ID: PMRREP31356| 194 Pages | 17 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

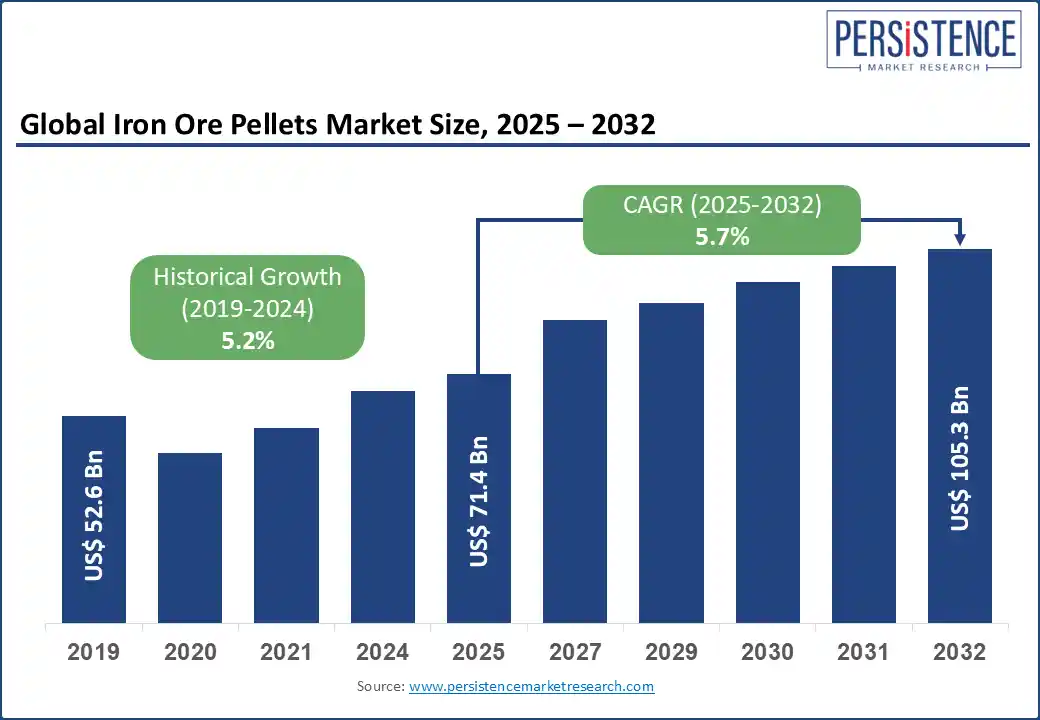

The global iron ore pellets market size is likely to be valued at US$ 71.4 Bn in 2025 and is expected to reach US$ 105.3 Bn growing at a CAGR of 5.7% during the forecast period from 2025 to 2032.

Pellet production plays a central role in the future of global DRI growth. DRI plants require DR-grade pellets with over 67% Fe and under 2% gangue, making these pellets essential for both gas-based and hydrogen-based DRI technologies Since 2016, DRI output has grown at nearly eight million tonnes per year, reaching 130–135 Mt in 2023, and could rise to 185–190 Mt by 2030. CDRI volumes tripled over the past two decades from 39 Mt to 102.1 Mt while HDRI jumped from 1.8 Mt to 13.9 Mt, driven by demand from EAF-based steelmakers. Every tonne depends on stable and high-quality pellet supply. Companies such as Vale are already setting up regional pellet hubs to address rising demand across multiple DRI sites.

Hydrogen-based projects such as H2 Green Steel and HYBRIT plan to produce over 5 Mt of green steel annually by 2030, using only DR-grade pellets as feedstock. These efforts underline the strategic need for reliable pellet supply chains. Any drop in pellet quality or availability could disrupt DRI timelines and efficiency. Sustained global steel production over 1,700 Mt across the top 15 nations directly reinforces the requirement for consistent pellet production, positioning it as the backbone of decarbonized steelmaking.

Key Industry Highlights:

|

Global Market Attribute |

Details |

|

Market Size (2024A) |

US$ 67.7 Bn |

|

Estimated Market Size (2025E) |

US$ 71.4 Bn |

|

Projected Market Value (2032F) |

US$ 105.3 Bn |

|

Value CAGR (2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.2% |

The demand for high-grade iron ore pellets is rising due to the global shift toward green steel production. Steelmakers are favouring feedstock with high iron content and low impurities to support direct reduction (DR) processes using hydrogen. DR-grade pellets with 68% Fe and ultra-low silica are proving essential in reducing CO2 emissions by up to 95% compared to blast furnace methods.

Major producers such as Vale and Metalloinvest are securing long-term supply deals and expanding capacity to meet this shift. As emission targets tighten globally, DR-compatible iron agglomerates are becoming a preferred input for sustainable steelmaking. Hydrogen-based steel plants in Sweden and Russia are actively integrating such pellets into their processes, indicating a long-term demand trajectory. For instance, H2 Green Steel’s tie-up with Vale and Metalloinvest’s 53-million-tonne supply agreement with OMK highlight industry-wide adoption. The transition to clean steel production is no longer experimental but entering large-scale implementation, making high-grade iron ore pellets a key enabler of decarbonization.

Emerging technologies such as iron ore briquettes are posing challenges to traditional pellet demand. Companies are advancing low-temperature briquetting processes that reduce CO2 emissions by around 80% compared to pelletizing. With successful pilot tests and strong agglomerate strength, briquettes are becoming viable for DR steel production. Their lower carbon footprint and operational cost could divert investment away from pellet facilities.

Vale and Midrex are already preparing to scale up briquette technology globally, signalling a shift in market dynamics. If widely adopted, these briquettes could replace pellets in applications where environmental performance and cost savings are prioritized. The increasing focus on alternative feedstock is putting pressure on conventional pellet producers to innovate or risk losing market share.

A clear industry trend is the adoption of renewable fuels in pellet production to curb emissions. Pelletizing, which contributes significantly to Scope-1 emission is decarbonized using bio-oil and biocarbon alternatives. LKAB and Vale have demonstrated the viability of such replacements by producing commercial-grade pellets with up to 350,000 tonnes of CO2 savings annually per plant. This move supports broader goals such as 33% reduction in operational emissions by 2030, and aligns with national strategies for carbon neutrality. As steelmakers commit to low-emission value chains, fossil-free agglomerate production is becoming a norm. Iron ore pellets made via renewable fuels are expected to set new benchmarks in sustainable raw material supply.

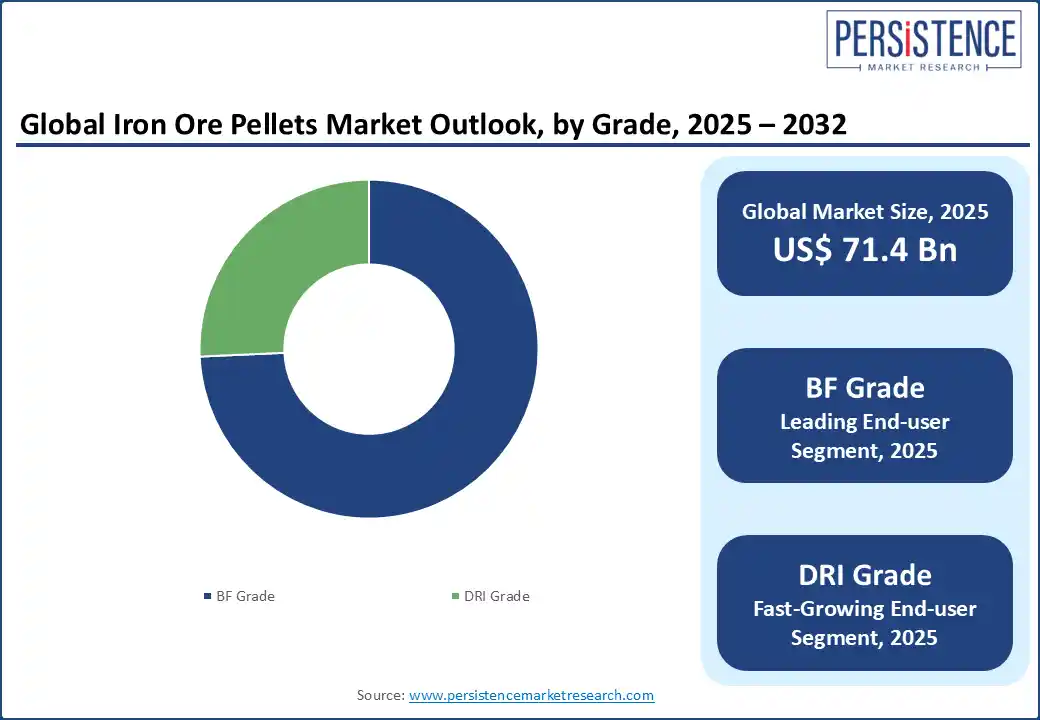

BF grade iron ore pellets hold the largest market share at 74.3% by value in 2022. Steel producers continue to rely on blast furnace technology due to its established infrastructure and cost efficiency. BF pellets offer consistent quality and support large-scale output, making them the preferred choice for integrated steel plants worldwide. Low production cost and wide availability further strengthen their dominance across mature steel markets.

On November 13, 2024, Vale secured a multi-year agreement with ROGESA to supply BF-grade pellets from 2025 to 2027. This deal supports ongoing blast furnace operations while preparing for a shift toward cleaner production. From 2028, ROGESA plans to adopt DR-grade pellets with the commissioning of its DRI plant in Dillingen. The transition reflects growing momentum in green steel while BF pellets continue to anchor global supply chains.

Captive trade type holds 72.4% market share, led by integrated steel producers sourcing pellets for in-house consumption. Companies such as Tata Steel and JSW Steel continue expanding pellet capacity to secure raw material supply, reduce costs, and ensure quality consistency. Strong backward integration and rising steel demand further boost captive pellet consumption.

North America contributes 10.2% to the global iron ore pellet market, driven by strong investments in high-grade pellet production and sustainable technologies. In the U.S., the expansion of direct reduction-grade pellet capacity is aligned with the country’s metallics strategy and the rapid rise of electric arc furnace (EAF) steelmaking. U.S. Steel’s Keetac facility, now producing 4 million tons of DR-grade pellets annually, plays a key role in supplying 104 operating minimills with low-cost, high-purity input.

In Canada, the Iron Ore Company of Canada (IOC) is reinforcing the region’s position in both sustainable pellet production and international supply. Recent efforts to cut emissions through electric boiler and burner upgrades highlight Canada’s shift toward low-carbon pelletizing.

At the same time, growing exports of DR-grade pellets to hydrogen-based HBI plants in France and Sweden reflect the region’s strategic role in global green steel supply chains. This dual focus on decarbonization and advanced feedstock supply is strengthening North America’s influence in the transition to fossil-free steelmaking.

East Asia dominates the iron ore pellet market with a 41.6% value share, led by China’s aggressive capacity expansion and decarbonization push. On September 25, 2024, Metso partnered with BSIET to deliver a 1.7 MTPA traveling grate induration system for Ruifeng Iron and Steel in Tangshan. The facility will replace outdated shaft furnaces and marks the 12th pellet project by Metso and BSIET in China. Their compact, low-emission technology supports China’s ongoing green steel transition and solidifies East Asia’s leadership.

Iron-rich agglomerates remain central to steelmaking across key provinces such as Hunan, where iron ore output jumped to 104,600 Ton in March 2025 from 71,500 Ton in February. Updates from the National Bureau of Statistics confirm active and expanding operations with the region nearing past highs such as 12,277,000 Tonnes recorded in December 2014. High product uniformity, reliable supply chains, and adoption of energy-efficient pelletizing systems drive demand and reinforce East Asia’s strong position in the global market.

South Asia & Oceania accounts for 17.2% of the global market share, driven by India’s consistent growth in iron ore pellet output. India raised its pellet production from 59.6 million tonnes in 2018–19 to 94 million tonnes in 2023–24. In FY2024–25, the country reached 105 million tonnes, marking a 5% year-on-year rise. Increased steel demand, wider adoption of blast furnace feedstock crossing 50%, and capacity expansions such as Bengal Energy’s 1.2 MTPA plant in West Bengal pushed this growth.

India’s raw material availability remained strong, with iron ore production at 251.13 million tonnes in 2021–22, supporting pelletizing units. Design capacity hit 164 million tonnes by 2025, up from 148 million the year before. Lower dependence on imports and shrinking exports, which dropped to 6.32 million tonnes in 2022–23 from 13.75 million in 2020–21, signal a market turning inward to meet domestic steelmaking needs. This regional momentum reinforces South Asia’s role as a growing hub for agglomerated iron feedstock.

The global iron ore pellets market is fairly consolidated, with major players such as LKAB, Rio Tinto (IOC), Vale S.A., Metalloinvest, and Samarco controlling 33% to 38% of the overall market. These companies focus on advancing low-carbon pellet technologies, transitioning to direct reduction (DR)-grade products, and aligning with hydrogen-based steelmaking needs. Their strategies increasingly center around fossil-free fuels, alternative agglomerates, and integration with clean steel ecosystems to maintain technical and environmental leadership.

Top manufacturers are scaling up their production capacity and entering logistics partnerships to strengthen global pellet delivery. Meanwhile, small and mid-sized players often depend on long-term contracts to secure demand under fixed pricing structures. Across the board, producers are prioritizing high-Fe, low-impurity pellet output to cater to the EAF and HBI markets, reflecting a shift from traditional blast furnace-grade materials toward premium and green-compliant feedstock.

The global iron ore pellets market is projected to be valued at US$ 71.4 Bn in 2025.

BF-grade iron ore pellets are expected to hold around 65–68% share of the global market by value in 2025, driven by continued reliance on blast furnace operations in traditional steelmaking regions despite growing DR-grade adoption.

The iron ore pellets market is poised to witness a CAGR 5.7% from 2025 to 2032.

Rising demand for DR-grade pellets to enable hydrogen-based low-carbon steelmaking is driving iron ore pellets market growth.

Scaling fossil-free pellet production using renewable fuels presents a major opportunity to meet sustainability targets.

Key players in the iron ore pellets market include Vale S.A., LKAB, Metalloinvest, Rio Tinto (IOC), and Samarco.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available on Report |

By Grade

By Trade Outlook

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author