ID: PMRREP12862| 190 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

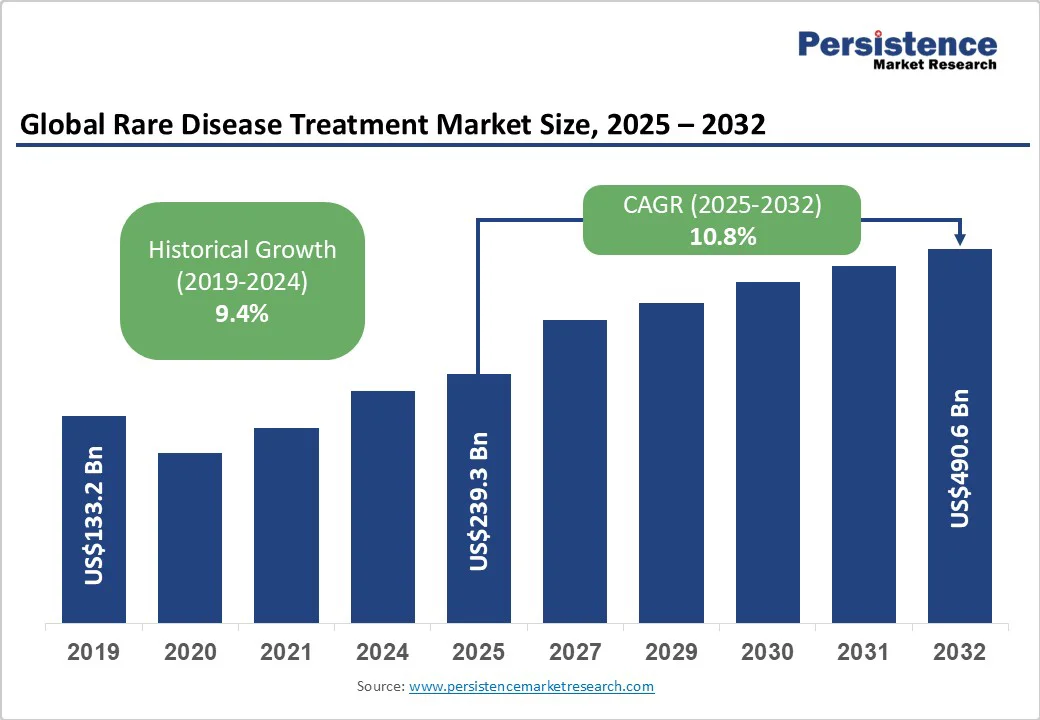

The global rare disease treatment market size is likely to be valued at US$239.3 billion in 2025. It is estimated to reach US$490.6 billion in 2032, growing at a CAGR of 10.8% during the forecast period 2025 - 2032, driven by developments in gene and cell therapies, as well as biologics and monoclonal antibodies. Accelerated approvals and AI-enabled virtual trials further support growth.

| Key Insights | Details |

|---|---|

| Rare Disease Treatment Market Size (2025E) | US$239.3 Bn |

| Market Value Forecast (2032F) | US$490.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 10.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 9.4% |

Supportive government policies and incentives have encouraged pharmaceutical companies to invest in treatments for rare diseases. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) offer benefits, including tax credits, fee waivers, and extended market exclusivity, which can last up to seven years in the U.S. and ten years in Europe, for approved orphan drugs.

These measures reduce research and development costs and ensure commercial viability for therapies addressing small patient populations. For example, in 2024, the European Commission granted orphan status to Orchard Therapeutics’ gene therapy for metachromatic leukodystrophy, enabling long-term protection from competition. Japan and Australia have also enhanced their orphan-drug frameworks, creating a favorable global environment that accelerates the development of treatments for rare diseases.

The increasing number of orphan-drug approvals from key regulatory bodies is propelling market growth. The FDA approved over 150 orphan-designated drugs in 2023, marking one of its highest counts to date, while the EMA continues to streamline its review processes to reduce approval timelines. This surge reflects growing clinical success rates and superior collaboration between biotech firms and patient advocacy groups.

For instance, recent approvals such as Vertex Pharmaceuticals’ Casgevy, the first CRISPR-based therapy for sickle cell disease, demonstrate how novel technologies are entering the rare disease space. With developments in genomics and precision medicine, this expanding approval pipeline continually translates scientific breakthroughs into tangible therapies for previously untreatable conditions.

The extremely high prices of rare disease treatments are prompting resistance from both public and private insurers. Many gene and cell therapies cost several hundred thousand dollars per patient, making reimbursement a major challenge. For instance, Bluebird Bio’s Zynteglo, priced at approximately US$2.8 million, encountered initial reimbursement hurdles in several European countries before being approved for conditional coverage.

Health Technology Assessment (HTA) bodies are now demanding long-term efficacy data and cost justification before granting payment approval. Hence, several promising therapies face delayed launches or limited market access despite regulatory clearance. This payer skepticism toward ultra-expensive drugs is compelling pharmaceutical companies to adopt outcome-based pricing models and re-evaluate their commercialization strategies.

Conducting randomized controlled trials (RCTs) in rare diseases remains difficult due to the limited number of eligible patients and their geographic dispersion. Recruiting statistically significant patient groups is often infeasible, leading to extended timelines or reliance on alternative trial designs, such as adaptive or single-arm studies.

For example, various gene therapy trials for ultra-rare disorders such as Duchenne muscular dystrophy struggle to achieve adequate sample sizes, delaying data collection and regulatory submissions. The lack of uniform diagnostic criteria and variations in disease progression further complicate trial standardization. Limited clinical evidence further complicates the assessment of safety, efficacy, and value by regulators and payers, thereby slowing the transition of experimental therapies into approved treatments.

Artificial intelligence and digital health platforms are opening new avenues for conducting decentralized clinical trials in rare disease research. AI tools help identify eligible patients globally by analyzing genetic databases, medical records, and social media communities, thereby reducing recruitment barriers. Virtual trials also allow remote monitoring through wearable devices and telemedicine, minimizing patient travel and dropouts.

For instance, Medable and Parexel have partnered to design AI-supported decentralized trials for rare neuromuscular diseases, improving inclusivity and data accuracy. The FDA’s ongoing efforts to validate digital biomarkers and remote endpoints are also improving regulatory acceptance. These virtual, AI-based trials make it feasible to study ultra-rare cohorts spread across regions, boosting the pace of clinical evidence generation.

The shift toward distributed or modular manufacturing is creating new opportunities for expanding personalized gene therapies. Traditional centralized facilities often struggle with the high customization and cold-chain logistics required for individualized treatments. Distributed production networks allow on-site or near-patient manufacturing, reducing turnaround time and costs.

For example, in 2024, the U.S. FDA collaborated with the Center for Biologics Evaluation and Research (CBER) to explore point-of-care manufacturing models for autologous cell therapies. Ori Biotech and Resilience are developing flexible, closed-system platforms that can produce patient-specific doses more efficiently. This decentralized approach ensures quick access to life-saving therapies, particularly for rare conditions that require customized genetic interventions.

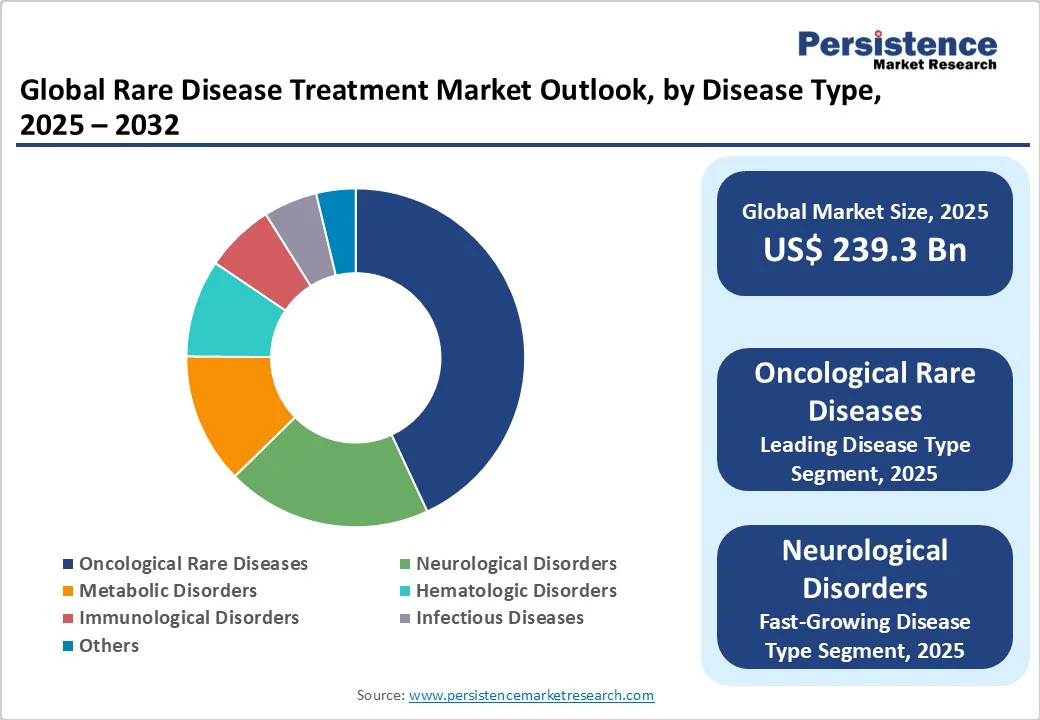

Oncological rare diseases are expected to account for nearly 43.5% of the market share in 2025, as cancer subtypes can be highly specific and genetically distinct, creating multiple ultra-rare patient populations. Precision medicine and targeted therapies have expanded treatment options for these subtypes, attracting research and development investment.

For instance, drugs such as Tazverik for epithelioid sarcoma and Pemazyre for cholangiocarcinoma show how molecular profiling enables therapy for previously untreatable rare cancers.

Neurological disorders are seeing considerable growth as they often cause severe, lifelong disability and lack effective treatments. Conditions such as Spinal Muscular Atrophy (SMA) and Duchenne Muscular Dystrophy (DMD) affect early development, creating an urgent need for therapeutic intervention.

Developments in gene therapy and antisense oligonucleotide treatments such as Evrysdi for SMA and Vyondys 53 for DMD have demonstrated that targeted neurological therapies can effectively improve patient outcomes.

Biologics and monoclonal antibodies are speculated to hold approximately 52.1% of the market share in 2025, as they can precisely target disease-causing molecules with minimal off-target effects. It is important for rare diseases, where traditional small-molecule drugs often fail.

They are especially effective in oncology and autoimmune-related rare conditions. For example, Blincyto (blinatumomab) is a bispecific monoclonal antibody used in certain rare types of leukemia, delivering targeted treatment where chemotherapy is ineffective.

Gene and cell therapies are accelerating steadily as they can address the root genetic causes of ultra-rare disorders rather than just managing symptoms. Therapies such as Zolgensma for spinal muscular atrophy and Libmeldy for metachromatic leukodystrophy demonstrate curative potential with a single-dose administration.

Hospitals are estimated to capture about 54.8% of the market share in 2025, as most therapies, especially gene, cell, and enzyme replacement treatments, require specialized administration and monitoring. Procedures, including intravenous enzyme infusions, autologous cell transplants, or CAR-T therapies, demand controlled clinical environments and trained staff.

Home-care settings are experiencing substantial growth as various biologics and enzyme replacement therapies have evolved to enable at-home administration, thereby improving patient convenience and reducing hospital burden. Treatments such as Elaprase for Hunter syndrome and subcutaneous formulations of Hemlibra for hemophilia can be safely self-administered with remote monitoring.

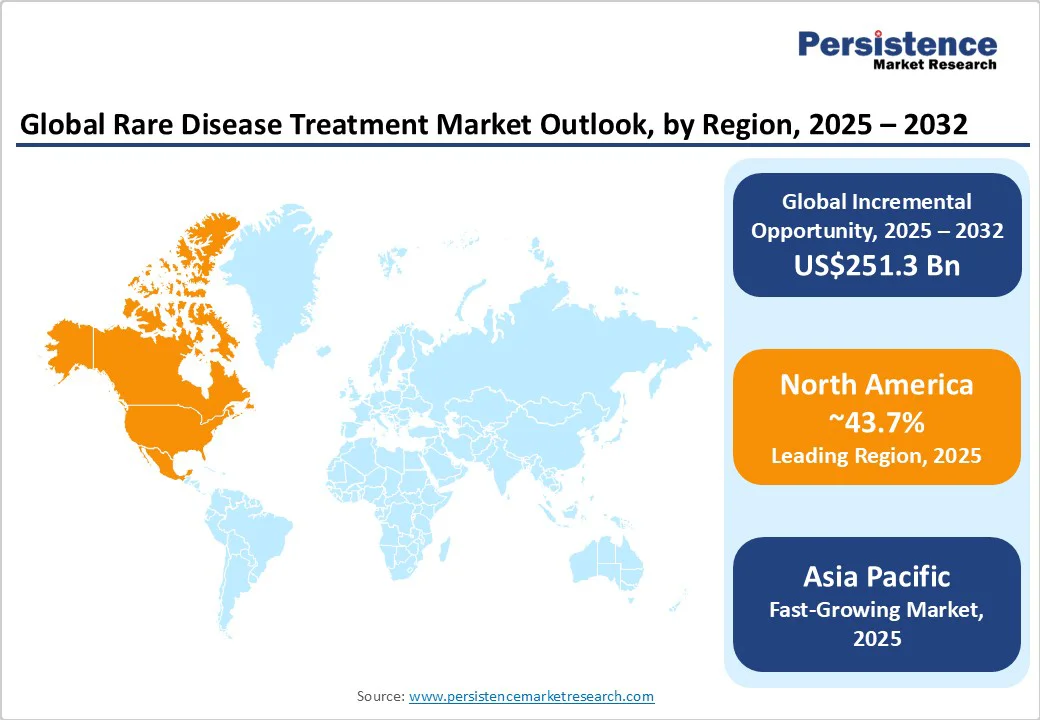

In 2025, North America is expected to account for approximately 43.7% of the market share, driven by steady momentum in FDA approvals for rare disease therapies. For example, more than half of all novel drugs approved by the FDA’s Center for Drug Evaluation and Research (CDER) in 2023 were for rare conditions. New treatments, such as Elevidys for Duchenne Muscular Dystrophy, have had their labeled use expanded, indicating an increasing focus on neuromuscular rare disorders.

Regulatory and policy changes are facilitating quick access, but with important caveats. The FDA has proposed an accelerated pathway for ultra-rare diseases (fewer than 1,000 patients), allowing single adequate trials when other therapies are missing. However, safety, long-term efficacy, and post-approval confirmatory requirements remain big hurdles.

Asia Pacific’s market is gradually improving but remains uneven across countries. Diagnosis remains a significant hurdle, as most patients experience years of delay before being identified due to limited awareness and a lack of specialized centers. A 2024 survey by the Economist Intelligence Unit reported that nearly two-thirds of rare disease patients in Asia Pacific do not receive appropriate care. This is mainly due to the inadequate diagnostic infrastructure and low disease awareness among healthcare workers.

Governments are beginning to act, but progress differs widely. China has established a nationwide rare disease network comprising over 400 hospitals and introduced fast-track approvals for orphan drugs, resulting in smooth access to therapies such as Evrysdi for spinal muscular atrophy. India, meanwhile, is expanding its Centers of Excellence under the National Policy for Rare Diseases and recently launched free pre-symptomatic screening for spinal muscular atrophy in Kerala.

Europe demonstrates superior regulatory support and increasing innovation. The European Medicines Agency (EMA) continues to approve therapies for ultra-rare conditions such as the enzyme replacement therapy for ADAMTS13 deficiency and next-generation cystic fibrosis drugs, including Alyftrek. These approvals highlight Europe’s commitment to expanding treatment options for diseases that previously lacked therapies.

Europe is also moving toward systemic reforms. The EU is promoting cooperation between member states, unified action plans for rare diseases, and funding for research and diagnostics through programs such as Horizon Europe. These initiatives aim to improve equity in access, but significant gaps remain in affordability and standardized care.

Collaborations between large pharmaceutical firms and small biotech companies characterize the global rare disease treatment market. Big players such as Novartis, Roche, Pfizer, and AstraZeneca are acquiring or partnering with small innovators that specialize in gene and cell therapies. This partnership model enables large companies to expand their orphan drug portfolios while providing biotechs with the resources to scale production and navigate complex regulatory approvals.

The rare disease treatment market is projected to reach US$239.3 Billion in 2025.

Orphan drug incentives and regulatory exclusivity are the key market drivers.

The rare disease treatment market is poised to witness a CAGR of 10.8% from 2025 to 2032.

Decentralized manufacturing and home-care administration are the key market opportunities.

Novartis AG, Roche Holding AG, and Johnson & Johnson (Janssen) are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Disease Type

By Therapy Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author