ID: PMRREP32955| 150 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

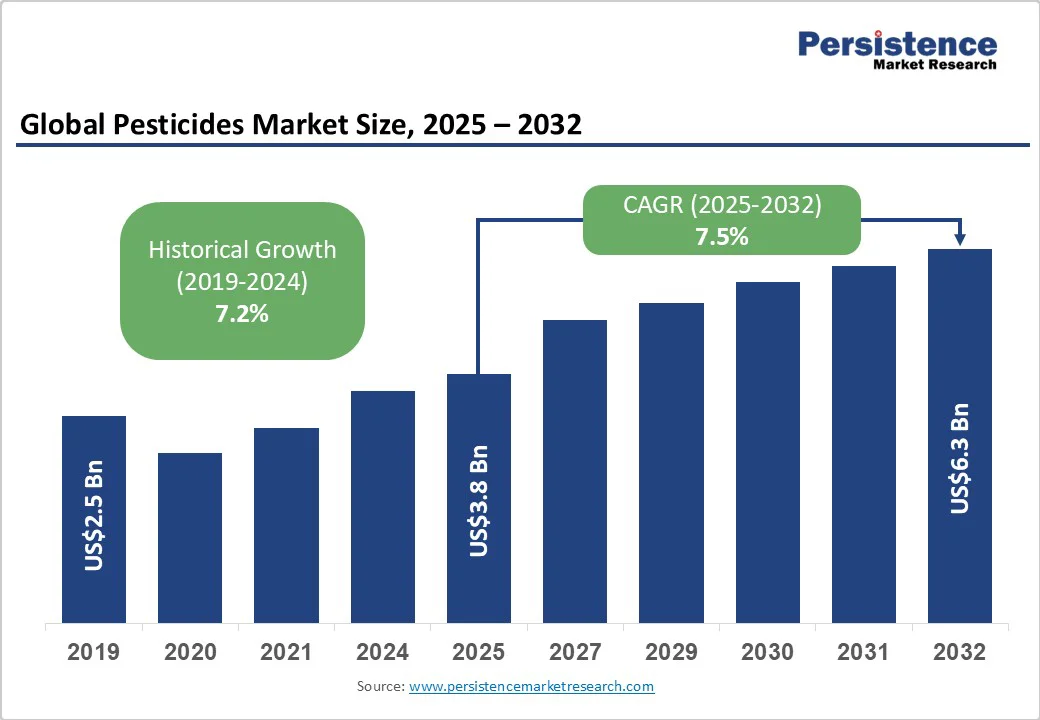

The global pesticides market size is likely to be valued at US$3.8 Billion in 2025 and is estimated to reach US$6.3 Billion in 2032, growing at a CAGR of 7.5% during the forecast period 2025 - 2032.

The pesticides market growth is being spurred by the need to ensure food security and sustain high crop yields for a surging global population. Rising pest pressures, evolving pest resistance, and climate-related challenges further boost demand.

| Key Insights | Details |

|---|---|

| Pesticides Market Size (2025E) | US$3.8 Billion |

| Market Value Forecast (2032F) | US$6.3 Billion |

| Projected Growth (CAGR 2025 to 2032) | 7.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.2% |

The global population surge is placing unprecedented pressure on agricultural systems to produce more food from limited arable land. Pesticides play a key role in safeguarding crop yields against pest infestations, ensuring a consistent food supply.

For example, in 2024, the Food and Agriculture Organization of the United Nations (FAO) highlighted that staple crops such as wheat and rice in Asia Pacific faced drastic yield losses due to pest outbreaks, which were mitigated through timely pesticide applications.

As governments and agribusinesses prioritize food security, pesticide use becomes essential to reduce pre- and post-harvest losses, maintain export quality, and stabilize market supply. The rising demand for calorie-dense crops such as cereals and grains amplifies the demand for effective crop protection, making pesticides a key tool for feeding growing populations while supporting economic stability in agricultural communities.

Pests are continuously evolving, developing resistance to conventional chemical treatments, which has boosted the reliance on modern pesticides. Overuse and repeated application of the same active ingredients have led to resilient pest populations, especially in high-intensity farming regions. For instance, studies in 2025 reported increasing glyphosate-resistant weed species across U.S. soybean and corn fields, compelling farmers to adopt new or combined pesticide formulations.

This trend propels innovation in both synthetic and bio-pesticides, encouraging the development of compounds with novel modes of action. The arms race between evolving pests and crop protection technologies further fuels sustained growth in pesticide consumption. It is also promoting research into integrated pest management strategies that balance efficacy and environmental safety.

The widespread use of pesticides has raised significant public health concerns, as exposure can lead to severe ailments such as cancers, neurological disorders, and reproductive issues. For example, a 2024 study in California linked prolonged exposure to organophosphate pesticides with increased rates of Parkinson’s disease among agricultural workers.

Similarly, glyphosate exposure has been scrutinized for potential carcinogenic effects, leading to ongoing legal and regulatory debates. In developing regions, improper handling and lack of protective equipment exacerbate these risks, with incidents of acute poisoning reported frequently in rural communities.

Pesticide application can have profound ecological consequences, contaminating soil and water bodies and disrupting natural ecosystems. Persistent chemicals such as neonicotinoids and organochlorines have been linked to declines in pollinator populations, including bees, which are essential for crop fertilization.

Runoff from treated fields often carries residues into rivers and lakes, affecting aquatic life and leading to bioaccumulation in food chains. Soil health is also compromised, reducing microbial diversity and nutrient cycling, which can affect long-term agricultural productivity.

The rise of microbial and botanical pesticides is creating new growth avenues in the pesticides market. These bio-based solutions deliver targeted pest control while minimizing harm to humans, beneficial insects, and the environment.

For example, in 2025, Syngenta launched a microbial biofungicide for tomato crops in Southeast Asia that reduced chemical fungicide usage by over 50% while maintaining yield. Governments and certification bodies are also promoting organic and sustainable agriculture, creating high demand for biopesticides.

Nanotechnology is transforming pesticide application by enabling precise targeting and controlled release of active ingredients. Nano-formulations improve solubility, reduce volatilization, and allow for slow-release mechanisms, improving efficacy while reducing chemical use.

In 2024, researchers at the University of California developed a nano-encapsulated insecticide for citrus crops that maintained pest control for 30 days with a single application, cutting runoff into waterways by 60%. Such precision reduces environmental contamination and mitigates resistance development in pests.

Bio-pesticides are predicted to account for approximately 67.2% of the market share in 2025, backed by their environmentally friendly profile and specificity. They target specific pests without harming beneficial insects, soil microbiota, or humans.

For example, in 2024, BASF and Marrone Bio Innovations launched a new biopesticide for fruit orchards in Asia Pacific that reduced chemical usage by 60% while maintaining yield. The rising global emphasis on sustainable agriculture, organic certification standards, and strict residue regulations in exports further pushes adoption.

Synthetic pesticides continue to see decent growth because they provide fast, broad-spectrum pest control essential for large-scale farming. Developments in formulation, such as micro-encapsulation and slow-release technologies, improve efficacy and reduce environmental runoff.

For instance, Corteva and FMC introduced novel synthetic herbicides in 2025 for corn and soybean that target resistant weed strains, supporting high productivity and crop protection in regions with pest-resistant challenges.

Liquid pesticides are anticipated to hold a share of about 55.9% in 2025, owing to their versatility and ease of application. They can be efficiently mixed with water and applied using various spraying equipment, ensuring uniform coverage over large areas. This adaptability makes them suitable for diverse agricultural settings, from small-scale farms to expansive commercial operations.

Dry pesticides, encompassing wettable powders and granules, are experiencing considerable growth due to their targeted application and reduced risk of drift. Granules are ideal for soil treatments as they minimize exposure to non-target organisms and are less likely to be absorbed through the skin compared to liquids. This characteristic makes them safe for applicators and beneficial insects.

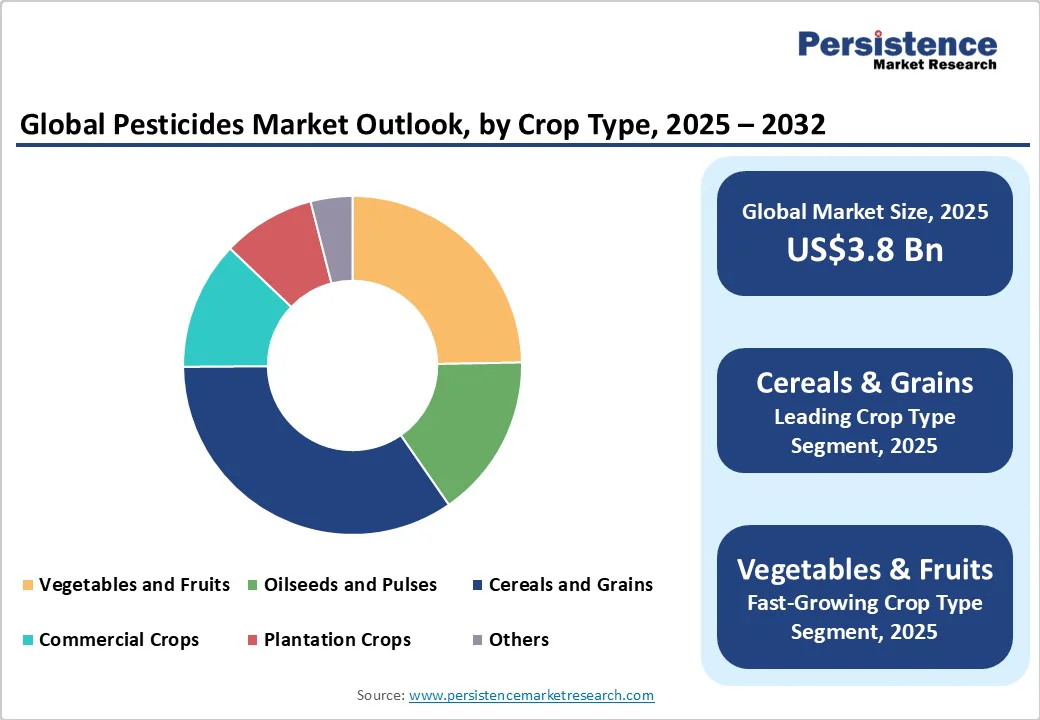

Cereals and grains are estimated to dominate with a share of nearly 34.6% in 2025, fueled by their high caloric yield per hectare, making them efficient staples for feeding large populations. They are rich in carbohydrates and serve as primary energy sources in multiple diets.

For instance, rice is a staple food for over half of the world's population, especially in Asia Pacific and Africa. Cereals such as wheat and maize are also integral to various food products, from bread to processed snacks.

Vegetables and fruits are key crop types because they provide essential vitamins, minerals, and dietary fiber, contributing to a balanced diet and combating hidden hunger. For example, vegetables deliver various micronutrients important for health. Also, the cultivation of diverse vegetable and fruit crops supports biodiversity, improving ecosystem resilience and reducing the risk of pest and disease outbreaks.

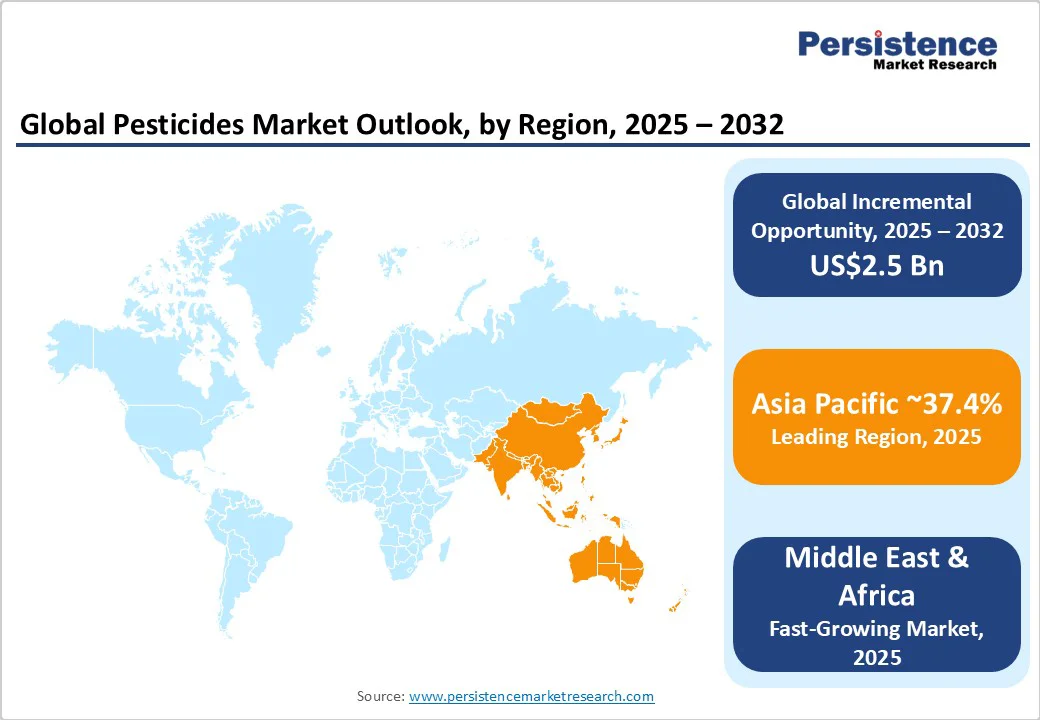

Asia Pacific is predicted to account for approximately 37.4% of the market share in 2025, owing to its vast agricultural landscape and rising demand for food security. In 2024, the region produced approximately 11 million tons of pesticides, marking a 9.4% increase from the previous year. This growth reflects a consistent upward trend, with production rising at an average annual rate of 5.1% over the past decade.

China and India are the leading consumers of pesticides in the region. However, the extensive use of pesticides has raised significant health and environmental concerns. In 2023, India reported over 1,197 pesticide-related accidental deaths across Punjab, Haryana, and Himachal Pradesh, accounting for more than 15% of the country's total pesticide fatalities. Also, a 2025 study showed alarming health and environmental consequences of pesticide use in Bangladesh, India, Laos, and Vietnam.

In the Middle East and Africa, pesticide use is increasing steadily, spurred by the requirement to boost agricultural productivity in areas facing food security challenges. However, this surge in pesticide application has raised significant health and environmental concerns. In Kenya, for instance, the Pest Control Products Board banned the open-field use of thiamethoxam and abamectin in December 2024 to protect pollinators.

Despite this, several smallholder farmers continue to use highly toxic pesticides without proper protective gear, leading to health issues such as skin irritation and respiratory problems. The government of Kenya has linked these chemicals to rising cancer rates, emphasizing the urgent requirement for better regulation and education on safe pesticide use. Initiatives such as the Sustainable Pesticide Management Framework (SPMF) have been launched in various countries, including Egypt.

In North America, pesticide use remains integral to agricultural practices, yet it is increasingly scrutinized due to health and environmental concerns. In 2024, the U.S. Environmental Protection Agency (EPA) took significant regulatory actions, including banning DCPA (Dacthal), a pesticide linked to fetal health risks, marking its first emergency pesticide ban in nearly 40 years. In addition, the EPA revoked tolerances for certain pesticide residues such as afidopyropen on lettuce, reflecting a more stringent approach to pesticide regulation.

State-level legislation also reflects rising concerns. Vermont passed a bill severely restricting neonicotinoids, a class of pesticides harmful to pollinators, aiming to protect over 300 native bee species. Technological developments are further influencing pesticide application methods. A 2024 study demonstrated that robotic spot-spraying technology on sugarcane farms reduced herbicide usage by up to 65% compared to traditional broadcast spraying.

The global pesticides market is undergoing significant transformations due to evolving market dynamics, regulatory pressures, and technological developments. A notable trend is the strategic restructuring among major agrochemical companies.

For instance, Corteva announced plans to separate its seed and pesticide units into independent, publicly traded companies by the second half of 2026. Regulatory challenges are also influencing the competitive landscape. In Europe, the debate over acceptable daily intake standards for trifluoroacetic acid (TFA), a persistent chemical resulting from the degradation of many per- and polyfluoroalkyl substances (PFAS), has intensified.

Leading pesticide companies focus on innovation, developing bio-based and precision crop protection solutions, while pursuing cost leadership through operational efficiency. Market expansion into Asia Pacific and Africa is common. Key differentiators include unique formulations, sustainable products, and regulatory compliance. Emerging trends involve digital agriculture services, integrated pest management solutions, and collaborative research and development partnerships.

The pesticides market is projected to reach US$3.8 Billion in 2025.

Rising global population and evolving pest resistance are the key market drivers.

The pesticides market is poised to witness a CAGR of 7.5% from 2025 to 2032.

Developments in microbial, botanical, and nano-formulated pesticides are the key market opportunities.

BASF SE, The DOW Chemical Company, and Sibbiopharm Ltd. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By Crop Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author