ID: PMRREP3548| 191 Pages | 11 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

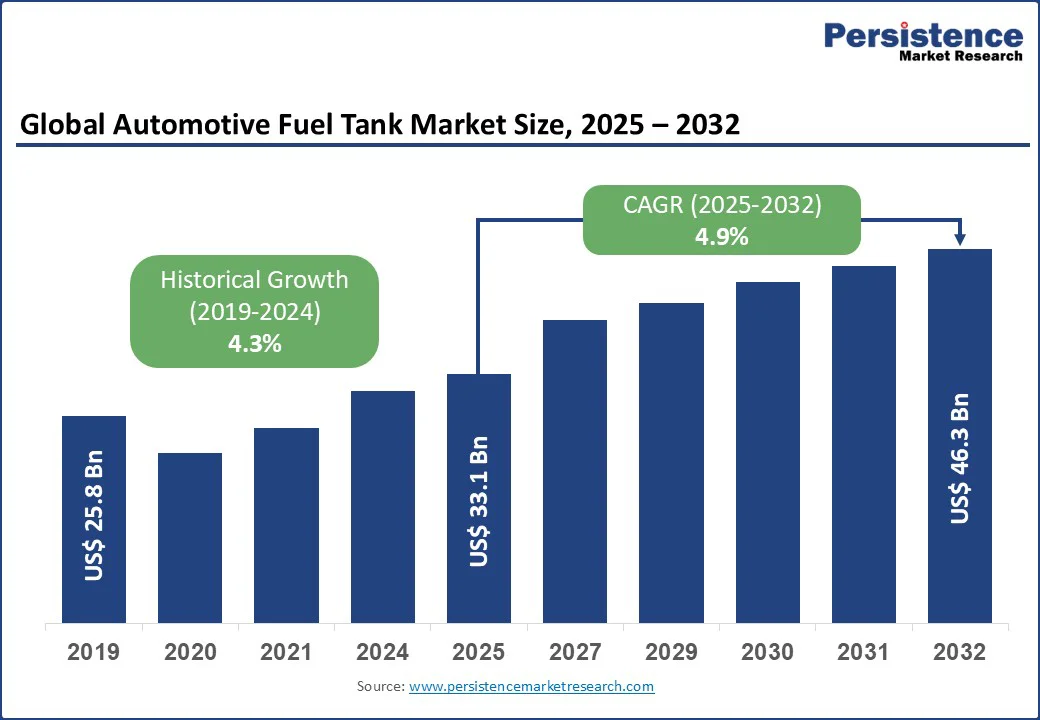

The global automotive fuel tank market size was valued at US$ 33.8 Bn in 2025 and is projected to reach US$ 46.3 Bn by 2032, expanding at a CAGR of 4.9% during the forecast period.

Key Highlights of the Automotive fuel tank market

|

Global Market Attribute |

Key Insights |

|

Automotive fuel tank market Size (2025E) |

US$ 33.1 Bn |

|

Market Value Forecast (2032F) |

US$ 46.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

Growth is driven by the rising production of passenger and commercial vehicles, stringent emission regulations encouraging advanced lightweight materials, and increasing adoption of plastic fuel tanks for weight reduction and efficiency. Investments in fuel cell and bladder tank technologies further enhance market opportunities, particularly in performance and sports vehicle applications.

The global automotive fuel tank market is primarily driven by the demand for lightweight materials and lower emissions. Stricter fuel economy and emission regulations are prompting manufacturers to use advanced materials such as plastic and aluminum. Plastic tanks are favored for their corrosion resistance, design flexibility, and reduced weight, enhancing vehicle efficiency. Additionally, the rise of hybrid and alternative fuel technologies is fostering innovations such as bladder tanks and fuel-cell-compatible storage, particularly in performance and sports vehicles. Supporting this trend, the European Union’s CO2 emission standards mandate average fleet reductions of 55% for cars and 50% for vans by 2030 compared to 2021 levels.

Regulatory frameworks such as the EU’s CO2 standards for new vehicles and the U.S. EPA fuel economy programs are supporting the shift toward lightweight, high-performance fuel storage solutions. These policy frameworks, along with the International Energy Agency (IEA) reporting that global passenger car sales exceeded 75 million units in 2023, underscore sustained demand for efficient and compliant fuel storage solutions worldwide.

The global automotive fuel tank market faces disruption from the growing adoption of electric vehicles (EVs), which eliminates the requirement for traditional fuel storage and gradually reduces demand in regions with strong EV infrastructure. At the same time, evolving safety and crash-resistance regulations mandate complex multi-layered tank structures, advanced leak-proof systems, and extensive compliance testing. While these advancements enhance durability and environmental protection, they also raise production costs and create design challenges for manufacturers. As conventional vehicle demand declines and engineering requirements become more stringent, manufacturers face heightened supply chain pressures, which slow the overall pace of fuel tank adoption across key markets.

The market is poised to benefit from the ongoing shift toward lightweight and sustainable fuel storage technologies, including advanced plastic, aluminum, and composite tanks, as well as bladder and fuel-cell-compatible designs for performance and sports vehicles. Adoption of these technologies supports improved fuel efficiency, lower emissions, and compliance with evolving environmental standards. Manufacturers are increasingly integrating digital design tools and simulation software to optimize tank durability, reduce material usage, and accelerate production timelines, aligning with broader sustainability goals.

Government initiatives are reinforcing this transition. For instance, the European Union’s End-of-Life Vehicle Directive encourages recyclable and environmentally friendly automotive components, while the U.S. Department of Energy promotes advanced fuel system technologies through research grants and pilot programs. Leading OEMs are investing in modular, lightweight tank solutions to meet fleet-wide emission targets and future hybrid vehicle requirements. These developments create opportunities for manufacturers to innovate, improve efficiency, and expand presence in markets prioritizing both performance and environmental compliance.

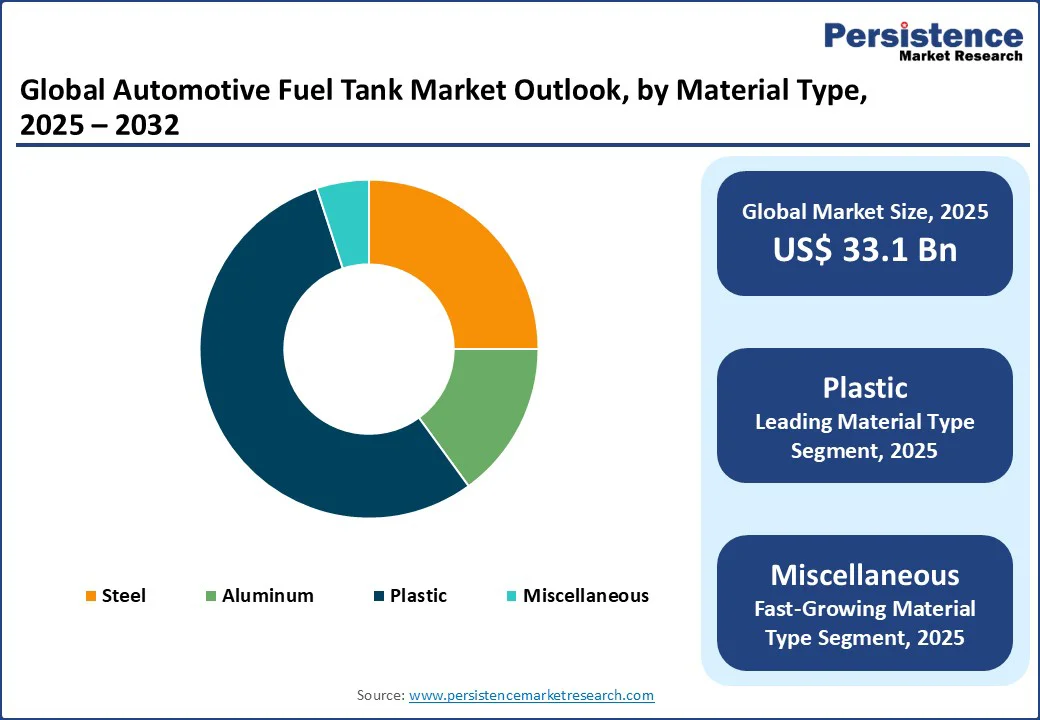

Plastic fuel tanks dominate with a 55% revenue share in 2023, driven by their lightweight design, corrosion resistance, and cost efficiency. Global emission regulations and OEM demand for improved fuel economy continue to accelerate their widespread adoption, particularly in passenger and light commercial vehicles. At the same time, miscellaneous designs such as bladder and fuel-cell-compatible tanks are advancing at a 6.0% CAGR, reflecting growing use in sports and hybrid vehicles supported by innovation-driven government programs.

Steel tanks remain essential in heavy commercial vehicles due to their durability and strength, though their role is gradually being reduced by lighter alternatives. Aluminum tanks, favored for recyclability and premium applications, are increasingly supported by European sustainability directives, positioning them as a strategic choice in regions focused on circular economy initiatives.

Fuel tanks with less than 45 liters of capacity accounted for 48.5% of market revenue in 2023, supported by strong demand for compact and midsize passenger vehicles, particularly in densely populated urban regions. Automakers continue to prioritize smaller, efficient tank designs to align with emission standards and consumer preferences for fuel economy. In contrast, the 45–70 liters category is advancing at a 5.4% CAGR, the fastest among all, as it provides an ideal balance between driving range and design flexibility for passenger and light commercial vehicles.

Larger tanks above 70 liters remain essential for heavy commercial and long-haul vehicles, though their role is increasingly shaped by stricter efficiency regulations and the gradual shift toward downsizing. Together, these trends reflect how evolving mobility requirements and policy frameworks are redefining capacity demand across global markets.

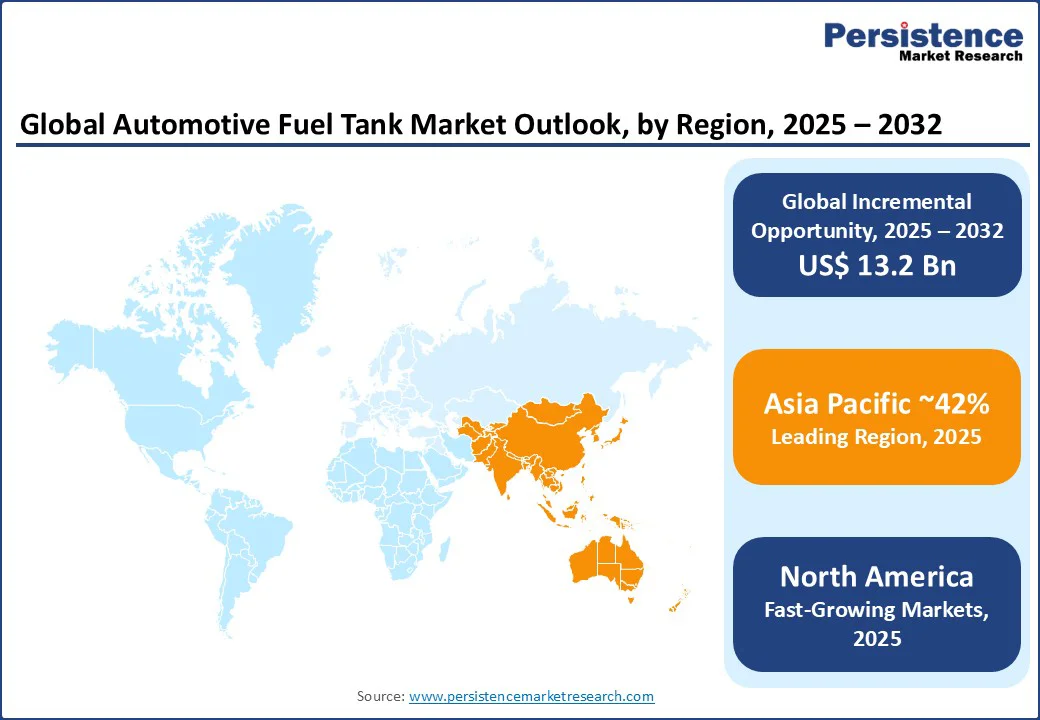

Asia Pacific dominates the global automotive fuel tank market with a 42% revenue share in 2023, reflecting its central role in global vehicle production and adoption of advanced storage technologies. China anchors this leadership with its expansive passenger vehicle output and accelerated shift toward lightweight plastic tanks to meet emission reduction targets. In 2023, Yapp Automotive Systems expanded its capacity for advanced plastic tanks, underlining the region’s innovation momentum. Japan sustains its market influence through precision-engineered tanks, reinforced by strong automotive exports and government roadmaps for next-generation mobility.

India’s growth is propelled by rising passenger car sales, FAME II incentives supporting hybrid adoption, and increased OEM investments in local manufacturing. South Korea and Southeast Asia add further dynamism, driven by urbanization, compact vehicle demand, and industrial policies supporting component localization. This positions Asia Pacific as the most influential region for both current adoption and future advancements in fuel tank technologies.

North America stands as the fastest-growing region in the global automotive fuel tank market, with a projected CAGR of 5.1% in the forecast period. This growth is propelled by the increasing adoption of lightweight materials and advanced fuel storage technologies. The United States leads the market, supported by robust passenger and commercial vehicle production and a focus on emissions reduction. In 2022, Plastic Omnium expanded its U.S. capacity to supply high-pressure hydrogen vessels for Ford trucks, aligning with the industry's shift towards hydrogen fuel cell vehicles. Canada maintains a steady demand for light commercial and passenger vehicles, encouraged by government incentives promoting low-emission fleets.

Regulations such as the EPA’s Corporate Average Fuel Economy (CAFE) standards drive the adoption of plastic and aluminum tanks and hybrid-compatible designs. Investments in digital design and sustainable manufacturing further strengthen production capabilities, supporting continued market expansion across North America.

Germany leads the European automotive fuel tank market, driven by stringent emission and safety regulations that shape material selection and design. Continental AG offers advanced fuel supply and tank components, enabling OEMs to improve efficiency while complying with EU CO2 standards. France and Italy maintain strong demand through robust passenger vehicle production and increasing adoption of hybrid and alternative fuel solutions, supported by national incentives for low-emission vehicles. The UK shows a growing preference for compact and midsize passenger vehicles, bolstered by government programs promoting advanced fuel systems.

Spain and Eastern European countries are expanding production capabilities as urbanization and fleet modernization fuel the adoption of efficient tank solutions. Across the region, regulatory frameworks, innovation in lightweight and recyclable tanks, and the gradual shift toward hybrid-compatible designs continue to influence market trends, positioning Europe as a central hub for sustainable and technologically advanced fuel storage solutions.

The global automotive fuel tank market is fragmented. Manufacturers are accelerating the adoption of lightweight materials, fuel-cell-ready designs, and digitalized production to tap into opportunities in hybrid and sports vehicles. Focused R&D and expanded production capacities are fueling competitive innovation and operational efficiency. At the same time, suppliers and distributors are optimizing regional networks to ensure timely delivery, regulatory compliance, and seamless supply chain coordination. Localized production and streamlined logistics enhance responsiveness to OEM requirements, supporting market growth amid tightening emission standards and the rise of vehicle electrification.

The automotive fuel market is set to reach US$ 33.1 Bn in 2025.

Stricter emission regulations, rising fuel economy mandates, and breakthroughs in lightweight plastic and aluminum materials are fueling growth in the global automotive fuel tank market.

The automotive fuel tank industry is estimated to rise at a CAGR of 4.9% from 2025 to 2032.

Lightweight, hybrid-compatible, recyclable, and high-performance fuel storage solutions are opening significant avenues for expansion across passenger, commercial, and alternative-fuel vehicles.

The major players dominating the global automotive fuel tank market are Plastic Omnium, TI Fluid Systems, Kautex Textron, Magna International, YAPP Automotive Systems, Fuel Total Systems.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Material Type

By Capacity

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author