ID: PMRREP35518| 193 Pages | 28 Jul 2025 | Format: PDF, Excel, PPT* | Industrial Automation

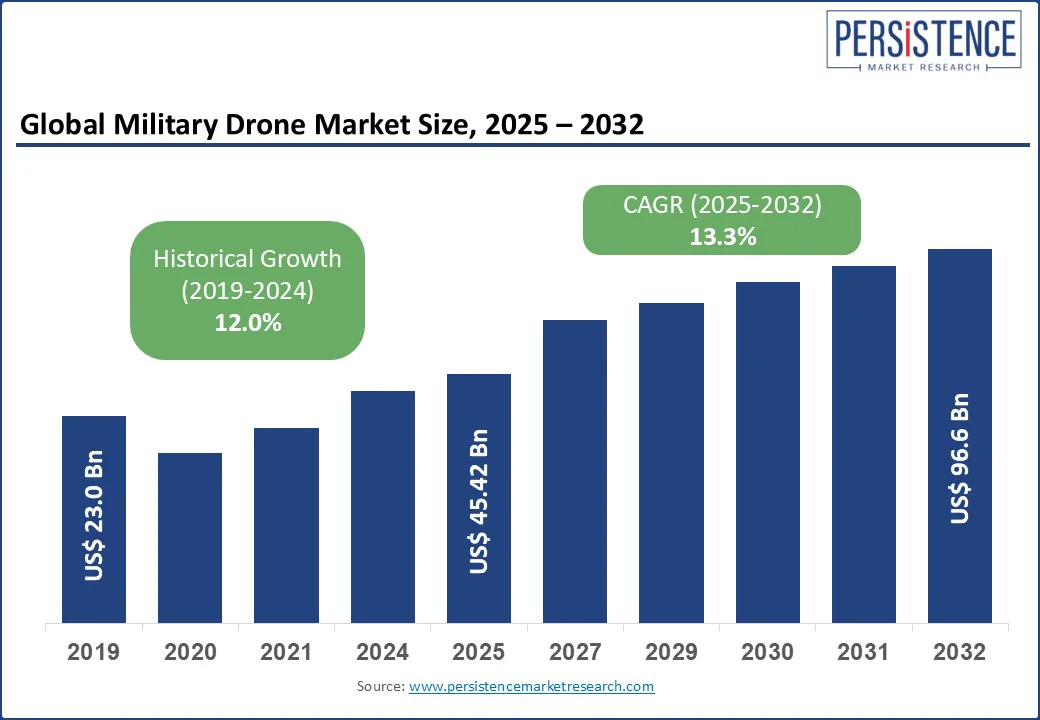

The global military drone market size is likely to be valued at US$ 45.42 Bn in 2025, and is estimated to reach US$ 96.6 Bn by 2032, growing at a CAGR of 13.3% during the forecast period 2025-2032. The military drone market growth is driven by expanding defense budgets, intensifying geopolitical tensions, and the increasing need for real-time intelligence across combat zones. Military drones, or unmanned aerial vehicles (UAVs), are revolutionizing modern warfare by enabling high-precision surveillance, reconnaissance, and strike capabilities without endangering human lives. These autonomous or remotely operated systems have become indispensable assets for tactical, strategic, and homeland defense missions worldwide.

The rapid integration of AI for autonomous targeting, deployment of swarming technologies for coordinated strikes, and the development of next-generation stealth capabilities is driving market growth. Lucrative opportunities await drone industry players in emerging markets across Asia and the Middle East, where governments are investing heavily in indigenous drone production and dual-use military applications.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

| Military Drone Market Size (2025E) | US$ 45.42 Bn |

| Market Value Forecast (2032F) | US$ 96.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 13.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 12.0% |

The military drone market growth trajectory is being redrawn by a noticeable shift toward multi-domain operational warfare, which demands real-time intelligence, precision targeting, and unmanned maneuverability across land, air, and sea. Military drones, such as Medium Altitude Long Endurance (MALE) and High Altitude Long Endurance (HALE) UAVs, are increasingly critical for Intelligence, Surveillance, & Reconnaissance (ISR) missions and electronic warfare capabilities. This system of drone warfare was evident during the Russia-Ukraine conflict, where cost-effective drones such as Bayraktar TB2s disrupted conventional ground strategies, highlighting the asymmetrical advantage offered by combat and reconnaissance drones.

The institutional sanction for the development of higher-order drone systems has further broadened the market horizon. For instance, the U.S. Department of Defense’s FY2024 budget request shows that over US$ 2.4 Bn had been allocated specifically for drone R&D and procurement. AI integration and autonomous navigation in unmanned aerial systems (UAS) is another dimension opening up new arenas for the military drone landscape. The rising demand for swarm drones, autonomous mission execution, and manned-unmanned teaming (MUM-T) is pushing defense agencies to invest in next-gen drone platforms.

Startups such as Anduril Industries and defense OEMs such as Northrop Grumman are at the forefront of AI-based drone development, fueling the evolution of autonomous and semi-autonomous loitering munitions, which offer both surveillance and strike capabilities. Defense OEMs are also working toward developing low-cost long-range munitions. For example, Northrop Grumman’s Lumberjack is a medium-range, jet-powered one-way attack drone (OWA) designed to deliver precision strikes or electronic warfare payloads at a fraction of the cost of traditional missiles. Advancements such as these are accelerating the growth of the military UAV market, especially in combat-ready, AI-enabled drones with edge computing and satellite-independent navigation.

The market’s momentum is restrained by the tightening of international export controls, particularly those influenced by the Missile Technology Control Regime (MTCR) and the escalating geopolitical complications. For instance, the MTCR-based restrictions imposed by the U.S. historically limited the export of high-end Unmanned Aerial Vehicles (UAVs) such as the MQ-9 Reaper to close allies only. Even as the U.S. Federal Government relaxed some restrictions in 2020, deals such as the acquisition of the MQ-9B Predator drones by India worth US$ 3.5 Bn have been delayed for years due to internal review processes, defense offset negotiations, and alignment with Indo-Pacific strategy goals. Such prolonged regulatory vetting and compliance bottlenecks have crippled procurement cycles, particularly in emerging drone markets across South and Southeast Asia, Africa, and Latin America.

Additional complexities have arisen over the past couple of years in the form of rising tensions across the Middle East and Eastern Europe, spurring countries to pursue domestic drone manufacturing to bypass dependence on foreign tech. Turkey, for example, with its Bayraktar TB2, and Iran, with its Shahed-series drones, are pushing indigenous drone production, leading to a parallel innovation ecosystem that may not align with NATO or other non-proliferation standards. This has further complicated defense drone integration across the globe, particularly in ISR missions and coalition-based warfare.

The convergence of AI with autonomous flight systems is unleashing a slew of opportunities in the smart combat UAV space. Militaries worldwide are shifting from remotely piloted drones toward autonomous, AI-driven drones capable of real-time threat analysis, evasive maneuvers, and coordinated swarm behavior. For example, the U.S. Air Force’s Autonomous Collaborative Platform program is accelerating efforts to deploy AI-enabled drones that can operate semi-independently alongside manned aircraft. Similarly, Israel Aerospace Industries (IAI) has been developing loitering munitions integrated with adaptive AI algorithms, enabling autonomous target selection in dynamic battle environments. This capability not only reduces operational risks but also significantly shortens decision cycles in high-stakes combat zones.

AI-powered UAVs offer militaries unparalleled advantages in electronic warfare, ISR, and precision strike missions. Furthermore, defense budgets are widening the allocation of funds to engineer next-gen drone systems. For instance, the Pentagon earmarked over US$ 1.4 Bn in 2024 for autonomous platforms and swarming technologies. As NATO members and Indo-Pacific allies look to modernize and digitize their aerial combat capabilities, the demand for AI-integrated military drones is set to skyrocket, presenting an immensely lucrative niche for defense contractors as well as drone software specialists.

In 2025, the airframe component is expected to lead the system segment, capturing the largest market revenue share of around 34% in 2025. The dominance of airframes is attributable to the increase in the procurement of fixed-wing UAVs with more robust and larger frames capable of carrying advanced payloads for ISR, loitering munitions, and long-endurance missions. Airframe systems are central to drone procurement due to the rise in the deployment of UAVs for various defense operations such as surveillance, targeting, and reconnaissance. The growing adoption of bigger UAV platforms in frontline militaries has further stimulated the demand for structural components that offer durability, modularity, and support integration of AI systems and EW modules.

The propulsion segment is projected to register the fastest CAGR as UAV architects focus their design and engineering capabilities on developing more efficient and resilient engine systems. Virtually every new MALE, HALE, and VTOL drone under development requires propulsion solutions ranging from turboprops to hybrid-electric powerplants. Propulsion and power systems are singlehandedly driving market expansion due to an escalating demand for longer-endurance military drones, redundancy, and operational flexibility. The rising adoption of hybrid-electric propulsion and high-voltage power architectures across ISR and loitering-munitions platforms is also proving to be an important factor for the rapid segment growth.

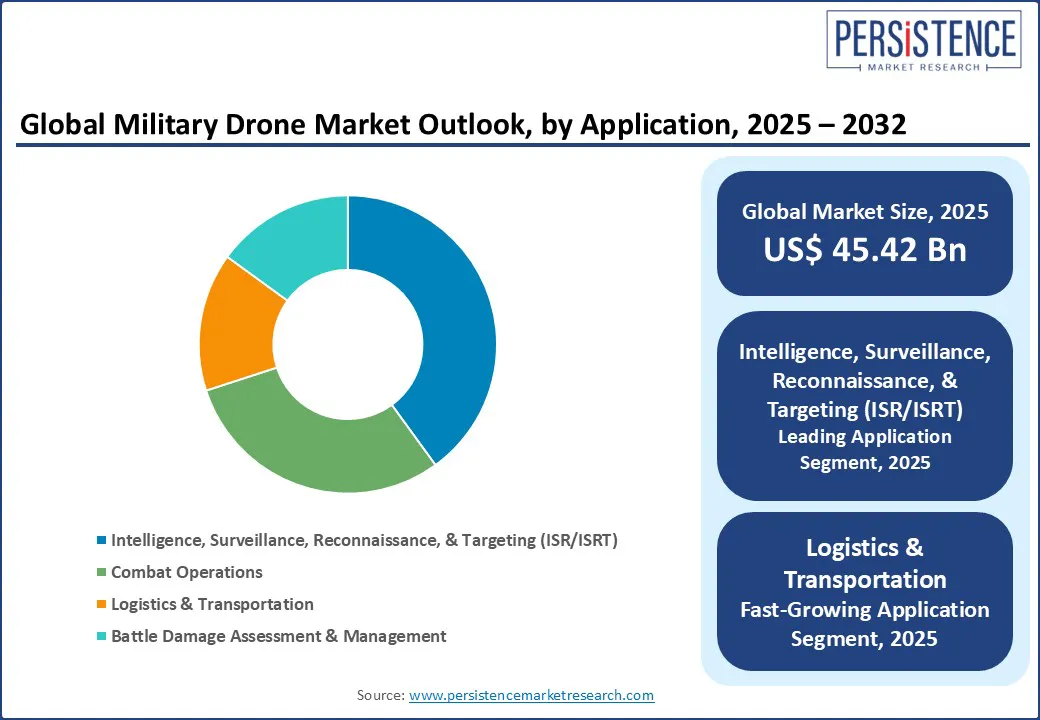

The ISR & targeting sub-segment is envisaged to remain the dominant application area in the market, commanding nearly 40% revenue share in 2025. Drones equipped with advanced EO/IR cameras, radar sensors, and swift data links are essential for delivering real-time battlefield intelligence, precision targeting, and situational awareness. ISR drones are sourced across multiple platform types, nano, tactical, MALE, and HALE, making this a foundational focal point for defense procurement strategies and technology roadmaps in intelligence-driven modern warfare.

The logistics & transportation sub-segment, on the other hand, is anticipated to exhibit the highest CAGR among applications through 2032, owing to the growing urgency for drones to support frontline resupply, medical evacuation, and austere-environment logistics. Militaries around the world are recognizing the value of UAVs to deliver critical equipment, ammunition, and medical kits into areas where conventional supply chains cannot reach or are compromised. The shift toward rapid-response, low-touch logistics using unmanned cargo drones reflects lessons learned from recent battlefield conflicts and disaster relief efforts, positioning logistics drones as a high-growth, strategic niche within the military UAV ecosystem.

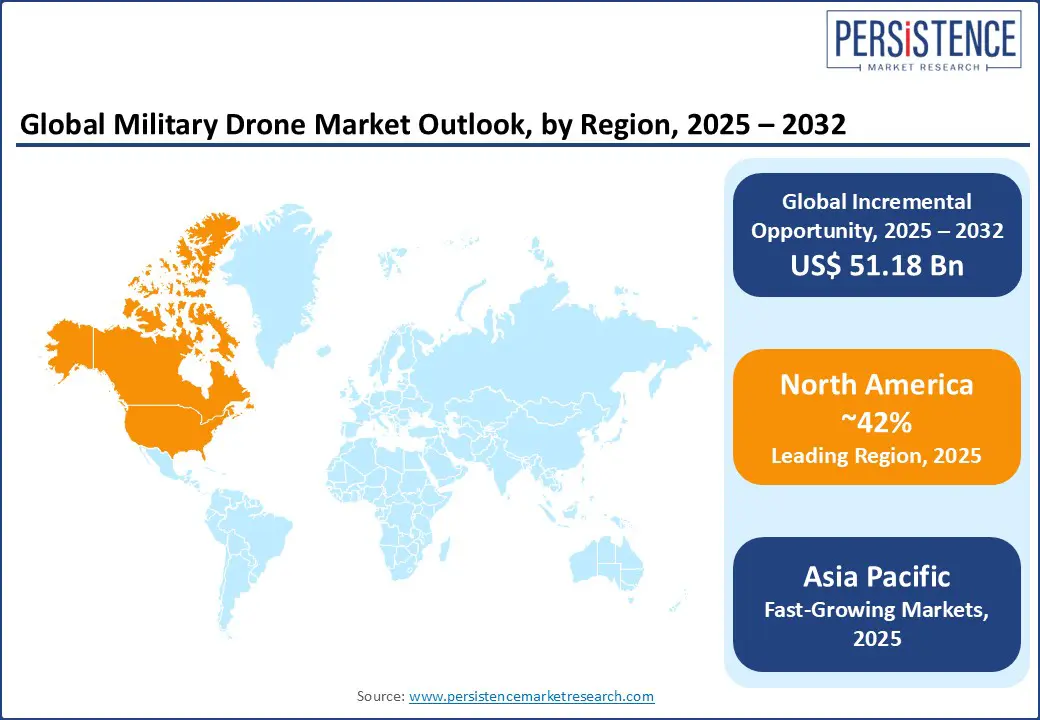

North America is expected to account for nearly 42% of the military drone market share, with the region’s leadership being powered by the U.S. Department of Defense’s consistent investment in next-generation defense systems in general and in advanced unmanned systems, especially fixed-wing and tactical UAVs, in particular. According to the data released by the Stockholm International Peace Research Institute (SIPRI), in 2024, military expenditure of the U.S. rose by 5.7% to hit US$ 997 Bn, which was around 37% of the global military spending and 66% of total spending by the entire NATO.

Aerospace & defense giants such as Northrop Grumman, General Atomics, and Lockheed Martin have mastered the engineering of such systems, securing multi-billion-dollar procurement contracts for UAVs across the spectrum. The convergence of high defense spending, leading-edge sensor and autonomy R&D, and a strong ecosystem of drone startups entrench North America’s position as the epicenter of this market.

Geopolitical tensions in the Middle East and East Europe have spiked the demand in North America for next-gen unmanned capabilities. Projects such as the Pentagon’s Autonomous Collaborative Platform and Replicator swarm initiatives offer compelling evidence of the shift to AI-capable, resilient drone architecture, which is an unmistakable nod to North America, mainly the U.S., being the world’s leading drone industrial base and the commercial backbone of the UAV market.

Asia Pacific is projected to register the highest CAGR among all regions through 2032, rising as the fastest-growing drone market globally. Expanding defense budgets by prime economies in the region, India and China, are the main growth determinants for the region. For example, SIPRI noted that China’s and India’s defense spending jumped by 7.0% and 1.6%, respectively, in 2024, as compared to 2023. Military expenses in these countries are now redirected to indigenously developed drone platforms such as the GJ-2, Wing Loong, and local tactical systems. These nations are emphasizing the promotion of domestic manufacturing to develop cost-efficient military drones, focusing on strengthening local industrial supply chains and creating a self-reinforcing growth cycle in the UAV arena.

The Russia-Ukraine conflict has added more fuel to this shift, demonstrating drone utility in asymmetric warfare and catalyzing procurement across Asia Pacific countries. Governments are actively channeling funding to both government-linked and private drone manufacturers, with an explicit intent to boost exports and augment military autonomy. India’s PLI scheme and China’s support for national drone champions have led to the building of hybrid rotor-wing and endurance UAV lines, producing both tactical ISR and strike platforms at remarkable scale.

Europe plays a key role in the military drone market due to its emphasis on dual-use innovation, regulatory alignment, and defense cooperation within the NATO system. The European market is slated to surge ahead owing to an increasing procurement of cutting-edge ISR capabilities and active cross-border defense collaborations,. Among individual countries, Germany, the U.K., and France are investing in tactical drone platforms and indigenous UCAVs backed by AI capabilities, strengthening Europe’s strategic autonomy.

Domestic startups are directing Europe's push for sovereignty-driven drone technology, further boosting the region’s geostrategic position in the market. For example, in June 2025, Germany’s Helsing raised €600 Mn (US$ 707 Mn) to build AI-powered strike drones and autonomy systems. Apart from this, higher spending by European Union (EU) nations on drone R&D and rising export ambitions are fueling the development of surveillance, multi-role tactical drones, and hybrid ISR-strike platforms tailored to EU defense frameworks, considerably enhancing the role of Europe in the modern UAV ecosystem.

The global military drone market is a dynamic blend of established defense veterans, emerging tech-driven firms, and state-sponsored manufacturers. Each of these entities is striving to capitalize on the soaring demand for autonomous, ISR, and strike-capable UAV platforms.

Key players such as Northrop Grumman, General Atomics, Lockheed Martin, and Israel Aerospace Industries have conquered the high-end market with HALE and MALE UAVs, leveraging long-standing government contracts and proprietary technology to their benefit. These firms are now channeling their energies toward integrating multi-mission payloads, AI-based autonomy, electronic warfare modules, and swarm capabilities, aligning with changing defense policies that prioritize speed, scalability, and survivability. Strategic collaborations, such as Lockheed Martin’s AI integration partnerships or IAI’s joint ventures in Asia, further highlight the growing emphasis on co-development and export adaptability.

In contrast, firms such as BAE Systems and Leonardo are making notable headway into the tactical drone space, targeting European defense programs that aim at strengthening sovereign capabilities and adhering to NATO compliance. The market holds numerous opportunities in modular drone systems, expendable loitering munitions, and hybrid-electric propulsion technologies. The rise of defense-tech startups across Europe and Asia Pacific has cast a shadow over traditional procurement models, with governments increasingly open to agile, low-cost platforms that deliver operational asymmetry.

The military drone market is projected to reach US$ 45.42 Bn in 2025.

An increasing shift toward multi-domain operational warfare, which demands real-time intelligence and precision targeting, is driving the market.

The military drone market is poised to witness a CAGR of 13.3% from 2025 to 2032.

The integration of adaptive AI algorithms in UAVs and the governmental push for the indigenous development of autonomous drones are key market opportunities.

Northrop Grumman Corporation, General Atomics Aeronautical Systems Inc., and Lockheed Martin Corporation are some of the key market players.

| Report Attribute | Details |

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Product Type

By Operation Mode

By Platform Class

By Range

By System

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author