ID: PMRREP17143| 188 Pages | 18 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

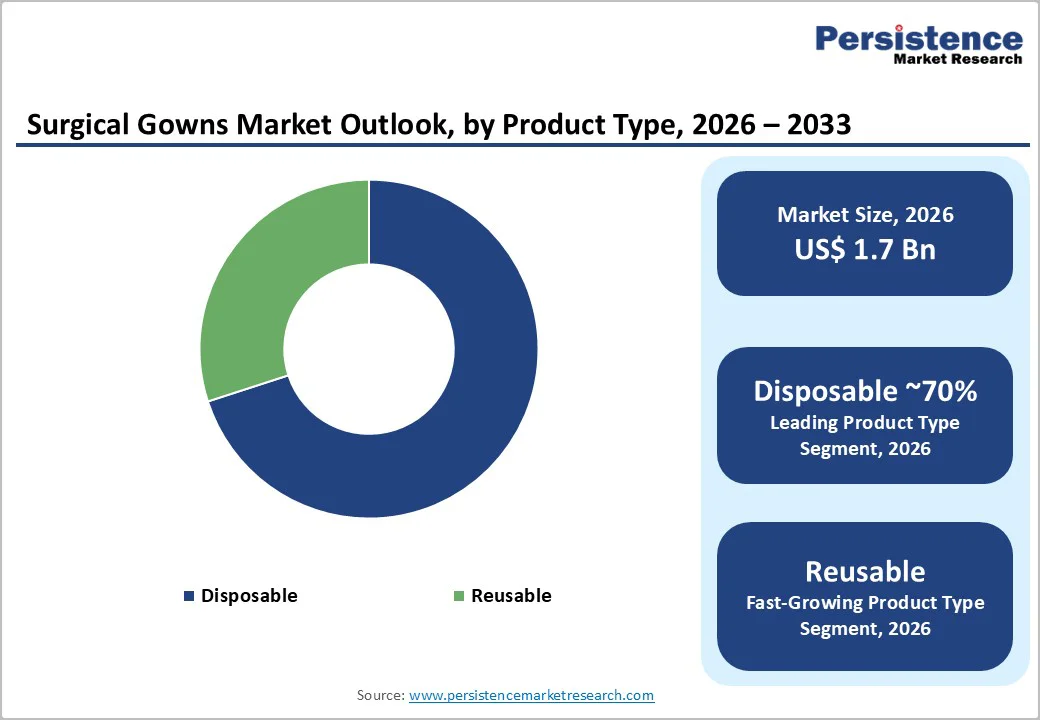

The global surgical gowns market size is estimated to grow from US$ 1.7 billion in 2026 and projected to reach US$ 2.5 billion by 2033, growing at a CAGR of 5.6% during the forecast period from 2026 to 2033.

The global market is experiencing steady expansion, supported primarily by the global rise in surgical procedures and heightened focus on infection prevention in healthcare settings.

An increasing geriatric population, along with greater prevalence of chronic illnesses, has led to a surge in surgical interventions across both developed and emerging regions, including the Asia Pacific and the Middle East, and Africa. As hospitals intensify efforts to reduce Hospital Acquired Infections (HAIs), the role of surgical gowns as a primary barrier for infection control has become more critical.

| Key Insights | Details |

|---|---|

| Surgical Gowns Market Size (2026E) | US$ 1.7 Bn |

| Market Value Forecast (2033F) | US$ 2.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.6% |

| Historical Market Growth (CAGR 2020 to 2024) | 4.7% |

The global rise in surgical procedures has become a defining force behind the increased demand for surgical gowns, especially those designed to offer advanced barrier protection. Growth in chronic illnesses, improved accessibility to healthcare services, and longer life expectancies have significantly expanded the surgical patient pool.

According to a 2023 WHO report, more than 300 million surgical procedures are carried out globally each year. Countries such as the U.S. and India conduct millions of procedures every year, with India alone performing more than 30 million surgeries annually across public and private facilities.

Hospitals are reinforcing infection control protocols to prevent intraoperative contamination based on the surge in the number of OT patients. Regulatory bodies have tightened safety norms since the COVID-19 pandemic, emphasizing the need for sterile, high-performance medical apparel to protect both patients and surgical teams.

Healthcare-associated infections (HAIs) remain a persistent concern, and organizations such as the CDC continuously highlight their burden on patient safety, recovery time, and healthcare costs. This heightened awareness has accelerated the adoption of technologically enhanced gowns with strong fluid and microbial barriers, making them a vital component of surgical infection-prevention strategies.

While disposable surgical gowns play a critical role in maintaining sterility during procedures, their widespread use has raised serious environmental concerns. Since most disposable gowns are made of non-biodegradable synthetic materials, they contribute significantly to the accumulation of medical waste after single use.

This challenge is particularly visible in countries with high surgical volumes, where hospitals generate large quantities of clinical waste daily. Environmental groups and regulatory authorities are urging healthcare providers and manufacturers to rethink the life cycle of protective medical apparel, from material sourcing to waste management.

The growing emphasis on sustainability has led to pressure for greener alternatives such as biodegradable fabrics, recyclable materials, and reusable gowns engineered for repeated sterilization. However, integrating sustainability into surgical gown production is not simple.

Achieving the same level of fluid resistance, sterility, strength, and comfort with eco-friendly materials often requires advanced manufacturing capabilities and significantly higher production investments. These costs and technology barriers can make sustainable versions less accessible, slowing the industry’s transition toward environmentally responsible protective apparel.

The rapid global expansion of Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics is creating new and lucrative opportunities for surgical gown manufacturers. Increasingly, elective and minimally invasive procedures are being shifted out of traditional hospitals and into cost-efficient outpatient settings due to shorter recovery timelines, reduced patient wait times, and lower operating expenses.

In the U.S. alone, ASCs now account for more than 60% of outpatient surgeries, and similar models are gaining traction in Europe, India, and Southeast Asia. As more surgical activity occurs outside large hospital systems, demand for reliable, disposable, and sterile surgical gowns continues to rise. These facilities prioritize streamlined workflow and infection control to prevent postoperative complications, making high-barrier surgical gowns an essential component of standard practice.

Additionally, outpatient centers frequently perform high patient turnover surgeries each day, driving consistent consumption of disposable medical apparel. The increasing preference for day-care surgery models, combined with growing investments in private healthcare infrastructure, is expected to significantly boost procurement of advanced protective gowns tailored for ambulatory and specialty surgical environments.

Disposable surgical gowns continue to command the largest share of the global market, contributing nearly 70% of total revenue in 2025. Their dominance stems primarily from the high level of infection control they offer, which aligns closely with international guidelines for medical textile safety.

Healthcare professionals prefer disposable variants because they eliminate risks associated with laundering, reprocessing, or repeated use, thereby reducing the probability of cross-contamination during surgeries. Hospitals and surgical centers also benefit from streamlined operations, as single-use gowns simplify inventory management and reduce dependency on sterilization infrastructure.

The COVID-19 era significantly accelerated this transition, reinforcing disposable gowns as the most reliable choice in maintaining sterility in high-risk environments.

In addition, manufacturers have improved breathability, comfort, and barrier strength, making newer disposable models more suitable for long procedures. With increasing emphasis on patient and surgeon safety, particularly in high-acuity operating rooms, disposable gowns are expected to retain their competitive advantage and remain the preferred choice among most end-users worldwide.

Hospitals remain the leading end-use segment in the surgical gowns market, holding nearly 65% of global demand in 2024. This dominance is driven by the consistently high volume of surgical procedures performed in inpatient settings, including emergency operations, trauma cases, and complex specialty surgeries.

Hospitals operate under stringent infection control and accreditation frameworks set by national health authorities, the WHO, and other regulatory bodies, making the procurement of high-quality surgical gowns a mandatory requirement.

Growing investments in hospital infrastructure across emerging economies, particularly in the Asia Pacific and the Middle East, have further expanded usage rates as new operating rooms and specialty departments come online.

Additionally, tertiary hospitals typically perform lengthy and multi-stage surgeries, which increases the need for premium, high-barrier surgical gowns for both patients and surgical staff. With rising patient admissions and the continuous expansion of surgical departments, hospitals are expected to remain the primary consumers of surgical gowns.

North America remains the leading regional market for surgical gowns, accounting for around 29% of the global share in 2025. The U.S. anchors this dominance due to high healthcare expenditure, rapid adoption of advanced medical devices, and a robust regulatory environment that consistently updates standards for surgical protection.

Hospitals and surgical centers in the U.S. have long-standing contracts with local manufacturers, ensuring strong product penetration and accelerated rollout of new technologies. Over the past few years, government procurement programs and updated CDC PPE guidelines have heightened expectations around fluid resistance, durability, and pathogen barrier performance, compelling manufacturers to introduce enhanced gown materials and ergonomic designs.

The region’s strategic shift toward outpatient and ambulatory surgical centers is another contributor, as these facilities require consistent supplies of high-quality disposable surgical gowns to support high patient turnover.

Increased investment in modernizing operating environments and sustained clarity on product safety compliance continue to make North America a focal point for innovation in surgical apparel. With reimbursement structures supporting procedural growth and the presence of several global leaders, the region is expected to maintain its strong position.

The European surgical gowns market is shaped by unified regulatory policies and strong emphasis on sustainable procurement practices across member states. Countries such as Germany, the U.K., and France play central roles, backed by significant public healthcare funding and demand for high-performance medical textiles.

The enforcement of updated EN 13795-1 standards has improved consistency in product certification and transparency for hospitals seeking reliable barrier protection apparel. Large-scale investment programs such as Germany’s upgrading of hospital infrastructure and the U.K.’s NHS modernization plan to increase surgical capacity are supporting broader adoption of certified, high-barrier gowns in both public and private healthcare institutions.

European health systems have also become front-runners in exploring environmentally responsible PPE, testing biodegradable textiles, recyclable fabric combinations, and long-life reusable gowns with advanced sterilization compatibility.

Several regional pilot projects are evaluating procurement frameworks that integrate sustainability metrics alongside clinical safety requirements. Driven by public health priorities, strong research ecosystem, and an evolving sustainability mandate, Europe continues to present a mature and forward-looking market for surgical apparel.

Asia Pacific represents the fastest-growing market for surgical gowns, propelled by rapidly increasing surgical procedure volumes in China, India, and Japan. Expanding healthcare access, rising chronic disease incidence, and the aging population have resulted in more patients requiring surgical interventions across both urban and regional facilities.

China leads in terms of production capability and domestic consumption, supported by an extensive medical textile manufacturing base and escalating investment in hospital modernization. India’s market growth is supported by the construction of new multispecialty hospitals, improved affordability of surgical services, and procurement strategies favoring cost-effective disposable gowns.

Japan continues to contribute through its focus on high-quality, technologically advanced medical textiles that comply with national standards for infection control. Across the region, prevention of (HAIs) has become a major factor in decision-making for PPE procurement.

A growing number of regional manufacturers have obtained international certifications, expanding export potential while serving domestic healthcare systems. As supply chains strengthen and competitive pricing coincides with rising demand for certified surgical protection, the Asia Pacific is solidifying its position as a core growth engine for the global surgical gowns industry.

The global surgical gowns market is moderately consolidated, dominated by established global leaders alongside specialized regional manufacturers. Major firms focus on mergers, geographic expansion, and product portfolio enhancements.

Manufacturers invest in research for next-generation protective fabrics, including antimicrobial gowns and eco-friendly materials. Key success factors include regulatory compliance, trust built on quality certification, and after-sales support. Innovative companies differentiate with customized offerings and integrated logistics solutions, as seen in their collaborations with healthcare institutions and government procurement agencies.

The global surgical gowns market is projected to be valued at US$ 1.7 Bn in 2026.

The increasing number of surgical procedures and a focus on reducing hospital-acquired infections are the key factors driving demand for surgical gowns.

The global surgical gowns market is poised to witness a CAGR of 5.6% between 2026 and 2033.

The greatest opportunity lies in premium, high-barrier, and sustainable surgical gown segments favored by hospitals and government health systems.

Key companies include Ahlstrom-Munksjö, Cardinal Health, INC., 3M Company, Medline Industries, Inc., and Surgiene Healthcare (India) Pvt. Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author