ID: PMRREP34105| 212 Pages | 26 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

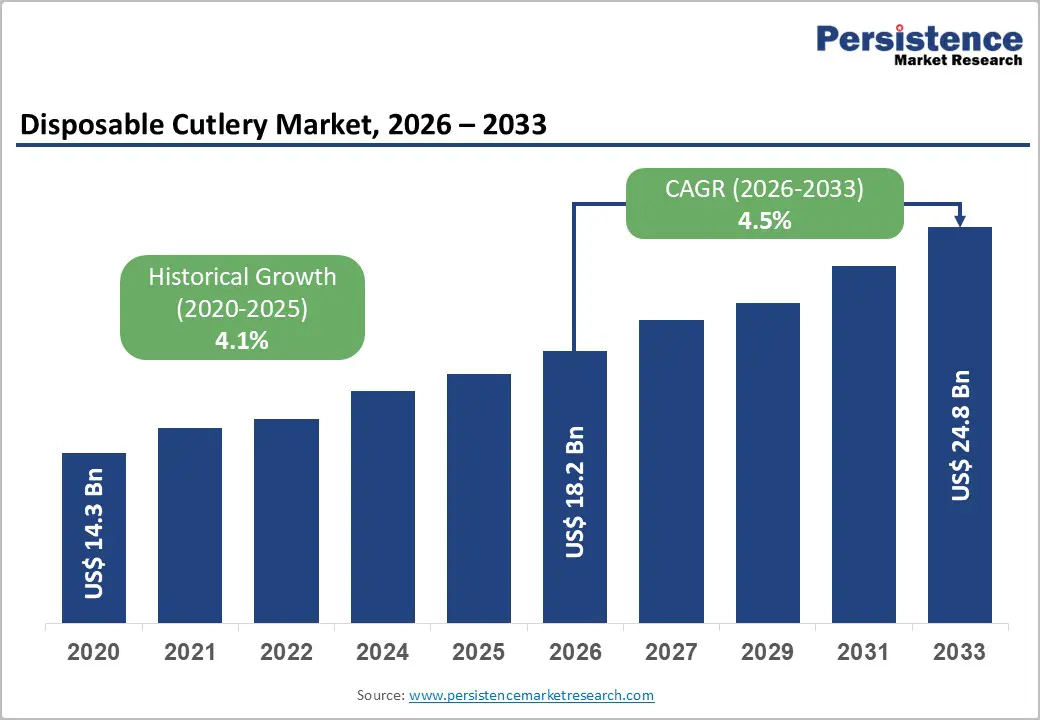

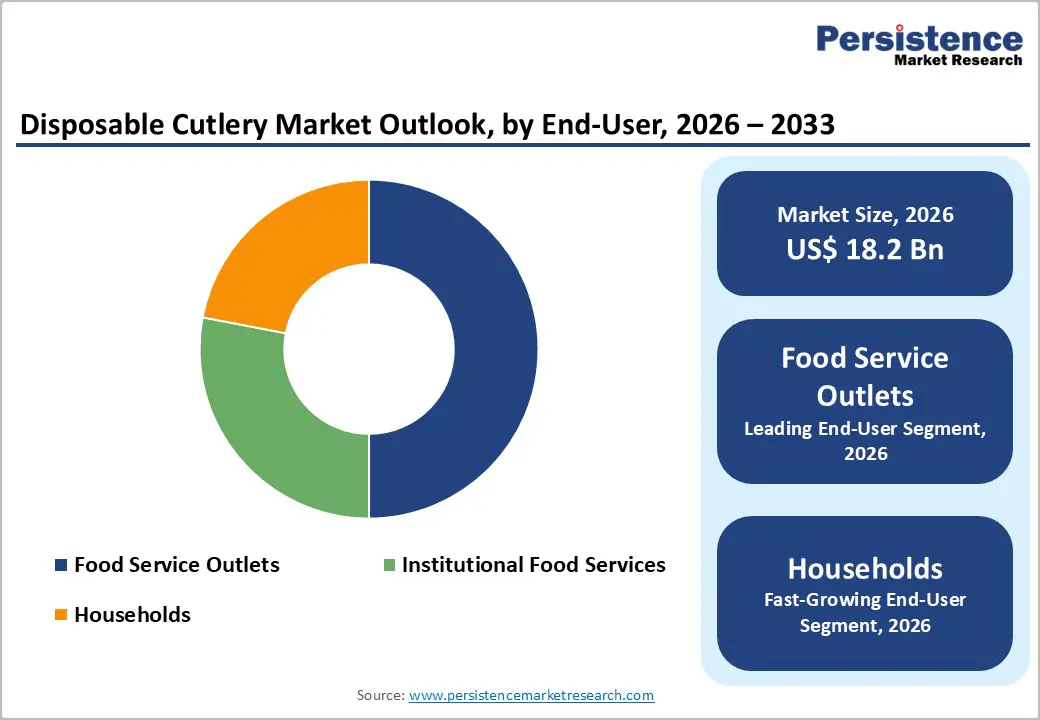

The global disposable cutlery market size is likely to be valued at US$ 18.2 billion in 2026, and is projected to reach US$ 24.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2026−2033. Market growth is supported by persistent urbanization and the expansion of on-demand food consumption models, which are accelerating demand for single-use utensils in quick-service and delivery formats. The proliferation of food delivery platforms and takeaway services reshapes consumer eating patterns, increasing reliance on disposable cutlery as a hygienic convenience. Sustained investment in sustainable materials and manufacturing capabilities responds to regulatory pressures on plastics, driving innovation and diversifying product portfolios across regions.

Elevated environmental awareness among consumers and institutional buyers creates structural demand for biodegradable and compostable alternatives, reinforcing long-term growth pathways and stimulating material science advancements. Emerging regulatory frameworks aimed at reducing plastic waste expand the addressable market for eco-friendly disposable cutlery, with compliance becoming a competitive advantage for manufacturers.

| Key Insights | Details |

|---|---|

|

Disposable Cutlery Market Size (2026E) |

US$ 18.2 Bn |

|

Market Value Forecast (2033F) |

US$ 24.8 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.1% |

Expansion of Food Delivery and On-Demand Consumption Models

The proliferation of food delivery platforms and on-demand dining services is reshaping consumer behavior and increasing demand for disposable cutlery in urban areas. Rapid growth in food delivery order volumes has led service providers to include single-use utensils with a majority of meal deliveries, creating consistent volume requirements for suppliers. Convenience-oriented consumption places a premium on cutlery that aligns with time-pressed lifestyles, particularly in metropolitan areas where QSR and cloud kitchen ecosystems have matured. This trend serves as a structural driver for the disposable cutlery sector, as dining outside the home continues to outpace traditional dine-in formats, thereby expanding the addressable base for suppliers. The integration of disposable cutlery into food delivery orders enhances perceived hygiene and service completeness while reducing the effort required for reusable utensils.

Urbanization and lifestyle evolution sustain this driver by amplifying demand density in key markets. Rising smartphone penetration and improved digital logistics are fueling the growth of takeaway and delivery channels, strengthening reliance on single-use cutlery solutions. The operational emphasis on rapid turnaround and minimal service friction across meal delivery and takeaway contexts reinforces the reliance on disposable utensils to ensure seamless service. Reduced washing and cleaning burdens for food service outlets further drive procurement decisions toward supplier volume and standardized packaging solutions that align with efficiency and cost-management priorities.

Environmental Regulation Compliance Costs

Increasingly stringent environmental regulations targeting single-use plastics pose a significant operational constraint by elevating compliance costs and restructuring manufacturing priorities. Legislation in the European Union (EU), India, and other major markets requires substantial retooling of production lines and certification processes for alternative materials, imposing additional capital expenditures on manufacturers. The transition to sustainable materials entails higher input costs, investments in specialized equipment, and adherence to eco-certification requirements, which result in extended lead times and margin compression for producers. For smaller enterprises lacking scale economies, navigating the regulatory compliance landscape creates financial strain and risk of attrition.

Compliance complexity also influences supply-chain dynamics, as producers seek certified feedstock sources for biodegradable polymers and biocomposites, thereby heightening their dependency on specialized suppliers. The higher unit cost of eco-conformant materials relative to conventional plastics puts pressure on the value chain, limiting pricing flexibility and challenging adoption among price-sensitive buyers. From an operational perspective, compliance obligations can divert resources from core market expansion initiatives, reducing agility in response to competitive threats. Regulatory volatility, in which amendments and implementation timelines shift, further undermines planning certainty, thereby limiting risk tolerance for investment in capacity expansion.

Innovation in Sustainable Materials and Biopolymers

Advancements in sustainable materials technology and biopolymers offer significant opportunities for market participants to differentiate offerings and capture value in emerging segments. The development of next-generation compostable and bio-based materials, such as enhanced polylactic acid (PLA) composites and hybrid fiber matrices, enhances product performance while aligning with regulatory requirements and environmental expectations. Manufacturers that successfully integrate material science innovations into scalable production lines can secure a competitive advantage through superior durability, decomposability, and certification credentials.

The shift toward sustainable materials also unlocks premium pricing structures in segments where buyers are willing to pay for enhanced environmental attributes, particularly among corporate, public-sector, and high-end food-service customers. Expansion of certified compostable cutlery categories broadens the addressable market beyond traditional price-driven segments, encouraging product diversification and portfolio expansion. Partnerships with biopolymer suppliers, bio-refineries, and innovation labs can accelerate time-to-market for advanced materials, enabling faster capture of first-mover benefits in niches such as edible cutlery or zero-waste products. Material innovation also aligns with strategic investments in circular-economy models and value-chain sustainability narratives, thereby enhancing brand differentiation and resilience. This deepens engagement with sustainability-focused stakeholders and expands potential for cross-sector collaboration, including restaurants, events, and hospitality operators seeking to meet aggressive environmental objectives.

Product Type Insights

Spoons are likely to be the leading segment with roughly 45% of the disposable cutlery market revenue share in 2026, due to consistent demand from a wide array of food service formats and integration into meal delivery bundles. Spoons represent a fundamental utensil category that intersects with diverse eating occasions, from soups and desserts to everyday ready-to-eat meals. Their universal utility and necessity in most meal contexts underpin stable procurement by institutional buyers and food service operators. Spoons are often included as default items in disposable cutlery assortments, reinforcing volume dominance. Design simplicity and manufacturing efficiency contribute to cost-effectiveness, making this category attractive for high-volume production and distribution. Urbanization and the expansion of quick-service restaurant footprints sustain heavy spoon use, particularly in delivery and takeaway segments, where multi-item orders often include soups, yogurts, and beverages that require spoons. Standardization of spoon specifications simplifies supply chain planning and reduces complexity for buyers managing inventory across multiple outlets.

Forks are expected to witness the fastest growth between 2026 and 2033, as evolving dining formats and expanding menu diversification increase the utility of forks in ready-to-eat and delivery contexts. Shifts toward multi-course meals, salads, and Western-inspired cuisine elevate reliance on cutlery that accommodates diverse food textures and shapes. Forks also align with rising demand in emerging markets, where consumer dietary patterns reflect greater adoption of upscale or varied meal options. The growth of premium ready-to-eat meal kits and catering services further underscores the need for reliable cutlery, with higher per-order cutlery usage rates than in more basic meal formats. Innovation in fork design, including hybrid material options and enhanced strength properties in bio-based products, supports broader adoption across commercial segments that previously favored only traditional plastic utensils. Improved performance characteristics address prior concerns around breakage and reduce resistance to switching among institutional buyers.

Material Insights

Plastic is poised to lead with a forecasted 60% share of the disposable cutlery market in 2026, owing to its entrenched supply chain infrastructure, cost efficiency, and widespread availability across global markets. Conventional plastics such as polypropylene and polystyrene benefit from established production bases, competitive pricing, and extensive distribution networks that support large-scale cutlery manufacturing. This entrenched position ensures plastic cutlery remains the default choice in contexts where cost sensitivity and operational simplicity drive procurement decisions. Despite sustainability pressures, plastic cutlery remains relevant in institutional and foodservice procurement, where pricing constraints and supply consistency are critical determinants. Producers benefit from mature supply chains and flexibilities in resin sourcing, enabling responsive production planning and inventory management.

Wood and bio-based materials are projected to be the fastest-growing segment between 2026 and 2033, driven by strong demand for sustainable alternatives and regulatory mandates to reduce the use of petroleum-based plastics. These materials benefit from increased acceptance among environmentally conscious consumers and institutional buyers that prioritize certified compostability and renewable feedstock profiles. Wood, bagasse, and plant-based composites present compelling narratives for brands seeking to differentiate through eco-credentials, particularly in developed markets with aggressive single-use plastic restrictions. Biodegradable cutlery categories also align with premiumization in food-service offerings, in which aesthetic appeal and sustainability messaging contribute to brand positioning and customer engagement. Enhanced material performance and certifications improve buyer confidence, reducing resistance to transition from legacy materials.

End-User Insights

Food service outlets are positioned as the leading segment, with nearly 50% market share in 2026, supported by high-volume usage in quick-service restaurants, catering services, and takeaway channels that consume large quantities of disposable utensils. These outlets operate under efficiency imperatives, where disposable cutlery simplifies operations by eliminating washing logistics and facilitating rapid table turnover and delivery fulfillment. Bulk procurement arrangements and standardized ordering patterns further entrench the use of cutlery among these buyers. Procurement strategies often aggregate cutlery purchases across multiple locations, benefiting from scale economies that reinforce the segment dominance. Institutional contracts with catering providers and event organizers also contribute to sustained call-off volumes for disposable cutlery, reflecting persistent service needs across diverse dining occasions.

Households are expected to be the fastest-growing segment between 2026 and 2033, driven by the increasing adoption of ready-to-eat meals, convenience dining solutions, and home meal delivery services, which increase at-home disposable utensil use. Shifts in household consumption patterns toward premium convenience foods and meal kits generate incremental demand for cutlery that complements traditional commercial channels. E-commerce retail platforms enhance access to a diverse range of cutlery options, enabling consumers to procure sustainable and specialized products tailored to at-home occasions. Urban lifestyles that emphasize convenience and hygiene further influence households' adoption of disposable cutlery, particularly in multi-person and rental housing arrangements, where dishwashing labor is a consideration. Broader awareness around environmental alternatives also encourages household experimentation with sustainable utensils, amplifying growth trajectories for this segment.

North America Disposable Cutlery Market Trends

North America is likely to maintain a stable position in the market for disposable cutlery in 2026 and beyond, backed by established distribution networks. Insights from the U.S. and Canada underscore institutional dominance, with schools, hospitals, and corporate cafeterias representing consistent high-volume users of disposable cutlery. Quick-service restaurants and food delivery providers rely on standardized supply contracts to ensure predictable procurement cycles and reinforce supplier stability. Growth drivers include regulatory mandates for compostable products, such as state-level bans on conventional single-use plastics and incentives for certified biodegradable products, which drive both product innovation and adoption. Competitive consolidation among major players allows scale advantages, cost optimization, and improved market reach. Extended producer responsibility (EPR) frameworks impact adoption, as compliance with eco-certification requirements becomes a key determinant in buyer selection, reinforcing supply reliability. Capital directed toward research and development focuses on enhancing material performance, product certification, and eco-friendly innovation.

Economic integration supports steady expansion, with Mexico contributing through cross-border trade. Mexico’s proximity to the U.S. market facilitates streamlined supply chains, export-import synergies, and efficient logistics for disposable cutlery manufacturers. Drivers include demographic diversity, rising urbanization, and regulatory alignment with global sustainability standards, which encourages adoption of biodegradable and compostable materials in food service and institutional channels. Competitive traits highlight innovation leaders leveraging advanced manufacturing technologies, material science development, and supply chain integration to optimize cost and quality. Investments focus on efficiency upgrades, including automation in production, improved packaging processes, and sustainable material sourcing, reducing operating costs while meeting regulatory compliance.

Europe Disposable Cutlery Market Trends

The Europe market is predicted to showcase steady growth through 2033 on account of stringent environmental mandates of the EU. Insights from Germany and France indicate shifts toward premium disposable cutlery products that meet high environmental and performance standards. Policy-driven transitions, including a ban on single-use plastics and incentives for biodegradable alternatives, drive manufacturers to innovate with certified compostable materials such as PLA, bagasse, and wood pulp. Competitive differentiation emerges through eco-certifications and compliance with industrial composting standards, positioning manufacturers to meet institutional and commercial demand. Regulatory enforcement reshapes landscapes by favoring specialized suppliers capable of producing high-quality, sustainable utensils. Capital flows target the adoption of green technologies, including improvements in material processing and automation, thereby enhancing production efficiency while maintaining certification compliance. Strategic partnerships with logistics providers, material innovators, and distributors accelerate

The U.K. and Italy demonstrate resilience in institutional applications. Demographic aging drives demand for cutlery solutions in healthcare, education, and workplace cafeterias, where hygiene and operational efficiency are priorities. Regulatory evolution following Brexit introduces alignment challenges and new certification requirements, encouraging local innovation and supplier adaptation. Competitive features include niche providers focusing on specialized biodegradable and high-performance products, capturing market segments that require premium solutions. Investments prioritize circular-economy initiatives, including closed-loop material sourcing and renewable energy integration, reducing the environmental footprint while ensuring cost efficiency. Alliances between manufacturers and distributors enhance scalability, enabling efficient delivery of eco-compliant products across multiple institutional sites.

Asia Pacific Disposable Cutlery Market Trends

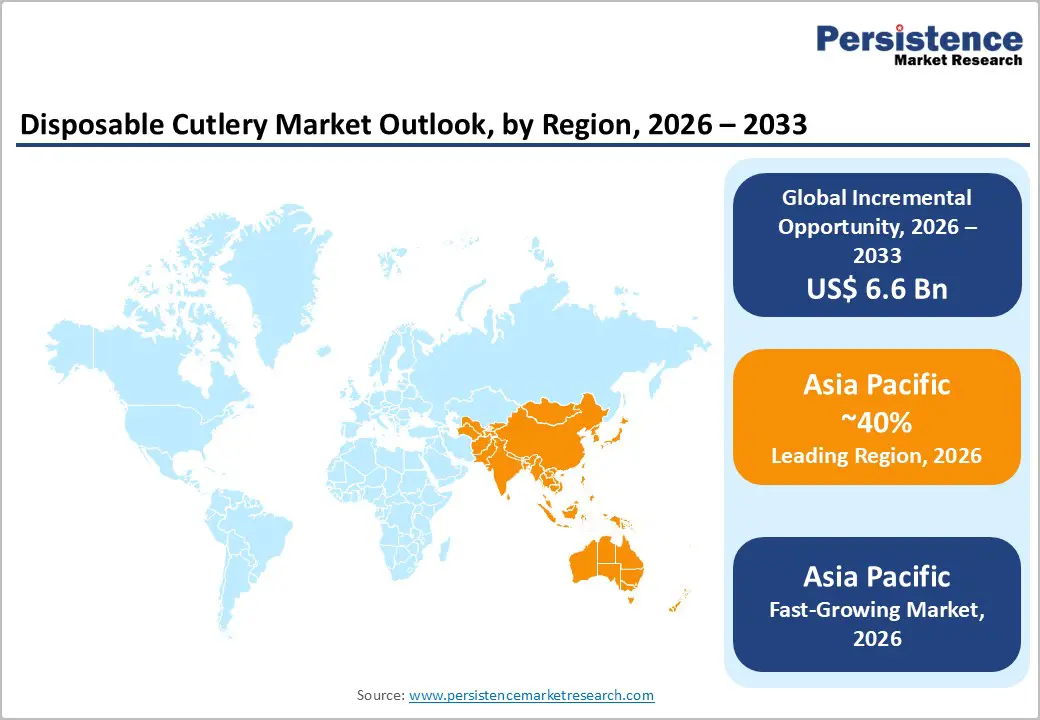

By 2026, the Asia Pacific is expected to lead with an estimated 40% share of the disposable cutlery market, supported by rapid urbanization and foodservice proliferation. Country-level insights reveal strong performance in China and India, where digital food delivery platforms dominate urban consumption and institutional catering. The rapid growth of cloud kitchens and takeaway services in metropolitan areas amplifies demand for disposable utensils, while the expansion of quick-service restaurant chains reinforces volume-based procurement practices. Policy incentives that support local manufacturing hubs, such as tax relief and infrastructure subsidies, encourage domestic production of both conventional and environmentally friendly cutlery. Cultural shifts toward convenience dining further drive uptake, with households and office cafeterias increasingly integrating disposable cutlery into daily routines. Regulatory frameworks focusing on hygiene standards reinforce adoption, as certified suppliers are preferred by institutional buyers.

Asia Pacific is forecasted to be the fastest-growing market for disposable cutlery between 2026 and 2033, stimulated by demographic booms and infrastructure investments. Emerging economies, particularly Indonesia and Vietnam, demonstrate rapidly expanding consumer bases, supported by rising urban populations and growing middle-class purchasing power. Investments in modern foodservice infrastructure, including commercial kitchens and distribution networks, enhance market access and reduce operational bottlenecks for cutlery suppliers. Technological adoption in supply chains, including inventory management and digital order integration, improves efficiency for both manufacturers and foodservice providers. Harmonization of export regulations across countries in the region facilitates cross-border trade, expanding market reach and attracting foreign investments. Competitive characteristics include agile startups and regional SMEs that leverage innovative materials, flexible production methods, and e-commerce distribution to challenge established incumbents.

The global disposable cutlery market exhibits a moderately fragmented structure, with leading players collectively accounting for 30% of global revenue. Market concentration remains limited, as numerous regional and local manufacturers compete alongside global suppliers, creating a balance between competitive pressure and innovation incentives. Huhtamaki Oyj, Pactiv LLC, Georgia-Pacific LLC, Dart Container Corporation, D&W Fine Pack LLC, Biopac UK Ltd, and Novolex Holdings Inc. dominate through scale advantages, extensive distribution networks, and established relationships with institutional and food service clients. Competitive positioning emphasizes cost efficiency, operational reliability, and compliance with evolving regulatory frameworks, particularly in regions enforcing bans on conventional plastics.

Key players leverage strategic initiatives to strengthen market presence and expand addressable share. Innovation in sustainable materials, including plant-based polymers, renewable fiber composites, and certified compostable plastics, differentiates offerings and enables compliance with environmental mandates. Geographic expansion into emerging economies allows companies to capture rising demand from urbanized populations and institutional food services. Operational agility, including flexible manufacturing lines and integration with digital distribution channels, supports rapid response to shifting regulatory and consumer requirements. Partnerships with raw material suppliers and logistics providers further optimize cost and supply reliability.

Key Industry Developments

The global disposable cutlery market is projected to reach US$ 18.2 billion in 2026.

Rising demand for convenience in food service, regulatory shifts toward sustainable materials, and urban lifestyle trends drive the market.

The market is poised to witness a CAGR of 4.5% from 2026 to 2033.

Innovation in biodegradable and compostable materials, expansion in institutional procurement, and growth in emerging markets are creating new market opportunities.

Some of the key market players include Huhtamaki Oyj, Pactiv LLC, Georgia-Pacific LLC, Dart Container Corporation, D&W Fine Pack LLC, and Biopac UK Ltd.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Material

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author