ID: PMRREP34425| 201 Pages | 30 Jan 2026 | Format: PDF, Excel, PPT* | Energy & Utilities

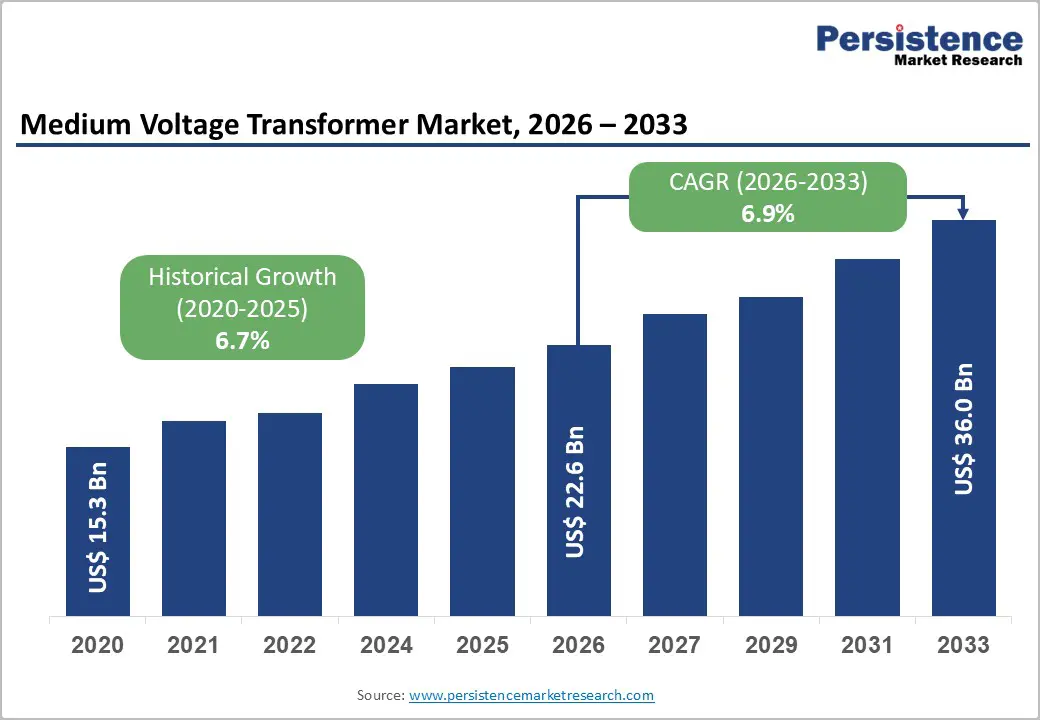

The global medium voltage transformer market size is likely to be valued at US$22.6 billion in 2026, and is expected to reach US$36.0 billion by 2033, growing at a CAGR of 6.9% during the forecast period from 2026 to 2033, driven by the increasing prevalence of renewable energy integration, rising demand for reliable power distribution networks in urbanizing regions, and advancements in energy-efficient three-phase distribution transformers.

Growing demand for compact, low-loss medium-voltage transformers, particularly three-phase units for industrial and power utility applications, is accelerating adoption among end users. Advances in eco-design standards and smart transformer monitoring are further increasing uptake by enhancing reliability and grid stability. The increasing recognition of medium-voltage transformers as critical to electrification, renewable grid connections, and infrastructure resilience in emerging markets remains a major driver of market growth.

| Key Insights | Details |

|---|---|

| Medium Voltage Transformer Market Size (2026E) | US$22.6 Bn |

| Market Value Forecast (2033F) | US$36.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.7% |

Rising renewable energy integration is reshaping power distribution networks as utilities transition from centralized fossil-fuel generation to decentralized and intermittent energy sources such as solar and wind. Unlike conventional power plants, renewables are often connected at the distribution level, leading to bidirectional power flows and fluctuating load patterns. This shift has increased stress on existing distribution infrastructure, which was originally designed for one-way electricity flow and predictable demand. The need for reliable, flexible, and digitally enabled distribution networks has grown significantly.

Utilities are increasingly focusing on grid modernization to ensure stable voltage control, minimize power losses, and manage variability in renewable generation. Advanced distribution automation, smart transformers, and real-time monitoring systems are being adopted to enhance fault detection, improve outage response times, and maintain grid resilience. Energy storage systems and microgrids are also gaining importance, as they help balance supply-demand mismatches and support grid stability during peak renewable generation or sudden drops in output. The rising penetration of electric vehicles, rooftop solar installations, and distributed energy resources has intensified the demand for robust distribution networks capable of handling higher loads and complex grid interactions.

High raw material costs and long lead times have emerged as significant challenges across capital-intensive industrial and infrastructure markets, particularly those dependent on metals, polymers, and specialized electronic components. Prices of key inputs such as copper, aluminum, steel, rare earth elements, and engineered resins are highly sensitive to global supply-demand imbalances, geopolitical tensions, energy costs, and mining or refining constraints. Frequent price volatility makes budgeting difficult for manufacturers and utilities, often compressing margins or forcing cost pass-throughs to end customers.

Long lead times for critical raw materials and sub-components have disrupted production planning and project execution. Many essential inputs are sourced from a limited number of suppliers or regions, increasing exposure to transportation delays, trade restrictions, and capacity bottlenecks. Custom-engineered parts and high-specification materials typically require extended qualification, processing, and testing cycles, further prolonging procurement timelines. These delays can cascade across the value chain, leading to postponed installations, missed commissioning schedules, and higher inventory carrying costs.

The expansion of smart transformers and eco-design-compliant units is driven by the growing need for efficient, resilient, and sustainable power distribution systems. Smart transformers integrate digital monitoring, communication capabilities, and power electronics to actively manage voltage fluctuations, load variations, and bidirectional power flows caused by distributed energy resources. Unlike conventional transformers, these systems enable real-time data exchange with grid control centers, allowing utilities to optimize asset performance, predict failures, and reduce unplanned outages. This intelligence is becoming increasingly important as distribution networks accommodate higher shares of renewable energy and electric vehicle charging infrastructure.

Eco-design-compliant transformers are gaining traction due to stricter energy-efficiency regulations and sustainability targets. These units are engineered to minimize no-load and load losses through advanced core materials, improved winding designs, and optimized cooling systems. The use of environmentally friendly insulating fluids and reduced material intensity further supports lower lifecycle environmental impact. Compliance with eco-design standards not only reduces operational losses but also helps utilities lower the total cost of ownership over long service lifespans.

The distribution segment is expected to lead the market, holding 62% of the share in 2026, owing to its critical role in delivering electricity from substations to end-users across the residential, commercial, and industrial sectors. Rising urbanization, renewable energy integration, and electrification of transport increased the complexity and load on distribution networks, driving higher investments compared to generation and transmission. Utilities prioritized upgrading aging distribution infrastructure with smart equipment, automation, and loss-reduction technologies to improve reliability and outage management.

Utilities have focused on upgrading aging distribution infrastructure by incorporating smart equipment, automation, and loss-reduction technologies to enhance reliability and outage management. A notable example is Maharashtra State Electricity Distribution Company Ltd (MSEDCL), which has teamed up with the Global Energy Alliance for People and Planet (GEAPP) to modernize its grid. Through this partnership, MSEDCL is integrating digital tools, analytics, and battery energy storage to stabilize supply and better support distributed renewable energy assets, showcasing a proactive approach to distribution modernization in response to the growing reliance on renewables.

The power segment is likely to be the fastest-growing transformer type, due to rising investments in high-capacity power infrastructure and grid expansion projects. The rapid addition of renewable energy plants, large-scale substations, and interregional transmission corridors has increased the demand for transformers capable of handling higher voltages and bulk power transfer. Aging power infrastructure in many regions is also being replaced with advanced, higher-efficiency units to reduce losses and improve reliability.

GE Vernova T&D India Ltd secured a major order from Power Grid Corporation of India Limited (POWERGRID) to supply more than 70 extra-high-voltage (765 kV) power transformers and shunt reactors for renewable power corridors supporting grid expansion and renewable integration. These large power transformers are designed to handle bulk power transfer across long distances and are essential for strengthening transmission infrastructure to accommodate increasing electricity demand and renewable energy capacity.

The three-phase segment is projected to lead the market, accounting for 78% of the market in 2026, as it is the preferred solution for high-capacity, continuous-power applications. Their ability to transmit and distribute electricity more efficiently than single-phase units makes them essential for industrial facilities, commercial complexes, and large-scale infrastructure projects.

As urban power networks expand, renewable energy plants and transmission substations increasingly rely on three-phase systems to manage higher loads and improve voltage stability. Siemens Energy regularly supplies three-phase transformers for large grid and utility applications, as they can handle high power loads and support stable distribution across power networks.

The single-phase segment is likely to be the fastest-growing, driven by expanding electrification in residential and light commercial markets. Rapid growth in housing developments, rural grid extension, and small commercial establishments has increased demand for compact, cost-effective power solutions that single-phase systems provide. The rising adoption of rooftop solar, home energy storage, and electric vehicle (EV) chargers further supports this growth, as these applications commonly operate on single-phase connections.

ProlecGE, a major transformer manufacturer (a joint venture between GE and Xignux), announced an additional US$85 million investment to double its manufacturing capacity specifically for single-phase pad-mount transformers. This expansion responds directly to rising electrification needs in North America, particularly residential distribution and grid reliability upgrades, where utilities increasingly require single-phase units for lower-capacity distribution and decentralized energy delivery.

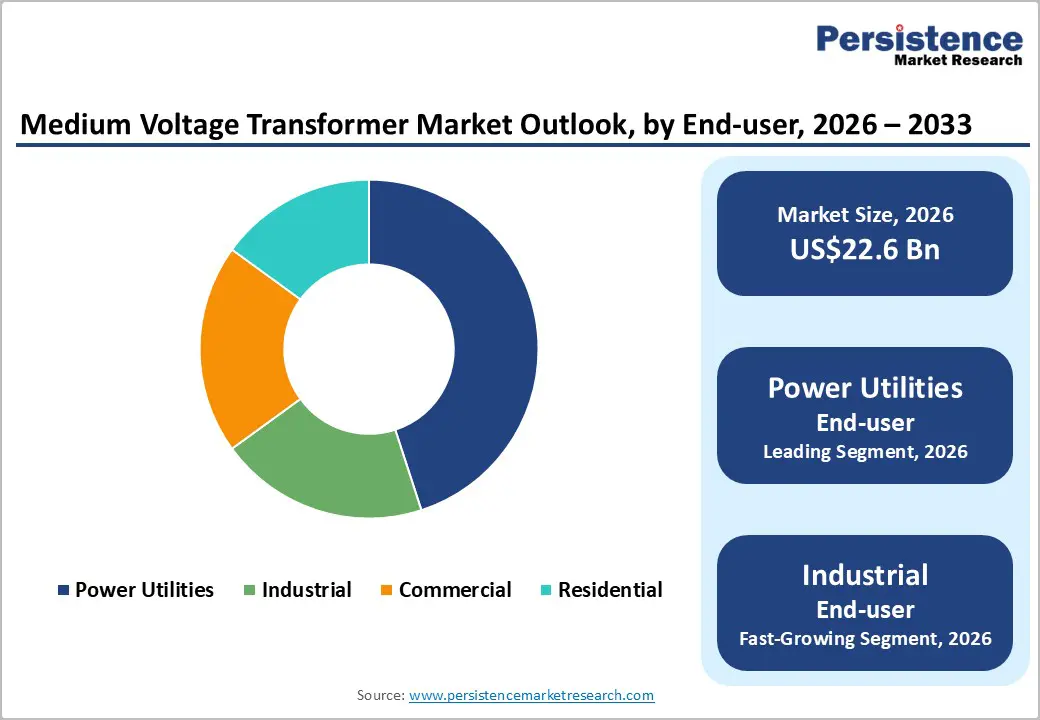

Power utilities are expected to dominate the market, contributing nearly 45% of revenue in 2026, supported by their central role in electricity distribution, grid expansion, and infrastructure modernization. Utilities are making substantial investments in transformers, switchgear, and other grid equipment to replace outdated assets and enhance network reliability.

Growing electricity demand, the integration of renewable energy sources, and the electrification of transportation are driving increased spending on capacity upgrades and on strengthening grid resilience. These investments highlight the critical role utilities play in electricity distribution, grid infrastructure expansion, and modernization of essential systems.

The industrial sector is expected to be the fastest-growing segment, driven by rapid electrification, automation, and capacity expansion across manufacturing and processing. Key sectors such as metals, chemicals, cement, oil & gas, data centers, and heavy engineering rely on reliable, high-capacity power infrastructure to support continuous operations and energy-intensive equipment. The growing use of electric furnaces, motors, robotics, and digital control systems has further increased the demand for stable and efficient power within industrial facilities.

To meet the rising demand, Eaton Corporation is significantly boosting its transformer manufacturing capacity in the U.S. With a US$340 million investment in a new three-phase transformer production facility in Jonesville, South Carolina, Eaton is positioning itself to support the growing power needs of industrial customers, including data centers, manufacturing plants, and electrification projects.

The North America market is driven by advanced grid modernization efforts, strong research and development capabilities, and a high level of public awareness regarding the benefits of grid reliability. In the U.S. and Canada, network systems provide robust support for transformer initiatives, ensuring the widespread availability of medium-voltage transformers across power utilities, industrial sectors, and commercial enterprises. The growing demand for three-phase transformers, which are convenient and easy to install, is accelerating adoption as they enhance efficiency and help address challenges posed by aging infrastructure.

Innovation in medium-voltage transformer technology, including smart monitoring, eco-friendly design improvements, and improved integration with renewable energy sources, is attracting significant investment from both the public and private sectors. Government initiatives and Department of Energy (DOE) campaigns continue to emphasize the importance of addressing outage risks, capacity limitations, and the challenges posed by emerging electrification demands, thereby sustaining strong market growth. The increasing focus on industrial-grade applications, particularly in data centers and other specialized use cases, is expanding the scope of medium-voltage transformer use.

Europe is propelled by increasing awareness of efficiency benefits, strong regulatory systems, and government-led grid decarbonization programs. Countries such as Germany, France, Italy, and Spain have well-established utility frameworks that support routine transformer upgrades and encourage the adoption of innovative delivery methods, including medium voltage transformers. These high-efficiency formulations are particularly appealing to power utilities, regulatory-conscious operators, and industrial users, improving reliability and coverage.

Technological advancements in medium-voltage transformer development, such as enhanced amorphous cores, application-specific delivery, and improved smart grades, are further boosting market potential. European authorities are increasingly supporting research and trials on transformers for both routine and specialized applications, strengthening market confidence. The growing emphasis on convenient, low-loss options aligns with the region’s focus on a preventive energy transition and emissions reduction. Public awareness campaigns and promotional drives are expanding reach in both urban and rural areas, while suppliers are investing in monitoring and developing new variants to improve efficacy.

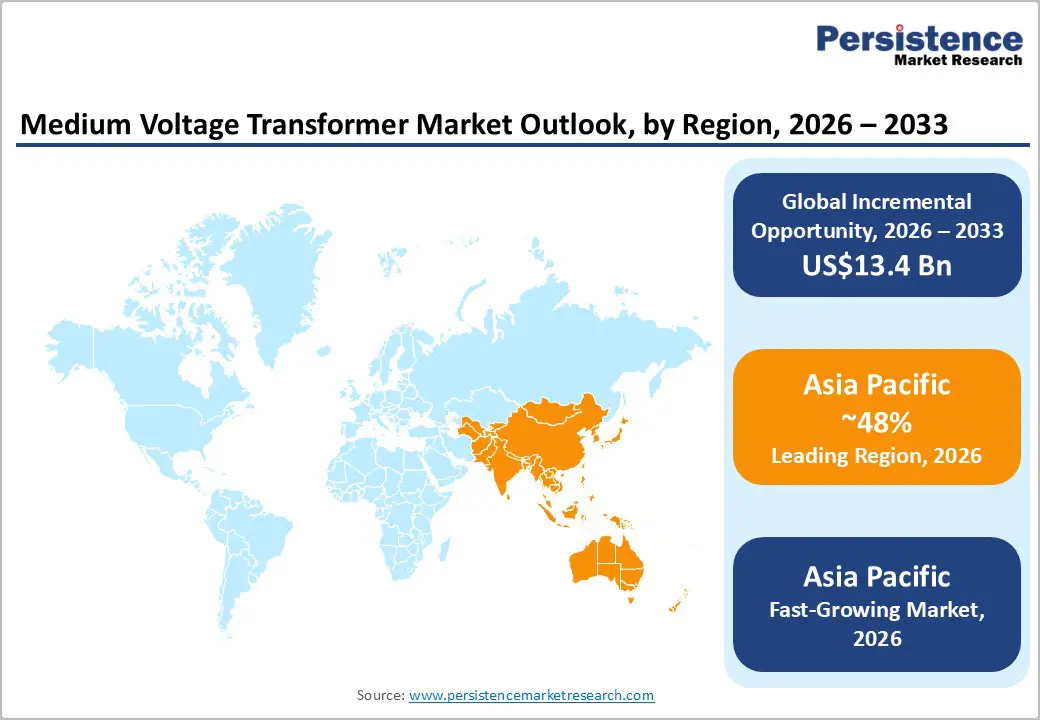

Asia Pacific is expected to become both the largest and fastest-growing market, capturing 48% of revenue by 2026, driven by rising electrification awareness, government initiatives, and expanding application programs across the region. Countries, including China, India, Japan, and Indonesia, are actively promoting transformer initiatives to support grid expansion and meet the growing demand for renewable energy. Medium voltage transformers are particularly well-suited to these regions due to their scalability, ease of installation, and effectiveness in large-scale distribution efforts across both urban and rural areas.

Technological advancements are driving the development of stable, efficient, and easy-to-deploy medium-voltage transformers that can withstand challenging climatic conditions and reduce reliance on loss-prone systems. These innovations are essential for improving grid coverage and reaching remote locations. The rising demand across power utilities, industrial sectors, and commercial applications is further fueling market growth. Public-private partnerships, increased infrastructure investments, and growing research and manufacturing capacity in transformer technology are accelerating the market's expansion. The convenience, enhanced efficiency, and reduced failure risk of medium-voltage transformers make them the preferred solution in many regions.

The global medium-voltage transformer market is characterized by competition between established power equipment leaders and emerging, efficiency-focused suppliers. In North America and Europe, CG Power & Industrial Solutions and Hammond Power Solutions lead through strong R&D, distribution networks, and utility ties, bolstered by innovative low-loss and smart programs. In the Asia-Pacific region, TBEA Co. Ltd. advances with localized solutions to enhance accessibility. Eco-design delivery boosts efficiency, reduces risk, and enables mass integration across regions. Strategic partnerships, collaborations, and acquisitions merge expertise, expand portfolios, and speed commercialization. Smart formulations address monitoring challenges, enabling penetration into digital grid areas.

The global medium voltage transformer market is projected to reach US$22.6 billion in 2026.

Renewable energy integration and demand for reliable power distribution networks are key drivers.

The medium voltage transformer market is poised to witness a CAGR of 6.9% from 2026 to 2033.

Smart transformers and eco-design compliant units are key opportunities.

CG Power & Industrial Solutions, Hyosung Heavy Industries, TBEA Co. Ltd., Hammond Power Solutions, and WEG SA are the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Transformer Type

By Phase

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author