consumers increasingly want transparency about where herbs are grown and whether products are organic or ethically produced. Businesses that focus on eco-friendly cultivation, traceability, and fair-trade practices can attract more trust and loyalty.

Export potential is another area of growth, with high demand in countries, including China and India. Using digital platforms for direct-to-consumer sales can also boost revenue. Additionally, the rising interest in natural beauty and skincare products creates new segments for herbal supplements, offering manufacturers multiple avenues to expand their market presence in the region.

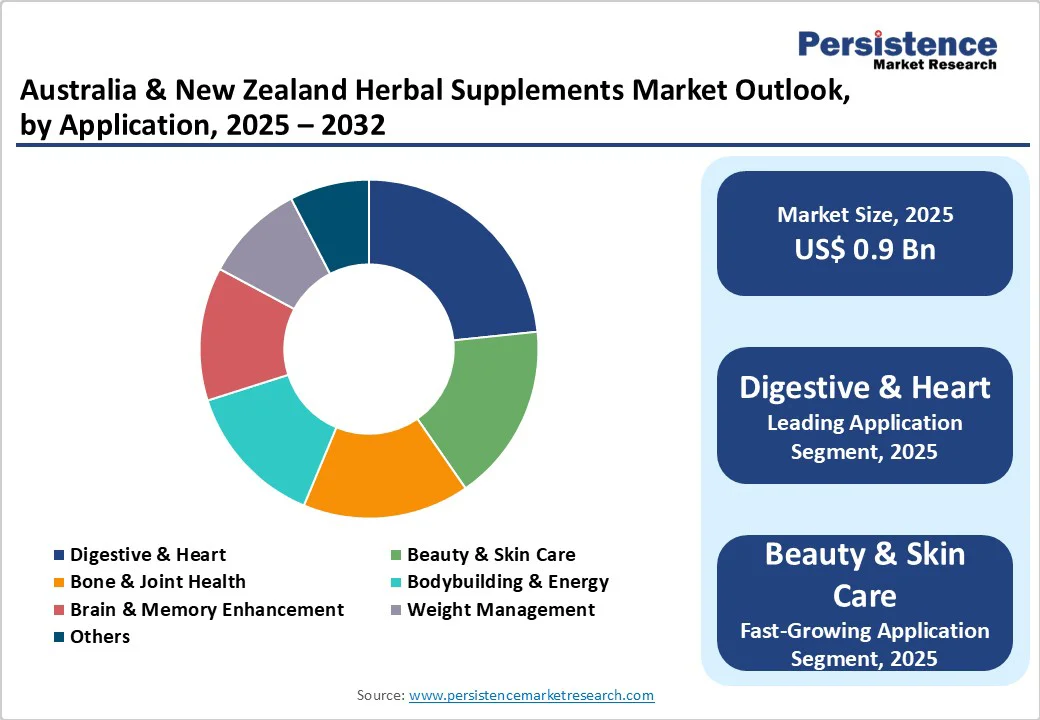

The digestive and heart health segment leads the herbal supplements market in Australia and New Zealand, holding the largest share among all applications. This growth is largely driven by rising consumer awareness about cardiovascular health and the benefits of herbal remedies in managing conditions such as hypertension, high cholesterol, and other heart-related disorders.

The prevalence of cardiovascular diseases in the region has increased in recent years, boosting demand for natural health solutions. Popular herbal ingredients in this segment include garlic, ginkgo biloba, and hawthorn, which are widely recognized for their positive effects on heart and digestive health. Scientific studies supporting the efficacy of these herbs further strengthen consumer confidence.

Regulatory frameworks in both countries also ensure the safe use of these supplements, encouraging wider adoption. Currently, the digestive and heart health segment accounts for an estimated 24% of the overall herbal supplements market, reflecting its dominant position and continued growth potential.

In Australia and New Zealand, pharmacies and drug stores dominate the herbal supplements market due to high consumer trust in established physical retail outlets for health-related products. Shoppers often prefer visiting these stores to verify product authenticity, consult with pharmacists, and make informed choices. The presence of trained staff and the ability to examine products physically strengthen consumer confidence, making brick-and-mortar stores the preferred purchase channel for many.

Despite this dominance, the online retail segment is growing rapidly. Consumers increasingly turn to e-commerce platforms for convenience, wider product variety, and competitive pricing. The rising health awareness among individuals has led them to seek detailed information, reviews, and guidance online before making a purchase.

Digital platforms also offer subscription services, personalized recommendations, and doorstep delivery, which attract busy and tech-savvy customers. This evolving consumer behavior is gradually reshaping the market, making online retail a key growth avenue alongside traditional pharmacies and drug stores in the herbal supplements sector of Australia and New Zealand.

The herbal supplements market in Australia is witnessing a growing focus on natural and plant-based products, driven by increasing health consciousness among consumers. Personalized nutrition and immunity-boosting supplements are gaining popularity. There is a strong shift toward preventive healthcare, with demand for vitamins, minerals, and herbal blends rising. E-commerce adoption is accelerating, allowing consumers to compare products and access niche offerings.

Sustainability and organic certifications are influencing purchase decisions, as environmentally conscious buyers prefer ethically sourced products. Collaborations between local brands and wellness influencers are also boosting market visibility, while pharmacies remain a key trusted channel for herbal supplement purchases.

In New Zealand, the herbal supplements market is expanding due to rising interest in wellness and holistic health practices. Consumers increasingly prefer natural remedies for immunity, digestion, and stress management. The demand for plant-based and organic supplements is growing, reflecting a shift toward eco-friendly and ethical consumption. Online retail platforms are becoming more prominent, providing easy access to specialized products and promoting customer reviews.

Local brands are leveraging indigenous botanicals and traditional knowledge to create differentiated offerings. Health-conscious millennials and aging populations are driving growth, while pharmacies, health stores, and specialty outlets continue to play a central role in influencing purchase decisions.

The herbal supplements market in Australia and New Zealand is characterized by a fragmented yet highly competitive landscape. Numerous small and medium-sized enterprises coexist with regional leaders such as Blackmores Limited, Vitaco Holdings Limited, and Integria Healthcare.

Companies are adopting strategies such as mergers, acquisitions, and partnerships with biotechnology firms to strengthen their R&D and distribution networks. Innovations in product formulations, sustainable sourcing practices, and digital marketing are primary differentiators for market leaders.

The focus on high-quality standards and organic certifications has created a premium product environment, fostering trust among consumers. Emerging business models include direct-to-consumer e-commerce platforms and personalized herbal solutions supported by AI and data analytics.

The Australia & New Zealand herbal supplements market is projected to be valued at US$1.4 Billion in 2025.

Growing health awareness, demand for natural remedies, immunity, digestion, and wellness products are the major drivers.

The Australia & New Zealand herbal supplements market is poised to witness a CAGR of 7.4% between 2025 and 2032.

The key opportunities include personalized supplements, AI-driven formulations, sustainable sourcing, ethical production, exports, digital sales, and natural beauty segments.

Top companies operating in the Australia & New Zealand herbal supplements market are Blackmores Limited, Vitaco Holdings Limited, Integria Healthcare, and Bioglans.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Country Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Application

By Distribution Channel

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author