ID: PMRREP35256| 163 Pages | 28 Apr 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

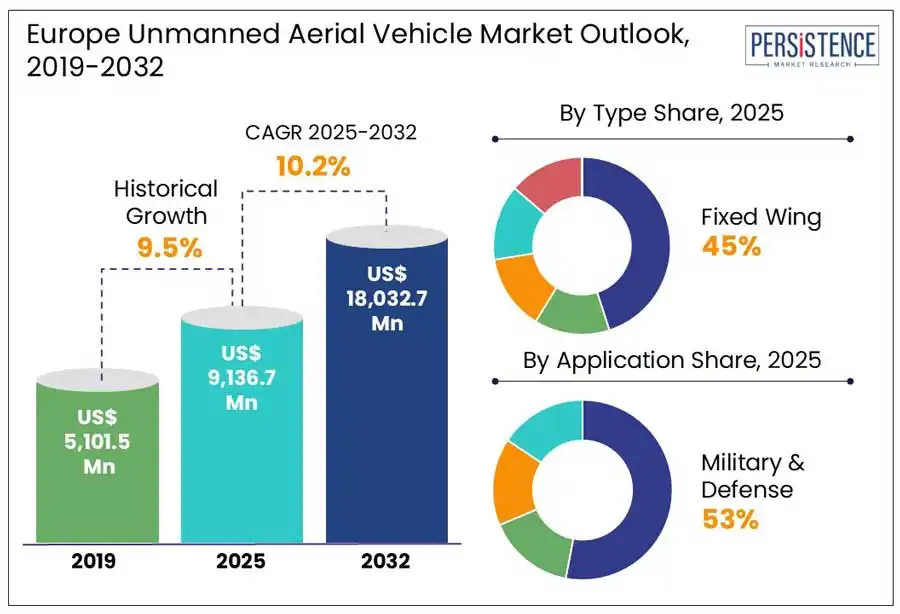

Europe Unmanned Aerial Vehicle market size is anticipated to rise from US$ 9,136.7 Mn in 2025 to US$ 18,032.7 Mn by 2032. It is projected to witness a CAGR of 10.2% from 2025 to 2032.

Unmanned aerial vehicles (UAVs), also known as drones, have a high consideration in different disciplines of military and civilian services due to their enhanced stability and endurance in several operations. Applications of UAVs are expanding exceptionally due to their advanced use in the Internet of Things (IoT), 5G, and B5G.

UAVs have been used in a variety of applications over the last decade, including object detection and tracking, public security, traffic surveillance, military operations, exploration of hidden or hazardous areas, indoor or outdoor navigation, atmospheric sensing, post-disaster operations, healthcare, data sharing, infrastructure management, emergency and crisis management, freight transportation, wildfire monitoring and logistics.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

Europe Unmanned Aerial Vehicle Market Size (2025E) |

US$ 9,136.7 Mn |

|

Market Value Forecast (2032F) |

US$ 18,032.7 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

10.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.7% |

A key trend in the European Unmanned Aerial Vehicle (UAV) market is the growing adoption of UAV-based remote sensing technology across various sectors such as agriculture, forestry, power infrastructure, and urban planning. UAVs offer a significant advantage over traditional satellite remote sensing by delivering higher resolution image data, enabling more accurate crop type identification, disease detection, and information extraction. This is revolutionizing precision agriculture and environmental monitoring, making UAVs an essential tool for data-driven decision-making.

One of the standout technologies is UAV-mounted LIDAR, which provides high-accuracy 3D elevation data for structures such as buildings, power lines, and artificial installations. This has proven critical for infrastructure inspection and asset management. Additionally, multi-view stereoscopic imaging is gaining traction due to its cost-effectiveness and simpler data processing, making it ideal for large-scale environment and land surface analysis.

While optical sensors dominate current applications, the potential of UAVs to carry a diverse range of sensors opens doors for further innovation. As spatial resolution continues to improve, UAVs will be capable of extracting fine-scale details, including crop surface anomalies and small object movement, enhancing their value in high-precision remote sensing.

One of the major restraints facing the European UAV market is the safe integration of unmanned aerial vehicles into non-segregated civil airspace. Ensuring the safety and rights of all airspace users demands not only robust planning but also cooperation among regulatory bodies, industry stakeholders, and aviation authorities. The absence of uniform procedures across European countries and the complexities involved in urban and high-traffic airspace management pose additional barriers to widespread UAV deployment.

As the first European Union and NATO member state outside Turkey to operate these advanced drones, Poland sets a precedent for other European nations considering similar enhancements to their defense capabilities. Poland's procurement of 24 Bayraktar TB2 unmanned aerial vehicles (UAVs) from Turkey, finalized in May 2024, marks a significant development in Europe's UAV landscape. As the first European Union and NATO member state outside Turkey to operate these advanced drones, Poland sets a precedent for other European nations considering similar enhancements to their defense capabilities.

This acquisition underscores a broader trend of European countries seeking to modernize their military assets through the integration of proven UAV technologies. The TB2's demonstrated effectiveness in various conflict zones has heightened interest in its capabilities. Poland's move may encourage other EU members to explore partnerships and procurements that bolster their surveillance and defense operations.

Furthermore, the deal includes provisions for technology transfer, enabling the Polish defense industry to develop expertise in UAV maintenance and operations. This aspect not only strengthens Poland's defense infrastructure but also presents opportunities for domestic industry growth and innovation in UAV technologies.

The military & defense application segment is expected to capture an estimated market share of 53.6% in 2025. This is driven by increasing defense budgets, border surveillance needs, and the demand for advanced intelligence, surveillance, and reconnaissance (ISR) capabilities. European nations such as France, the UK, Germany, and Italy heavily invest in next-generation UAV technologies to enhance national security and support NATO operations. Additionally, the integration of UAVs with AI, sensors, and real-time data transmission systems further propels their adoption in tactical military operations and combat scenarios.

The fixed wing segment is expected to dominate, accounting for a projected market share of approximately 50% in 2025. Fixed-wing UAVs are preferred for long-range missions, endurance, and high-altitude operations, making them ideal for defense, surveillance, and border patrol. With growing investments in defense modernization and increasing demand for efficient aerial mapping and large-scale monitoring across sectors such as agriculture and infrastructure, fixed-wing UAVs are becoming more prominent.

The rotary-wing UAV segment will continue to be crucial for missions requiring vertical takeoff and landing, maneuverability, and close-range operations. These UAVs are widely used in urban surveillance, search and rescue, and commercial applications such as inspection and filming.

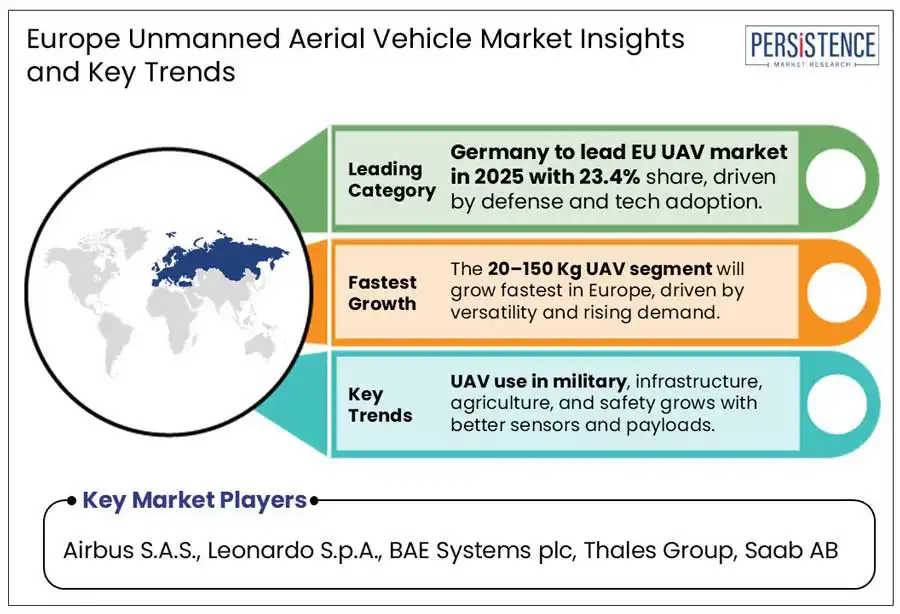

Germany is poised to lead the Europe Unmanned Aerial Vehicle Market in 2025, accounting for an estimated 23.4% market share. This leadership is fueled by the country’s comprehensive defense modernization programs and the rapid integration of unmanned systems across military and commercial domains. With substantial government investments in aerial, ground, and maritime unmanned platforms, Germany is reinforcing its defense capabilities while stimulating technological innovation.

The nation has become a central hub for unmanned systems research and development, supported by a strong ecosystem of manufacturers and academic institutions. German industries are at the forefront of autonomous technology, particularly in developing autonomous ground vehicles for military use. Simultaneously, they are broadening applications in civilian sectors such as agriculture, logistics, and infrastructure inspection.

The United Kingdom is poised for impressive growth with a projected CAGR of around 16% by 2032. This growth is driven by significant investments in military modernization and a thriving commercial innovation landscape. The UK has emerged as a leader in establishing forward-thinking regulatory frameworks for unmanned aerial systems, especially in urban air mobility and beyond visual line of sight (BVLOS) operations.

British companies are advancing the development of high-tech unmanned maritime systems, capitalizing on the nation’s rich naval legacy and technical expertise. Government backing for autonomous systems R&D has spurred major private sector investment and fostered strong ties between industry and academia. The UK’s strategic focus on applications in public safety, border surveillance, and infrastructure monitoring continues to create a broad spectrum of opportunities across civil and defense sectors, positioning the country as a key innovator in the European unmanned systems landscape.

France's comprehensive approach to technology research and deployment has allowed it to maintain a prominent position in the European unmanned aerial vehicle market. The nation’s robust aerospace and defense sector plays a crucial role in advancing sophisticated unmanned aerial systems for both military and civilian uses. French firms are recognized for their expertise in creating specialized UAVs for sectors such as agriculture, infrastructure inspection, and security services.

France's strategic focus on autonomous technologies, which has resulted in the establishment of specialized research clusters and innovation hubs, is one of the primary factors contributing to its success. Additionally, France’s commitment to dual-use technology has facilitated a smooth transition of military innovations into the civilian sphere. The country has also been at the forefront of fostering cross-border partnerships with other European nations, particularly in co-developing defense-focused on unmanned systems, strengthening its influence in the regional UAV ecosystem.

Europe Unmanned Aerial Vehicle (UAV) market is highly competitive, driven by technological advancements and the transition towards a UAV-based economy. The demand for clean energy solutions and sustainable UAV technologies is fueling intense competition among established players and emerging innovators.

Leading companies dominate the European UAV market with their advanced product portfolios, cutting-edge research capabilities, and vast production networks. These firms focus on expanding their footprint in military and commercial UAV applications through strategic collaborations and technological innovations. They are heavily investing in advanced autonomous systems, sensor integration, and green UAV technologies to align with Europe’s decarbonization objectives and meet regulatory standards.

Meanwhile, regional players are gaining traction by offering specialized UAV solutions, particularly in sectors such as agriculture, infrastructure monitoring, and public safety. These companies are differentiating themselves through innovation in hybrid drones, modular systems, and AI-driven software, further intensifying the competitive dynamics.

The market is set to reach US$ 9,136.7 Mn in 2025.

Increased Defense Spending and Security Needs, and Civil and Commercial Applications are the major growth drivers.

The industry is estimated to rise at a CAGR of 10.2% through 2032.

Commercial and Industrial Applications, and Public Safety and Emergency Response are the key market opportunities.

Airbus S.A.S., Leonardo S.p.A., BAE Systems plc, Thales Group, and Saab AB are a few leading players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Application

By Weight

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author