ID: PMRREP14161| 199 Pages | 16 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

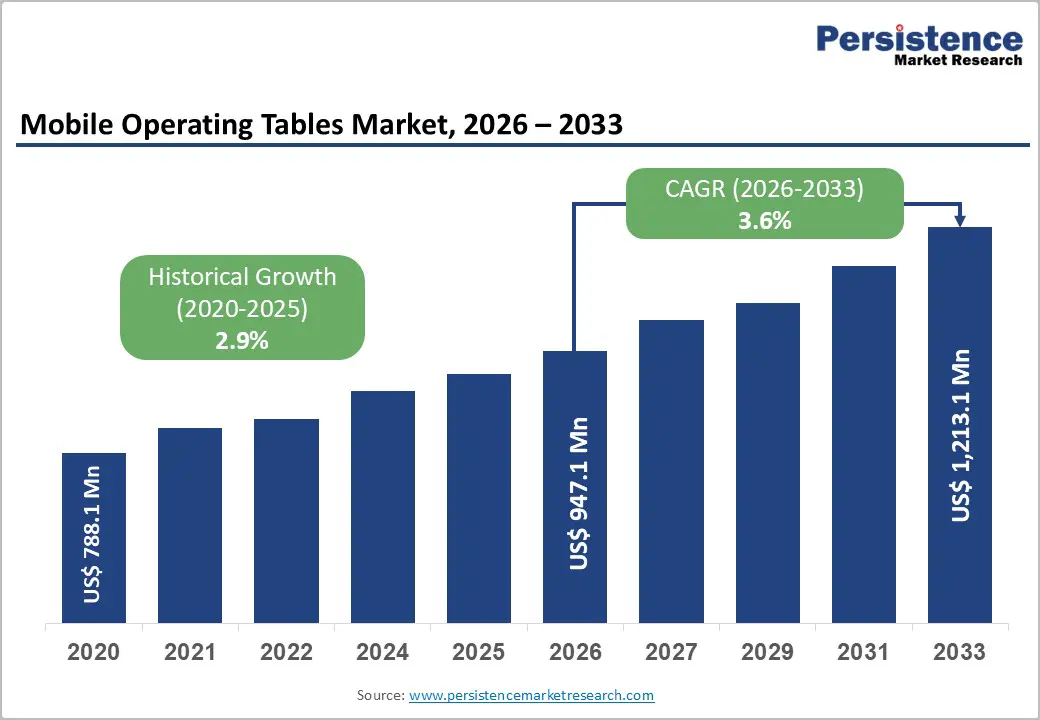

The global mobile operating tables market size is estimated to grow from US$ 947.1 million in 2026 to US$ 1,213.1 million by 2033 growing at a CAGR of 3.6% during the forecast period from 2026 to 2033.

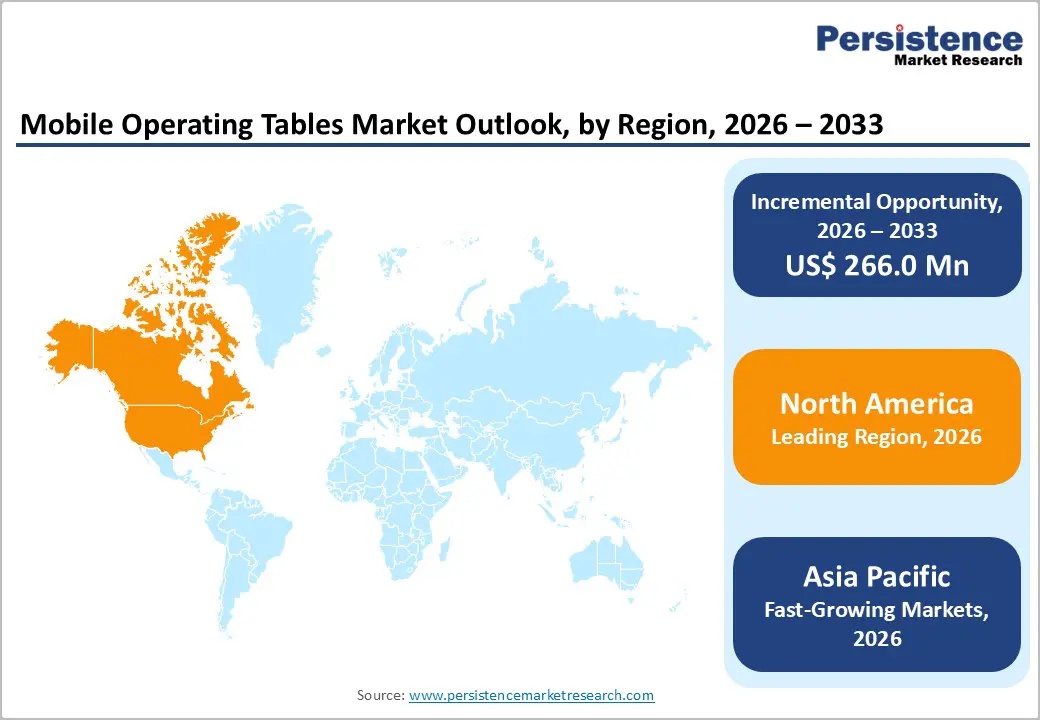

The market is experiencing steady growth, driven by rising surgical volumes, increasing minimally invasive procedures, and the modernization of hospital infrastructure. North America leads due to advanced healthcare systems and high adoption of technologically advanced surgical equipment. Asia-Pacific is the fastest-growing region, supported by expanding healthcare facilities, rising procedure volumes, and increasing investment in hospital and surgical infrastructure.

| Key Insights | Details |

|---|---|

| Mobile Operating Tables Market Size (2026E) | US$ 947.1 Mn |

| Market Value Forecast (2033F) | US$ 1,213.1 Mn |

| Projected Growth (CAGR 2026 to 2033) | 3.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 2.9% |

The global population is aging rapidly, which directly increases the volume of surgical procedures and supports demand for mobile operating tables. The number of people aged 60 years and older is projected to rise from over one billion in 2023 to more than two billion by 2050. This demographic shift means a larger proportion of individuals are entering age groups that face higher rates of surgical intervention for conditions such as joint degeneration, cardiovascular disease, and cataracts. Older adults typically require more complex and frequent surgical care, and millions of older adults undergo surgery annually. These trends increase the volume of procedures and, consequently, the demand for advanced surgical equipment, including mobile operating tables that provide flexibility and support varied surgical needs.

Chronic non-communicable diseases are a leading cause of morbidity and contribute to elevated surgical volumes globally. Cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes dominate the burden of disease, and as populations age, the prevalence of these conditions increases, often necessitating surgical intervention such as cardiac procedures, oncologic resections, and orthopedic surgeries. Research estimates that hundreds of millions of surgery-level procedures are required annually to address the global disease burden, with surgical needs varying by region. The rising incidence of chronic illnesses, combined with an aging population, is driving growth in total surgical procedures worldwide, which in turn is supporting demand for mobile operating tables that improve operational efficiency and accommodate diverse surgical requirements.

Advanced electro-hydraulic and motorized mobile operating tables represent a significant capital investment for healthcare facilities, which can limit adoption, particularly in cash-constrained public hospitals and smaller private clinics. In developed health systems such as the United States, the average cost of a high-end surgical table can exceed tens of thousands of dollars, with fully featured electro-hydraulic units often costing two to three times as much as basic manual tables. Healthcare providers report that capital budgets are frequently stretched across competing priorities like imaging systems, electronic health records, and facility upgrades, meaning expensive operating room equipment may be delayed or deprioritized. For rural and community hospitals, where margins are tighter and reimbursement rates lower, absorbing these high upfront costs can be especially challenging.

In lower-resource settings, high equipment costs compound existing infrastructure and staffing challenges. Many public hospitals in developing countries operate with limited annual capital expenditure allotments, and essential supplies often take precedence over advanced OR equipment. Even when funding is available, procurement processes can be lengthy and subject to budgetary oversight, delaying investment in modern electro-hydraulic tables. Data from global health expenditure tracking show that many low- and middle-income countries spend less than 5 percent of GDP on healthcare overall, thereby constraining their ability to adopt high-cost surgical technologies. As a result, a significant segment of global surgical facilities continues to rely on older or basic tables, which restrains overall market growth for advanced mobile operating tables despite clinical advantages.

The growing demand for electro-hydraulic and smart mobile operating tables with advanced positioning controls reflects broader trends in surgical care toward precision, efficiency, and safety. Operating rooms increasingly incorporate digital technologies, robotics, and imaging systems that require equipment capable of seamless integration and fine control. For example, a report from the U.S. Centers for Medicare & Medicaid Services shows that hospital investments in capital equipment, including advanced surgical suites and digitally enabled infrastructure, have risen steadily over the past decade. Surgeons and hospital administrators are prioritizing technologies that reduce procedure time and improve outcomes, and tables with programmable positioning, load-sensing, and C-arm compatibility align with these goals. As surgical complexity increases, the need for tables that support dynamic positioning during procedures grows, creating a clear opportunity for the adoption of electro-hydraulic and smart tables.

Advanced positioning controls deliver measurable clinical and operational benefits beyond basic support. Data from clinical quality initiatives indicate that improved patient positioning can reduce risks of pressure injuries, nerve damage, and intraoperative complications, particularly in lengthy procedures such as spine surgeries or bariatric cases. Hospitals that adopt smart table technology report better staff ergonomics, fewer manual adjustments, and enhanced compatibility with intra-operative imaging, which can reduce overall procedure time. Moreover, national health systems in high-income countries are increasingly tying reimbursement and quality metrics to efficiency and patient safety, incentivizing investment in technology that supports these objectives. Consequently, the mobile operating table market can leverage this shift toward data-driven, precision-oriented surgical environments as a significant growth opportunity.

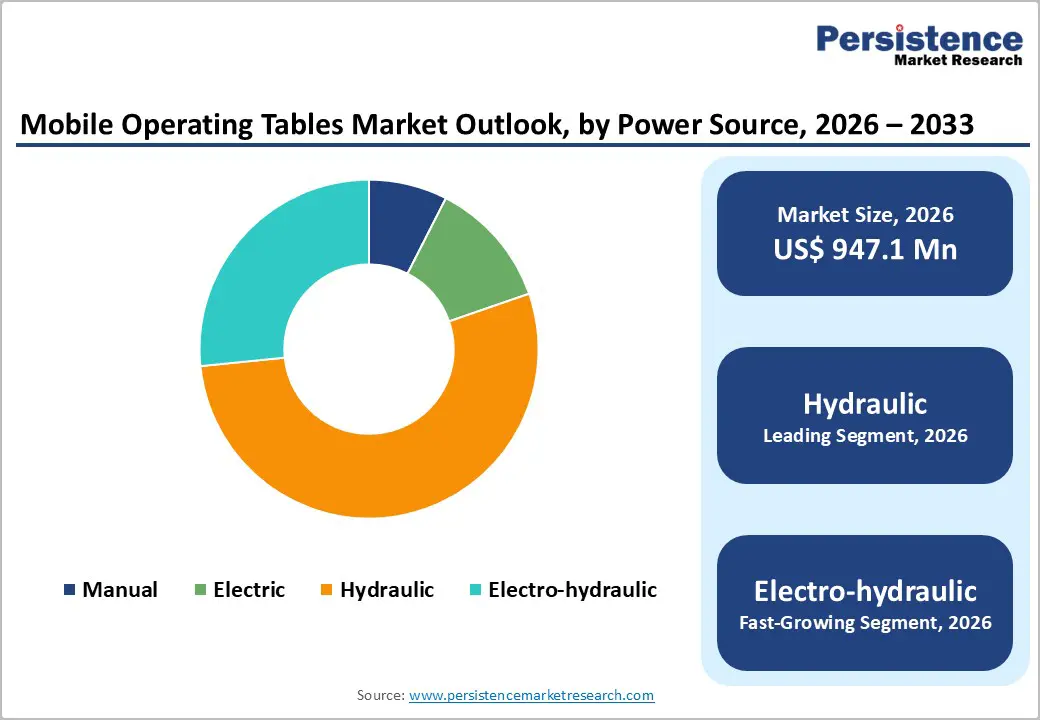

Hydraulic power source occupies 53.7% share of the global market in 2025, because they deliver robust performance, high load capacity, and consistent reliability under repeated surgical use. In operating rooms, tables must support significant patient weight variations and rapid repositioning; hydraulic mechanisms provide smooth, precise movement without the electrical complexity that can interrupt workflows. Hospitals invest in equipment that minimizes downtime, and hydraulic tables have fewer electronic components to fail, which aligns with data showing operating room efficiency directly affects procedure throughput and revenue. For example, U.S. hospital data indicate that average OR utilization rates regularly exceed 70 percent, driving preference for dependable technologies. Additionally, hydraulic tables tend to have lower lifecycle maintenance costs than fully motorized alternatives, making them a cost-effective standard in both high-volume urban hospitals and resource-limited facilities.

because they account for the largest volume of surgeries globally, creating broad demand for versatile tables that can support diverse surgical needs. According to estimates from global health authorities, an additional 143 million essential surgical procedures are needed each year to address unmet surgical needs worldwide, with general surgery accounting for a substantial share of this gap. In high-income health systems such as the United States, hospitals perform millions of general surgical procedures annually, including appendectomies, cholecystectomies, hernia repairs, and exploratory laparotomies, which are far more frequent than many specialty operations. Because mobile operating tables are used in most general surgical suites for patient positioning, imaging compatibility, and intra-operative access, their adoption is higher in this application segment than in narrower specialty domains, driving general surgery’s dominance in the overall mobile operating table market.

North America dominates the mobile operating tables market with a 40.4% share in 2025, driven by its advanced healthcare infrastructure, high surgical procedure rates, and strong capital investment in medical technology. In the United States alone, hospitals performed over 25 million inpatient surgical procedures in a recent year, reflecting high demand for modern operating room equipment. The region also has one of the highest per-capita healthcare expenditures globally, exceeding 16 percent of GDP in the United States, enabling hospitals to invest in advanced electro-hydraulic and smart mobile tables. Furthermore, widespread adoption of minimally invasive and image-guided surgeries in North American facilities increases demand for flexible, C-arm-compatible mobile operating tables. These factors collectively drive the region’s leadership in both revenue and deployment of advanced mobile operating table solutions.

Europe is an important region in the mobile operating tables market due to its large, well-established healthcare systems, high surgical procedure rates, and strong regulatory emphasis on quality and safety. The European Union consistently reports high volumes of both inpatient and outpatient surgeries, driven by aging populations in countries such as Germany, France, and the United Kingdom, where individuals aged 65 and older represent over 20% of the population. Public and private European hospitals invest significantly in modern operating room infrastructure to meet stringent clinical quality standards and reduce waiting times. Health expenditure in major European nations ranges from around 9%to over 11% of GDP, supporting the acquisition of advanced surgical equipment. Additionally, Europe’s robust medical device regulatory framework ensures high performance and safety standards, further anchoring the region’s role in mobile operating table demand and adoption.

Asia Pacific is the fastest-growing region in the mobile operating tables market, driven by rapid healthcare infrastructure expansion, rising surgical procedure volumes, and increasing healthcare spending. Per capita health spending in many Asia Pacific countries has been growing faster than GDP, particularly in upper-middle-income nations, reflecting stronger investment in hospital facilities and services. Hospitals account for the largest share of health expenditure in the region, underscoring the emphasis on surgical and acute care capacity. Expansion of general and specialty hospitals in China, India, Japan, and Southeast Asia is increasing demand for operating room assets, including mobile tables for general and minimally invasive procedures. Additionally, the region’s large and ageing population, with millions of new cancer and chronic disease cases requiring surgical intervention annually, further accelerates growth. The combined effect of these trends positions Asia Pacific as the fastest-growing regional market for surgical tables and related OR technologies.

Leading companies in the mobile operating tables market focus on innovative, precise, and ergonomic solutions. They invest in advanced materials, smart positioning controls, and digital integration to enhance reliability, patient safety, and workflow efficiency. R&D emphasizes durability, ease of use, and cost-effectiveness, while collaborations with hospitals and surgical centers support broader adoption of advanced mobile operating tables globally.

The global mobile operating tables market is projected to be valued at US$ 947.1 Mn in 2026.

Rising surgical volumes, aging populations, minimally invasive procedures, hospital modernization, and demand for flexible, efficient, and technologically advanced operating tables.

The global mobile operating tables market is poised to witness a CAGR of 3.6% between 2026 and 2033.

Adoption of smart electro-hydraulic tables, digital OR integration, specialty surgery expansion, emerging market growth, and ambulatory surgical center development.

Stryker Corporation, Steris Plc, Getinge-Maquet Germany Holding GmbH, Siemens AG, Hill-Rom Holdings Inc, Skytron LLC.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis |

|

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Power Source

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author