ID: PMRREP32047| 210 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

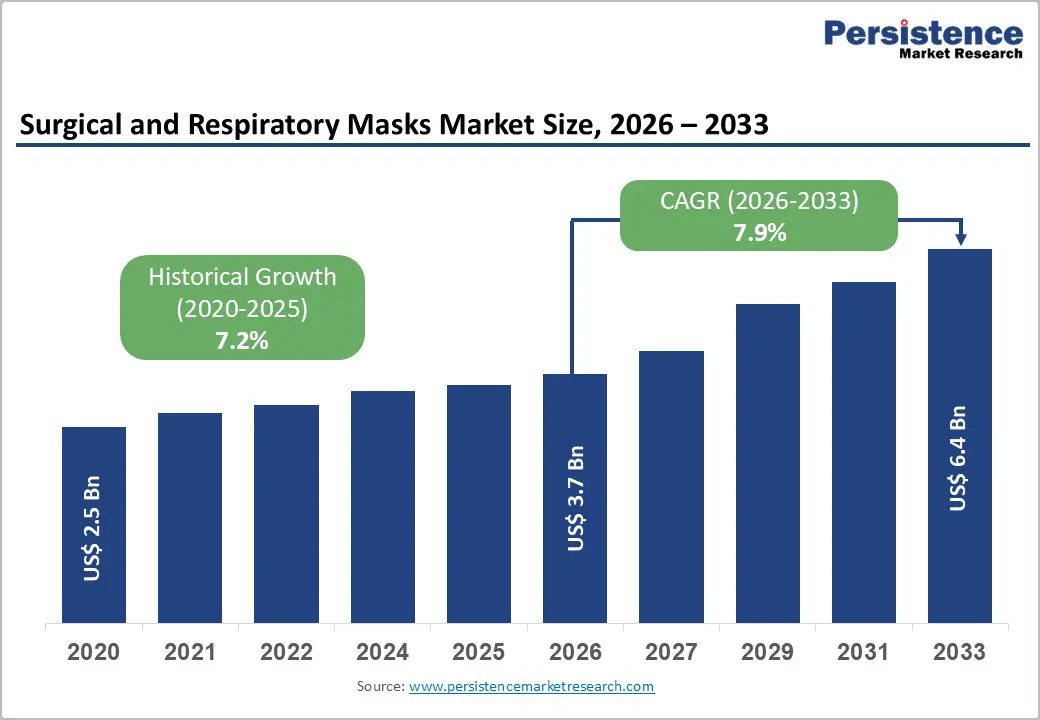

The global Surgical and Respiratory Masks market size is expected to be valued at US$ 3.7 billion in 2026 and projected to reach US$ 6.4 billion by 2033, growing at a CAGR of 7.9% between 2026 and 2033.

The market expansion is primarily driven by increasing healthcare infrastructure investments, rising prevalence of hospital-acquired infections (HAIs), and stringent occupational safety regulations across industries. According to the CDC, on any given day, approximately 1 in 31 hospital patients has at least one healthcare-associated infection, highlighting the critical need for effective infection prevention through validated protective equipment. Additionally, heightened awareness of respiratory diseases and the adoption of evidence-based infection control practices in healthcare facilities have created sustained demand for high-quality surgical masks and respirators across clinical and non-clinical applications.

| Key Insights | Details |

|---|---|

|

Surgical and Respiratory Masks Market Size (2026E) |

US$ 3.7 billion |

|

Market Value Forecast (2033F) |

US$ 6.4 billion |

|

Projected Growth CAGR(2026-2033) |

7.9% |

|

Historical Market Growth (2020-2025) |

7.2% |

Escalating Healthcare Infrastructure Investments and Surgical Procedure Volumes

The global healthcare industry is experiencing unprecedented growth, particularly in emerging economies where surgical procedure volumes are expanding at accelerated rates. According to regulatory bodies including OSHA and the European Agency for Safety and Health at Work (EU-OSHA), healthcare facilities are mandated to maintain comprehensive respiratory protection programs for both healthcare workers and patients. The increasing number of surgical interventions, coupled with heightened awareness of infection control following recent pandemic experiences, has created substantial baseline demand for FDA-cleared and NIOSH-approved surgical masks and respirators. Healthcare systems in developed nations are investing heavily in PPE stockpiling and compliance infrastructure, while emerging markets are establishing robust supply chains to meet evolving regulatory standards and operational requirements.

Stringent Regulatory Compliance and Occupational Safety Standards

Regulatory frameworks governing respiratory protection have become substantially more stringent, with agencies such as the FDA, NIOSH, and OSHA implementing comprehensive standards for mask performance, filtration efficiency, and breathability. The implementation of new OSHA standards enacted in 2025 has raised minimum protection requirements by an estimated 12% in industrial and healthcare settings across North America alone. These regulatory mandates require organizations across multiple sectors—healthcare, construction, manufacturing, and chemical processing to invest in certified respiratory protection solutions. Compliance with these frameworks has become non-negotiable for institutional buyers, driving consistent demand for products meeting Bacterial Filtration Efficiency (BFE) standards exceeding 99% and NIOSH 42 CFR 84 certifications, particularly among hospital networks and industrial enterprises.

Supply Chain Volatility and Raw Material Cost Fluctuations

The surgical and respiratory masks market continues to experience significant supply chain disruptions stemming from geopolitical tensions, semiconductor shortages affecting manufacturing equipment, and volatility in raw material pricing. The global supply of critical components, including synthetic polymers, activated carbon, and electrostatic filtration media, remains vulnerable to market shocks and regional production disruptions. According to industry analyses, raw material costs have experienced fluctuations ranging from 15-25% year-over-year in certain regions, directly impacting manufacturing margins and product pricing. Additionally, logistics costs for international shipment of masks and respirators have remained elevated, creating accessibility challenges particularly for smaller healthcare institutions and pharmacies operating with constrained budgets. These cost pressures have intensified competition from counterfeit and substandard products, which, while reducing demand for certified products, have simultaneously created consumer confusion and regulatory compliance challenges.

Market Saturation in Developed Regions and Price Compression Dynamics

Developed markets in North America, Europe, and mature Asia-Pacific regions are experiencing market saturation as demand normalizes following pandemic-driven surge cycles. The proliferation of manufacturers entering the surgical mask and respirator market has intensified price competition, resulting in margin compression for both manufacturers and distributors. Retail pricing for basic surgical masks in mature markets has declined by approximately 30-40% from pandemic-era highs, reducing profitability across the distribution chain. This pricing pressure has forced smaller regional manufacturers to exit the market or consolidate operations, reducing product diversity and creating barriers to market entry for emerging competitors. Furthermore, the availability of low-cost alternatives from manufacturing-dominant regions like China has created pricing pressure even for premium and specialty mask products featuring advanced filtration technologies.

Rapid Adoption of Advanced Filtration Technologies and Smart Mask Integration

The development and commercialization of next-generation respiratory protection solutions present substantial market opportunities for technology-focused manufacturers. Integration of artificial intelligence-powered monitoring systems, real-time air quality detection sensors, and dynamic filter adjustment capabilities within mask designs is creating differentiated product categories commanding premium pricing. Manufacturers developing masks with antimicrobial nanoparticle coatings, self-disinfecting technologies featuring UV integration, and improved ergonomic designs for extended-wear applications are capturing market share from conventional product categories. The healthcare sector, particularly intensive care units and emergency departments, is demonstrating strong willingness to adopt these advanced solutions for superior infection control outcomes.

Surgical Masks Leading Segment with Substantial Market Dominance

Surgical masks, encompassing basic surgical masks, anti-fog foam variants, and fluid/splash resistant formulations, represent the dominant product category within the market, commanding approximately 58% market share in 2025. This leadership position is substantiated by the fundamental criticality of surgical masks in hospital operating rooms, patient care environments, and routine medical procedures. The CDC guidelines for infection prevention mandate surgical mask usage during all patient-care activities presenting risk of exposure to blood, bodily fluids, or respiratory secretions. The accessibility of surgical masks relative to higher-specification respirators, combined with regulatory requirements for consistent institutional stocking, creates predictable baseline demand particularly within hospital networks. Furthermore, the transition toward specialty variants including anti-fog formulations designed for extended-wear applications in surgical theaters and fluid-resistant products addressing specific clinical environments has expanded the addressable market while supporting premium pricing strategies. The market leadership of surgical masks is expected to persist through the forecast period despite competitive pressures from respirator product segments.

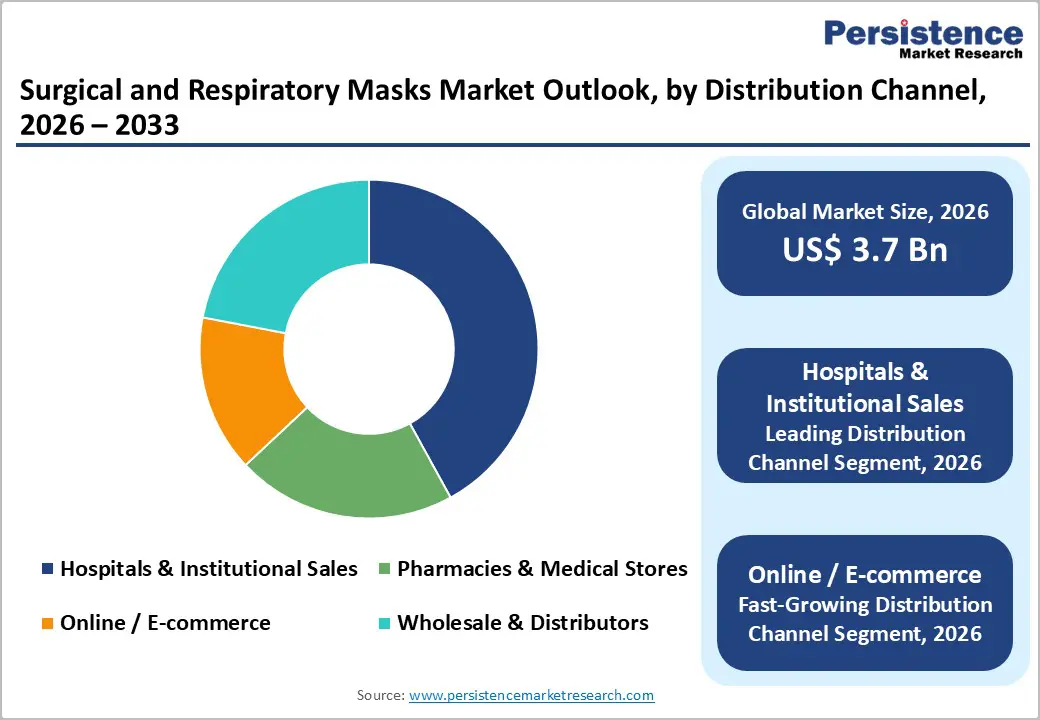

Hospitals & Institutional Sales Commanding Largest Distribution Share

Hospitals and institutional healthcare buyers represent the dominant distribution channel, capturing 42% market share in 2025 and representing the primary revenue driver for manufacturers and distributors. This channel dominance reflects the systematic procurement requirements of healthcare systems, stringent regulatory compliance standards mandating continuous availability of certified masks, and the critical nature of respiratory protection within clinical operations. Institutional buyers negotiate volume-based contracts with manufacturers, ensuring reliable supply chains and preferential pricing while simultaneously supporting manufacturer revenue stability and operational planning. The average hospital network maintains sophisticated supply chain management systems requiring predictable product specifications, quality certifications, and logistics reliability requirements that smaller distributors and online retailers struggle to consistently meet. Pharmacies and medical stores, representing the secondary distribution channel with 28% market share, serve individual consumers and smaller clinical facilities with more flexible purchasing patterns and higher per-unit retail pricing, contributing disproportionate margins despite lower volume penetration.

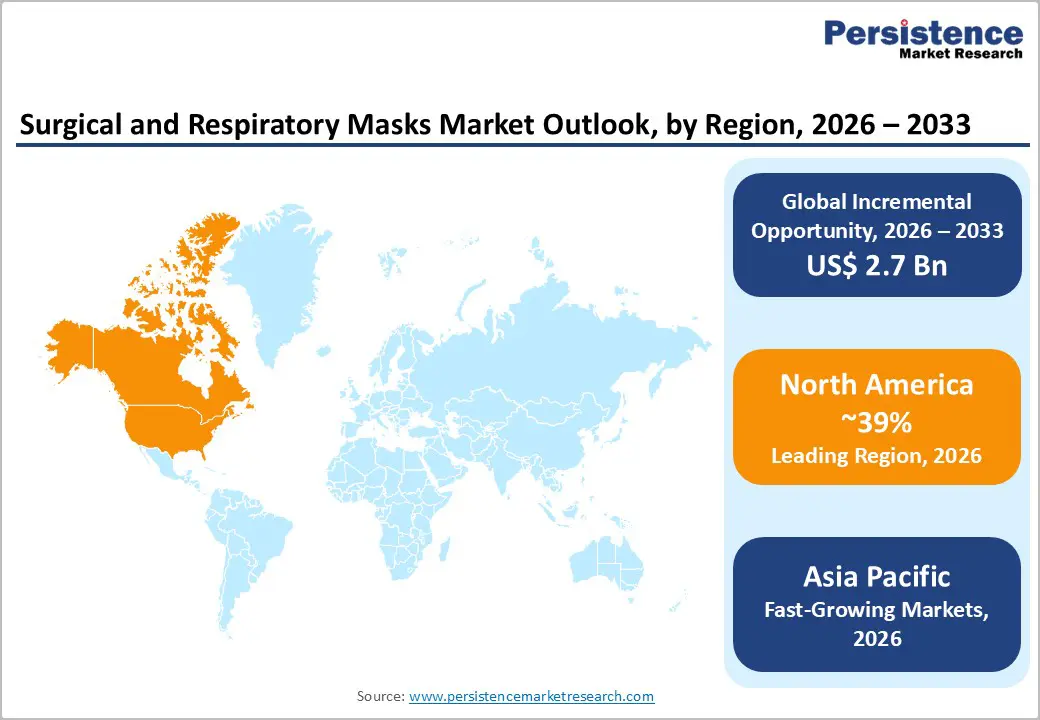

North America commands the largest global market share at 39% in 2025, driven by the region's advanced healthcare infrastructure, rigorous regulatory framework, and substantial healthcare expenditure. The United States market is particularly dominant within the region, representing approximately 81% of North American market value, supported by approximately 6,000 registered hospitals, 33 million annual surgical procedures, and comprehensive workplace safety regulations administered by OSHA.

The region's market is characterized by strong demand from established hospital networks including Mayo Clinic, Cleveland Clinic, and large integrated delivery systems that maintain sophisticated supply chain management and PPE procurement systems. Regulatory compliance remains paramount, with the FDA maintaining rigorous oversight of surgical mask clearances and NIOSH administering comprehensive N95 respirator certification programs. The U.S. market demonstrated 7.2% historical CAGR from 2020-2025, supported by sustained healthcare spending and institutional commitment to infection prevention protocols documented by the CDC.

Asia Pacific is emerging as a high-growth region in the surgical and respiratory masks market, driven by a combination of public health awareness, rapid urbanization, and expanding healthcare infrastructure. Rising air pollution levels in countries such as China and India are increasing routine mask usage among the general population, beyond hospital settings. Governments across the region are strengthening infection control policies and stockpiling essential PPE, supporting sustained institutional demand. Growth in hospital capacity, medical tourism, and surgical volumes is further boosting consumption of surgical masks. At the same time, respiratory masks such as N95 and equivalent standards are gaining traction in industrial workplaces due to stricter occupational safety regulations. The region is also benefiting from strong domestic manufacturing capabilities, particularly in China, India, and Southeast Asia, which improve affordability and supply resilience. Additionally, the rapid expansion of e-commerce platforms is accelerating consumer access to masks, making online sales a key growth driver. Overall, Asia Pacific is transitioning from volume-driven demand to a more quality- and standards-focused market.

The competitive landscape of the surgical and respiratory masks market is shaped by intense rivalry focused on innovation, quality, and supply reliability. Manufacturers compete on product differentiation through advanced filtration materials, ergonomic design, and compliance with evolving safety standards. Pricing strategies and channel reach play a crucial role, with firms expanding distribution across institutional, retail, and digital platforms to secure broader market access. Strategic partnerships with healthcare institutions and industrial buyers help lock in long-term demand, while investment in localized production enhances responsiveness to regional needs. Overall, competition is accelerating due to rising demand, technological advancements, and heightened regulatory expectations.

The global Surgical and Respiratory Masks market is expected to be valued at US$ 3.7 billion in 2026, representing significant healthcare and occupational safety investment as institutions prioritize comprehensive respiratory protection infrastructure across clinical and industrial applications.

The market is primarily driven by escalating healthcare infrastructure investments, expanding surgical procedure volumes particularly in emerging economies, stringent OSHA and FDA regulatory compliance requirements, heightened institutional awareness of healthcare-associated infections documented by the CDC affecting approximately 1 in 31 hospitalized patients, and growing occupational safety consciousness across manufacturing and construction sectors.

North America commands the largest global market share at 39% in 2025, driven by advanced healthcare infrastructure, rigorous regulatory oversight by the FDA and OSHA, approximately 6,000 registered hospitals across the United States, and substantial institutional healthcare expenditure supporting comprehensive infection prevention programs.

Advanced filtration technologies integrating artificial intelligence-powered monitoring systems, real-time air quality detection, antimicrobial nanoparticle coatings, and self-disinfecting technologies represent the most substantial market opportunity, with projected market value contributions of 20-25% of total market value by 2033 as healthcare systems and industrial employers prioritize premium protection solutions.

Hollister Inc., DermaRite Industries LLC, 3M, Coloplast Corp, etc.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Mn/Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Distribution Channel

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author