ID: PMRREP15235| 196 Pages | 9 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

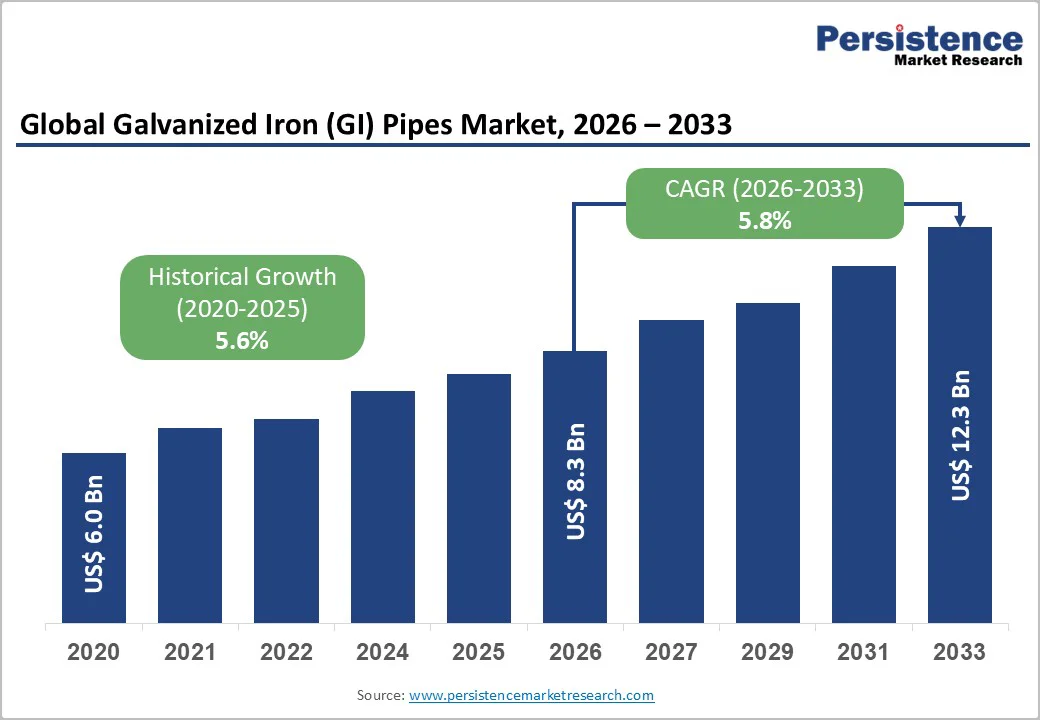

The global galvanized iron (GI) pipes market size is likely to be valued at US$8.3 billion in 2026 and is expected to reach US$12.3 billion by 2033, growing at a CAGR of 5.8% during the forecast period from 2026 to 2033, driven by rapid infrastructure development, urbanization, and a construction boom, particularly in Asia Pacific, fueling demand for corrosion-resistant, durable pipes in water supply and industrial applications.

Growing industrial use in oil & gas and agriculture, along with sustainability trends promoting eco-friendly coatings, supports market growth worldwide.

| Key Insights | Details |

|---|---|

| Galvanized Iron (GI) Pipes Market Size (2026E) | US$8.3 Bn |

| Market Value Forecast (2033F) | US$12.3 Bn |

| Projected Growth CAGR (2026 - 2033) | 5.8% |

| Historical Market Growth (2020 - 2025) | 5.6% |

Public infrastructure development is a major driver for the GI pipes market, as governments prioritize urban expansion, water supply networks, and industrial facilities. Large-scale projects such as municipal water distribution systems, sewage networks, and public housing initiatives increase demand for durable, corrosion-resistant piping solutions.

GI pipes are preferred for these applications due to their long service life, strength, and ability to withstand varying environmental conditions.

Urbanization, coupled with increasing industrialization, further supports demand, as new commercial complexes, roads, and transportation facilities require reliable piping systems. This steady investment in public infrastructure ensures a consistent pipeline of growth for manufacturers and suppliers of GI pipes.

Public projects often involve high-volume procurement, creating opportunities for manufacturers to scale operations and optimize production. Regulations and standards governing construction quality and safety drive the selection of certified GI pipes, reinforcing market stability.

A major restraint for the GI pipes market is the increasing competition from plastic piping solutions such as PVC, HDPE, and PPR pipes. These materials are lightweight, corrosion-resistant, and easier to install, making them attractive alternatives for both residential and commercial applications. Plastic pipes also require less maintenance, reduce labor costs, and enable faster deployment in large-scale projects, thereby challenging the traditional advantages of GI pipes.

The adoption of plastic pipes has pressured GI pipe manufacturers to innovate and enhance value propositions, including improving anti-corrosion coatings and offering pre-galvanized or customized solutions. Despite the superior strength and durability of GI pipes, the cost and convenience benefits of plastics limit market expansion in some applications.

To remain competitive, manufacturers are focusing on high-performance and large-diameter applications, infrastructure projects, and regulatory-compliant installations where GI pipes retain an edge.

Lightweight GI innovations present a significant market opportunity, driven by the growing need for high-strength yet easy-to-handle piping across construction, water supply, and industrial applications. Advancements in thinner-gauge steel, improved zinc-coating technologies, and precision welding techniques are enabling manufacturers to produce GI pipes that maintain structural durability while reducing overall weight.

Manufacturers are investing in automated forming lines, advanced galvanizing baths, and metallurgical enhancements to develop next-generation lightweight GI pipes tailored for sectors such as HVAC, fabrication, modular construction, and irrigation. These innovations not only enhance corrosion resistance but also improve bending capability and adaptability for complex layouts.

Lightweight GI pipes open strong opportunities in markets prioritizing energy-efficient buildings, prefabricated structures, and quick-assembly systems.

Standard GI pipes are expected to lead the global market, capturing over 50% of the total revenue share in 2026, owing to their broad applicability in plumbing, water distribution, construction frameworks, and rural and urban pipeline networks. Their corrosion resistance, longer service life, and suitability for both high-pressure and low-pressure systems make them a preferred choice across residential, commercial, and industrial projects.

For example, large-scale water supply upgrades in developing regions often rely on standard GI pipes for durable distribution lines and municipal plumbing grids. These pipes are extensively used in water supply networks, building utilities, and structural applications, reinforcing their strong market dominance.

Customized GI pipes are expected to be the fastest-growing category, driven by rising sector-specific requirements across automotive, fabrication, machinery, and industrial applications. These pipes are engineered to meet precise specifications related to coating thickness, pressure rating, mechanical strength, and geometric dimensions, making them suitable for specialized and high-performance environments.

Growth is supported by industries moving toward tailored solutions for efficiency, durability, and lightweight design. For example, machinery manufacturers increasingly adopt custom-dimensioned GI pipes for precision assemblies, conveyor structures, and equipment frames where uniform strength and tailored sizing are critical.

Medium-diameter GI pipes are projected to lead the market, capturing over 45% share in 2026, due to their suitability across key applications such as plumbing, irrigation, borewell systems, light-industrial pipelines, and structural frameworks.

Their balanced dimensions offer an ideal combination of strength, flow capacity, and ease of installation, which positions them as the most versatile diameter range in the market. Their easy availability, compatibility with installation, and reliable performance across diverse environments sustain their strong market dominance.

Large diameter GI pipes are likely to be the fastest-growing category, driven by expanding infrastructure pipelines, industrial fluid networks, and large-scale water distribution projects. These pipes are increasingly used in drainage systems, industrial processing plants, urban water transmission, and high-capacity municipal pipelines.

Governments worldwide are investing in modernizing public water systems, industrial corridors, and petrochemical facilities, all of which require large-diameter, corrosion-resistant GI pipelines.

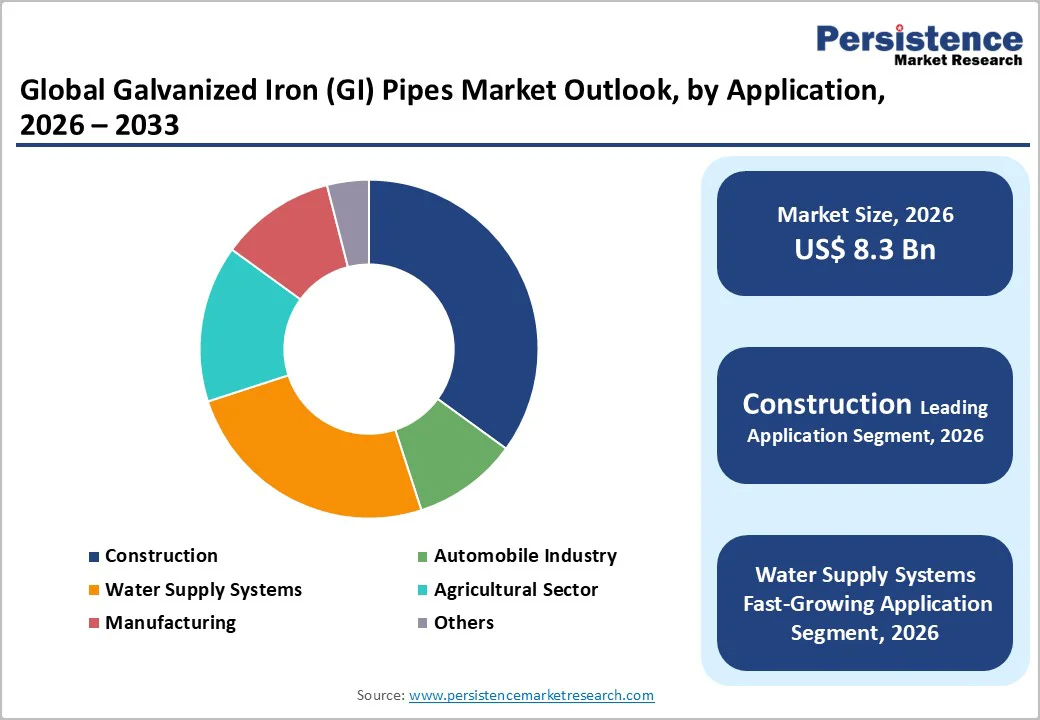

The construction segment is expected to dominate the market with over 40% share in 2026, driven by the extensive use of GI pipes in structural frameworks, scaffolding, fencing, roofing supports, ventilation systems, and building utility networks, ensuring steady demand across residential, commercial, and infrastructure projects.

The durability, strength, and corrosion resistance of GI Pipes make them integral to long-lasting structural applications. For example, large-scale commercial building projects across Asia and the Middle East continue to integrate GI pipes for scaffolding and support structures due to their high load-bearing capacity and lower maintenance requirements. Growing construction in housing, commercial, and industrial projects continues to make GI Pipes indispensable.

Water supply systems are the fastest-growing category, driven by increasing focus on urban water security, rural water connectivity, and public drinking water schemes. GI Pipes are preferred for their reliability in transporting potable water, resistance to internal corrosion, and long service cycles, making them ideal for municipal and rural water networks.

The rise in government-funded water projects, the modernization of old pipeline systems, and the rapid expansion of sanitation and public utility schemes are accelerating demand for GI pipes in this category. For example, several rural water distribution programs in India and African nations continue to adopt GI pipes for durable, rust-resistant potable water lines that function reliably across varying climate and soil conditions.

The industrial sector is expected to lead the market, accounting for around 35% of total revenue. Reflecting the extensive use of GI Pipes across manufacturing, oil & gas, mechanical processing, metal fabrication, chemical plants, and machinery systems.

Their corrosion resistance, rigidity, and ability to withstand varying operating conditions make them essential in industrial fluid transport, exhaust systems, coolant lines, and structural installations. GI Pipes are also widely used in warehouses, industrial sheds, and plant layouts due to their structural strength.

The infrastructure segment is the fastest-growing end-user, driven by governments investing heavily in roads, bridges, urban utilities, industrial corridors, and large-scale public development projects. GI Pipes are crucial for drainage networks, street lighting poles, electrical conduits, boundary protection, and major water transmission lines.

As countries emphasize sustainable and long-lasting infrastructure, the demand for GI Pipes increases due to their durability, adaptability, and protection against harsh environmental exposure.

North America is witnessing steady advancement in the GI pipes market, supported by the region’s strong construction, industrial, and utility infrastructure sectors. Demand is reinforced by widespread use of GI pipes in residential plumbing systems, commercial building frameworks, HVAC installations, fire-safety networks, and agricultural irrigation.

The region’s aging water distribution systems are undergoing significant modernization, prompting municipalities to replace old pipelines with corrosion-resistant GI options that ensure long-term durability.

North America is experiencing a major trend toward advanced coatings and higher-grade galvanized products that significantly enhance corrosion protection and extend service life.

Manufacturers are integrating automated welding, precision forming, and advanced zinc-coating technologies to meet stricter building codes and performance expectations. Sustainability goals are also influencing production, with companies exploring eco-efficient galvanization methods and recyclable steel technologies.

Europe represents a robust market, driven by rising demand from construction, water management, and industrial sectors, supported by strict building standards and a focus on long-lasting materials. The region’s widespread renovation and modernization of aging infrastructure, especially water distribution networks, heating systems, and commercial buildings, continues to drive steady consumption of GI pipes.

Europe’s focus on high-quality construction materials is strengthening the use of medium-diameter and heavy-duty GI pipes across urban and rural projects.

Europe is also witnessing a clear trend toward environmentally responsible manufacturing and advanced galvanization technologies. Regulations encouraging reduced emissions and sustainable material use are pushing producers to adopt energy-efficient galvanizing processes, eco-friendly coatings, and recyclable steel inputs.

The rise of smart buildings and industrial automation has increased demand for precision-engineered GI pipes compatible with modern HVAC and mechanical systems.

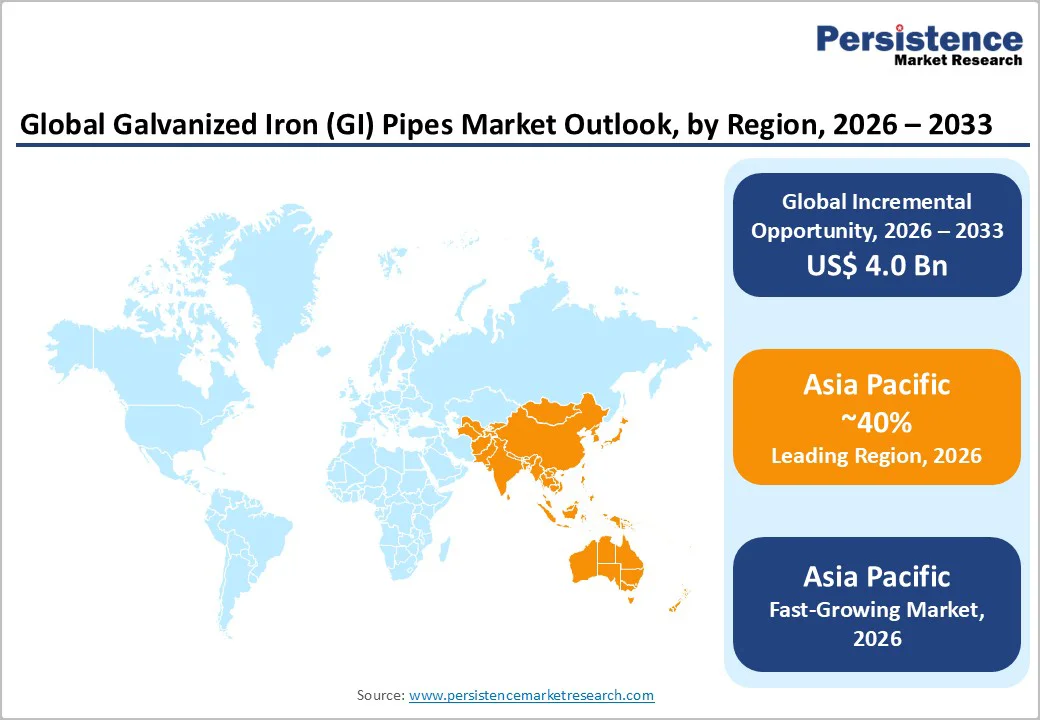

Asia Pacific is projected to be the leading and fastest-growing region in the galvanized iron (GI) pipes market, driven by rapid urbanization, infrastructure development, and expansion of residential and commercial construction.

Governments in China, India, Indonesia, and Vietnam are prioritizing large-scale water supply upgrades, smart city programs, and public utility modernization, which is increasing the adoption of corrosion-resistant GI pipes for plumbing, water distribution, and structural applications.

In India, initiatives such as the Jal Jeevan Mission are significantly accelerating the installation of GI pipes in rural and semi-urban regions. The demand for high-strength and advanced coated GI pipes is rising as users prefer products with longer service life and improved resistance to moisture and harsh environmental conditions, particularly in coastal and humid areas prevalent across the Asia Pacific.

Industrial growth in Southeast and South Asia is boosting demand, as GI pipes remain essential for process piping, fire-fighting systems, and plant utilities.

The global galvanized iron (GI) pipes market exhibits a moderately fragmented structure, driven by widespread demand from construction, water management, and industrial applications. Manufacturers are focusing on enhancing galvanizing quality, improving mechanical strength, and expanding product ranges to cater to diverse end-user needs.

Companies are increasingly integrating automation in fabrication and adopting energy-efficient galvanizing methods to meet evolving regulatory standards and sustainability goals.

With key leaders including Jindal Steel & Pipes, Tata Steel, Nippon Steel, ArcelorMittal, United States Steel Corporation, Tenaris, and TMK, the market reflects a blend of global giants and strong regional manufacturers.

These players compete through technology upgrades, capacity expansions, strategic partnerships, and tailored GI solutions for construction, utilities, and industrial applications. Many companies are also investing in stronger distribution networks and after-sales support to capture project-based demand.

The galvanized iron (GI) pipes market is valued at US$8.3 billion in 2026 and expected to reach US$12.3 billion by 2033, reflecting robust growth.

Key drivers include rapid urbanization, infrastructure development, and increasing demand for durable water supply, plumbing, and industrial piping solutions.

The industrial segment is anticipated to lead the galvanized iron (GI) pipes market with about 35% share, driven by extensive use in manufacturing, oil and gas, and heavy industrial applications.

Asia Pacific leads the market with around 40% share, driven by manufacturing strength in China, India, Japan, and ASEAN, supported by urbanization, industrial growth, and agricultural irrigation demand.

Development and adoption of lightweight, high-strength, and corrosion-resistant GI pipes for infrastructure, industrial, and water supply applications.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Diameter Size

By Diameter Size

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author