ID: PMRREP18487| 183 Pages | 12 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

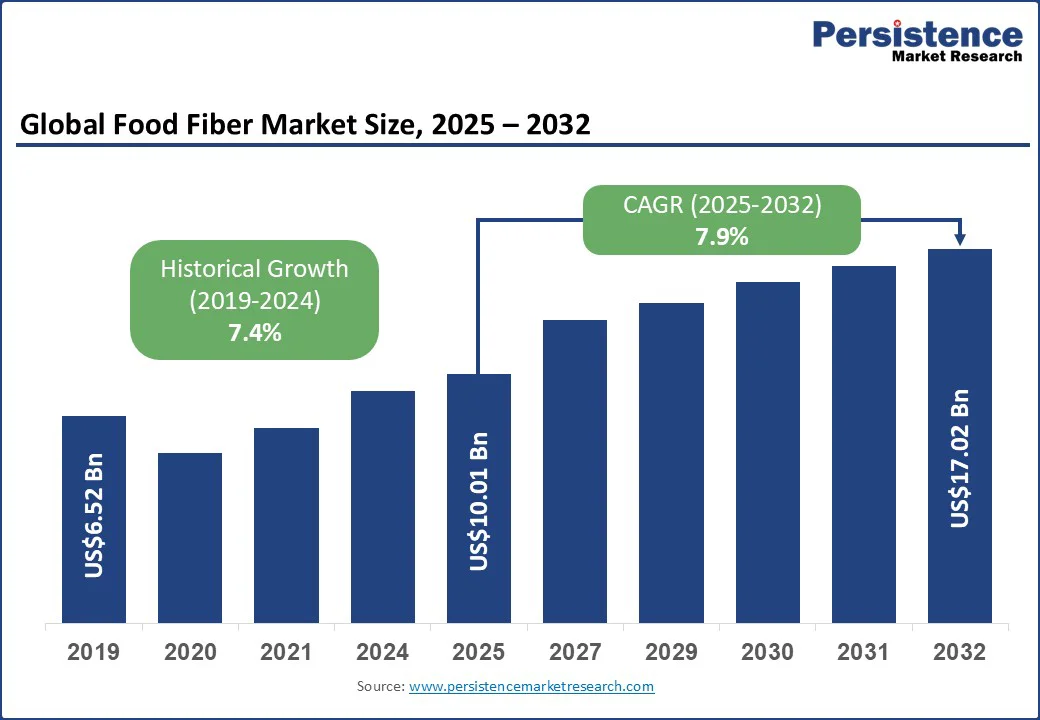

The global food fiber market size is likely to be valued at US$10.01 Bn in 2025 and is expected to reach US$17.02 Bn by 2032, growing at a CAGR of 7.9% during the forecast period from 2025 to 2032.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Food Fiber Market Size (2025E) |

US$10.01 Bn |

|

Market Value Forecast (2032F) |

US$17.02 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.4% |

The food fiber market is witnessing steady expansion, driven by rising consumer awareness of digestive health, weight management, and the benefits of fiber-enriched diets. Increasing incorporation of dietary fibers into functional foods, beverages, and supplements, along with supportive government health initiatives, is fueling demand across both developed and emerging economies.

The primary growth driver is the development of advanced extraction technologies that utilize underexploited agricultural by-products such as peanut skins, wheat bran, and fruit peels. Techniques, including enzymatic processing and steam explosion, are improving the yield and functionality of soluble fibers, enhancing their prebiotic and antioxidant properties. This approach delivers a higher-value ingredient while supporting cost-efficiency and sustainability by reducing food waste.

The growing focus on eco-friendly fiber sourcing is creating strong opportunities for manufacturers to align with consumer expectations for natural and traceable ingredients. For example, Vegea converts grape marc (the residue from winemaking) into yarns, textiles, and bio-polymers, usable in sectors of fashion, furniture, and packaging. The process is free from toxic solvents, aligning well with clean extraction and sustainable by-product valorisation.

One of the key restraints is the growing concern over the negative health effects of excessive fiber fortification in processed foods. Many fiber-enriched snacks, beverages, and supplements rely heavily on isolated ingredients such as inulin, which, when consumed in high amounts, can cause digestive discomfort, bloating, and even adverse impacts on gut microbiome balance. This rising awareness among health-conscious consumers is creating skepticism toward engineered fiber products and limiting their long-term acceptance compared to naturally fiber-rich whole foods.

Another restraint stems from technical and supply chain limitations in fiber integration. Insoluble fibers often alter product characteristics, such as texture, taste, and stability, making it difficult to maintain consumer appeal in bakery, dairy, and beverage applications. Overcoming these formulation challenges requires specialized R&D and adds complexity to product development. Fluctuations in agricultural yields and seasonal variations in fiber-rich raw materials introduce supply unpredictability, making it harder for smaller players to sustain consistent quality and pricing.

A key market opportunity is the emergence of enzymatic sugar-to-fiber conversion technologies. Innovative solutions, such as inulin-converting enzymes, help food manufacturers to transform sugars in cereals, snacks, and baked goods into functional fibers without altering the taste or texture. This approach supports sugar reduction strategies and enhances the nutritional profile of everyday foods. With consumer demand rising for healthier indulgence products, this technology opens significant revenue potential in reformulating popular categories to deliver both taste and digestive health benefits.

Another distinctive opportunity is the use of fiber-based edible packaging and functional coatings that combine sustainability with nutrition. Soluble fiber films and seaweed-derived wraps are being developed to extend shelf life, reduce plastic use, and provide added dietary fiber to the final product. This innovation aligns with clean-label and eco-friendly consumer preferences while offering manufacturers a way to differentiate through multifunctional packaging solutions.

As retailers and food brands intensify their focus on circular economy models, fiber-based packaging has the potential to reshape value creation beyond traditional food applications. For example, Apeel Sciences uses edible, tasteless coatings derived from plants (mono-/diglycerides inspired by plant cuticles) to coat fruits and vegetables. These coatings extend the shelf life of avocados and citrus by reducing moisture loss and oxidation, reducing reliance on plastic packaging.

Soluble fibers are projected to hold approximately 59.85% share in 2025, owing to their ability to dissolve in water and form gels. These properties allow soluble fibers to contribute to texture, shelf life, and the overall product stability in food & beverage applications. They are used in categories such as fortified drinks, baked goods, and supplement powders.

Some types of soluble fibers, including beta-glucan and psyllium, are associated with health claims that have been approved by regulatory bodies such as the U.S. Food and Drug Administration. These claims relate to cholesterol reduction and support for heart health. Inulin, a type of soluble fiber derived from chicory root or Jerusalem artichoke, is often used in applications aimed at gut health and sugar reduction. It is included in products where prebiotic functionality or partial sugar replacement is required.

Insoluble fibers represent the fastest-growing segment. These fibers do not dissolve in water and are primarily used to add bulk and structure. Advances in processing technologies, including fine milling and encapsulation, have made it easier to incorporate insoluble fibers into products without negatively affecting texture or mouthfeel. This has led to wider use in dry products such as cereals, snack items, and baked goods.

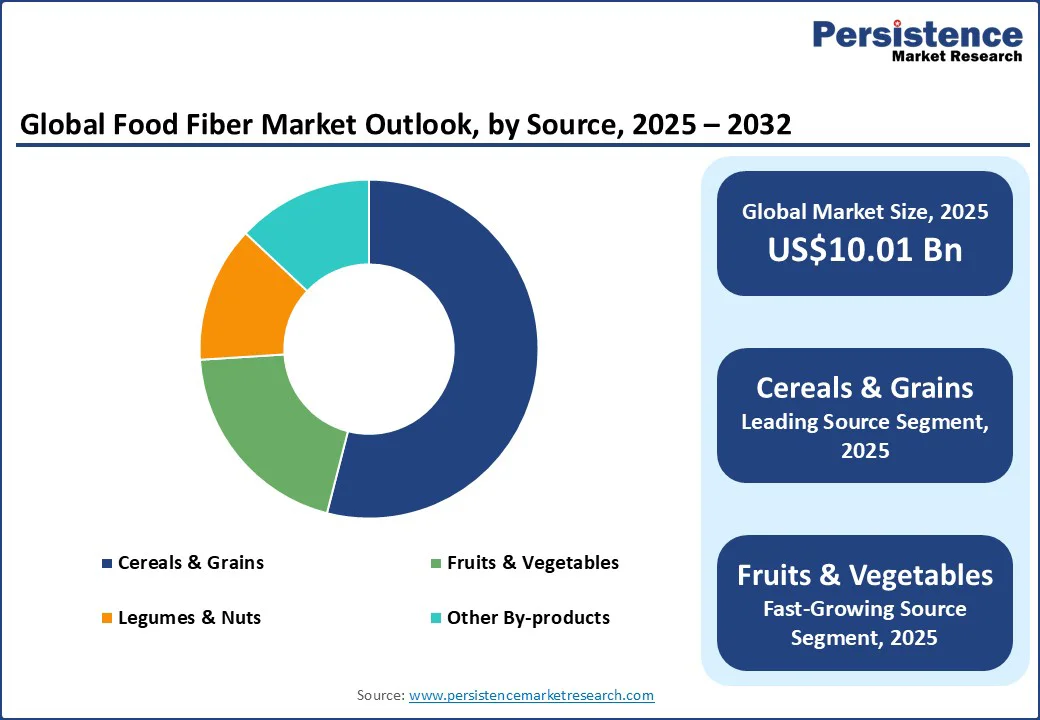

Cereals and grains account for approximately 53.63 % of the market share by source. These include wheat, barley, rye, oat bran, and corn. Both soluble and insoluble fibers are extracted from these sources. Processing yields consistent material inputs that integrate into standard food production lines. These fibers are used in bread, crackers, pasta, and other staple items.

Beta-glucan from oats is an example of a fiber extracted from cereals that is often included in products focused on cardiovascular function, including packaged cereals and oat-based beverages.

Fruits and vegetables represent the fastest-growing source category. Fibers derived from these sources are used in products positioned for minimal processing and ingredient transparency. Fibers such as pectin, obtained from apple or citrus peels, and inulin, sourced from chicory, are included in wellness-positioned items such as functional beverages, snack bars, and plant-based desserts. These fibers are selected based on their physical properties, such as gelling and water retention, and are also used as sugar or fat replacers in reduced-calorie formulations.

In some production models, fruit and vegetable processing byproducts are repurposed into fiber-rich powders or concentrates. This supports waste reduction targets and lowers raw material input costs. The use of such ingredients in high-fiber bars, clean-label snacks, and dairy alternatives is increasing across several regions.

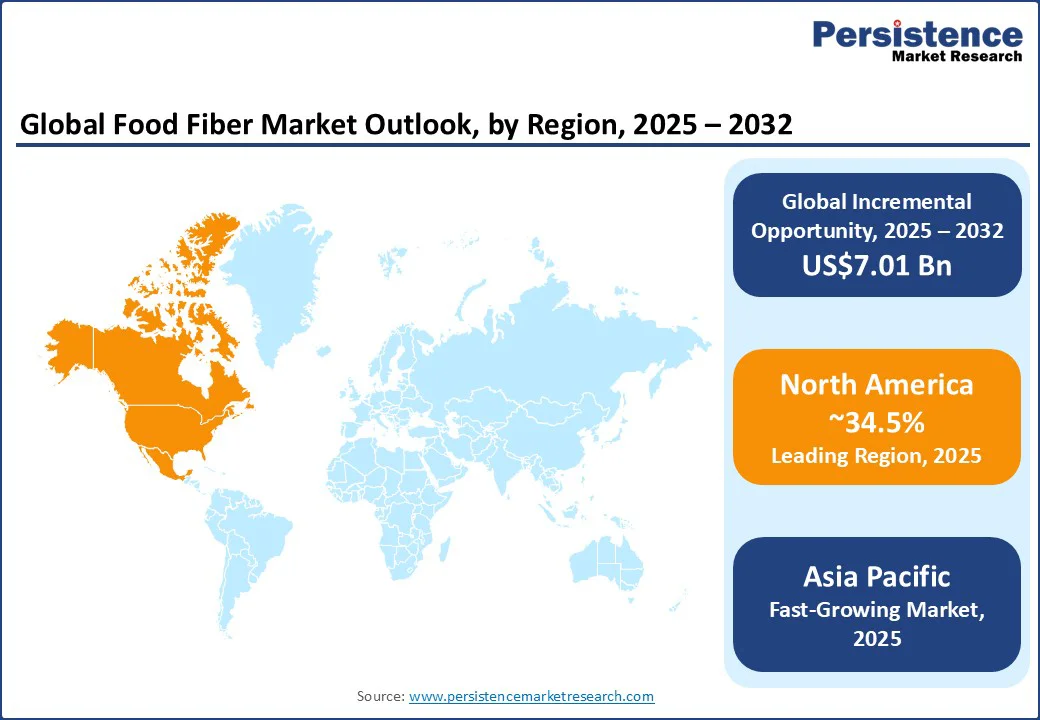

North America continues to dominate with a share of 34.5 % in 2025, underpinned by strong consumer awareness of gut health and an advanced food innovation ecosystem. In the U.S., dietary habits are increasingly shaped by preventive health concerns, leading to the popularity of fiber-enriched supplements and functional foods. A growing trend is fiber personalization through microbiome testing, where companies are offering tailored solutions based on individual gut health profiles. This is particularly relevant as digestive health and weight management remain top priorities among American consumers.

Recent product launches also demonstrate how sustainability and nutrition intersect. Floura, for example, uses by-products such as fruit and vegetable skins to create snack bars delivering 13 grams of fiber per serving. The appeal lies in combining nutrition with waste reduction, addressing two major consumer expectations in one product. Canada is following a similar trajectory, with increased government promotion of whole-grain consumption and fiber intake through public health campaigns. Canadian bakeries and cereal companies are responding by fortifying their product lines with soluble fibers, such as inulin, expanding opportunities in everyday foods.

Asia Pacific is the fastest-growing region in the global food fiber market. Rising disposable incomes, changing dietary patterns, and growing awareness of lifestyle-related diseases such as diabetes are accelerating demand for fiber-rich foods. In countries with traditionally grain-heavy diets, there is now a noticeable shift toward value-added products such as fortified bakery goods, beverages, and supplements. Local manufacturers are innovating with indigenous fiber sources, making products more culturally relevant and affordable for mass consumption.

India is witnessing rapid growth in fiber-enriched products, due to escalating rates of obesity and type 2 diabetes. For instance, major food companies are increasingly introducing fiber-fortified atta (wheat flour), which has quickly gained acceptance among urban consumers seeking healthier alternatives without changing their staple diet.

In South Korea, the rise of functional grains such as barley and wild rice has given bakery and snack manufacturers new avenues for growth. Companies are positioning high-fiber products as both premium and essential for longevity, capitalizing on the Korean market’s strong health-conscious culture. Companies such as CJ CheilJedang, one of the country's largest producers of barley flakes, are expanding R&D efforts to develop barley-based products that meet consumer demand for digestive and metabolic health.

Dongseo Food recently launched a granola product containing 27% U.S. barley, showcasing how traditional grains are being adapted into modern formats. CR Food has gained attention with its “Prebiotics Whole Grain Flakes,” made from steamed and baked whole grains such as barley.

Europe remains a mature but highly innovative market for dietary fibers, supported by a strong tradition of whole grain consumption and increasing demand for clean-label, plant-based ingredients. Consumer preference for natural and sustainable products has encouraged manufacturers to incorporate fiber-rich ingredients into everyday foods, from breads and cereals to dairy alternatives. In particular, the European market has seen a rise in fiber-enriched bakery snacks that balance indulgence with functionality.

In the U.K., brands such as Weetabix are actively reformulating their cereals to include higher levels of natural fibers, while bread makers are expanding their whole-grain and oat-based ranges. These efforts align with government-backed campaigns promoting high-fiber diets as a way to reduce obesity and improve digestive health.

Germany, on the other hand, maintains its strong position through its rye and multigrain bread culture. Companies such as Fazer Group are leveraging this tradition by introducing organic and sustainable high-fiber products, appealing to eco-conscious consumers. Germany also stands out as an innovation hub for soluble fibers such as beta-glucan, which are being added to dairy alternatives and functional beverages.

The global food fiber market is characterized by a mix of multinational food corporations, specialized ingredient suppliers, and emerging startups that are reshaping consumer preferences through innovation. Leading players such as Cargill, DuPont, Tate & Lyle, Archer Daniels Midland (ADM), and Roquette Frères dominate the supply side by offering a wide range of soluble and insoluble fibers tailored for applications in bakery, beverages, and nutritional supplements. These companies are actively investing in R&D to develop fibers with improved functionality, such as better solubility, enhanced texture, and prebiotic properties, which cater to the growing demand for gut health and clean-label solutions.

At the same time, regional players and startups are intensifying competition by focusing on sustainable sourcing and niche applications. Companies in Asia Pacific, particularly in India and South Korea, are leveraging local grain varieties and culturally relevant formulations to capture market share. The combination of large-scale global suppliers and agile regional innovators is driving product diversification and price competitiveness in the market.

The food fiber market size is estimated at US$10.01 Bn in 2025.

By 2032, the food fiber market is projected to reach US$17.02 Bn, reflecting strong demand across multiple applications.

Key trends include the rising use of prebiotic fibers in functional beverages, the incorporation of fiber from upcycled food by-products, and the increasing adoption of plant-based, clean-label formulations.

By fiber type, soluble fibers hold the largest market share, supported by their functional role in digestive health and applications in beverages and supplements. By source, cereals and grains dominate, owing to their widespread use in bakery, breakfast cereals, and fortified foods.

The food fiber market is anticipated to grow at a CAGR of 7.9% from 2025 to 2032.

Some of the leading companies in the food fiber market include Cargill Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company (ADM), DuPont Nutrition & Biosciences, and Roquette Frères.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Fiber Type

By Source

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author