ID: PMRREP35460| 147 Pages | 3 Jul 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

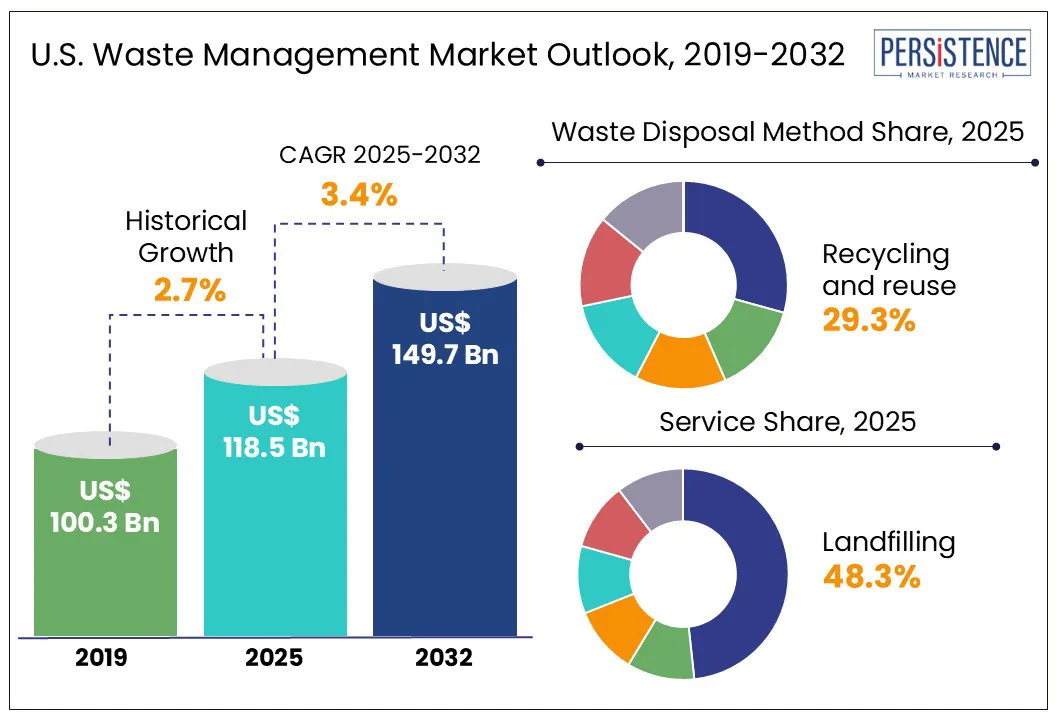

According to Persistence Market Research, the U.S. waste management market size is likely to be valued at US$ 118.5 Bn in 2025 and is expected to reach US$ 147.0 Bn by 2032, growing at a CAGR of 3.4% in the forecast period from 2025 to 2032.

The U.S. discards around 350 million tonnes of municipal waste annually, with every household producing about 4.51 pounds of trash daily, amounting to over 728,000 tons of waste every day. Of the 267.8 million tons of municipal solid waste produced, only 67.2 million tons are recycled, underscoring the critical demand for modern recycling and composting systems. The expansion is expected to push the market growth driven by surging per capita waste generation, rapid infrastructure development, and stringent regulations promoting sustainability.

Consumer culture and urbanization are propelling massive volumes of landfill-bound materials, especially in states such as California, Texas, and New York. Over 40% of total municipal waste comprises plastics, paper, and cardboard, largely fueled by e-commerce and packaging-heavy lifestyles. More than 2,600 landfill sites operate across the country, with one-third of that space consumed by packaging waste. During the holiday season alone, trash volume spiked by 25%. Plastic usage remains alarming, as five million bottles are discarded every hour, while textile waste reaches 16.9 million tons per year, with 85% of the waste ending up in landfills.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

Waste Management Market Size (2024A) |

US$ 114.6 Bn |

|

Estimated Market Size (2025E) |

US$ 118.5 Bn |

|

Projected Market Value (2032F) |

US$ 149.7 Bn |

|

Value CAGR (2025 to 2032) |

3.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.7% |

Landfills absorb more than 63% of everyday U.S. waste, emitting roughly 270 million tons of CO-equivalent in 2018. That output equals nearly 5 % of the country’s energy-related emissions and keeps climate regulators on alert. Stakeholders view conventional dumping as an unsustainable bottleneck rather than a cheap convenience.

Communities, companies, and authorities respond with localized incinerators, neighborhood compost sites, and ambitious zero-waste roadmaps. Limited funding still slows roll-outs, yet widening public support and clear economic signals are channeling investment into smarter, lower-emission processing systems that have pushed the U.S. waste-management market to adopt modern systems beyond traditional disposal methods.

Several regions still operate with outdated or inadequate systems to manage the growing volume of disposable products, especially single-use plastics. Limited availability of sorting, composting, and recovery facilities results in potentially reusable materials ending up in landfills or incinerators. The lack of reuse infrastructure, such as refill stations or repair hubs, makes the situation worse. Without essential mechanisms to separate and reintegrate materials into the economy, communities face significant challenges in reducing reliance on conventional disposal methods.

Rising volumes of household and commercial waste create a strong opportunity to reduce material at the source. In 2018, packaging and containers made up 28% of total waste, while 2.5 million tons of paper and plastic dishware went to disposal. Cutting waste before it enters the system lowers collection costs and allows waste-management providers to offer targeted reduction services.

Stronger regulations and public demand push businesses to adopt reuse-friendly models. Oregon became the first state to pass a bottle bill deposit law, and nine others have followed: California, Connecticut, Hawaii, Iowa, Maine, Massachusetts, Michigan, New York, and Vermont. These laws support smarter packaging and open new avenues for recovery and reuse services.

Electronic waste generation is rising sharply, driving a major transformation in the U.S. waste management landscape. In 2022, global e-waste reached 62 million tonnes, with metals alone making up nearly 31 million tonnes. North America recorded over 14 kg of e-waste per person, yet formal recovery rates globally stood at just 22.3%. This widening gap between consumption and recovery continues to push the U.S. toward a new recycling strategy.

High-value materials like copper and gold remain locked in discarded electronics due to limited collection infrastructure. In 2022, the global e-waste stream contained an estimated US$91 billion in recoverable metals, including US$19 billion in copper and US$15 billion in gold. Weak collection systems have left most of this value untapped, reinforcing the need to scale up local material recovery networks.

Formal recycling has already shown strong results by preventing 900 million tonnes of ore extraction and cutting 93 million tonnes of CO?-equivalent emissions. These environmental gains reinforce the business case for advanced recycling systems. U.S. waste operators are now focusing on domestic processing, creating closed-loop networks that reduce reliance on offshore or informal disposal practices.

As global scrutiny of e-waste exports grows, the U.S. positions itself to lead with localized, circular recovery infrastructure. Urban mining, supported by policy shifts and private investment, is becoming central to capturing value from electronic discards while reducing the environmental footprint.

This shift goes beyond basic disposal. It reflects a system-wide evolution that combines material recovery, emissions control, and resource independence. The U.S. waste management industry now plays a crucial role in enabling sustainable growth in an economy increasingly driven by technology and finite resources.

Recycling and reuse command 29.3 % of municipal solid-waste services. Shoppers look for low-impact choices, and local programs answer that demand by recapturing materials and extending product life. This shift keeps more value in the economy and trims the volume sent to landfills or incinerators.

Single-stream collection now standard in most curbside systems drove rapid gains through the mid-2000s, yet national recycling rates stalled near 32 % by 2018. Easier recycling lifted participation, but new streams of multilayer film, mixed plastics, and e-commerce packaging have offset earlier progress.

Material mix now dictates performance. Paper and paperboard still make up 36 % of household discards and flow smoothly through recovery lines, while complex plastics drag overall rates down. Sorting and resale operations generate 12 % of the sector’s US $80 billion revenue, linking haulers with manufacturers hungry for secondary feedstock.

Operators invest in optical sorters, robotics, and public-private partnerships to scale capacity and cut costs. At the same time, brands roll out reusable and compostable designs to match growing consumer pressure. Together, these moves keep recycling and reuse at the heart of a circular economy that prioritizes resource efficiency and long-term growth.

Landfilling dominates the U.S. waste management market, accounting for 48.3% of municipal solid waste disposal. More than 3,000 active landfills handle a substantial portion of the nearly 300 million tons of waste generated each year. Around 447 kg of waste per person annually ends up in landfills, while recycling rates remain below 25%. This method continues to be widely used across many regions due to economic feasibility and infrastructure availability, particularly in the Midwest and Southeast.

The sector has seen a shift toward operational efficiency through the use of advanced compaction technologies and improved waste breakdown techniques. These advancements allow operators to extend the life of existing landfills by maximizing airspace. Control of landfill capacity has largely moved to private operators, enabling large-scale consolidation and greater investment in infrastructure. While states in the West and Northeast pursue policies to cut landfill dependency, others remain more reliant due to slower regulatory adoption and economic constraints.

The U.S. waste management market is dominated by major players such as WM, Republic Services, Waste Connections, Clean Harbors, and Casella Waste Systems. These companies expand through acquisitions and invest heavily in advanced recycling centers, renewable natural gas facilities, and AI technologies that optimize operations. Their broad service offerings allow them to secure large contracts and maintain steady revenue streams.

Alongside these giants, smaller and more specialized companies are driving innovation. Recycle Track Systems, for example, uses sensor-based technology and data analytics to improve waste tracking and management. Reworld focuses on regional waste-to-energy solutions and circular economy programs, catering to customers with specific sustainability needs.

This blend of large and niche players is shaping the market landscape. By combining technology with environmental goals, emerging companies challenge the established firms, encouraging continuous improvements in efficiency and emissions reduction across the industry.

The U.S. market is projected to be valued at US$ 118.5 Bn in 2025.

The market is poised to witness a CAGR of 3.4% from 2025 to 2032.

Rising landfill emissions and food disposal challenges are pushing demand for alternative waste processing systems.

Source reduction and curbside collection programs are unlocking the potential for a circular economy.

The leading players in the market include Waste Management Inc., Republic Services Inc., Waste Connections Inc., Clean Harbors Inc., Casella Waste Systems, and Stericycle.

|

Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Billion for Value |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage

|

|

|

Customization and Pricing |

Available on Report |

By Waste Type

By Service

By Waste Disposal Method

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author