ID: PMRREP18448| 199 Pages | 26 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

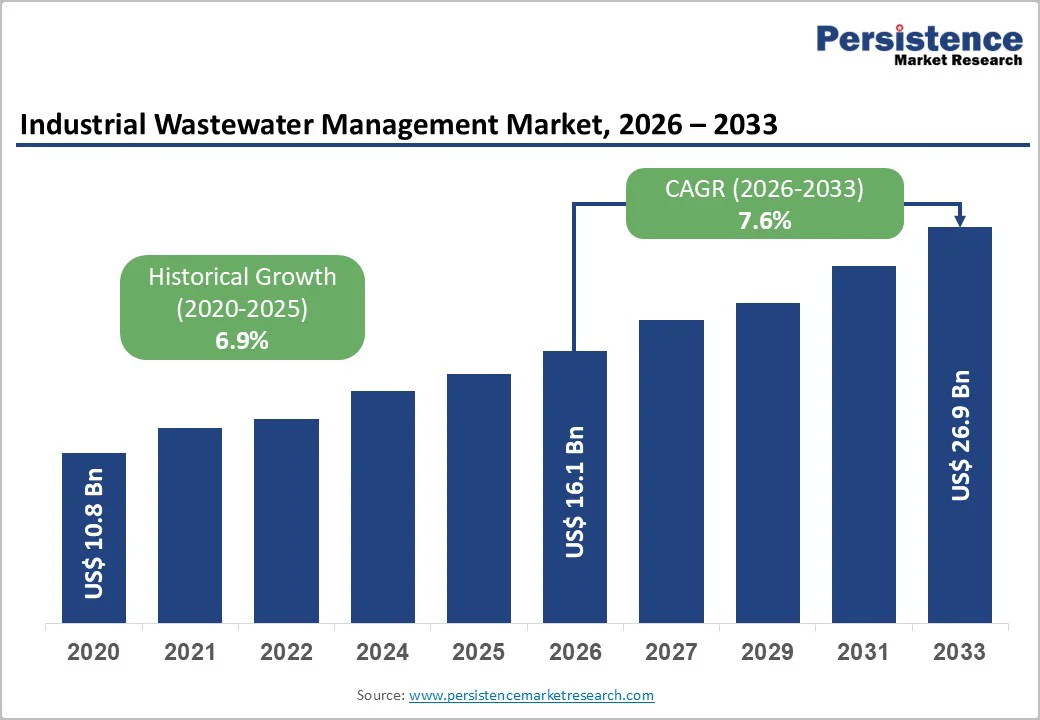

The global industrial wastewater management market size is likely to be valued at US$ 16.1 billion in 2026, and is projected to reach US$ 26.9 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2026−2033. Market expansion reflects rising industrial water intensity, stricter environmental enforcement, and accelerating capital allocation toward sustainable production systems.

Regulatory mandates from environmental authorities such as the U.S. Environmental Protection Agency (EPA), European Environment Agency (EEA), and India’s Central Pollution Control Board (CPCB) continue to raise minimum treatment thresholds across power, chemicals, and process industries. Industrial water reuse targets, particularly zero-liquid-discharge (ZLD) and closed-loop systems, strengthen demand for advanced biological and membrane-based treatment technologies. Capital deployment trends favor integrated service models combining design, installation, and lifecycle operation, improving long-term cost efficiency. Emerging economies contribute incremental volume growth, while developed regions drive technology adoption and margin expansion.

| Key Insights | Details |

|---|---|

|

Industrial Wastewater Management Market Size (2026E) |

US$ 16.1 Bn |

|

Market Value Forecast (2033F) |

US$ 26.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

7.6% |

|

Historical Market Growth (CAGR 2020 to 2025) |

6.9% |

Stringent environmental regulations are functioning as a primary catalyst for the industrial wastewater management market growth, as they impose binding compliance obligations on industrial operations. Regulatory frameworks define permissible discharge limits, water reuse thresholds, and pollutant concentration benchmarks, turning wastewater control into a license-to-operate requirement. Enforcement mechanisms such as audits, penalties, and operational suspensions elevate environmental compliance into a board-level risk consideration. Organizations respond by embedding wastewater treatment within core operational strategy, capital planning, and performance management. This regulatory environment transforms wastewater handling from a reactive function into a structured, process-driven activity aligned with governance and sustainability objectives.

Policy mandates also translate environmental priorities into measurable industrial actions with direct financial implications. In India, for example, the CPCB states that high-water-consuming industries must achieve 60% wastewater recycling by 2027, establishing a quantified compliance benchmark. This single requirement accelerates investment in treatment infrastructure, digital monitoring systems, and reuse-oriented process redesign. Clear regulatory thresholds drive standardization, technology adoption, and operational discipline across industrial facilities. Firms that align early with such mandates strengthen regulatory standing, protect brand equity, and secure long-term resource efficiency, while laggards face escalating compliance risk and cost exposure.

Technical and skilled labor shortages restrain industrial wastewater management as advanced treatment systems require specialized knowledge in process engineering, automation, chemistry, and regulatory control. Rapid deployment of membrane systems, digital monitoring platforms, and high-efficiency biological processes has raised operational complexity, while workforce development struggles to align with these evolving requirements. Training cycles remain long, certification standards remain stringent, and experienced professionals approach retirement, creating structural gaps across operations, maintenance, and system optimization. According to a survey published by the EPA, 27% of water and wastewater utilities report shortages of certified operators and critical technical staff, highlighting a measurable skills deficit across the sector.

Labor scarcity also increases operational and compliance risk. Skilled professionals support stable plant performance, regulatory alignment, cost control, and rapid fault resolution. Limited availability of qualified personnel slows project execution, extends commissioning timelines, and raises dependence on external consultants, pushing operating costs upward. Internal teams face higher workloads, which weakens process consistency and limits capacity for innovation adoption. Strategic initiatives such as digital transformation, water reuse optimization, and energy-efficient upgrades progress at a slower pace under workforce constraints.

Growth across emerging economies creates a strong opportunity as industrial expansion accelerates across manufacturing, energy, chemicals, and processing activities. Rapid urban development and export-oriented production raise wastewater volumes while regulatory oversight tightens around discharge quality and environmental protection. Public infrastructure often struggles to match industrial scale, pushing private players to invest in efficient treatment systems. Capital inflows, industrial parks, and foreign direct investment (FDI) can stimulate the demand for advanced solutions that align productivity with environmental responsibility. This environment supports long-term adoption of integrated treatment models that improve operational resilience and regulatory alignment while supporting sustainable industrial growth.

Water reuse initiatives strengthen this opportunity through rising pressure on freshwater availability and escalating water procurement costs. Industries seek closed-loop water systems to stabilize operations, manage risk, and improve cost efficiency. Treated effluent reuse supports process water, cooling, and utilities while strengthening environmental credentials and compliance readiness. Policy incentives and sustainability commitments from multinational corporations reinforce this shift toward reuse-driven strategies. Investment focus moves toward high-efficiency treatment technologies that deliver consistent quality for reuse applications. This transition positions wastewater solutions as strategic assets rather than compliance tools, creating strong value propositions tied to efficiency, resource security, and long-term operational performance.

Biological treatment is likely to be the leading segment with a projected 38% of the industrial wastewater management market revenue share in 2026, due to its strong suitability for treating large volumes of organic-rich effluents across key industrial operations. Industries favor this approach for its operational reliability, stable performance under continuous load conditions, and compatibility with established infrastructure. Predictable operating costs and lower energy intensity support long-term deployment in processing-intensive sectors. Widespread technical familiarity and proven effectiveness in meeting discharge standards reinforce confidence among industrial operators, sustaining broad adoption across mature and developing industrial clusters.

Membrane treatment is expected to witness the fastest growth between 2026 and 2033, as industrial water strategies shift toward higher treatment efficiency and reuse readiness. Stricter effluent quality expectations elevate demand for advanced separation capabilities that deliver consistent, high-purity output. Continuous innovation improves membrane durability and system efficiency, strengthening economic viability at scale. Industries with sensitive processes prioritize these systems to reduce water risk and compliance exposure. Expanding reuse applications position membrane solutions as a strategic investment supporting resilience, operational continuity, and long-term resource optimization.

Operation & maintenance (O&M) services are poised to lead with a forecasted 40% share in 2026, owing to industrial operators focus on maximizing uptime and ensuring regulatory compliance. Outsourcing lifecycle management reduces internal resource burden while providing predictable operating costs and risk mitigation. Long-term service contracts enable continuous monitoring, preventive maintenance, and rapid issue resolution. The reliability, technical expertise, and standardized processes offered by O&M providers create high value, particularly for capital-intensive facilities where operational continuity and efficiency are critical for sustaining productivity and profitability.

The monitoring & compliance services are anticipated to be the fastest-growing segment between 2026 and 2033, fueled by regulatory frameworks increasingly requiring real-time reporting and digital oversight. Integration of automated sensors, analytics platforms, and compliance dashboards enhances operational transparency, enabling industries to proactively address environmental and safety obligations. Growing emphasis on environmental accountability and operational accountability drives investment in advanced monitoring solutions. These services help operators minimize violations, optimize treatment efficiency, and generate actionable insights, positioning monitoring and compliance as essential components of modern industrial wastewater management strategies.

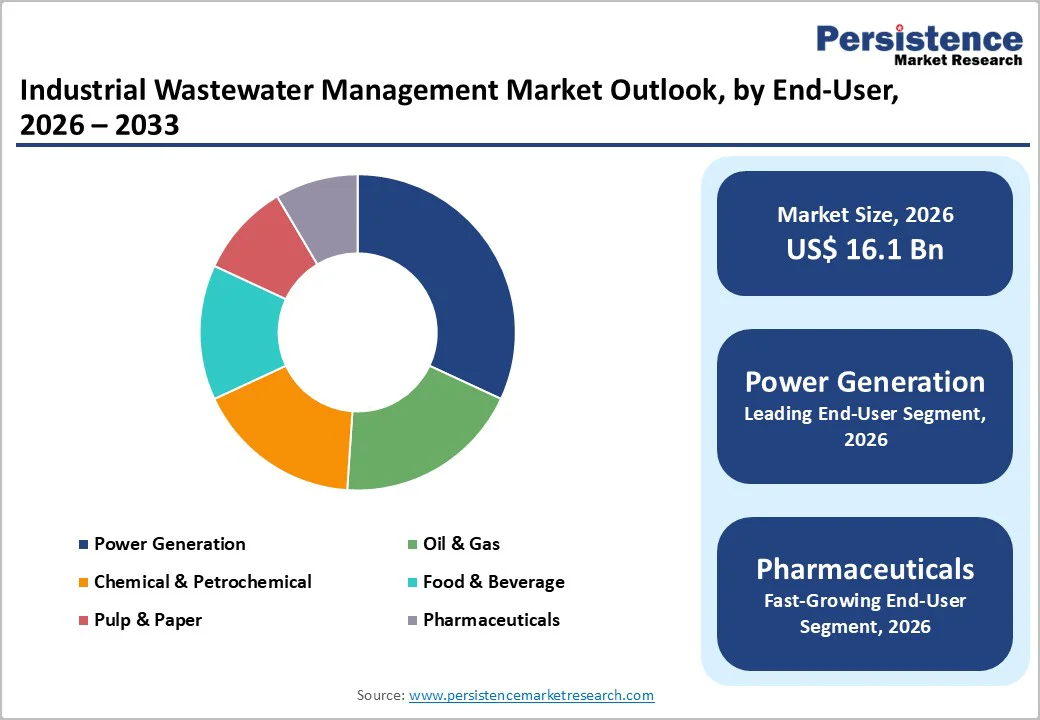

The power generation sector is slated to hold a dominant position, with an anticipated 30% of the global industrial wastewater management demand in 2026, driven by large effluent volumes from thermal plants and the need for regulatory compliance. Cooling water discharge, boiler blowdown, and process effluents require robust treatment to meet regulatory standards and minimize environmental impact. Operators prioritize reliable, large-scale solutions that ensure operational continuity while maintaining compliance. The scale of operations, combined with predictable treatment needs, supports sustained investment in standardized wastewater management systems, making power generation the dominant segment across industrial end-users.

The pharmaceuticals segment is forecasted to be the fastest-growing between 2026 and 2033, boosted by complex effluent characteristics and stringent regulatory oversight. High-value production processes demand advanced treatment technologies capable of handling biologically active, high-strength, and often hazardous wastewater streams. Investment in specialized solutions ensures compliance, protects sensitive water sources, and supports sustainable production practices. Increasing production capacity, regulatory stringency, and emphasis on environmental responsibility drive adoption.

North America is predicted to retain its prominent role in the industrial wastewater management market through 2033, owing to a robust industrial foundation, stringent environmental regulations, and widespread use of cutting-edge treatment methods. Industrial hubs in chemicals, pharmaceuticals, power generation, and food processing generate substantial effluent volumes that demand scalable, dependable solutions. Agencies such as the United States Environmental Protection Agency (EPA) and state regulators enforce compliance, which accelerates deployment of both traditional and advanced systems. Operators secure long-term advantages by integrating real-time monitoring and modular upgrades to handle variable loads while minimizing operational disruptions.

Sustainability strategies shape the regional landscape as companies adopt circular water approaches that emphasize effluent reuse, by-product recovery, and reduced freshwater consumption. Membrane filtration, hybrid processes, and analytics platforms help facilities achieve environmental, social, & governance (ESG) goals alongside regulatory mandates. This blend of oversight, performance demands, and technical maturity fosters steady innovation. Facility managers should evaluate hybrid systems early and partner with certified providers to optimize capital returns, ensure discharge compliance, and position operations for evolving zero-liquid-discharge standards.

Europe is set to remain a key player in industrial water management, driven by rigorous environmental standards, advanced industrial infrastructure, and a strong commitment to sustainability. Germany, France, and Italy produce substantial wastewater from sectors such as chemicals, pharmaceuticals, food processing, and metals, necessitating effective treatment solutions. The European Union (EU) Water Framework Directive ensures compliance, prompting industries to adopt automation, digital monitoring, and energy-efficient systems. Europe’s deep technical expertise and well-established practices position it as a leader in water management, with continuous improvements in process reliability and environmental performance.

European industries prioritize water reuse, closed-loop systems, and the recovery of valuable by-products to maximize resource efficiency. Technologies like membrane filtration, hybrid treatment systems, and advanced monitoring tools are widely deployed in both large and small facilities. Support from government policies and corporate sustainability programs accelerates the adoption of innovative solutions. The focus on operational efficiency and environmental responsibility further solidifies Europe’s leadership in industrial water management, offering a benchmark for global best practices.

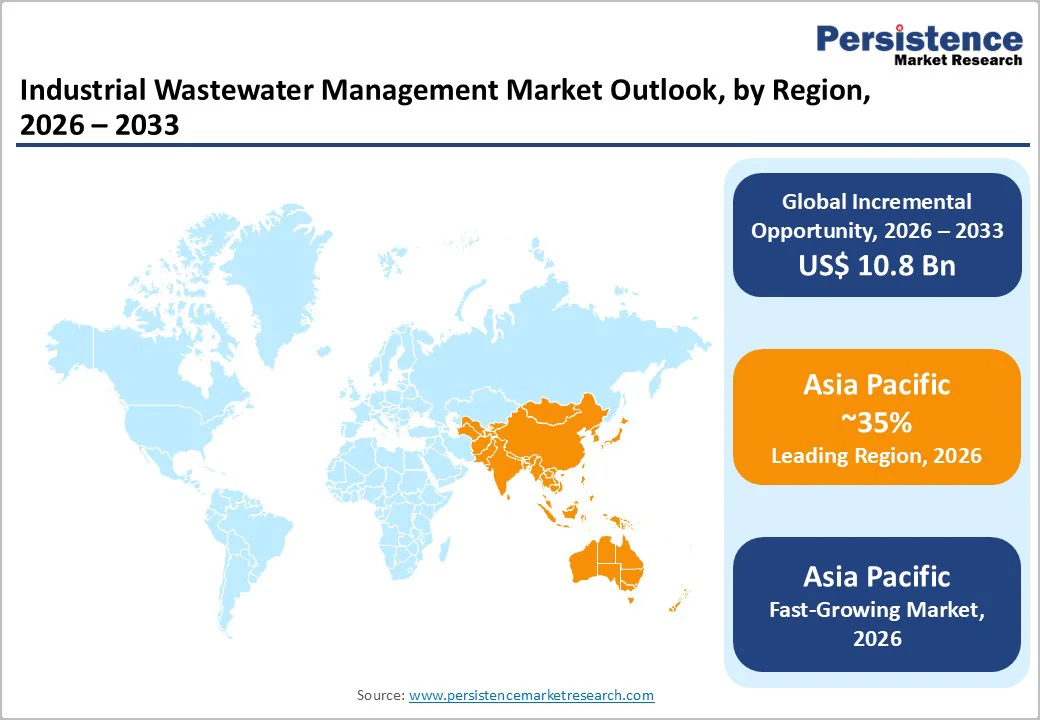

Asia Pacific is anticipated to dominate in 2026 with an estimated 35% of the industrial wastewater management market revenue share, supported by fast-growing production clusters in China, India, and Southeast Asia. High-output industries such as chemicals, textiles, pharmaceuticals, and electronics generate complex effluent streams, which pushes facilities to adopt higher-capacity treatment solutions that scale with throughput. Large infrastructure programs and heightening FDI into manufacturing parks further expand the installed base for treatment systems, especially where new sites must meet permitting conditions from the outset. To convert this tailwind into measurable returns, operators can standardize treatment trains by sector and lock in performance guarantees that align with local discharge limits and ramp-up schedules.

Asia Pacific is also projected to be the fastest-growing region through 2033, as accelerated industrialization intersects with increasing freshwater scarcity and tighter compliance expectations. Regulators and internal water-reuse targets are pushing plants toward high-efficiency approaches, including membrane filtration, modular treatment units, and automation-enabled monitoring for faster issue detection and reporting. This shift creates opportunities to move beyond basic compliance and implement reuse-oriented designs that lower intake, stabilize operations during drought stress, and reduce long-run cost per cubic meter treated.

The global industrial wastewater management market is moderately fragmented, with the top five players – Veolia, Xylem, SUEZ, Ecolab Inc., and Pentair – collectively holding about 40% of total revenue. These leaders leverage their scale to deliver comprehensive treatment solutions that incorporate automation, digital monitoring, and energy-efficient designs. They maintain strong regional networks and deep technical expertise to support critical industries such as chemicals, pharmaceuticals, power generation, and food processing. Buyers gain by partnering with these established providers to access lifecycle services, predictive maintenance tools, and regulatory assurance across multiple sites.

Market competitiveness increasingly relies on innovation, service scope, and lifecycle management capabilities. Major firms invest heavily in R&D to address complex contaminants and tighten compliance, while smaller regional players succeed by tailoring niche solutions for local needs. Collaboration through joint ventures and strategic alliances expands market reach and technical portfolios. Facility operators should evaluate potential partners based on their ability to offer flexible service contracts, rapid response times, and proven technologies that align with long-term operational and environmental goals.

The global industrial wastewater management market is projected to reach US$ 16.1 billion in 2026.

Rapid industrialization, stringent environmental regulations, and increasing focus on water reuse drive the market.

The market is poised to witness a CAGR of 7.6% from 2026 to 2033.

Rising adoption of water reuse initiatives, advanced treatment technologies, and growth in emerging economies present key market opportunities.

Few of the key players in the market include Veolia, Xylem, SUEZ, Ecolab Inc., Pentair, and Thermax Limited.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Treatment Method

By Service Type

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author