ID: PMRREP33517| 300 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

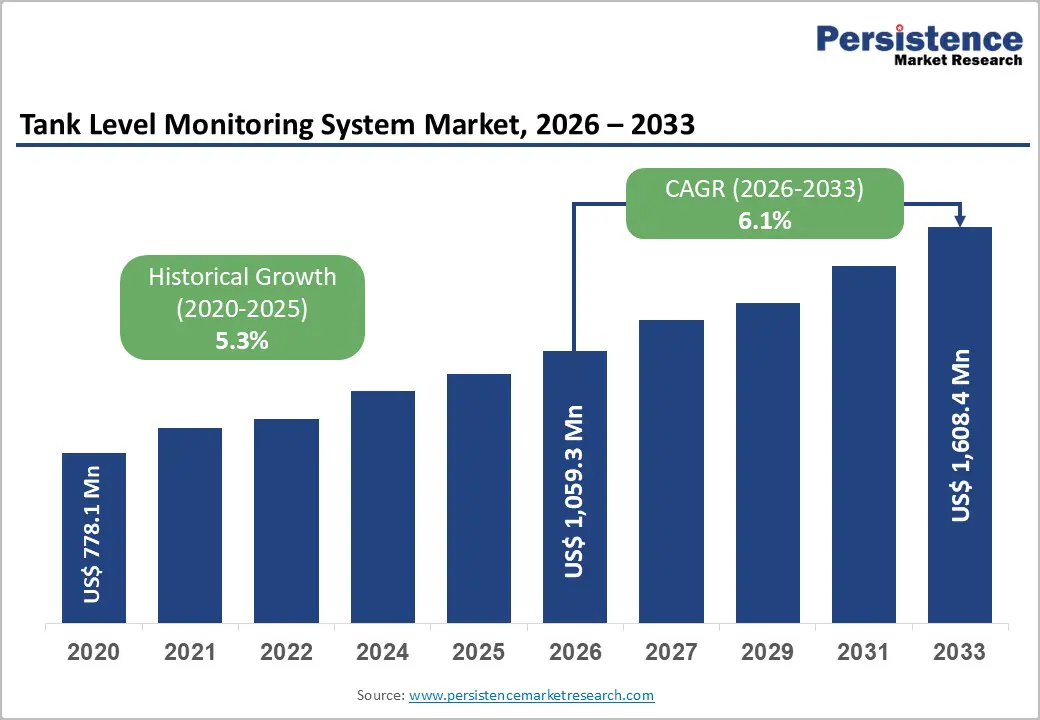

The global Tank Level Monitoring System Market is projected at US$1,059.3 million in 2026 and is projected to reach US$1,608.4 million by 2033, growing at a CAGR of 6.1% between 2026 and 2033. Market growth is driven by escalating demand for automation and operational efficiency across oil and gas, chemical processing and power generation sectors, coupled with stringent regulatory compliance mandates including API 2350 and OSHA standards. Integration of IoT sensors, wireless connectivity and cloud-based monitoring platforms enables real-time visibility into tank operations, reducing downtime, preventing overfills and optimizing inventory management across industrial facilities worldwide.

| Global Market Attributes | Key Insights |

|---|---|

| Tank Level Monitoring System Market Size (2026E) | US$ 1,059.3 million |

| Market Value Forecast (2033F) | US$ 1,608.4 million |

| Projected Growth CAGR (2026-2033) | 6.1% |

| Historical Market Growth (2020-2025) | 5.3% |

Market Drivers

Stringent regulatory compliance and overfill prevention standards

Global regulatory frameworks, particularly API 2350 standards for petroleum facilities and OSHA Process Safety Management regulations, mandate advanced tank level monitoring to prevent catastrophic overfill incidents and environmental spills. API 2350 requires comprehensive risk assessment, automatic overfill prevention systems and real-time level measurement across refineries, distribution terminals and chemical storage facilities. The Buncefield incident and similar disasters have elevated regulatory scrutiny, compelling facility operators to deploy high-fidelity monitoring infrastructure capable of continuous level transmission, independent alarming and automated shutdown capabilities. Compliance investment represents a significant market driver, with operators investing in certified, redundant monitoring systems to meet Category 2 and 3 classification requirements under API 2350 standards.

Rapid industrialization and energy infrastructure expansion in Asia Pacific

Asia Pacific is experiencing unprecedented industrial expansion, driven by heavy capital deployment across oil and gas extraction, refining, petrochemical processing, and power generation sectors. China, India, and Southeast Asian nations are constructing new refineries, chemical complexes, and bulk storage facilities at scale, creating strong greenfield demand for tank level monitoring systems. Government initiatives such as Made in China 2025 and India’s petroleum infrastructure development roadmap are accelerating project approvals and construction timelines. Rapid industrialization, rising regional energy consumption, and increasing pressure on limited water resources are intensifying adoption of radar and ultrasonic monitoring technologies. These solutions enable precise measurement, operational optimization, and regulatory compliance across diverse industrial processes, positioning Asia Pacific as the fastest expanding market through the forecast period.

Market Restraints

High capital expenditure and integration complexity

Tank level monitoring systems, particularly radar and ultrasonic platforms integrated with legacy control systems, require substantial capital investment ranging from thousands to hundreds of thousands of dollars per installation. Additional costs for sensor deployment, instrumentation wiring, control system integration, and staff training elevate total cost of ownership, deterring adoption among smaller operators and emerging market facilities with constrained capital budgets. Installation complexity in existing operational facilities necessitates process shutdowns or managed downtime, creating operational disruption costs that further constrain deployment rates in mature, continuously operating installations.

Competitive commoditization and vendor consolidation pressures

Intensifying competition among sensor manufacturers and monitoring platform providers is compressing margins across the tank level monitoring market. Proliferation of lower cost alternatives, including basic float gauges and simple pressure based systems, continues to exert pricing pressure on advanced radar and ultrasonic technologies. Ongoing vendor consolidation and supply chain concentration among dominant players such as Emerson and Honeywell further constrain market access for emerging competitors. These dynamics limit differentiation, restrict innovation investment, and reduce pricing flexibility for smaller specialized vendors, ultimately slowing technology upgrades and expansion opportunities despite rising end user demand across industrial and infrastructure applications globally worldwide markets.

Market Opportunities

Smart agricultural and livestock water management systems

Agricultural and livestock water management represents a major expansion opportunity, as dairy, cattle, and crop operations increasingly require real time monitoring of storage tanks and water troughs across vast, remote properties. Satellite IoT and cellular based monitoring solutions now allow farmers to track water levels, detect leaks, and prevent livestock loss even in areas lacking reliable network coverage. The agricultural water tank market is expanding at approximately 7.1% CAGR across Asia Pacific through 2032, supported by smart irrigation systems and precision farming practices. With the total tank monitoring market projected to reach US$1.61 billion by 2033, agricultural adoption could unlock a multi hundred million dollar cumulative opportunity across Asia Pacific and emerging agricultural economies over the extended forecast period ahead.

Mining industry expansion and environmental compliance monitoring

Mining operations are increasingly deploying tank level monitoring systems for tailings storage, water management, and chemical processing as environmental regulations intensify globally. Mining companies require robust, continuous monitoring of large volume containment facilities to prevent spills, manage risks, and ensure strict water quality compliance. Rapid expansion of mining activities across Africa, Latin America, and Southeast Asia is creating substantial greenfield opportunities for both invasive and non invasive monitoring solutions engineered for harsh, remote operating environments. Rising investments in environmental remediation, digitalization, and sustainability driven practices are accelerating adoption of advanced sensing technologies. Collectively, these factors are expected to support steady mid to high single digit growth in mining focused tank level monitoring solutions through 2033 globally across critical mineral markets.

Product Type Analysis

The Invasive Product Type segment is the leading category, commanding approximately 58% of global market revenue in 2026. Invasive systems, which include float-based gauges, servo systems and submersible pressure transmitters installed inside tanks, dominate due to their mature technology, established reliability record and lower initial deployment costs. Widespread installed base across refineries, chemical plants and utility facilities sustains substantial replacement and upgrade demand. Invasive systems remain preferred in many regulatory-compliant applications where proven track records and long operational history support compliance documentation and risk assessment processes.

The Non-invasive Product Type is the fastest-growing segment, expanding at approximately 6.6% CAGR between 2026 and 2033. Non-invasive technologies including external ultrasonic and radar sensors eliminate tank entry, reduce contamination risks and simplify installation in operational facilities. Superior safety profiles, lower maintenance requirements and ability to retrofit existing tanks without modification drive accelerated adoption. Growth is particularly strong in hazardous chemical and explosive atmosphere applications where intrinsic safety certifications and non-contact measurement provide critical operational advantages.

Technology Analysis

The Float & Tape Gauging Technology segment is the leading technology category, representing approximately 40% of global market value in 2026. Float-based systems offer cost-effective, mechanically simple solutions for atmospheric tank monitoring, with established operational history spanning decades. Continued widespread use in legacy systems and low-cost deployments sustains base demand. Float systems remain acceptable for many non-critical applications and facilities where advanced features are not required, maintaining significant market share despite competition from digital alternatives.

The Radar-Based Technology is the fastest-growing segment, projected to expand at approximately 7.2% CAGR through 2033. Radar systems provide superior accuracy in adverse conditions including high temperatures, pressure variations and corrosive atmospheres. Non-contact measurement capability enables deployment in hazardous chemical and explosive environments where intrinsic safety is mandatory. Radar's integration with IoT platforms, wireless connectivity and cloud-based analytics enables premium-priced solutions targeting high-value industrial applications. Growth is particularly robust in North American refineries and Middle Eastern petrochemical complexes where API 2350 compliance and operational optimization drive investment.

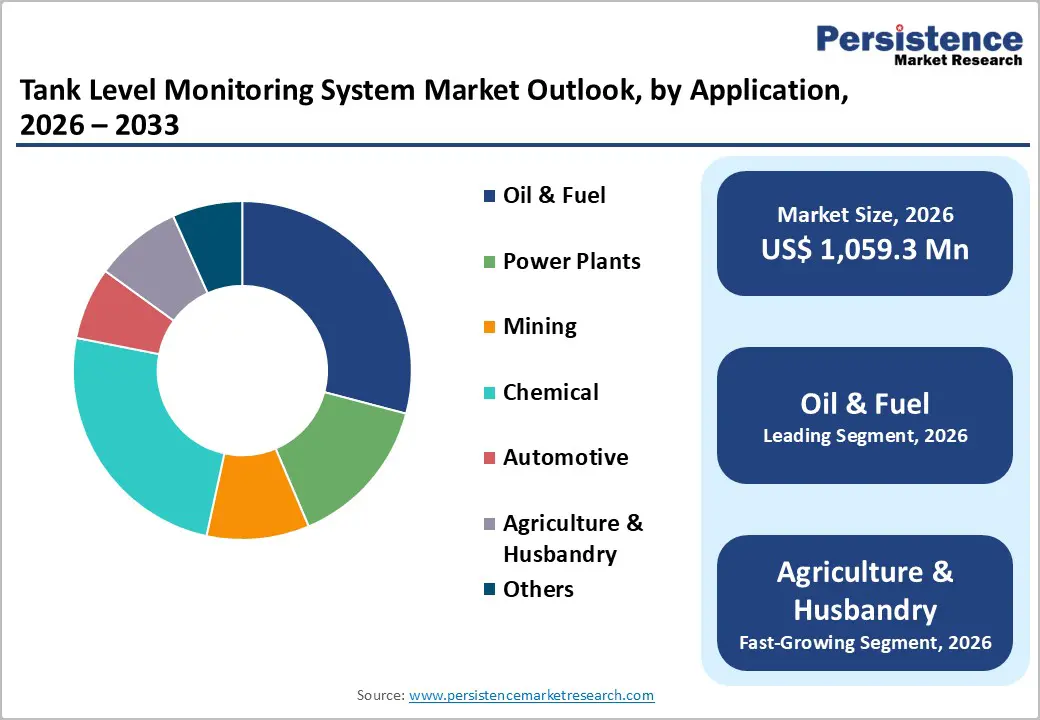

Application Analysis

The Oil & Fuel Application segment is the leading category, commanding approximately 29% of global market value, driven by critical safety requirements in petroleum storage, refining and distribution operations. Regulatory mandate for API 2350 compliance, overfill prevention and accurate custody transfer measurements sustains substantial capital investment across refineries, storage terminals and transportation fleets. Mature supply chains and established vendor relationships support continued growth in this application segment.

The Agriculture & Husbandry Application is the fastest-growing segment, projected to expand at approximately 7.0% CAGR through 2033. Livestock water management, irrigation systems and dairy operations are increasingly adopting remote monitoring solutions enabled by satellite IoT and cellular connectivity. Agricultural digitalization initiatives across Asia Pacific and emerging markets are creating greenfield deployment opportunities. Integration of water monitoring with precision irrigation and farm management systems creates bundled value propositions that drive higher-than-average adoption rates in developing economies.

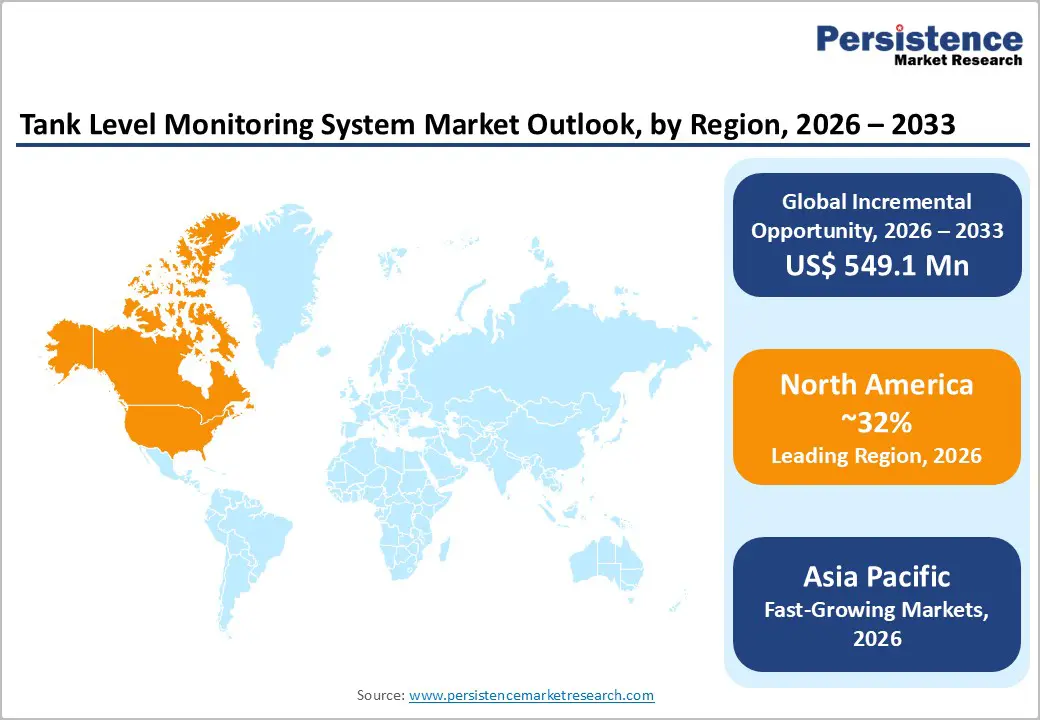

North America

North America represents a mature market with established regulatory compliance infrastructure and advanced technology adoption, holding an estimated 32% of global tank level monitoring system market value in 2026. The United States dominates the region, with robust petroleum refining, chemical processing and power generation sectors driving sustained demand for API 2350-compliant monitoring systems. Stringent OSHA Process Safety Management regulations and state-level environmental protection mandates create recurring replacement and upgrade demand as facilities modernize legacy instrumentation. Strong presence of major vendors including Emerson and Honeywell and well-developed integration ecosystem support continuous technology advancement and customer investment.

North America's fastest growth is concentrated in radar and ultrasonic technologies for advanced process automation and predictive maintenance applications. Integration with SCADA systems and enterprise analytics platforms command premium pricing and drive above-average margin profiles in the regional market. Early adoption of satellite IoT and cellular connectivity for remote facility monitoring creates additional growth vectors in distributed tank farm operations.

Europe

Europe constitutes a significant market with an estimated 27% share of global tank level monitoring system revenue, growing at a steady CAGR of approximately 5.6% between 2026 and 2033. Germany's strong industrial base, supported by robust petrochemical and power generation sectors, drives substantial monitoring system demand. The United Kingdom, France and Spain maintain active refining and chemical processing operations requiring continuous investment in compliance infrastructure. EU regulatory harmonization around measurement traceability, environmental protection and worker safety establishes consistent demand drivers across member states.

European markets emphasize precision engineering and integration with existing control infrastructure. Manufacturers including KROHNE are leading innovation in marine tank monitoring and chemical transport applications. Focus on sustainability and circular economy principles is driving adoption of IoT-enabled systems for improved resource efficiency and waste reduction across industrial operations.

Asia Pacific

Asia Pacific is the fastest-growing regional market, with significant market share of approximately 35% of global tank level monitoring system value in 2026 and projected to grow at an estimated CAGR exceeding 7.2% through 2033. China's massive refining and petrochemical infrastructure expansion, combined with rapid industrialization in India and Southeast Asia, creates unprecedented deployment opportunities. Government initiatives supporting infrastructure modernization and energy sector development are accelerating facility construction and monitoring system adoption across the region.

Asia Pacific exhibits highest growth potential in radar and ultrasonic technologies, driven by new facility construction and advanced automation requirements. Agricultural water management applications are experiencing particularly robust growth as livestock operations and irrigation systems modernize to meet productivity and environmental objectives. Strong regional manufacturing capabilities enable competitive local sourcing of sensor components and integration services, supporting rapid market penetration and localized cost optimization.

Strategic Developments

Business Strategies

Leading players pursue premium positioning through advanced radar and IoT integration, emphasizing API compliance and predictive analytics. Strategies emphasize geographic expansion in Asia Pacific and emerging markets through local partnerships and cost-optimized offerings. Ecosystem integration combining hardware, software platforms and managed services increasingly differentiates vendors, creating recurring revenue streams and enhancing customer switching costs across enterprise accounts.

The global Tank Level Monitoring System Market is expected to be approximately US$1,059.3 million in 2026, reaching nearly US$1,608.4 million by 2033.

The market is driven by stringent regulatory compliance mandates including API 2350 and OSHA standards, rapid industrialization in Asia Pacific, and IoT integration enabling real-time remote monitoring capabilities.

The Tank Level Monitoring System Market is projected to grow at a CAGR of approximately 6.1% between 2026 and 2033.

Key opportunities include smart agricultural and livestock water management systems, mining industry environmental compliance monitoring, automotive supply chain digitalization, and emerging market infrastructure expansion.

Major global players include Emerson Electric Co., Honeywell International Inc., KROHNE Messtechnik GmbH, Yokogawa Electric Corporation, Gems Sensors Inc., Rochester Sensors, AMETEK Inc., Endress+Hauser Group, Danfoss A/S, Vega Grieshaber KG, WIKA Alexander Wiegand, Banner Engineering Corp., and Kallipr Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author