- Executive Summary

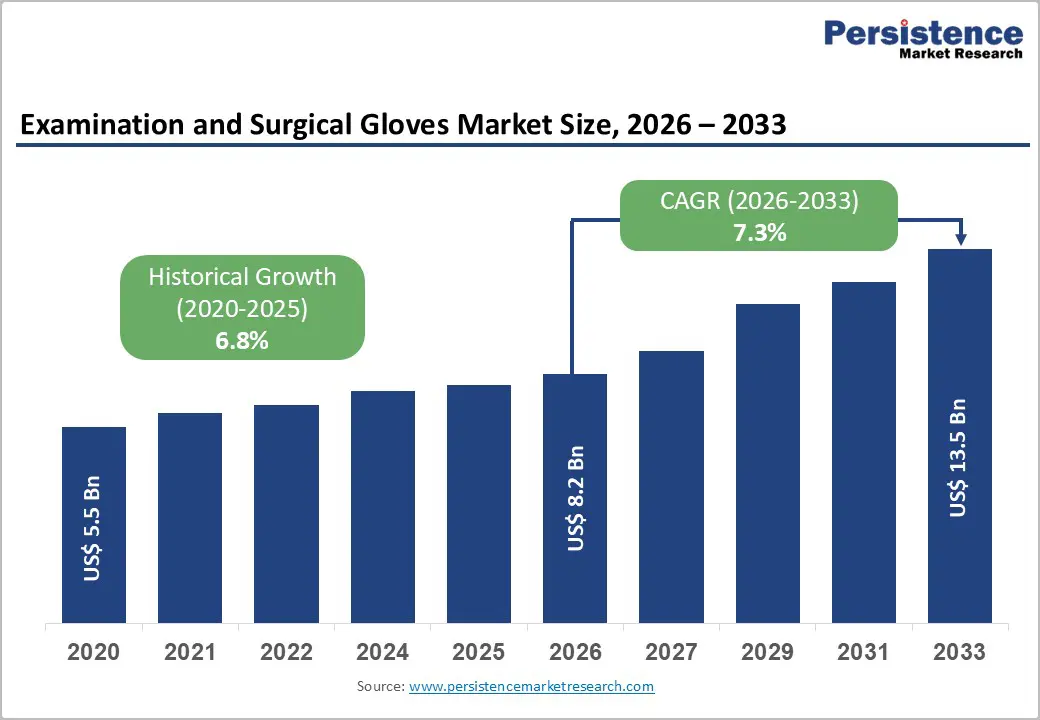

- Global Examination and Surgical Gloves Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Market Dynamics

- Driver

- Restraint

- Opportunities

- Trends

- Macro-Economic Factors

- Global GDP Outlook

- Global Healthcare Expenditure

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- Value Added Insights

- Value Chain analysis

- Key Market Players

- Product Adoption Analysis

- Key Promotional Strategies by key players

- PESTLE Analysis

- Porter's Five Forces Analysis

- Regulatory and Technology Landscape

- Global Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Global Examination and Surgical Gloves Market Outlook: Product Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Product Type, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- Market Attractiveness Analysis: Product Type

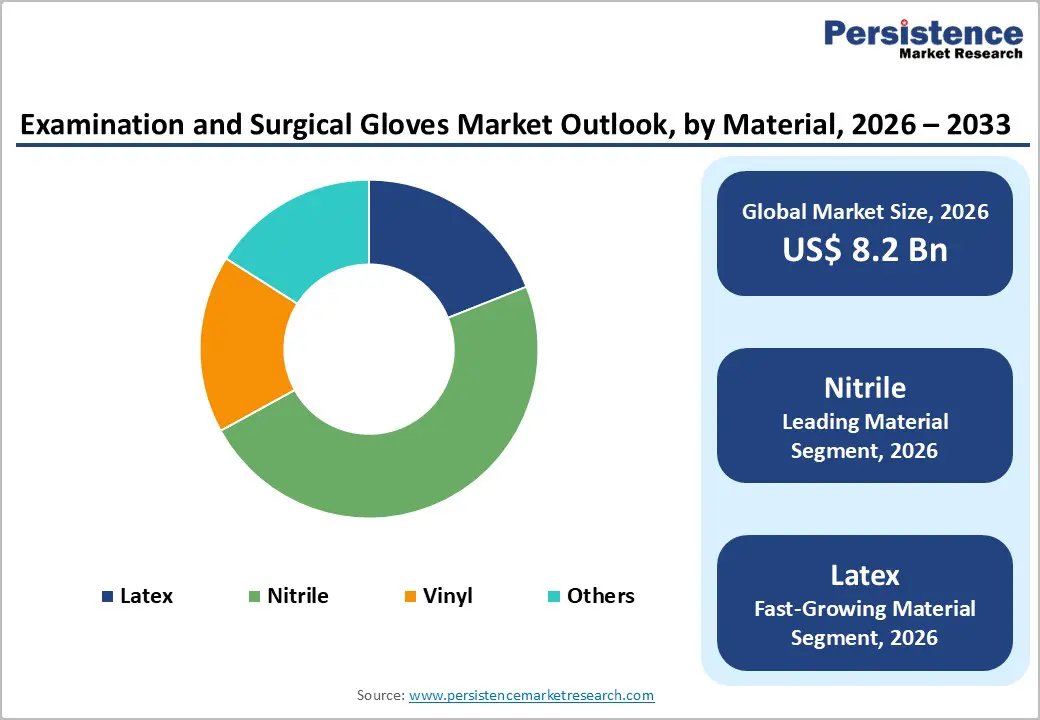

- Global Examination and Surgical Gloves Market Outlook: Material

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Material, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- Market Attractiveness Analysis: Material

- Global Examination and Surgical Gloves Market Outlook: End User

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by End User, 2020-2025

- Current Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- Market Attractiveness Analysis: End User

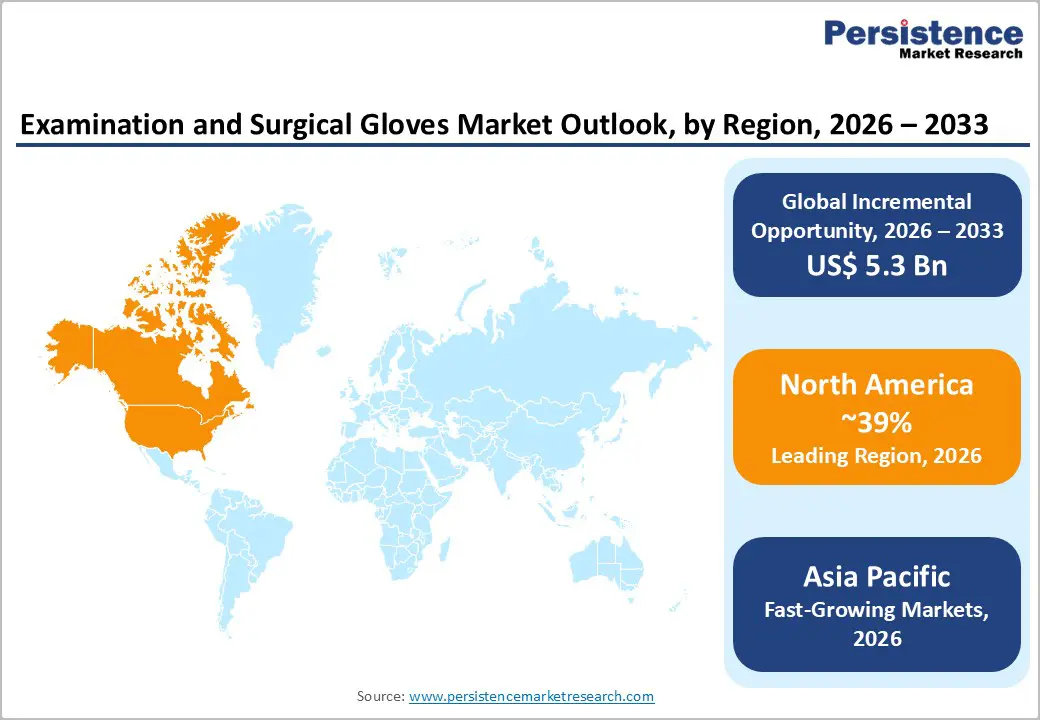

- Global Examination and Surgical Gloves Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- North America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- North America Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- North America Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- Europe Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Europe Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- Europe Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- Europe Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- East Asia Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- East Asia Market Size (US$ Bn) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- East Asia Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- East Asia Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- South Asia & Oceania Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- South Asia & Oceania Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- Latin America Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Latin America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- Latin America Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- Latin America Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- Middle East & Africa Examination and Surgical Gloves Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Middle East & Africa Market Size (US$ Bn) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Examination Gloves

- Surgical Gloves

- Middle East & Africa Market Size (US$ Bn) Forecast, by Material, 2026-2033

- Latex

- Nitrile

- Vinyl

- Others

- Middle East & Africa Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Top Glove Corporation Bhd

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Ansell Limited

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Medline Industries, Inc.

- Cardinal Health, Inc.

- Semperit AG Holding

- Kimberly-Clark Corporation

- INTCO Medical

- Dynarex Corporation

- B. Braun Melsungen AG

- Top Glove Corporation Bhd

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment