ID: PMRREP13372| 201 Pages | 9 Feb 2026 | Format: PDF, Excel, PPT* | Industrial Automation

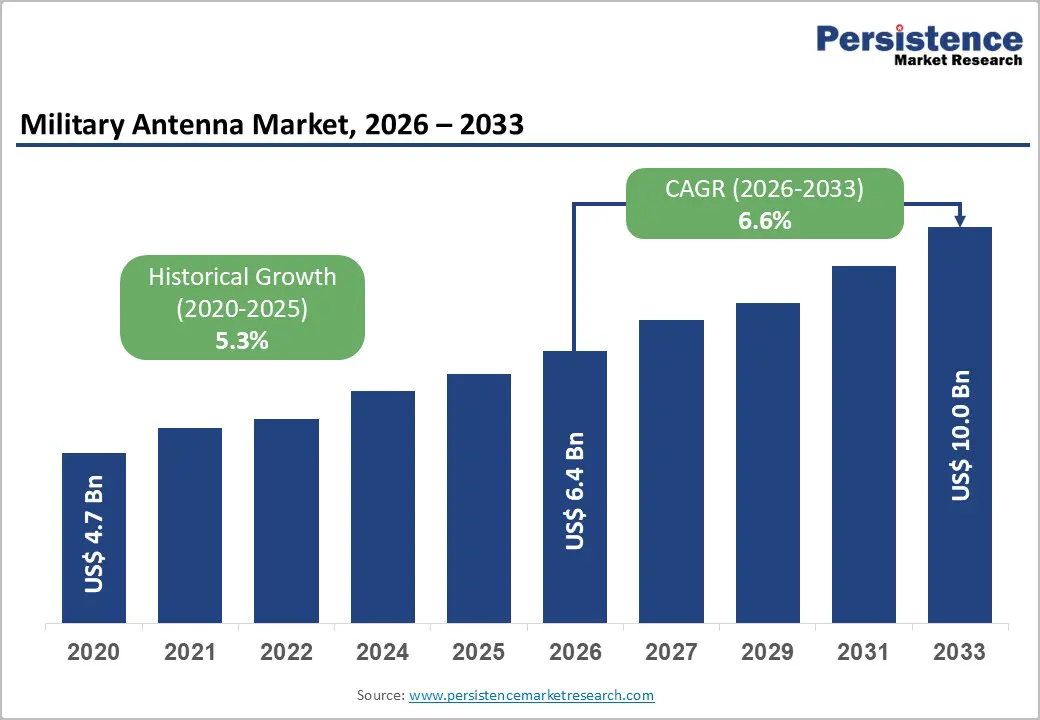

The global military antenna market size is likely to be valued at US$ 6.4 billion in 2026 and is projected to reach US$ 10.0 billion by 2033, growing at a CAGR of 6.6% between 2026 and 2033.

The market's expansion reflects accelerating global defense spending, technological advances in electronically steered phased-array systems, and increasing demand for secure military communications across airborne, maritime, and ground platforms. Global military spending reached approximately US$ 2.44 trillion in 2023, with anticipated increases through 2033 supporting sustained antenna procurement across NATO allies, the United States military modernization programs, and emerging defense infrastructure investment in Asia Pacific nations.

| Key Insights | Details |

|---|---|

| Military Antenna Market Size (2026E) | US$ 6.4 Bn |

| Market Value Forecast (2033F) | US$ 10.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.3% |

Sustained global increases in defense spending and comprehensive military modernization programs across developed and emerging nations are driving persistent demand for advanced antenna systems to support tactical communication, surveillance, and electronic warfare applications. Global military expenditure reached US$ 2.44 trillion in 2023, expanding at 3.7% annual rates through 2033, with the United States defense budget exceeding US$ 820 billion annually, supporting the ongoing replacement of legacy antenna systems with sophisticated phased array and electronically steered platforms.

NATO allies, including Germany, the United Kingdom, France, and Poland, increased defense spending by an average 12.3% in 2024 following the escalation of the Russia-Ukraine conflict, directly stimulating the procurement of advanced antenna systems for tactical data links supporting Link 16 communications networks and surveillance platforms. India military modernization initiative allocated US$ 72.5 billion for defense equipment procurement through 2033, emphasizing antenna technology for ground-based radar systems, airborne surveillance, and satellite communications.

Unprecedented expansion in the deployment of unmanned aerial vehicles (UAVs) across military forces worldwide and growing surveillance application requirements are generating exceptional demand for lightweight, conformal antenna systems designed specifically for autonomous platform integration. Global military UAV procurement expanded from approximately 8,400 units in 2020 to an estimated 18,200 units in 2024, with projections indicating 25,000+ units annually by 2033. The Brazilian Air Force contracted for Hermes 900 medium-altitude, long-endurance UAVs, which require specialized antenna systems for real-time surveillance data transmission, exemplifying emerging market demand.

Airborne antenna segment demand is expanding at a 7.8% annual growth rate, driven by integration requirements for fighter and transport aircraft and for emerging unmanned combat air vehicles (UCAVs). Conformal antenna designs enabling seamless UAV integration without compromising aerodynamic performance remain a critical procurement priority for military forces prioritizing surveillance and reconnaissance capabilities.

Substantial capital investment requirements for advanced antenna research and development, extended military procurement evaluation periods, and limited production-volume economics create significant financial barriers that constrain market expansion, particularly for innovative technology developers. New military antenna platform development requires 24-36-month development cycles, US$50-150 million in average research and development investment per system, and completion of rigorous MIL-STD compliance testing and NATO standardization agreement (STANAG) certification processes.

Phased array antenna development programs undertaken by Raytheon Technologies, L3Harris, and Northrop Grumman collectively represent US$2+ billion in annual research investment globally, accessible exclusively to tier-one defense contractors. Small- to medium-sized enterprises developing specialized antenna innovations face prohibitive certification costs and extended procurement timelines, substantially limiting market entry opportunities.

Growing spectrum congestion in military frequency bands and complex electromagnetic compatibility requirements create increasingly challenging technology development environments, substantially constraining antenna system performance and interoperability. Military spectrum allocation across the C-band (4-6 GHz), X-band (8-12 GHz), Ku-band (12-18 GHz), and Ka-band (27-40 GHz) is facing unprecedented competition from expanding civilian satellite communications, 5G telecommunications, and emerging digital applications. Electronic warfare threats, intentional jamming, and unintended interference from expanding spectrum usage constrain antenna operational performance in contested environments. Multi-band antenna requirements imposing simultaneous operation across diverse frequency allocations create substantial technical complexity in antenna design, amplification architectures, and receiver systems.

Emerging directed-energy weapons programs and the military's emphasis on high-power microwave antenna systems for defeating airborne threats represent transformative market opportunities for defense contractors developing specialized antenna architectures. Raytheon Technologies completed advanced development of high-power microwave antenna systems designed for rugged field deployment, defeating electronic targets at electromagnetic speeds, exemplifying military investment in directed energy capabilities. The United States Air Force allocated US$350 million through fiscal 2026 for directed energy program development, thereby driving substantial requirements for antenna technology innovation. High-power microwave (HPM) antenna systems require advanced electromagnetics, phase-control architectures, and thermal-management capabilities, thereby establishing specialized market niches for innovative manufacturers. Gallium nitride (GaN) semiconductor integration, which enables higher power output with superior efficiency and reduced thermal requirements, positions GaN-based antenna components as essential technologies for directed energy applications.

Massive expansion of low-earth orbit (LEO) satellite constellation deployment for secure military communications and tactical data links represents an exceptional long-term market opportunity for antenna manufacturers developing specialized terminal systems. SpaceX Starshield, Amazon Kuiper, Telesat Lightspeed, and OneWeb constellation development programs embed antenna requirements across thousands of ground terminals and airborne platforms, requiring seamless integration with legacy military communication infrastructure. Ka-band satellite terminals, which enable higher bandwidth, reduced congestion, and improved spectral efficiency, are substantially increasing adoption rates, with adoption rates substantially exceeding those of traditional X-band and Ku-band systems. Communications on the move (COTM) and satellite on the move (SOTM) architectures enable individual soldier-level satellite access through miniaturized antenna systems, substantially expanding the addressable market beyond traditional fixed installations and mobile command centers.

Reflectors maintain market dominance, with an approximately 28% market share, comprising parabolic dish antennas used in satellite communications, ground-based radar systems, and fixed-installation applications requiring exceptional gain and directional characteristics. Reflector antenna technology remains a proven workhorse for fixed military installations supporting surveillance, electronic intelligence (ELINT), and satellite ground terminals, where size, weight, and power constraints are secondary to performance optimization. FEED Horns account for approximately 22% of the market, serving as fundamental microwave antenna components that enable efficient energy transfer between transmission lines and reflector surfaces across diverse frequency bands. FEED Networks command approximately 18% of the market, integrating multiple feed elements that enable multibeam capabilities essential for simultaneous communications across multiple frequency bands or spatial directions.

The Ultra-High Frequency (UHF) band (300 MHz-3 GHz) dominates antenna applications, accounting for approximately 34% of the market, and offers reliable ground-wave propagation characteristics ideal for tactical communications, line-of-sight military radio systems, and software-defined radio (SDR) implementations. UHF antenna proliferation reflects fundamental physics that enable extended transmission ranges compared with higher-frequency alternatives while maintaining manageable physical dimensions.

The High-Frequency (HF) band (3 MHz-30 MHz) accounts for approximately 19% of the market, enabling long-range skywave propagation that supports strategic military communications and maritime navigation applications. The Super High Frequency (SHF/Microwave) band (3 GHz-30 GHz) accounts for approximately 31% of the market, encompassing X-band, Ku-band, and Ka-band applications that dominate satellite communications, radar, and electronic warfare systems. SHF antenna expansion accelerates at 7.4% annual growth rates driven by satellite constellation modernization toward higher frequency bands, reducing antenna size while improving spectral efficiency.

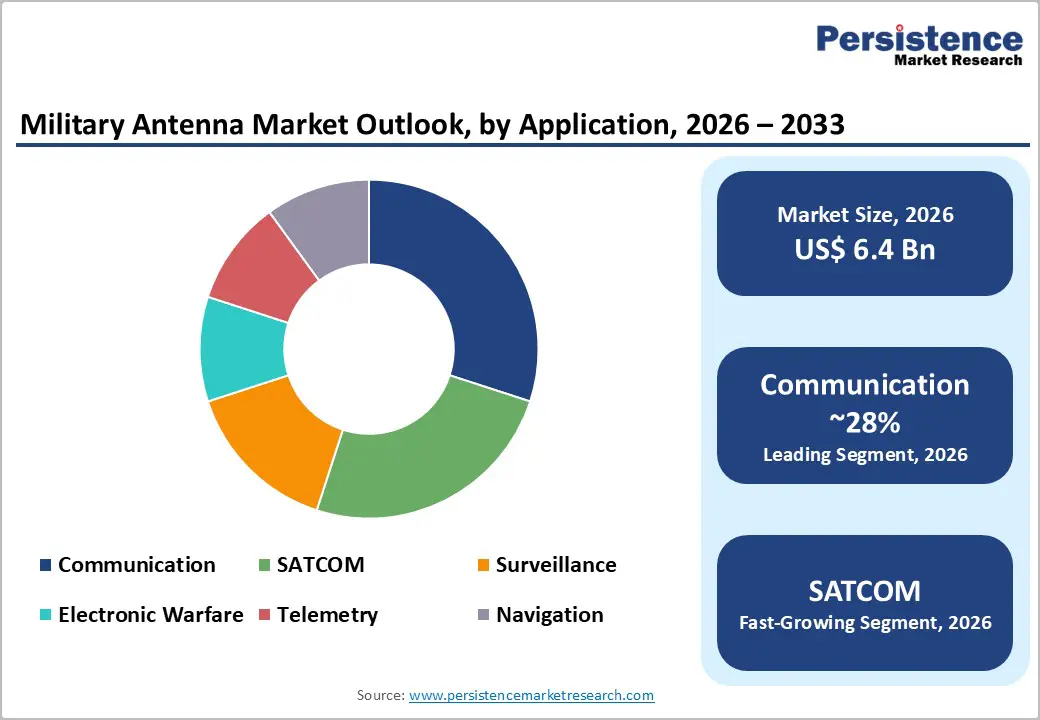

Communication applications dominate with approximately 28% market share, supporting tactical data links, secure voice transmission, and command-control network integration across distributed military forces. SATCOM (Satellite Communications) applications command approximately 24% market share, expanding at an accelerating 7.8% annual growth rate driven by LEO constellation development and military emphasis on resilient communication architectures independent of terrestrial infrastructure vulnerability. Surveillance applications account for approximately 21% of the market, encompassing radar, electronic intelligence (ELINT), and signals intelligence (SIGINT) antenna systems that support threat detection and target acquisition. Electronic Warfare applications account for approximately 14% market share, including jamming-resistant antennas, direction-finding systems, and electronic countermeasures capabilities addressing the emerging threat environment.

Ground platforms command market dominance with approximately 41% market share, encompassing fixed military installations, mobile tactical shelters, and forward operating base communication infrastructure. Ground-based radar systems supporting border surveillance, air defense, and counter-drone applications drive sustained demand for sophisticated phased array and multibeam antenna architectures. Airborne platforms account for approximately 32% of the market and are expanding at an accelerating 7.6% annual growth rate, driven by UAV proliferation and military aircraft modernization, with an emphasis on electronic-warfare survivability and surveillance capabilities. Conformal airborne antenna integration, enabling seamless platform integration while minimizing aerodynamic impact, remains a critical procurement priority.

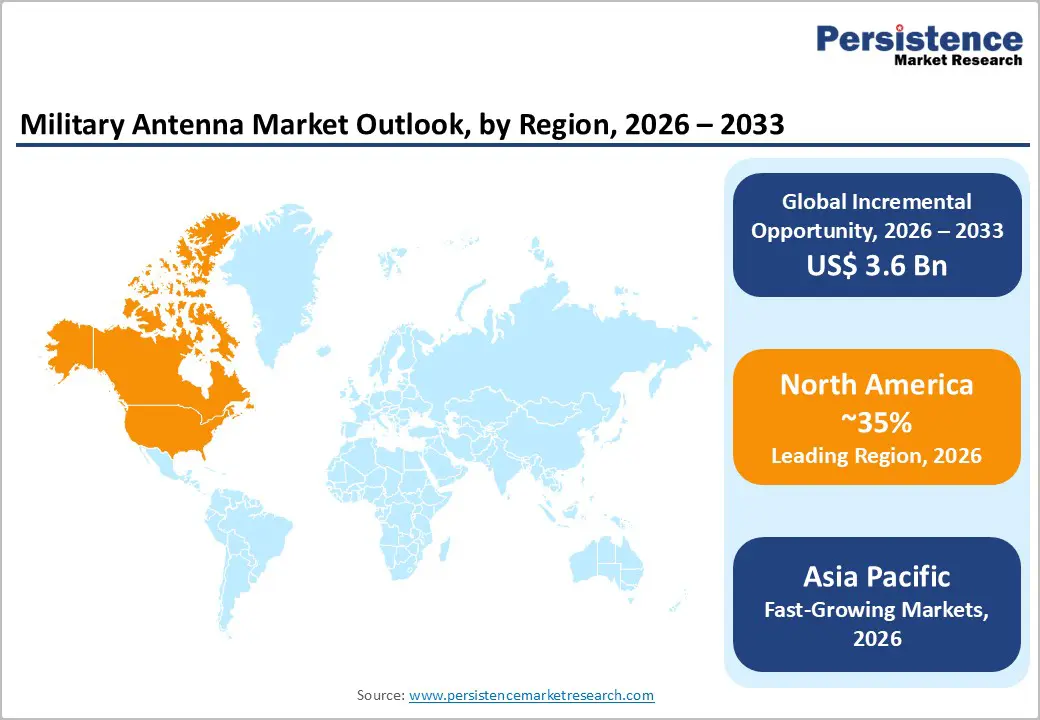

North America maintains established market leadership with approximately 36% global market share, anchored by United States defense spending leadership and comprehensive military modernization programs. U.S. Department of Defense allocated US$ 821.5 billion for fiscal 2026 defense appropriations, with substantial allocations supporting antenna procurement across the Army, Navy, Air Force, Marine Corps, and Space Force operational requirements. SATCOM modernization programs, including Raytheon's Navy Multiband Terminal (NMT) deployment across 300+ Navy vessels, submarines, and shore stations, exemplify sustained investment in next-generation antenna capabilities. Link 16 tactical communications network integration across NATO forces establishes standardized antenna requirements cascading through allied procurement, amplifying North American defense contractor dominance.

Europe represents approximately 28% global market share, characterized by accelerated defense spending following the Russia-Ukraine conflict and strengthened NATO alliance coordination. European NATO members increased defense spending by an average 12.3% in 2024, with Germany, France, the United Kingdom, and Poland allocating substantial resources for military modernization encompassing antenna system upgrades. German defense spending reaching US$ 100+ billion annually supports comprehensive military equipment modernization, emphasizing NATO interoperability standards and secure communication infrastructure. United Kingdom military modernization programs emphasizing advanced air defense and naval capability expansion drive demand for sophisticated radar and communication antenna systems. Airbus Defence and Space, Thales Group, Leonardo, and MBDA collectively coordinate European antenna development supporting alliance standardization requirements.

Asia Pacific emerges as the fastest-growing region with approximately 22% market share, expanding at an accelerating 8.4% annual growth rate driven by a regional defense spending surge and military modernization competition. Chinese defense spending expansion, military technology development emphasis, and People's Liberation Army modernization drive substantial antenna procurement across airborne, marine, and ground platforms supporting emerging carrier strike group capabilities and advanced fighter aircraft integration. India's defense modernization program, allocating US$ 72.5 billion through 2033, emphasizing indigenous defense manufacturing and offset procurement requirements, creates an expanding market for antenna technology suppliers, establishing India's manufacturing footprint. Japanese defense spending increases, supporting countermeasures to Chinese military expansion and North Korean threats, accelerate antenna procurement for air defense, maritime surveillance, and ground-based radar system modernization.

The military antenna market exhibits significant consolidation among tier-one global defense contractors Raytheon Technologies, L3Harris Technologies, Northrop Grumman, Lockheed Martin, Thales Group, Airbus Defence and Space, and Leonardo collectively commanding approximately 62% aggregated market share through comprehensive antenna portfolios, established defense customer relationships, and substantial research and development capabilities.

Market leaders pursue expansion through strategic acquisition of specialized antenna manufacturers, research partnerships with defense research agencies, and substantial investment in GaN-based semiconductor integration. Phased array antenna development remains concentrated among tier-one suppliers due to specialized expertise requirements, regulatory certification complexity, and capital-intensive manufacturing infrastructure.

The global Military Antenna market is likely to be valued at US$ 6.4 billion in 2026 and is projected to reach US$ 10.0 billion by 2033, expanding at a 6.6% CAGR.

Primary growth drivers include escalating global defense spending reaching US$ 2.44 trillion in 2023 with sustained 3.7% annual increases, military modernization programs across NATO allies, United States defense budget expansion to US$ 821.5 billion annually, and unprecedented unmanned aerial vehicle proliferation expanding from 8,400 units in 2020 to estimated 18,200 units in 2024 requiring specialized lightweight antenna systems.

Reflectors dominate with approximately 28% market share, utilized in satellite communications, ground-based radar systems, and fixed installations. FEED Horns represent 22% share, FEED Networks command 18% share, and Low Noise Block Converters account for 17% share, with others including phased array and conformal antennas expanding at an accelerating 8.2% annual growth rates.

North America maintains market leadership with approximately 36% global market share, anchored by the United States defense spending dominance.

Market leaders include Raytheon Technologies, L3Harris, Northrop Grumman, Lockheed Martin, and Thales Group.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Antenna Type

By Frequency

By Application

By Platform

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author