ID: PMRREP3892| 194 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

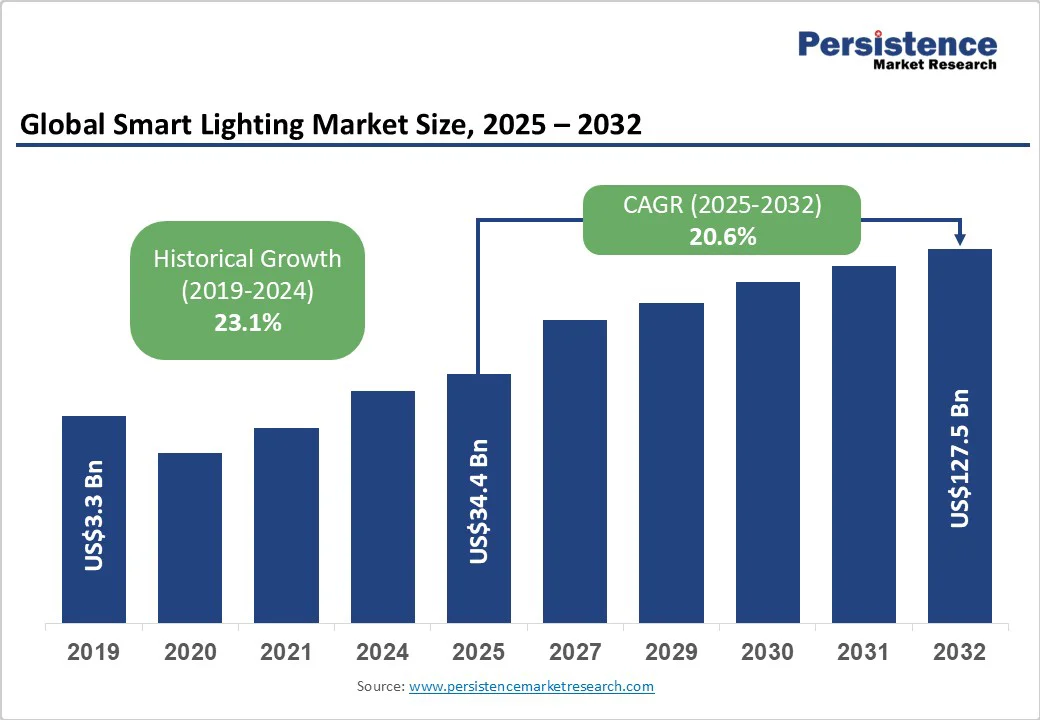

The global smart lighting market size is likely to be valued at US$34.4 billion in 2025. It is estimated to reach US$127.5 billion by 2032, growing at a CAGR of 20.6% during the forecast period from 2025 to 2032, driven by the increasing deployment of modern lighting solutions across residential, commercial, and public infrastructure sectors.

Key growth factors include rapid technological advancements in IoT-enabled lighting solutions and supportive regulatory frameworks that promote energy efficiency and sustainability.

The convergence of wireless communication technologies and growing urbanization has driven rising demand for scalable, intelligent lighting systems that improve energy efficiency and enhance user convenience.

| Key Insights | Details |

|---|---|

| Smart Lighting Market Size (2025E) | US$34.4 Bn |

| Market Value Forecast (2032F) | US$127.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 20.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 23.1% |

Global regulatory efforts such as the Ecodesign Directive of the European Union (EU) and the U.S. Energy Independence and Security Act are imposing stringent energy efficiency standards on lighting products. These policies are compelling manufacturers and end-users to transition toward intelligent lighting solutions that significantly reduce energy consumption compared to traditional fixtures.

For example, LED-based smart lighting can lower electricity usage by up to 50%, aligning with government targets to reduce national energy footprints. These regulations stimulate product innovation and expand market demand. They are estimated to contribute 3-4% annual growth through compliance-driven deployments by 2032. This regulatory push is increasingly shaping procurement policies across both commercial and municipal sectors, thereby accelerating the deployment of smart lighting worldwide.

Another emerging dimension is that smart lighting is being increasingly fused with IoT platforms, enabling remote monitoring, automation, and data analytics. Advances in wireless communication protocols such as ZigBee, Bluetooth Mesh, and Wi-Fi 6 facilitate interoperable, scalable lighting networks suited for smart homes, cities, and industrial environments.

Continuous improvements in sensor technology allow enhanced adaptive lighting functionalities, optimizing user comfort and operational efficiency. The integration fosters increased value propositions by enabling predictive maintenance, occupancy-based control, and environment-responsive lighting customization. The integration of AI, sensors, and wireless protocols is positioning smart lighting as a foundational element in the broader smart infrastructure ecosystem.

The growth of the smart lighting market is heavily contingent on the availability of and access to semiconductor components and specialized materials, which are susceptible to global supply chain volatility. Recent industry-wide chip shortages have highlighted vulnerabilities that impact manufacturing lead times and pricing stability.

Fluctuations in raw materials, such as rare earth elements used in LED and sensor fabrication, incur risks of cost inflation, with a potential margin compression of 5%-7% projected in short- to medium-term periods. Geopolitical tensions and trade restrictions may further disrupt supply continuity, necessitating diversified sourcing strategies and enhanced supplier resilience.

The adoption of smart lighting systems is also constrained by their upfront costs, which are often markedly higher than those of conventional counterparts, posing adoption challenges, especially in price-sensitive emerging economies. The premium price includes advanced hardware components, integrated sensors, and software platform licensing fees.

Estimated installation and configuration expenses can increase total project costs by 15%-25%, potentially delaying return on investment for end-users. Limited economies of scale compound such cost barriers in some regions, which restrict system affordability and slow penetration in small & medium enterprises (SMEs) and residential applications.

The convergence of artificial intelligence (AI) and voice assistant platforms with smart lighting offers a significant growth vector. Integration with voice-activated systems, such as Amazon Alexa, Google Assistant, and Apple Siri, enhances the user experience by offering intuitive, hands-free lighting control, personalization, and automation.

AI algorithms enable adaptive lighting schedules based on user behavior and environmental data, optimizing comfort and energy use. Responding to the rising consumer demand for seamless smart home integration and workplace digitization, market players adapting to these technological trends have been able to capture differentiated market share through innovation leadership and platform interoperability.

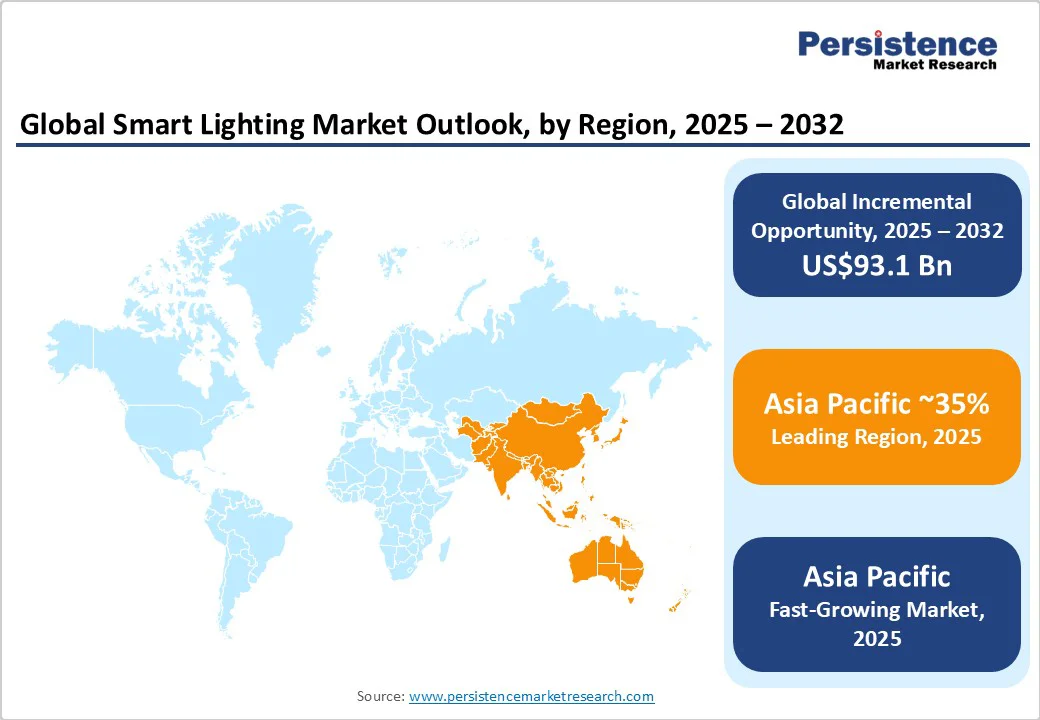

Rapid urbanization in the Asia Pacific and parts of Latin America is stimulating extensive investments in smart city projects with integrated intelligent lighting infrastructures. The deployment of smart street lighting and public area illumination is projected to grow the market share in emerging economies to approximately 30% by 2032.

Governments are allocating capital to upgrade their legacy lighting systems aggressively as part of their sustainability and digital transformation agendas, creating actionable opportunities for suppliers specializing in scalable, modular solutions tailored to diverse climatic and urban conditions.

The hardware segment is poised to hold a dominant position, accounting for approximately 60% of the revenue share in 2025. This leadership is primarily driven by the broad adoption of smart bulbs, luminaires, and complete lighting fixtures that incorporate energy-efficient LED technology combined with embedded sensors and control modules.

The availability of standardized hardware platforms has lowered entry barriers and improved scalability for large commercial, industrial, and residential deployments. Hardware innovation continues to focus on reducing energy consumption while enhancing user convenience through smart control features, further anchoring its expansive share.

The software segment is poised to exhibit the fastest growth trajectory, driven by increasing demand for advanced control software, cloud-based lighting management platforms, and data analytics services that leverage sensor-generated insights.

Software enables predictive maintenance, optimal light scheduling, and integration with broader building management systems, amplifying operational efficiencies. The shift toward subscription-based SaaS models is fostering recurring revenue streams and driving sustained innovation, positioning software as an indispensable component of future smart lighting systems.

Within the applications segment, the commercial sector is expected to secure the largest share, capturing an estimated 40% of the smart lighting market revenue by 2025. This dominant position reflects widespread deployments in office buildings, retail environments, hospitality venues, and healthcare facilities, which prioritize energy efficiency and occupant well-being.

Corporate sustainability mandates, coupled with building certification programs such as the Leadership in Energy and Environmental Design (LEED) and the Building Research Establishment Environmental Assessment Method (BREEAM), are significant catalysts for smart lighting adoption. The integration of IoT-enabled lighting controls enhances user experience and supports operational management.

The residential application segment is rapidly emerging as the fastest-growing category. This growth is fueled by increasing consumer preference for smart home technologies that provide customizable lighting scenes, voice control capabilities, and energy savings.

Affordability improvements in smart bulbs and kits, combined with increasing awareness of the impact of ambient lighting on health and mood, are driving the residential segment's penetration. Advancements in interoperability among diverse smart home platforms also enable seamless integration, driving demand from tech-savvy homeowners and early adopters.

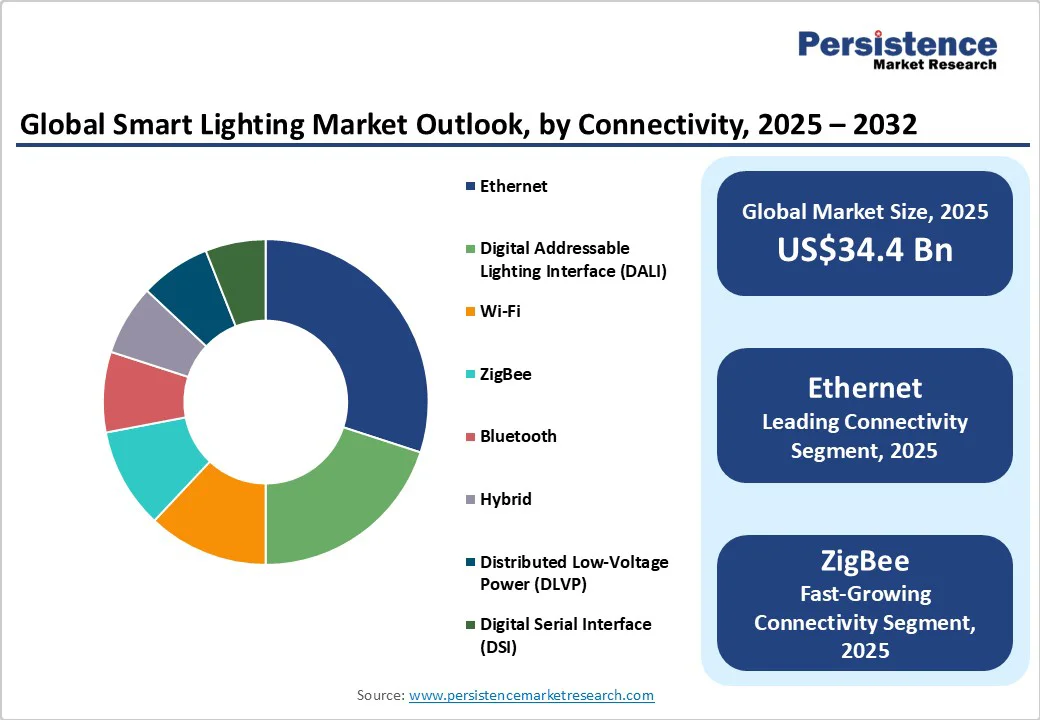

The connectivity segment in smart lighting is diverse, with both Ethernet and DALI maintaining a strong market presence. Ethernet is projected to lead wired connectivity in 2025 with a 30% share, driven by its high reliability, bandwidth, and seamless integration into existing IT infrastructures, especially in commercial and industrial environments. Its ability to support real-time data transmission is crucial for dynamic lighting and automation.

DALI remains highly relevant due to its lighting-specific capabilities. Its standardized protocol ensures device interoperability and enables advanced control features such as scene setting and group management, making it essential for complex, building-wide lighting deployments.

The ZigBee segment is projected to be the fastest-growing wireless connectivity protocol in the smart lighting market between 2025 and 2032. This robust growth is attributed to the low power consumption, reliable mesh networking capabilities, and strong ecosystem support of ZigBee, fostered by the Connectivity Standards Alliance (CSA). ZigBee facilitates efficient and scalable communication in residential, commercial, and industrial smart lighting applications, ensuring seamless interoperability and integration with popular smart home assistants and IoT platforms.

The Asia Pacific is unequivocally the fastest-growing regional market for smart lighting, with a dominant market share of approximately35% in 2025. China, Japan, India, and ASEAN nations are leading regional growth, driven by rapid urbanization, government infrastructure development projects, and increasing consumer adoption of smart home technologies. Proactive government policies that emphasize digital transformation and the adoption of green energy are fueling extensive smart city initiatives, particularly in large metropolitan areas.

The region boasts manufacturing advantages, including cost-efficient production capacities and access to raw materials, which have enabled affordable hardware and its proliferation across emerging markets. Rising middle-class populations, combined with increasing internet penetration and smartphone usage, drive demand for connected smart lighting solutions.

Regulatory frameworks are progressively standardized with international benchmarks, facilitating technology transfer and scalability. The competitive environment features strong local players partnering with international firms, focusing on product adaptation for diverse climatic and economic conditions, ensuring the Asia Pacific remains pivotal to global market growth.

North America is forecasted to maintain a commanding presence, with an estimated 30% share of the smart lighting market in 2025. The U.S. is the driving force, bolstered by mature market dynamics, a highly developed innovation ecosystem, and an aggressive regulatory framework encouraging energy-efficient lighting solutions.

The U.S. Department of Energy’s lighting standards and rebate programs, combined with municipal smart city initiatives, are significantly accelerating the adoption of smart lighting across both public infrastructure and private commercial sectors. The regional market is also accruing benefits from a concentration of key industry players investing heavily in R&D, particularly in AI integration and advanced analytics, reinforcing its competitive edge.

The regulatory environment maintains a focus on reducing greenhouse gas emissions and promoting sustainable urban development, enhancing long-term market stability. Investment trends indicate growing interest in venture capital for lighting-as-a-service models and IoT interoperability, positioning North America as a testing ground for cutting-edge smart lighting innovations and deployment strategies.

Europe is projected to capture approximately 25% of the global share in 2025, underpinned by strong contributions from Germany, the U.K., France, and Spain. The region is characterized by comprehensive regulatory harmonization efforts, notably the EU Ecodesign Directive and Energy Performance of Buildings Directive, which are instigating widespread replacement of conventional lighting with smart, energy-efficient alternatives. Such policy alignment reduces market entry complexities and fosters cross-border technology adoption.

Increased investments in urban modernization, sustainability mandates, and smart city initiatives drive market growth in Europe. Leading economies are leveraging advanced manufacturing infrastructure and technological expertise to accelerate deployments in commercial and public lighting sectors.

Competitive landscapes reveal multipolar market characteristics, with multinational corporations collaborating with regional specialists to focus on compliance, innovation, and customer-centric solutions. The investment environment favors scalability and integration of smart lighting with renewable energy and energy management systems.

The global smart lighting market structure is moderately consolidated, with leading players collectively accounting for approximately 45% of the market share as of 2025. Key companies such as Phillips, Acuity, and OSRAM maintain competitive positioning by leveraging extensive R&D, diversified product portfolios, and global distribution networks.

Market concentration remains balanced with room for emerging players specializing in niche software services and innovative connectivity solutions. This moderately consolidated market structure encourages continuous technology advancements while maintaining competitive pricing dynamics.

The smart lighting market is projected to reach US$34.4 Billion in 2025.

The convergence of wireless communication technologies and unprecedented urbanization that has fostered a huge demand for scalable, intelligent, and energy-efficient lighting systems is driving the market.

The market is poised to witness a CAGR of 20.6% from 2025 to 2032.

Widening deployment of modern lighting solutions across residential, commercial, and public infrastructures, rapid technological advances in IoT-enabled lighting solutions, and supportive regulatory frameworks promoting energy efficiency and sustainability are key market opportunities.

Koninklijke Philips N.V., Acuity Brands, Inc., and OSRAM Licht AG are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Application

By Connectivity

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author