ID: PMRREP34567| 188 Pages | 24 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

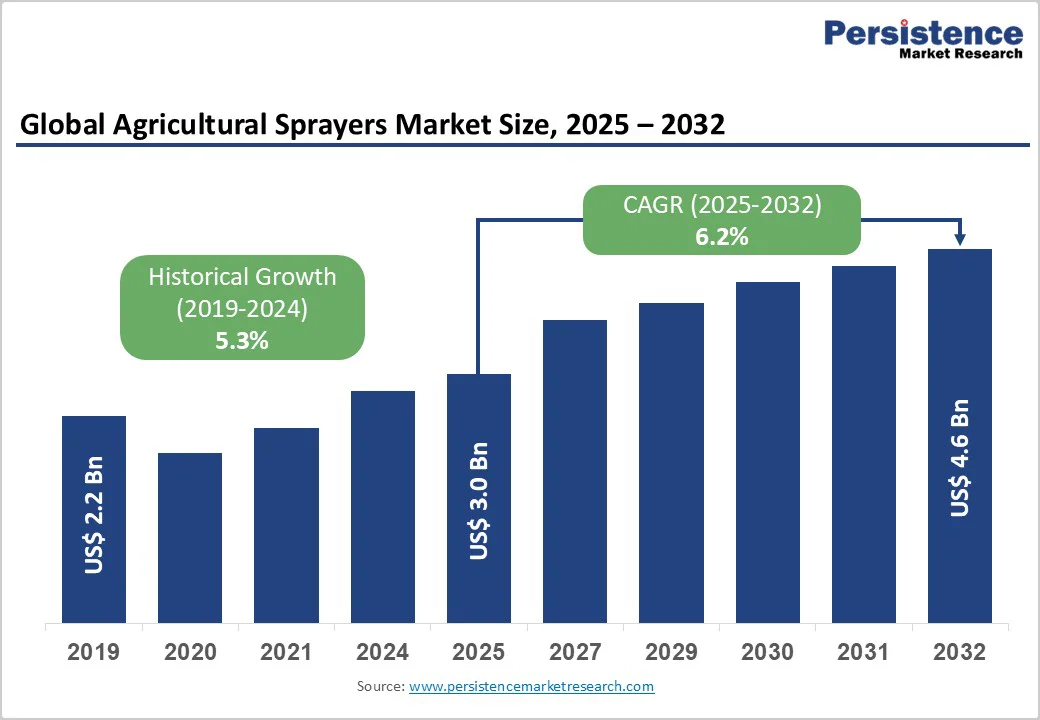

The global agricultural sprayers market size is likely to be valued at US$ 3.0 billion in 2025, and is projected to reach US$ 4.6 billion by 2032, growing at a CAGR of 6.2% during the forecast period 2025 - 2032.

Growth is driven by rising global food demand, pushing farmers toward mechanized and precision spraying solutions to enhance yield and efficiency. Adoption of GPS-guided, AI-enabled, and variable rate technologies has made spraying more data-driven, cutting chemical use by up to 30%. Severe labor shortages in North America and Europe are accelerating the shift toward self-propelled and autonomous sprayers for improved productivity and cost efficiency.

| Key Insights | Details |

|---|---|

| Agricultural Sprayers Market Size (2025E) | US$ 3.0 Bn |

| Market Value Forecast (2032F) | US$ 4.6 Bn |

| Projected Growth CAGR (2025 - 2032) | 6.2% |

| Historical Market Growth (2019 - 2024) | 5.3% |

The agricultural sprayers market is growing rapidly as developing economies mechanize farming operations and implement supportive government policies. Governments across Asia Pacific, Latin America, and Africa are providing subsidies and credit programs to help farmers purchase modern agricultural equipment.

Workforce trends are accelerating adoption of powered spraying systems, as agricultural employment shifts away from manual labor in countries such as China and India. Small and mid-sized farms in developing regions are increasingly adopting drone and electric sprayers to reduce labor costs and improve operational efficiency.

These advancements support improved spray precision, reduced expenses, and expanded market opportunities for both local and international sprayer manufacturers.

Environmental regulations worldwide are also accelerating the adoption of advanced, eco-efficient sprayer technologies that reduce chemical usage while maintaining productivity. Regulatory frameworks in the European Union (EU), North America, and Asia establish requirements for lower pesticide application and higher precision spraying.

Precision spraying methods such as variable-rate and drone-based systems help farmers meet regulatory compliance while reducing chemical inputs and improving crop quality. The transition toward sustainability is encouraging farmers to replace traditional fuel-powered sprayers with electric and battery-powered alternatives.

As precision farming adoption continues to expand across commercial and organic farms, the demand for compliant, resource-efficient sprayers is increasing significantly.

High upfront costs remain a significant barrier to widespread adoption of precision spraying technologies, particularly among small and mid-size farmers in developing economies where profit margins are narrow. Advanced spraying equipment represents a substantial capital investment that many farmers cannot afford without financing support.

Limited availability of financing options, combined with lack of trained operators and insufficient post-purchase technical support in rural areas, further complicates adoption decisions. Several farmers continue using traditional manual sprayers or low-cost fuel-powered equipment due to these affordability constraints, slowing mechanization progress and limiting technology adoption in price-sensitive agricultural markets.

Government subsidy programs exist but reach only a fraction of potential users, leaving most small-scale farmers unable to access modern spraying technology despite its productivity and environmental benefits.

The transition to electric and battery-powered sprayers faces practical challenges related to rural electricity access and charging infrastructure availability, particularly in developing economies. Although electric sprayers reduce fuel consumption and greenhouse gas emissions compared to diesel equipment, limited battery runtime restricts their effectiveness on large farms requiring extended spraying operations.

Rural areas in Asia Pacific, the world's largest agricultural sprayer market, often lack dependable electrical supply, confining electric sprayers mainly to smaller orchards and mid-sized farms in more developed regions. High battery replacement costs, extended charging cycles, and emerging recycling regulations add financial barriers to adoption.

Artificial intelligence, machine learning (ML), and sensor-based imaging are transforming agricultural spraying by enabling highly precise, efficient, and sustainable chemical applications. AI-powered sprayers can identify weeds in real time and reduce chemical use by up to 70%, enhancing both crop health and environmental outcomes.

Leading companies such as CNH Industrial, AGCO Corporation, and Stara S/A have introduced smart, AI-integrated sprayers that operate autonomously, reducing labor dependence and increasing field efficiency.

Aerial drone spraying services are rapidly growing, with the global agricultural drone spraying market expected to surge significantly over the next decade. Equipped with GPS, multispectral sensors, and AI analytics, drones improve spraying accuracy and can cover large areas quickly with minimal soil disruption.

Government initiatives in countries like India and the U.S. are promoting drone adoption from commercial farms to medium-sized holdings, driving market expansion. Broadly, the agricultural sprayer market growth is getting fueled by digital innovations, autonomy, sustainability demands, and increasing focus on precision agriculture technologies.

Self-propelled sprayers lead with 32.7% of the agricultural sprayers market revenue share in 2025, underscoring the transition toward mechanized and autonomous spraying systems. Equipped with integrated engines, hydraulic controls, and wide spray booms, these units deliver consistent pressure and coverage across large, uneven terrains.

Their suitability for expansive commercial farms, coupled with features such as GPS guidance and automatic section control, makes them indispensable for modern precision agriculture operations seeking efficiency and productivity gains.

The fastest-growing segment through 2032 is expected to be aerial sprayers, including drones and unmanned aerial vehicles (UAVs), driven by rapid adoption in Asia Pacific and North America. Their ability to cover up to 40 acres per hour with minimal soil compaction and labor input positions them as a transformative alternative for both small and large farms, particularly under labor-scarcity conditions.

Large farms dominate global sprayer demand, accounting for 43.1% of the market in 2025. Mechanization necessity and labor shortages across vast agricultural operations spanning hundreds of hectares underpin this dominance. Large-scale enterprises increasingly deploy advanced self-propelled sprayers integrated with GPS-based precision controls, variable rate application systems, and autonomous guidance technologies to optimize productivity and input efficiency.

The medium farm segment is expanding rapidly, supported by agricultural modernization programs and rising access to financing for mid-tier farmers in developing regions. These farms are transitioning from manual or tractor-mounted systems toward semi-automated electric and battery-powered sprayers to enhance productivity while managing operational costs.

The segment’s evolution reflects the democratization of precision spraying technology beyond large-scale commercial farming.

Fuel-based sprayers dominate the market with a 56.8% share in 2025, reflecting farmers’ reliance on diesel-powered equipment for large-scale operations. These sprayers provide extended runtime, high pressure, and easy refueling, making them ideal for time-sensitive applications during pest or disease outbreaks. Established maintenance infrastructure and operational familiarity further reinforce their market leadership.

At the same time, battery-powered sprayers represent the fastest-growing category, projected to grow at a 17.9% CAGR through 2032. Advancements in lithium-ion battery efficiency, declining costs, and government initiatives promoting low-emission equipment are driving adoption. Their quiet operation, low maintenance, and zero fuel dependency make them increasingly popular for mid-sized farms and environmentally regulated agricultural zones.

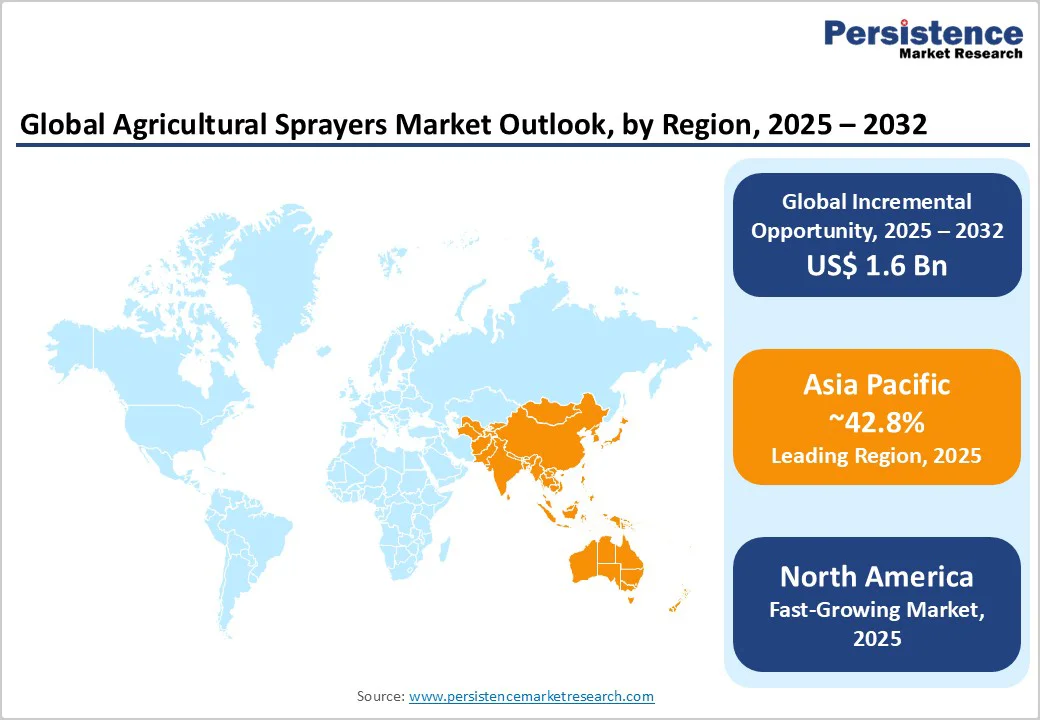

North America accounts for around 27.4% of the agricultural sprayers market share in 2025, supported by its advanced precision agriculture infrastructure, government initiatives, and early adoption of autonomous spraying technologies.

The U.S. remains the regional leader, with Deere & Company, AGCO Corporation, and CNH Industrial driving innovation in smart and sustainable spraying systems. Supportive programs such as the Sustainable Canadian Agricultural Partnership and the Agri-Tech Innovation Initiative are further strengthening precision equipment deployment and technology integration.

The region continues to see strong adoption of self-propelled and AI-enabled sprayers equipped with GPS guidance, telemetry, and variable rate control. Expanding high-value crop cultivation and a focus on sustainability-driven chemical management reinforce North America’s leadership in advanced spraying technologies and its continued position as a key innovation hub in global agriculture.

The Europe agricultural sprayers market is expanding steadily at a 2025 - 2032 CAGR of 6.3%, driven by stringent environmental regulations, sustainability mandates, and rising adoption of electric-powered equipment.

Germany leads the region, benefiting from strong engineering capabilities and export-driven agricultural machinery production. EU policies such as the Sustainable Use of Pesticides Directive and INRAE’s Growing and Protecting Crops Differently (PPR-CPA) program are accelerating the transition toward precision agriculture and responsible chemical application.

The growing shift toward organic and eco-efficient farming, particularly in Germany and France, is boosting demand for high-precision field sprayers. Manufacturers such as EXEL Industries, Kuhn Group, and Deere & Company are leading advancements in GPS-guided, AI-based, and variable rate spraying systems, positioning Europe as a benchmark region for sustainable and technology-driven crop protection solutions.

Asia Pacific dominates the agricultural sprayers landscape, accounting for 42.8% of global revenues in 2025. The region’s leadership is underpinned by vast agricultural acreage, strong government subsidy programs, and rapid mechanization across India, China, and Japan.

Widespread deployment of drones and self-propelled sprayers by companies such as DJI, XAG, and Kubota reflects the shift toward automation and efficiency in farming practices. Initiatives such as India’s Drones4Rice project have further accelerated digital spraying adoption.

Declining agricultural labor availability across the region has intensified demand for mechanized spraying systems. Southeast Asia, in particular, offers strong growth potential through large-scale rice and plantation crop cultivation. Solar and battery-powered sprayers are gaining traction in water-scarce regions, supported by renewable energy policies. Asia Pacific stands as both the largest and fastest-growing regional market for advanced spraying technologies.

The global agricultural sprayers market structure is moderately consolidated, with top-tier manufacturers accounting for a significant share of global revenues. Market leadership is concentrated among firms with strong R&D capabilities, advanced manufacturing infrastructure, and extensive global distribution networks.

The capital-intensive nature of sprayer production, coupled with the growing need for precision and automation technologies, creates high entry barriers, reinforcing consolidation across major players and regional specialists.

Competition increasingly centers on innovation rather than price, with leading companies focusing on AI integration, autonomous spraying, and digital farm management ecosystems. Emerging manufacturers are targeting affordable solutions for developing markets, while service-based models such as equipment leasing and drone-spraying networks are reshaping the competitive dynamics of the agricultural sprayers market.

The global agricultural sprayers market is projected to reach US$ 3.0 billion in 2025.

Key drivers include agricultural mechanization, precision agriculture adoption, labor shortages, environmental regulations, and government subsidy support.

The market is poised to witness a CAGR of 6.2% from 2025 to 2032.

Major opportunities include AI-integrated autonomous sprayers, drone-based spraying services, battery-electric equipment, and digital farm management platforms.

Some of the key market players include Deere & Company, CNH Industrial, AGCO Corporation, Kubota, Mahindra & Mahindra, and EXEL Industries.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Farm Size

By Power Source

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author