ID: PMRREP34127| 237 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

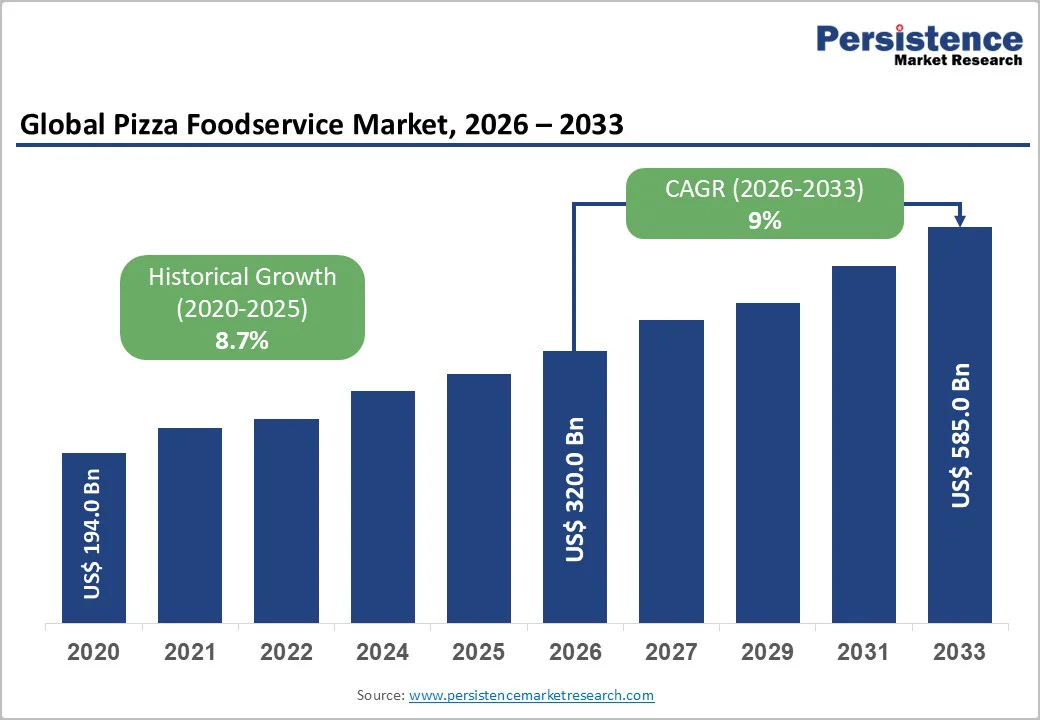

The global pizza food service market size is likely to be valued at US$ 320.0 billion in 2026, and is projected to reach US$ 585.0 billion by 2033, growing at a CAGR of 9% during the forecast period 2026-2033. This growth is underpinned by increasing urbanization, rising disposable incomes, and a strong consumer shift toward convenience through Online Delivery, Digital Ordering, and delivery-oriented business models such as ghost kitchens. At the same time, evolving consumer preferences toward premium offerings, including plant-based pizza and customizable toppings, support market expansion.

| Key Insights | Details |

|---|---|

| Pizza Foodservice Market Size (2026E) | US$ 320.0 Bn |

| Market Value Forecast (2033F) | US$ 585.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 9% |

| Historical Market Growth (CAGR 2020 to 2025) | 8.7% |

The pizza foodservice market growth is driven by rapid urbanization, rising dual-income households, and evolving routines that prioritize convenience. As daily schedules tighten, demand for ready-to-eat meals grows, with delivery and takeout capturing a larger share than dine-in. For instance, in India, Jubilant FoodWorks, operator of Domino’s, opened 184 new stores in FY25 and plans 230 more, reflecting strong urban demand for accessible pizza options. This shift broadens the addressable customer base, while the proliferation of quick-service restaurants (QSR), takeaway pizza, online delivery, and digital ordering further reinforces growth momentum. Consumers increasingly prefer quick, reliable, and time-saving options that fit urban lifestyles.

Technological advancements are transforming pizza preparation and delivery. Digital ordering platforms, automated kitchens, AI-driven forecasting, and optimized logistics enhance efficiency for both chained outlets and independent pizzerias. These innovations reduce labor pressures, shorten service times, and support customization trends such as thin crust, premium toppings, and plant-based pizzas. Together, lifestyle and technology trends improve customer experience, boost order frequency, and sustain growth across traditional and delivery-first models.

Pizza foodservice businesses are facing mounting pressure from shifting consumer expectations and evolving health regulations. Increasing awareness around calories, sodium, processed ingredients, and overall nutritional value is prompting many customers to limit consumption or seek alternatives. At the same time, regulatory standards on food composition continue to tighten, adding compliance requirements that restrict product flexibility. These shifts collectively challenge operators to balance taste, affordability, and transparency while maintaining consumer trust.

Alongside health-driven constraints, cost inflation and supply chain volatility add further strain to market performance. Fluctuations in key raw materials such as cheese, flour, meats, and vegetables can quickly erode margins, particularly for operators working within competitive or thin-profit environments. Securing high-quality, premium, or specialty ingredients also increases sourcing complexity, especially for smaller establishments. When combined with rising operational expenses, these pressures can limit menu innovation, drive pricing decisions, and affect overall profitability across both independent and chain operators.

The strong growth potential of the market can be tapped through strategic expansion in emerging economies and the increasing adoption of delivery-first formats. Rising urbanization, higher disposable incomes, and changing food preferences in developing markets create a favorable environment for international and local operators. Digital-native models such as ghost kitchens further strengthen this opportunity by enabling low-cost scalability and efficient market penetration. Their ability to operate with minimal overhead supports rapid geographic reach while catering to the growing preference for delivery and takeout.

Evolving consumer expectations around taste, health, and personalization open the door for premiumization across product lines. For instance, Blackbird Foods launched “Blackbirdie Pizza Minis” in 2025, offering small 5-inch vegan, non-GMO, dairy-free pizzas through retail channels, while Toppers Pizza introduced fully vegan, plant-based variants at its restaurant locations. Offering plant-based options, functional ingredients, gourmet toppings, and customizable crust varieties enables brands to differentiate and command higher margins. Localized menus tailored to cultural preferences help operators connect with diverse consumer groups, enhancing customer loyalty and brand relevance.

Chained outlets are expected to dominate with approximately 60% of the pizza foodservice market revenue share in 2026, supported by strong branding, standardized processes, and efficient supply-chain systems. Their ability to maintain consistent quality across multiple regions enables rapid expansion into mature and emerging markets. In April 2025, for instance, Papa John’s partnered with Google Cloud to implement AI-powered digital ordering, push notifications, and chatbots, enhancing operational efficiency and customer engagement. Large-scale marketing investments further strengthen brand recall and drive higher order volumes. As urban markets grow, these chains benefit from prime locations and broad customer reach. Their operational scale allows seamless integration of digital platforms, loyalty programs, and delivery systems, providing a competitive advantage over smaller competitors.

Independent outlets are set to be the fastest-growing segment, projected to expand at 9.6% CAGR through 2033, fueled by a soaring demand for authenticity and customization. These outlets attract consumers seeking artisanal techniques, regional flavors, and specialty crusts such as thin crust. Flexibility has enabled quick menu innovation, seasonal ingredients, and local adaptations. Lower capital requirements allow easier market entry. As consumer interest in novelty rises, independents are expected to strengthen their niche presence and sustain above-industry growth.

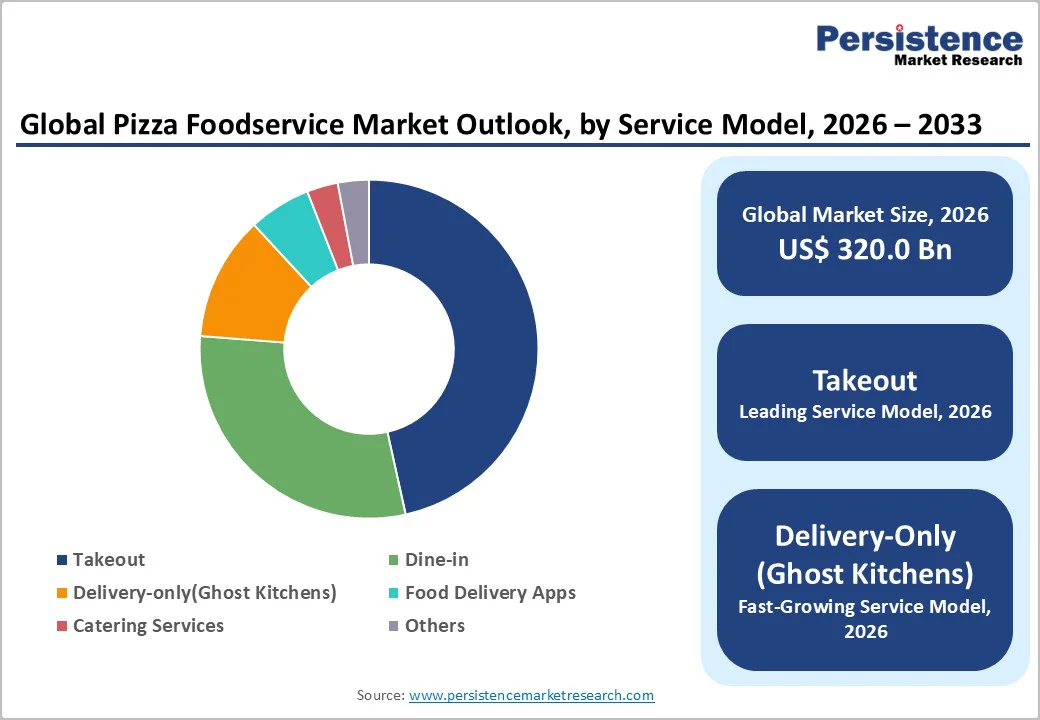

The takeout model is projected to lead in 2026, capturing around 47% revenue share, driven by convenience, shorter wait times, and affordability it offers compared to dine-in. Many consumers choose takeout for family meals, office lunches, or on-the-go consumption, making it a stable revenue source. The segment benefits from packaging innovations that maintain food quality and temperature during transit. Its operational simplicity supports predictable demand patterns, and busy lifestyles globally reinforce takeout as a core distribution channel for both chains and independent outlets.

Delivery-only kitchens are poised to grow the fastest, expected to advance at a 9.1% CAGR from 2026 to 2033, owing to the widespread adoption of digital ordering platforms and app-based delivery options. These kitchens operate without dine-in areas, reducing overhead and enabling rapid scaling in dense urban zones. In 2025, Domino’s expanded delivery via third-party platforms such as DoorDash, widening customer access and boosting incremental sales. Flexible structures allow menu testing, virtual brands, and faster expansion. Efficient logistics shorten delivery times and improve satisfaction, making delivery-only models highly cost-effective for growth.

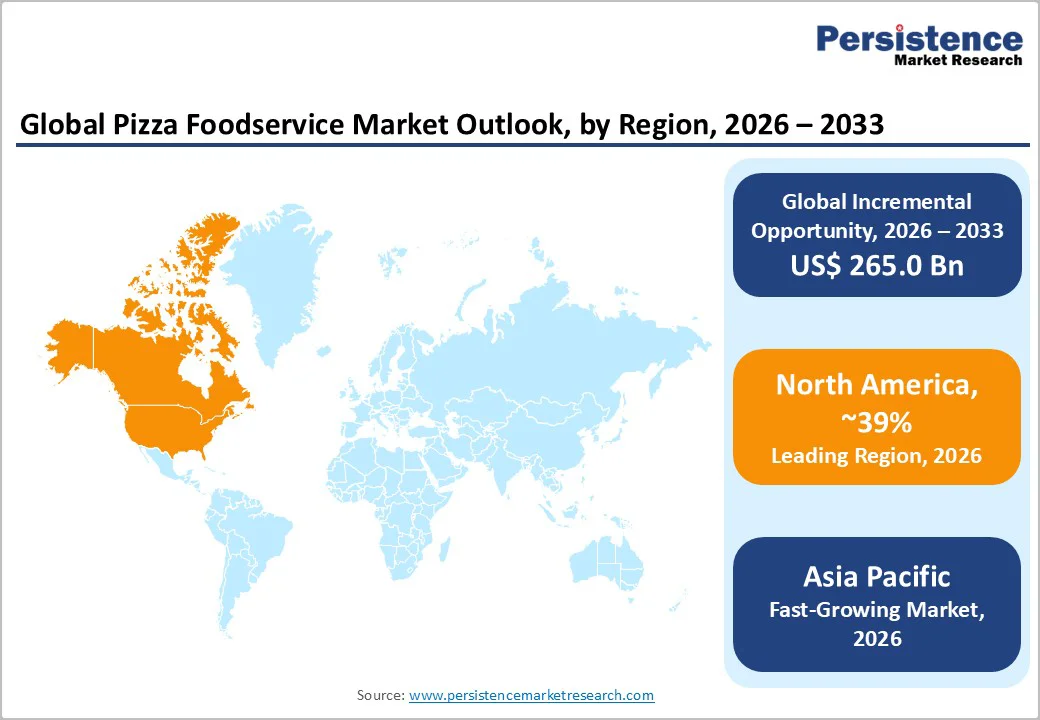

North America is expected to dominate in 2026, estimated to secure 39% of the pizza foodservice market share, powered primarily by the U.S., where quick-service pizza formats and advanced delivery ecosystems are deeply established. High disposable incomes, massive adoption of digital ordering, and growing use of automation across kitchen operations reinforce this leadership. Mature supply-chain networks and strong brand presence among major chains create a highly efficient operating environment. Regulatory standards on food safety and packaging encourage consistency but increase operational costs, prompting continuous innovation. Despite being a saturated market, evolving consumer expectations for faster service and improved convenience sustain long-term relevance. Incremental growth continues as operators enhance menus, streamline delivery, and offer personalized digital experiences.

The regional competitive landscape features a blend of major chains and local independents, the latter gaining traction through gourmet positioning and regional flavor diversity. Technology investments remain central to market expansion, including AI-driven scheduling, automated make-lines, and sustainable last-mile delivery initiatives. Urban and suburban regions continue to attract targeted expansion, particularly in underpenetrated neighborhoods seeking convenient dining options. Menu innovation, including healthier alternatives and premium toppings, helps brands retain consumer interest in a highly competitive environment. The region’s strong purchasing power supports ongoing upgrades in packaging and service efficiency.

Europe stands as one of the major contributors to global pizza demand, supported by Germany, the U.K., France, and Spain, where a mix of traditional pizza culture and rising fast-casual formats drive consistent performance. The regional market benefits from established dining habits, increasing urbanization, and a growing inclination toward convenient meal solutions. Western-style diets continue influencing younger consumers, strengthening demand for quick-service and takeaway formats. Food safety, labeling, and sustainability standards set by the European Union (EU) shape product offerings and encourage higher-quality sourcing. As health consciousness rises, demand grows for plant-based, gluten-free, and environmentally responsible menu options.

Competition in Europe spans large multinational chains and independent artisanal pizzerias, the latter strengthening their position through regional ingredient use and authentic culinary methods. Many operators are investing in modern restaurant formats, digital ordering, and efficient takeaway systems to appeal to on-the-go consumers. Urban centers offer fertile ground for franchising and fast-casual expansion, particularly among younger, value-driven diners. Sustainability trends are influencing packaging, supply chains, and menu innovation across the region. Operators increasingly differentiate through nutrition-focused offerings and premium crust or topping varieties, making the regional market highly dynamic.

Asia Pacific is likely to be the fastest-growing regional market for pizza foodservice, projected to post a 9.6% CAGR through 2033, propelled by rapid urbanization, rising disposable incomes, and accelerated westernization of diets. Key markets such as China, India, Japan, and Southeast Asia exhibit strong appetite for affordable quick-service dining. Increasing smartphone penetration and widespread use of online food-delivery platforms further elevate demand, especially among younger consumers. Shifting lifestyle patterns in metro cities support frequent ordering and preference for convenience-based dining formats. Operators are leveraging this momentum by expanding delivery fleets, digital storefronts, and value-focused menu options. The region’s large consumer base creates significant long-term scalability.

The competitive landscape combines global chains with fast-growing local brands offering regionally inspired flavors, such as spicy, seafood-based, or fusion-style pizzas. Regulatory standards around food safety, sourcing transparency, and import controls shape supply-chain decisions and influence ingredient availability. Investors are gravitating toward cost-efficient models such as dark kitchens and compact takeaway outlets to reach high-density markets. Partnerships with delivery apps accelerate market penetration and increase brand visibility. Affordability remains crucial, leading operators to develop low-cost menu formats to appeal to price-sensitive consumers while driving high-volume orders. Asia Pacific's demographic scale and evolving consumer habits make it one of the most promising growth hubs for pizza foodservice companies.

The global pizza foodservice market structure is moderately consolidated, dominated by major international chains such as Domino’s, Pizza Hut, Papa John’s, and Little Caesars. These brands benefit from extensive franchising systems that support rapid expansion across diverse geographies. Their leadership is reinforced by advanced digital ordering platforms, AI-based delivery routing, and strong loyalty programs that enhance customer retention. Investments in automated kitchen technologies improve operational efficiency and order consistency. Menu innovation, including plant-based pizza, premium toppings, and customizable thin crust options, further differentiates offerings. Robust supply-chain integration enables competitive pricing and reliable ingredient sourcing.

Independent pizzerias and regional chains compete effectively through authenticity, artisanal preparation, and localized menu differentiation. These operators appeal to consumers seeking unique flavors, handcrafted styles, and community-rooted dining experiences. Their agility allows rapid adaptation to emerging trends, including healthier ingredients and premium customization. The rise of online delivery, food-delivery apps, and ghost kitchens has expanded digital access and lowered barriers to market entry. Many independents leverage flexible pricing and personalized service to build customer loyalty. Cost-efficient expansion models, such as delivery-only formats, allow them to scale without heavy capital investment. Brands balancing innovation, quality, and digital convenience are increasingly competitive in high-growth markets.

The global pizza foodservice market is projected to reach US$ 320.0 billion in 2026.

Urban migration, rising incomes, quick-service and delivery-first preferences, technology adoption, and a strong demand for customizable menus are driving the market.

The market is poised to witness a CAGR 9% from 2026 to 2033.

Opportunities include independent pizzerias, ghost kitchen expansion, digital ordering adoption, plant-based and premium menu offerings, and urban growth markets.

Some of the key players in the market include Domino’s, Pizza Hut, Papa John’s, and Little Caesars.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Service Structure

By Service Model

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author