ID: PMRREP9971| 188 Pages | 1 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

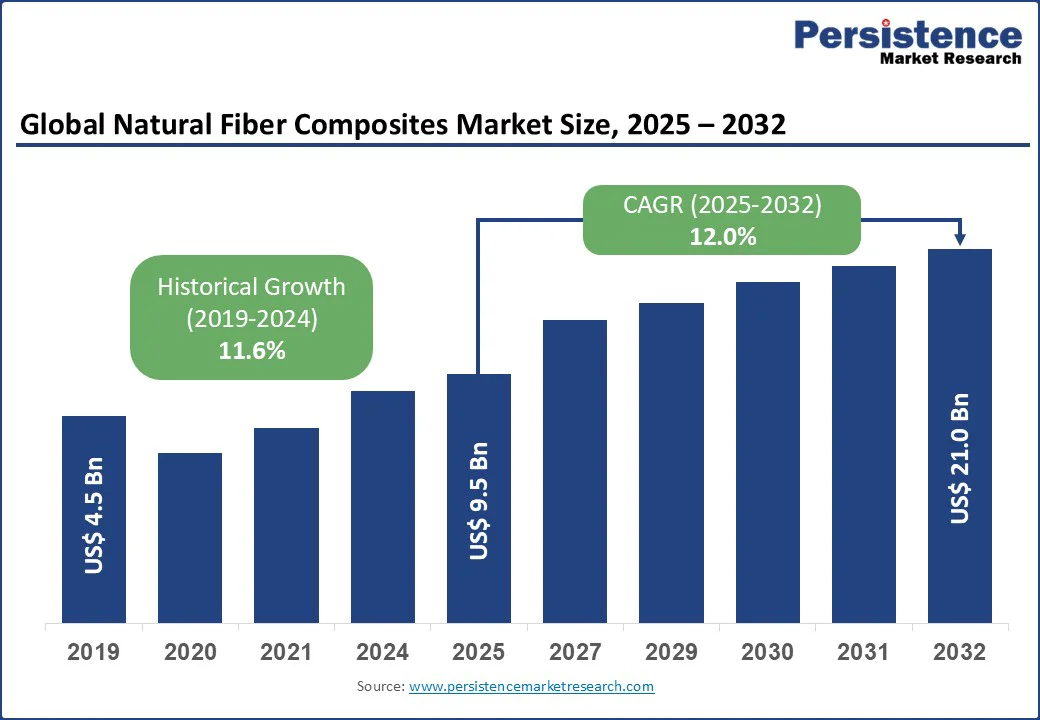

The global natural fiber composites market size is likely to be valued at US$9.5 Bn in 2025 and is expected to reach US$21.0 Bn by 2032, growing at a CAGR of 12.0% during the forecast period from 2025 to 2032.

Rising demand for sustainable, lightweight, and cost-effective materials across the automotive, construction, and consumer goods industries encourages the natural fiber composites market. This growth is driven by stringent environmental regulations, increasing consumer preference for eco-friendly products, and the superior mechanical properties of natural fibers such as jute, hemp, and flax. Additionally, the push for reduced carbon emissions and improved fuel efficiency in vehicles further accelerates adoption, making natural fiber composites a vital component of green innovation.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Natural Fiber Composites Market Size (2025E) |

US$9.5 Bn |

|

Market Value Forecast (2032F) |

US$21.0 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

11.6% |

The growing shift toward sustainable and lightweight materials is a key driver for the natural fiber composites market. Industries such as automotive, construction, and consumer goods are adopting these materials to lower environmental impact, enhance energy efficiency, and meet evolving sustainability standards. Natural fibers such as hemp, jute, and flax offer the right balance of strength, durability, and lightness, making them suitable replacements for heavier synthetic materials. Their renewable nature also aligns with the global push for circular economy practices and reduced carbon emissions.

Governments are actively supporting this transition with policies and initiatives that encourage the use of eco-friendly composites. For instance, the U.S. Department of Energy highlights lightweight materials, including natural fiber composites, as critical in improving vehicle fuel economy and reducing emissions. Such initiatives strengthen the case for wider adoption, positioning natural fiber composites as a practical and sustainable solution across multiple applications.

The adoption of natural fiber composites is constrained by the relatively high production costs compared to conventional synthetic materials. Processing natural fibers requires additional treatments, such as chemical modifications and coupling agents, to enhance compatibility and performance, which increases overall manufacturing expenses. The absence of standardized large-scale production methods further adds to operational costs, making these composites less competitive in cost-sensitive industries despite their sustainability benefits.

In addition, the availability of raw materials such as jute, hemp, and flax is limited and highly dependent on regional cultivation and seasonal yields. Variations in agricultural output, combined with supply chain inefficiencies, restrict consistent access to quality fibers. The lack of reliable raw material availability makes it challenging for manufacturers to achieve economies of scale and meet the growing demand. As a result, both high production costs and supply constraints act as significant restraints on the expansion.

The rising integration of natural fiber composites across automotive, construction, and consumer goods sectors presents a significant growth opportunity. In the automotive industry, manufacturers are increasingly turning to lightweight biocomposites for components such as interior panels, dashboards, and trunk liners to improve fuel efficiency and meet stringent emission standards. Similarly, the construction sector is adopting these materials in applications like decking, insulation, and cladding due to their durability, thermal resistance, and eco-friendly profile. Their ability to reduce overall weight while maintaining strength positions natural fiber composites as a viable alternative to conventional materials.

In consumer goods, natural fiber composites are gaining traction in furniture, packaging, and sports equipment, driven by rising consumer preference for sustainable and biodegradable products. Growing awareness of environmental benefits, combined with regulatory encouragement for renewable materials is expected to accelerate adoption.

Wood fibers continue to dominate the natural fiber composites market, accounting for around 55% market share in 2025. Their widespread availability, low processing cost, and versatile applications make them the preferred choice in both automotive and construction sectors. In 2024, nearly half of the global composite panels incorporated wood fibers due to their durability, recyclability, and ease of integration with polymer matrices. Their role in producing lightweight yet sturdy structures further strengthens their position as the most widely used raw material for natural fiber composites.

Hemp fibers are emerging as the fastest-growing raw material driven by their superior tensile strength, sustainability, and biodegradability. Their increasing adoption in automotive interiors and construction materials rose by about 15% in 2024, highlighting strong industry interest. As manufacturers prioritize eco-friendly and high-performance composites, hemp’s renewable nature and mechanical advantages position it as a key growth segment for future applications.

In 2025, inorganic compounds account for around 42% of the natural fiber composites market, establishing themselves as the dominant matrix material. Their popularity is largely attributed to excellent thermal resistance, fire-retardant properties, and structural stability, which makes them suitable for demanding applications in construction and infrastructure. Inorganic matrices are widely used in panels, claddings, and insulation products, where safety and durability are critical factors. Their ability to enhance the mechanical performance of natural fibers while ensuring long service life has reinforced their leading position in the global market.

Natural polymers represent the fastest-growing matrix type, fueled by rising demand for biodegradable and eco-friendly composites. Increased adoption in packaging, consumer goods, and green construction materials witnessed a 12% rise in 2024, reflecting growing interest in sustainable alternatives. These polymers, derived from renewable sources such as starch and cellulose, enable the development of fully biodegradable composites, aligning with global sustainability goals. Their expanding application base positions natural polymers as a transformative growth driver for the future.

Compression molding holds the largest share of the natural fiber composites market, accounting for around 70% in 2025. Its dominance stems from its suitability for producing large, durable, and cost-efficient components, especially in the automotive and construction sectors. The process is widely preferred for panels, claddings, and structural parts due to its ability to handle high fiber loading and deliver consistent quality at scale. Compression molding also supports mass production, making it the go-to technology for industries that require strength, reliability, and lower production costs.

Injection molding is emerging as the fastest-growing technology, with increasing use in automotive, consumer goods, and electronics. In 2024, about half of natural fiber composite parts were produced using this method due to its precision, scalability, and design flexibility. Its ability to manufacture lightweight, complex-shaped components efficiently makes it particularly attractive for automotive interiors and electronics housings. Rising demand for high-performance and sustainable materials is expected to further accelerate the adoption of injection molding in the coming years.

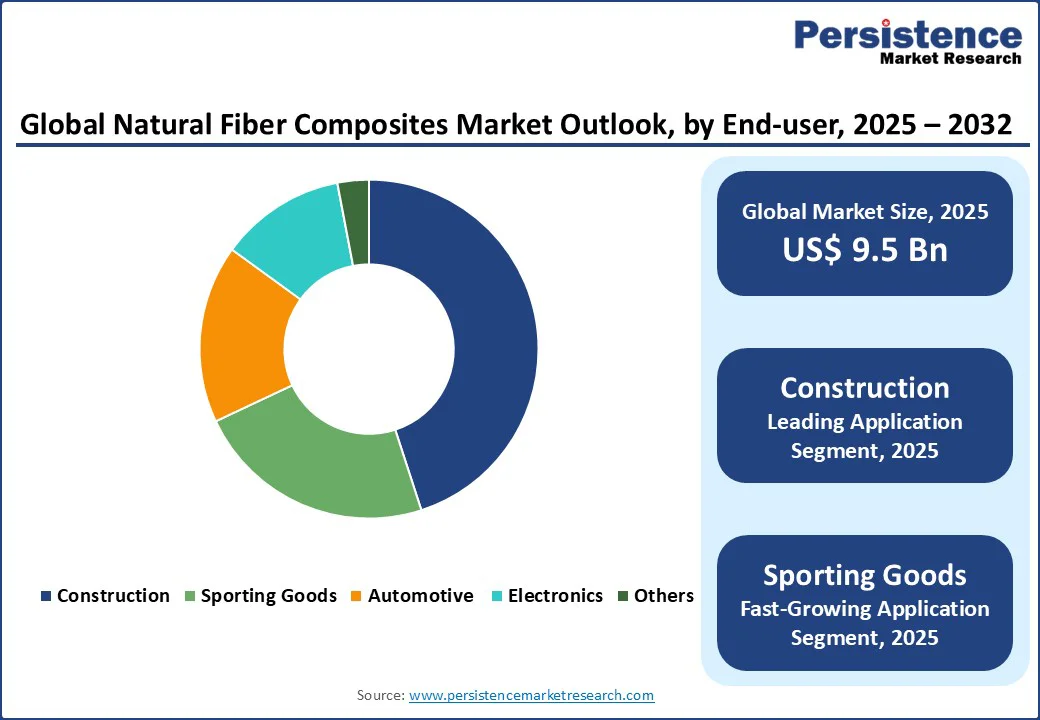

Construction holds the dominant position in the natural fiber composites market, accounting for approximately 45% market share in 2025. This leadership is driven by the rising demand for sustainable and lightweight building materials that enhance energy efficiency and reduce environmental impact. Natural fiber composites are increasingly used in cladding, decking, insulation, and structural panels due to their recyclability, durability, and cost-effectiveness. In addition, global green building initiatives and stricter environmental regulations are accelerating the adoption of composites, further strengthening construction’s role as the leading application segment.

The sporting goods sector is emerging as the fastest-growing application for natural fiber composites. Lightweight and high-strength fibers are being incorporated into bicycles, rackets, helmets, and protective equipment to enhance performance and reduce dependence on petroleum-based materials. Rising consumer awareness of sustainability, along with a growing preference for eco-friendly lifestyle products, is fueling demand. As a result, sporting goods is one of the most dynamic and rapidly expanding opportunities for composite manufacturers.

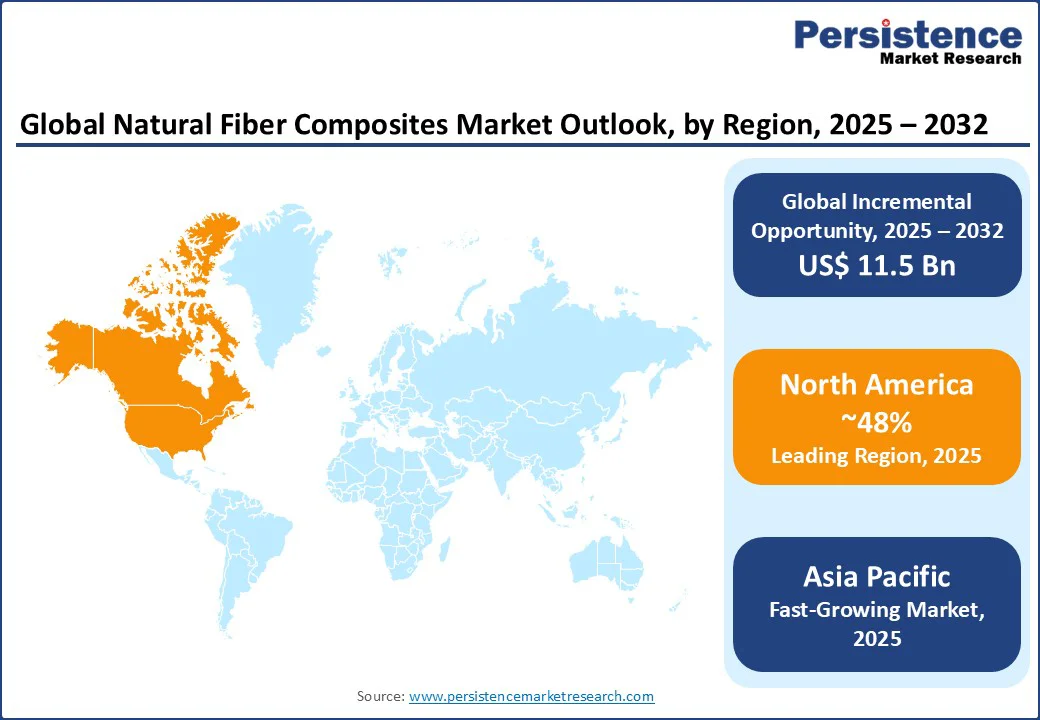

North America leads the natural fiber composites market, accounting for approximately 48% market share in 2025. This dominance is supported by strong adoption in the automotive and construction industries, where lightweight and sustainable materials are in high demand. The U.S. automotive sector, particularly electric vehicle manufacturing, is integrating natural fiber composites to reduce vehicle weight and improve fuel efficiency. Additionally, green building initiatives and government incentives promoting eco-friendly construction materials further strengthen regional demand. Advanced research facilities, established supply chains, and the presence of leading manufacturers also contribute to North America’s commanding market position

Europe holds a substantial share of the natural fiber composites market, supported by strong sustainability initiatives and stringent environmental regulations. The region’s automotive industry, particularly in Germany and France, is actively incorporating natural fiber composites in interiors and structural components to enhance fuel efficiency and reduce emissions. Additionally, Europe’s well-established construction sector is increasingly adopting eco-friendly composites for insulation, cladding, and decking as part of the EU’s green building directives. With continuous innovation, strong research collaborations, and consumer preference for sustainable products, Europe remains a key contributor to the growth.

Asia Pacific is the fastest-growing region in the natural fiber composites market, driven by rapid industrialization, urbanization, and rising demand for sustainable materials. Countries such as China, India, and Japan are witnessing strong adoption in automotive and construction sectors, where lightweight and eco-friendly composites support fuel efficiency and green building initiatives. Expanding electric vehicle production and government-backed sustainability programs further accelerate market penetration. Additionally, the abundant availability of raw materials such as jute, hemp, and coir in South Asia offers a cost advantage for manufacturers. This combination of high demand and resource accessibility positions the Asia Pacific as the key growth engine globally.

The global natural fiber composites market is characterized by continuous innovation in material processing, product performance, and sustainable applications. Companies are focusing on advanced manufacturing techniques such as compression molding and injection molding to enhance scalability and cost efficiency. Strategic partnerships, capacity expansions, and investments in bio-based polymers are common as firms target automotive, construction, and consumer goods sectors. Regional players leverage raw material availability, while global manufacturers emphasize eco-friendly technologies to strengthen market presence.

The natural fiber composites market is projected to reach US$9.5 Bn in 2025, driven by demand for sustainable materials.

Key drivers include environmental regulations, demand for lightweight materials, and growth in the EV and construction sectors.

The natural fiber composites market will grow from US$9.5 Bn in 2025 to US$21.0 Bn by 2032, with a CAGR of 12.0%.

Opportunities include EV market expansion, green construction, and advancements in biodegradable composites.

Leading players include Flexform SpA, Procotex, TECNARO GMBH, UPM, Trex Company, Inc., and Bcomp.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Raw Material

By Matrix

By Technology Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author