ID: PMRREP33598| 198 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

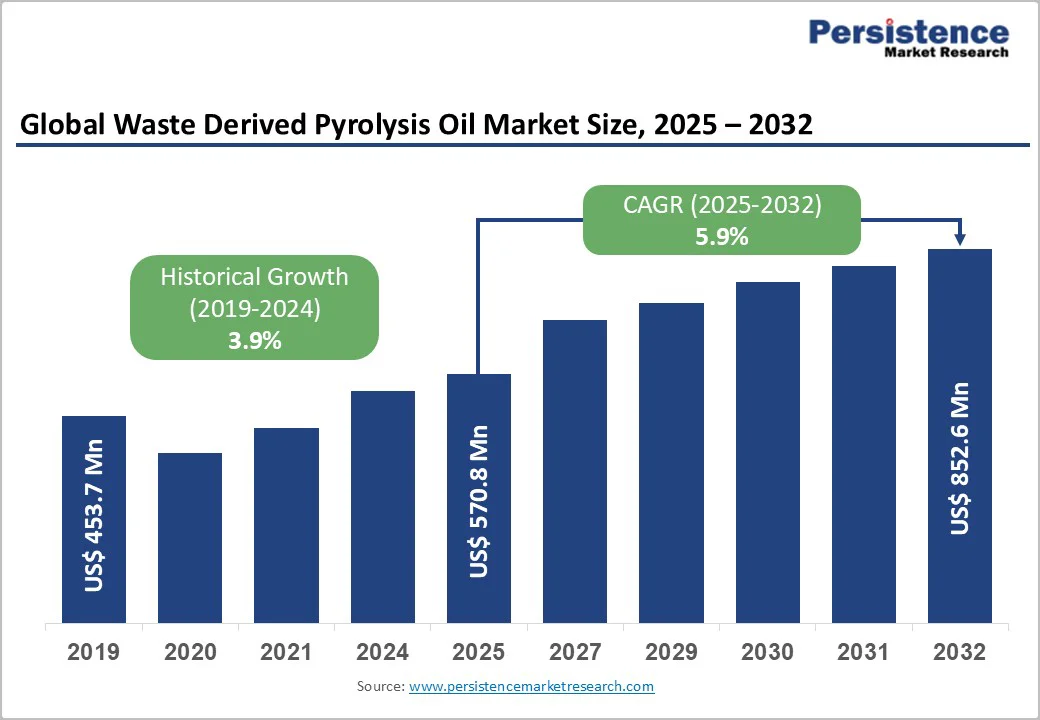

The global waste derived pyrolysis oil market size was valued at US$ 570.8 million in 2025 and is projected to reach US$ 852.6 million, growing at a CAGR of 5.9% between 2025 and 2032. Market expansion is driven by accelerating global plastic waste crisis, increasing government circular economy policies and waste-to-energy mandates supporting pyrolysis technology adoption. Rising renewable fuel requirements, environmental regulations restricting landfilling and incineration, and technological advancements improving conversion efficiency and oil quality, further supports the market growth.

| Key Insights | Details |

|---|---|

|

Waste Derived Pyrolysis Oil Market Size (2025E) |

US$ 570.8 Mn |

|

Market Value Forecast (2032F) |

US$ 852.6 Mn |

|

Projected Growth CAGR(2025-2032) |

5.9% |

|

Historical Market Growth (2019-2024) |

3.9% |

Global plastic waste crisis creates exceptional market opportunity for waste-derived pyrolysis oil technology addressing environmental sustainability and waste management challenges. Global plastic waste generation exceeding 400 million metric tons annually with limited recycling capacity creating urgent need for alternative disposal technologies. Plastic waste reaching landfills and oceans at alarming rates driving government regulations and extended producer responsibility mandates supporting pyrolysis adoption. Circular economy policies increasingly requiring waste valorization and material recovery across developed and emerging markets.

Non-recyclable plastic waste including mixed plastics, contaminated materials, and multilayer films representing ideal feedstock for pyrolysis conversion. Waste management companies and municipalities seeking cost-effective solutions addressing landfill diversion targets and environmental compliance. Revenue generation opportunities through waste-to-fuel conversion providing economic incentives for technology investment. Growing public pressure and corporate sustainability commitments supporting demand for environmentally-responsible waste solutions. Market opportunity reflects fundamental shift toward circular economy principles and waste valorization.

Global renewable energy transition and climate policy creates substantial waste-derived pyrolysis oil demand through requirement for alternative fuels and decarbonization strategies. Energy transition initiatives across developed and emerging markets requiring diverse fuel alternatives supporting grid stability and operational flexibility. Industrial sector seeking cost-competitive alternatives to fossil fuels supporting energy cost optimization and carbon footprint reduction. Pyrolysis oil compatibility with existing diesel engines and heating systems enabling rapid technology adoption without infrastructure overhaul.

Transportation sector exploring alternative fuels supporting emission reduction targets creating demand for pyrolysis-derived diesel substitutes. Government renewable fuel mandates and blending requirements establishing minimum alternative fuel utilization targets. Climate policy investments supporting renewable energy infrastructure development accelerating market expansion. Declining energy costs through pyrolysis technology improvements enhancing competitive positioning versus virgin fossil fuels. Consistent energy transition commitment supports multi-year market expansion.

Pyrolysis facility construction requiring significant capital investment limiting new entrant market participation and expansion. Facility cost ranging from US$ 20-50 million for commercial-scale operations restricting market accessibility to large-scale operators. Long project development timelines extending 2-3 years from planning through operational commencement. Technology scalability challenges affecting conversion efficiency at higher volumes impacting operational margins. Skilled workforce and technical expertise requirements limiting facility availability particularly in emerging markets.

Pyrolysis oil quality variability depending on feedstock composition and processing parameters creating consistency challenges affecting market adoption. Impurities and contaminants requiring additional refining before certain applications increasing operational costs. Engine and equipment compatibility concerns limiting application flexibility. Regulatory approvals and quality certifications requiring time and investment slowing commercialization timelines.

Rapid advancements in fast and flash pyrolysis technologies present a major opportunity for the global waste-derived pyrolysis oil market, enabling higher conversion efficiencies, improved oil quality, and lower production costs. Flash pyrolysis systems achieving around 70% liquid-oil yield with reaction times measured in seconds significantly enhance commercial viability by maximizing output and minimizing thermal losses. Next-generation thermal conversion systems are now capable of delivering up to 90% plastic-to-oil conversion efficiency at optimized temperatures, strengthening economic performance for large-scale operations. The development of modular and containerized pyrolysis units further supports distributed and decentralized waste-processing models, enabling integration with municipal waste collection networks and reducing logistics costs.

Catalyst-enhanced pyrolysis technologies are also improving oil quality, reducing impurities, and delivering more consistent fuel-grade outputs, expanding downstream applications in energy and chemicals. Increasing process automation, digital monitoring, and AI-driven control systems are reducing operational complexity, accelerating adoption among both small and large operators. Meanwhile, ongoing international standardization efforts for pyrolysis oil quality, safety, and performance are helping build market confidence and attract institutional investment. As these technologies mature, advanced pyrolysis oils command premium pricing and margin advantages, positioning technology-led operators for significant growth.

Refined pyrolysis oil (diesel, petrol/gasoline, and industrial fuel oil) dominates the global waste-derived pyrolysis oil market, accounting for nearly 58% of total product demand. This dominance is primarily driven by its compatibility with existing fuel infrastructure, enabling seamless blending and substitution in transportation fleets, industrial boilers, and power generation systems without requiring extensive equipment modifications.

Among these segments, refined diesel-grade pyrolysis oil holds the largest share at approximately 35%, supported by its widespread use in diesel engines, standby power units, heavy machinery, and industrial heating applications. Its superior combustion characteristics, higher energy density, and performance metrics comparable to conventional petroleum diesel make it the preferred refined product among commercial users.

Plastic waste remains the dominant feedstock source for waste-derived pyrolysis oil, accounting for approximately 72% of total market utilization. Its leadership is driven by the massive global availability of post-consumer and industrial plastic waste streams, coupled with superior thermal conversion efficiency compared to biomass or mixed waste inputs. Plastics, such as LDPE, HDPE, and Polystyrene deliver higher oil yields, more consistent product quality, and better process stability, making them the preferred choice for large-scale pyrolysis operations. The escalating global plastic waste crisis, supported by regulatory mandates for chemical recycling and corporate commitments to circular material sourcing, further strengthens plastic waste’s role as the primary feedstock.

Advancements in sorting, mechanical pre-treatment, and contamination removal enhance feedstock reliability, enabling operators to scale output while maintaining oil quality standards aligned with petrochemical and fuel-grade applications. As a result, plastic waste continues to anchor the feedstock segment, driving both market growth and investment in next-generation pyrolysis technologies.

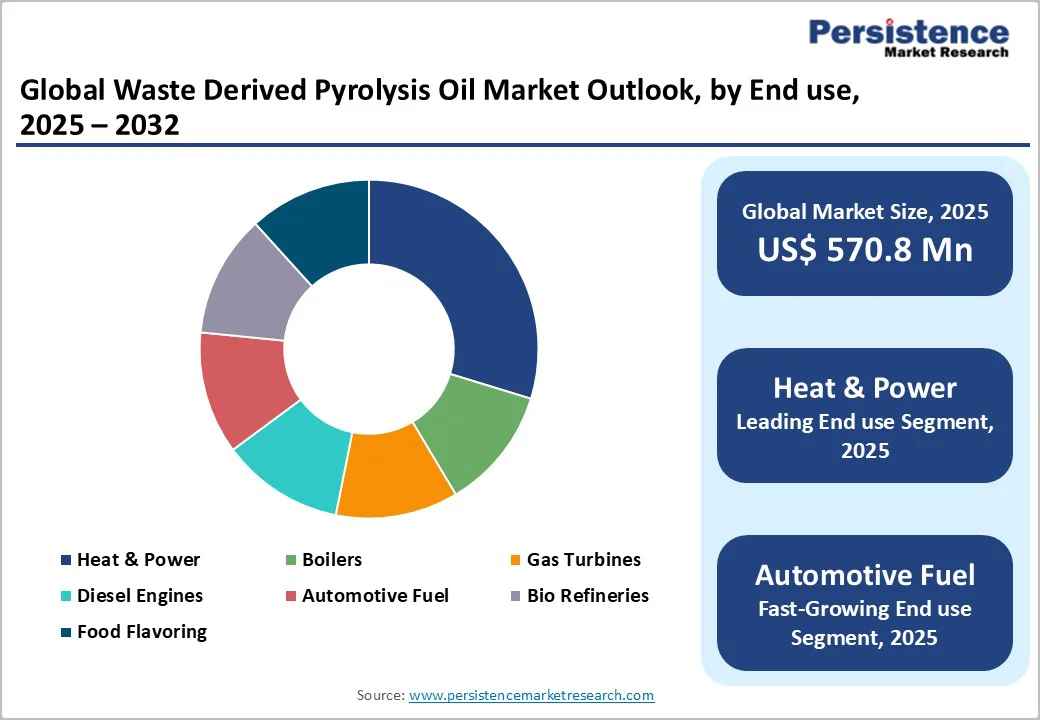

Heat and power generation remains the dominant Application for waste-derived pyrolysis oil, representing approximately 40% of total market demand. Industrial users increasingly adopt pyrolysis oil as an alternative fuel for boilers, furnaces, and combined heat-and-power (CHP) systems due to its competitive cost structure and ability to reduce reliance on conventional fossil fuels. The high energy content of refined pyrolysis oil, combined with its stable combustion performance, supports widespread use in manufacturing plants, district heating networks, brick kilns, cement facilities, and metal processing industries.

The ability to integrate pyrolysis oil into existing burner and heating infrastructure with minimal modification further accelerates adoption across industrial clusters. Growing pressure to decarbonize thermal energy systems, coupled with rising natural gas and fuel oil prices, continues to strengthen the demand outlook. As renewable fuel mandates expand and industries seek lower-emission heating alternatives, heat and power generation is expected to remain the leading and most economically influential application segment in the global market.

North America maintains significant market position through established waste management infrastructure and advanced technology adoption. United States Environmental Protection Agency implementing stricter landfill regulations supporting waste-to-energy technology adoption. Recycling infrastructure development and municipal waste management modernization creating integration opportunities. Corporate sustainability commitments and alternative fuel exploration driving regional demand.

Advanced technology ecosystem and research institutions supporting innovation development. Federal government support for circular economy initiatives facilitating market expansion. Energy independence and domestic fuel production priorities supporting policy framework for pyrolysis oil integration.

Europe leads global pyrolysis oil market with stringent waste management regulations and circular economy policy focus. Extended Producer Responsibility mandates driving waste valorization investments across member states. Germany leading European market through waste sorting infrastructure and chemical recycling development programs. United Kingdom landfill tax pressure incentivizing waste diversion and alternative fuel adoption. France and Spain expanding waste-to-energy infrastructure with government support for sustainable technologies. EU regulatory harmonization supporting streamlined technology deployment across member states. Environmental consciousness and sustainability commitments driving premium technology adoption and market expansion.

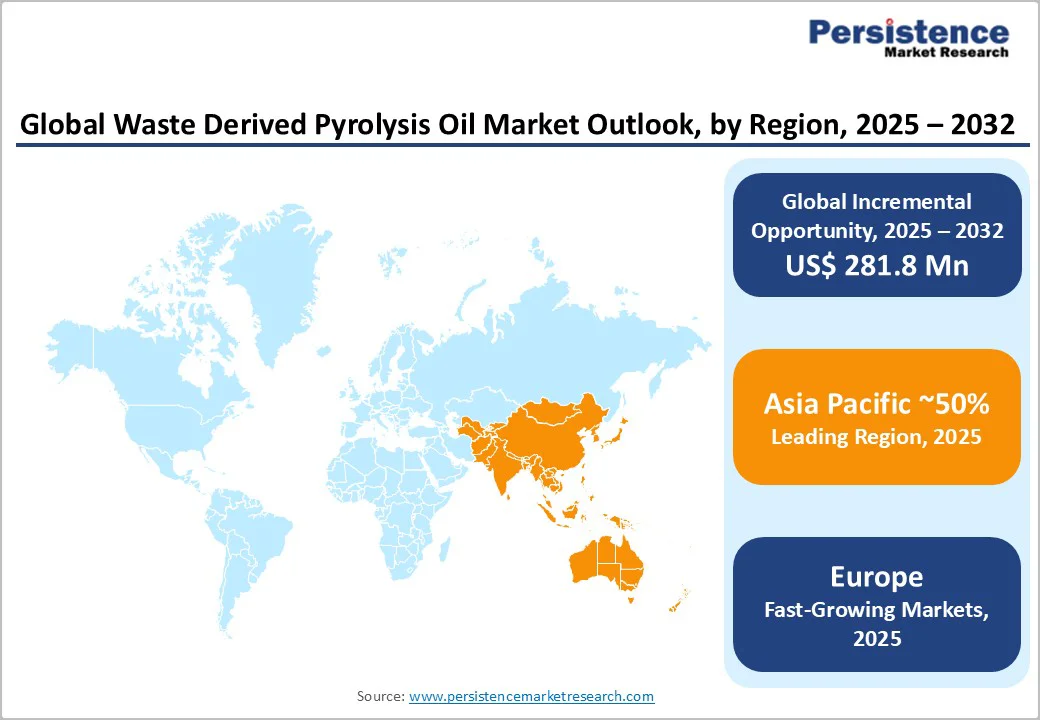

Asia Pacific dominates global waste-derived pyrolysis oil market with over 50% of global plastic waste generated in region creating massive feedstock availability. China as world's largest plastic waste generator consuming 30% of global plastic waste volumes supporting substantial market opportunity. India demonstrating highest growth trajectory at 6.2% CAGR through aggressive waste-to-energy policy initiatives and circular economy programs.

Rapid urbanization and industrial expansion creating emerging market opportunities. Government localization programs and manufacturing incentives attracting global technology deployment. Waste collection infrastructure development supporting technology accessibility. Regional manufacturing advantages and cost competitiveness supporting market penetration and volume scaling.

The global waste-derived pyrolysis oil market is moderately consolidated, with leading players such as Fortum Oyj, Enerkem, Agilyx Corporation, and Quantafuel AS collectively accounting for an estimated 42–48% of global market share. Their leadership is supported by advanced proprietary pyrolysis technologies, large-scale commercial facilities, and long-term partnerships with waste management companies, petrochemical refiners, and municipal agencies. These companies continue to deepen their competitive advantage through sustained investments in process optimization, catalyst development, and technology platforms capable of producing higher-quality, refinery-ready pyrolysis oil.

Tier-two operators including Ensyn Corporation, Twence B.V., and Green Fuel Nordic maintain strong regional positions by specializing in niche conversion technologies and feedstock-specific systems. Their localized expertise and flexible plant configurations enable them to serve regional markets effectively and expand into bio-refinery integration and specialty chemical applications.

The global waste-derived pyrolysis oil market was valued at US$ 570.8 million in 2025 and is projected to reach US$ 852.6 million by 2032, representing a CAGR of 5.9% during the forecast period.

Primary demand drivers include escalating plastic waste crisis, government circular economy mandates and extended producer responsibility policies, and renewable energy transition requirements.

Refined Pyrolysis Oil (Diesel, Petrol, Fuel Oil) commands the dominant segment at approximately 58% market share, driven by fuel compatibility with existing infrastructure, widespread industrial adoption, and transportation application compatibility supporting mainstream market penetration.

Asia Pacific dominates with over 50% of global plastic waste generation, driven by China's massive waste volumes, India's high-growth circular economy adoption at 6.2% CAGR, rapid industrialization, and emerging market opportunities supporting sustained regional market leadership.

Bio-refinery integration and petrochemical feedstock applications targeting chemical recycling and specialty material production represent the highest-value emerging opportunities supporting premium pricing, margin expansion, and value-added product development.

Market leaders include Fortum OyJ (Finland) with advanced pyrolysis capabilities and European expansion, Enerkem (Canada) specializing in thermoconversion technology, and Agilyx Corporation (United States) focusing on plastic-to-oil innovations, collectively representing approximately 42-48% market concentration.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Source

By Pyrolysis Process

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author