ID: PMRREP32995| 210 Pages | 2 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

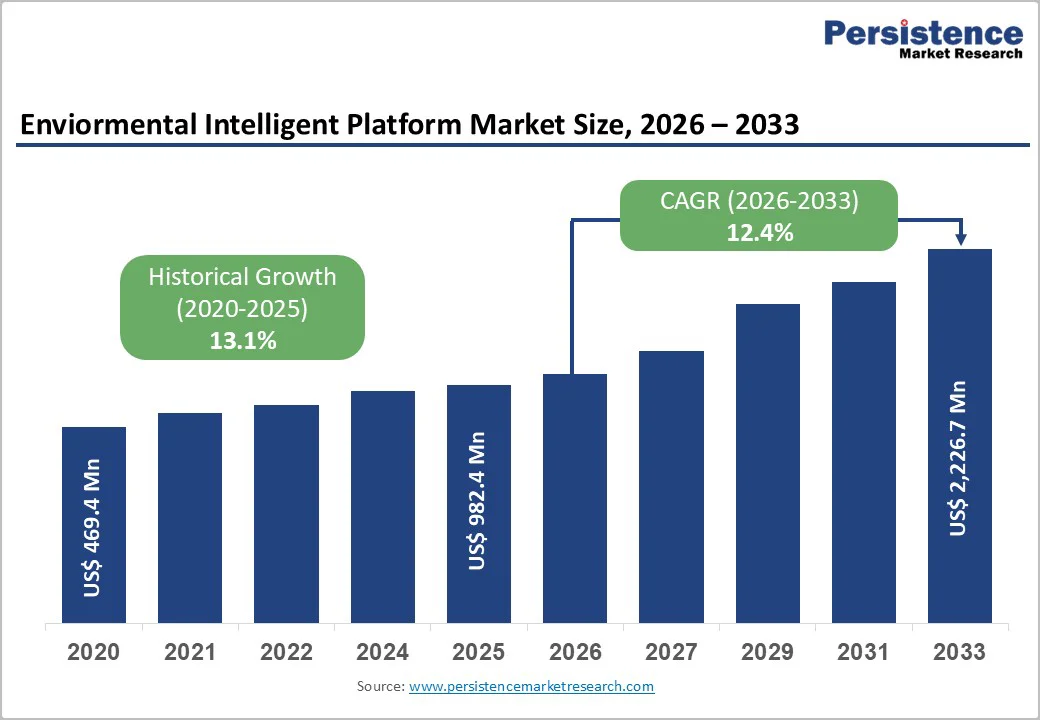

The global environmental intelligent platform market size is likely to be valued at US$ 982.4 million in 2026 and projected to reach US$ 2,226.7 million by 2033, growing at a CAGR of 12.4% between 2026 and 2033. The market is primarily driven by a rise in environmental regulations, increased corporate sustainability commitments, and the rapid adoption of artificial intelligence and Internet of Things technologies for real-time environmental monitoring and compliance.

Organizations across industries are increasingly recognizing the necessity of environmental data management to meet stringent regulatory requirements such as the European Union’s Corporate Sustainability Reporting Directive (CSRD), India’s Business Responsibility and Sustainability Reporting (BRSR) framework, and SEC climate-related disclosure rules.

| Key Insights | Details |

|---|---|

| Environmental Intelligent Platform Market Size (2026E) | US$ 982.4 Mn |

| Market Value Forecast (2033F) | US$ 2,226.7 Mn |

| Projected Growth CAGR (2026 - 2033) | 12.4% |

| Historical Market Growth (2020 - 2025) | 13.1% |

Regulatory pressures represent the most significant driver of environmental intelligent platform adoption globally. The European Union’s Corporate Sustainability Reporting Directive (CSRD) is affecting approximately 50,000 companies worldwide, requiring detailed climate disclosures with mandatory limited assurance starting in 2024 and escalating to reasonable assurance by 2027. India’s Business Responsibility and Sustainability Reporting (BRSR) framework mandates that the top 250 listed companies must disclose Scope 3 greenhouse gas emissions starting FY 2025-26 on a comply-or-explain basis. India’s operationalized Carbon Credit Trading Scheme (CCTS) requires companies to register emissions data and achieve compliance targets. These regulatory mandates create non-negotiable demand for sophisticated environmental intelligence platforms equipped with carbon footprint management capabilities to collect, validate, and report emissions data across Scope 1, 2, and 3 categories. Organizations failing to comply face substantial financial penalties, regulatory sanctions, and reputational damage, making intelligent platform investments essential for regulatory adherence and corporate governance.

Technological advancements in artificial intelligence, machine learning, Internet of Things, and cloud computing are fundamentally transforming environmental monitoring and intelligence capabilities. Machine learning now powers predictive analytics for environmental performance forecasting, enabling organizations to model climate risks, optimize energy consumption, and forecast emissions trajectories. IoT sensors deployed across manufacturing facilities provide continuous real-time data on temperature, humidity, emissions, water usage, and waste generation. Cloud-based deployment architectures have captured 65% of the environmental management systems market due to scalability, rapid deployment capabilities, and seamless integration with enterprise systems. These technological capabilities enable organizations to transition from manual, periodic environmental reporting to real-time, automated, continuous environmental intelligence systems that deliver immediate actionable insights.

Despite strong regulatory drivers, substantial implementation costs present significant barriers to widespread environmental intelligent platform adoption, particularly for small and medium-sized enterprises. Enterprise-grade platforms require significant capital investment in software licensing, infrastructure deployment, data integration, and personnel training. Integration complexity arises from the necessity to connect environmental platforms with existing enterprise systems including ERP systems, production management platforms, and financial systems. Many organizations have legacy infrastructure built on proprietary systems, making seamless integration technically challenging and expensive. Data quality issues compound implementation difficulties, as many organizations lack standardized data collection processes, requiring extensive data cleansing and validation efforts. These factors create extended implementation timelines, substantial upfront capital requirements, and ongoing operational costs that limit platform adoption among cost-constrained organizations, thereby restraining overall market growth and creating competitive advantages for well-resourced enterprises.

Cybersecurity risks and data privacy concerns pose substantial barriers to the adoption of environmental intelligence platforms, particularly for organizations handling sensitive environmental data in regulated industries. Environmental data increasingly qualifies as strategic corporate information, as competitors, regulators, and stakeholders seek to access proprietary emissions data, carbon reduction strategies, and environmental performance metrics. Data breaches exposing environmental information can result in financial penalties, regulatory sanctions, and competitive disadvantages.

Organizations must implement comprehensive cybersecurity frameworks, including end-to-end encryption, secure data transmission, access controls, and continuous monitoring. The EU’s GDPR and industry-specific regulations create strict requirements for data protection and cross-border data transfers. Organizations remain concerned about cloud-based platform security, preferring on-premises solutions for sensitive data despite lower scalability and higher operational costs. These cybersecurity and privacy concerns disproportionately impact organizations in regulated industries, including defense, energy, and government sectors, restraining platform adoption and creating preference for high-cost, proprietary environmental management systems.

The convergence of healthcare digitalization, government climate action initiatives, and environmental health priorities creates substantial market opportunities for environmental intelligent platforms. Telemedicine adoption surged by 60% during the pandemic and is expected to comprise 25-30% of all medical visits in the United States by 2026, creating demand for environmental monitoring integrations that track indoor air quality, pathogen exposure risks, and occupational health environmental factors. Government agencies at national and subnational levels are implementing climate action initiatives, smart city programs, and environmental monitoring frameworks that require sophisticated data collection and analysis capabilities. The smart city market is projected to reach USD 1.5 trillion by 2025, with governments investing substantially in environmental surveillance, real-time pollution monitoring, and resource optimization platforms. Environmental intelligent platforms enabling air quality monitoring, water quality tracking, waste management optimization, and renewable energy integration are increasingly embedded in government infrastructure and public health programs. These applications create substantial market expansion opportunities, particularly in Asia-Pacific regions where government-led smart city initiatives are accelerating infrastructure investments and creating institutional demand for integrated environmental intelligence solutions.

Agricultural sectors represent an emerging growth opportunity for environmental intelligent platforms, driven by climate change impacts, resource scarcity pressures, and sustainability imperatives. Precision agriculture applications utilizing satellite imagery, drone monitoring, soil sensors, and IoT devices enable farmers to optimize water usage, reduce chemical applications, and minimize environmental footprints while maintaining or improving agricultural productivity. Environmental intelligent platforms integrating satellite data with machine learning analytics enable real-time crop health assessment, pest detection, irrigation optimization, and yield forecasting while simultaneously tracking water consumption, soil health, and carbon sequestration. Regulatory pressures including the EU Green Deal’s requirements for sustainable agricultural practices and the FAO’s global emphasis on climate-smart agriculture, are driving agricultural sector digitalization investments. Developing nations, including India, China, and ASEAN countries, are experiencing rapid agricultural sector mechanization and digitalization as rural economies modernize. These trends create substantial demand for environmental intelligence platforms adapted to agricultural applications, enabling environmental monitoring while improving farmer productivity and sustainable resource management. Companies successfully developing agriculture-specific environmental intelligence solutions are positioned to capture significant market share in this rapidly expanding segment.

Cloud-based environmental intelligence platforms dominate the solution market, commanding approximately 70% market share in 2025, driven by superior scalability, flexibility, and cost-effectiveness compared to on-premises alternatives. Cloud deployment architectures enable organizations to implement environmental monitoring without substantial infrastructure investments, access advanced analytics and machine learning capabilities, and rapidly scale operations across multiple facilities and geographies. The shift toward cloud-native EMS platforms reflects organizational preference for subscription-based models that align capital expenditures with operational scale. Cloud deployment further enables faster feature deployment, continuous platform updates, and seamless integration with complementary enterprise applications.

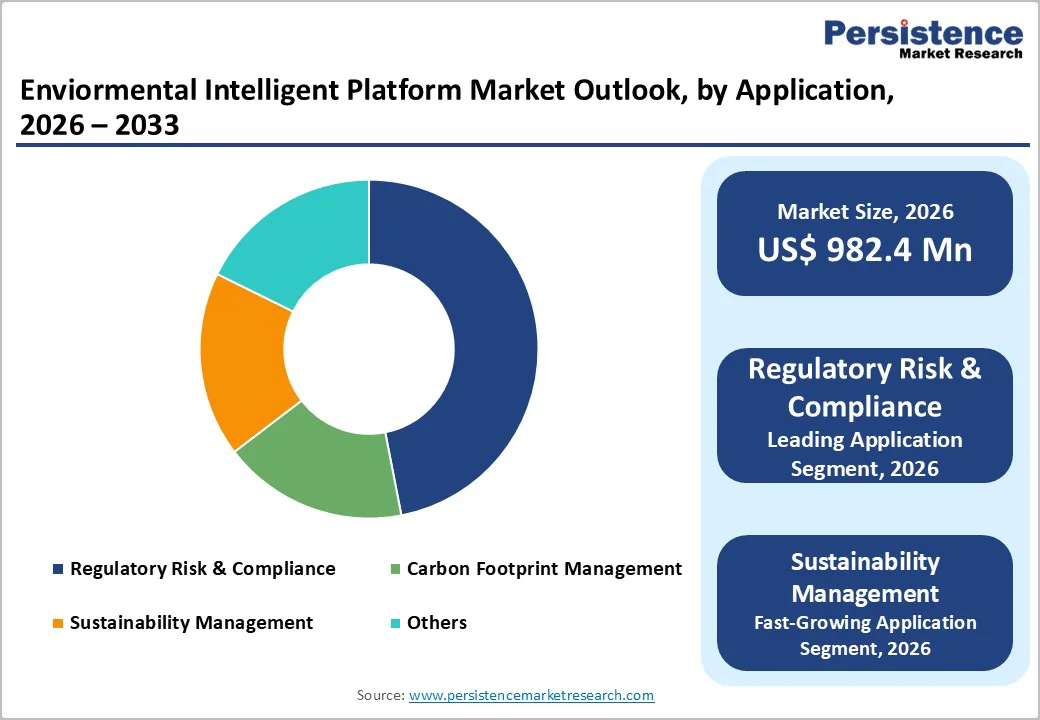

Regulatory risk and compliance management represents the leading application segment, capturing approximately 45% market share in 2025, reflecting the fundamental driver of environmental intelligent platform adoption. Organizations prioritize platforms that automate compliance tracking, streamline regulatory reporting, ensure adherence to evolving environmental standards, and reduce non-compliance risks.

The compliance application addresses multiple regulatory frameworks, including ISO 14001, EMAS, EU ETS, CSRD, BRSR, and industry-specific environmental regulations. However, sustainability management applications demonstrate the fastest growth with a projected CAGR of 16% from 2025 to 2032, as organizations increasingly view environmental management as a strategic business priority rather than purely compliance obligation. Sustainability management applications enable corporations to establish science-based sustainability targets, monitor progress toward net-zero objectives, optimize resource consumption, and communicate environmental performance to investors and stakeholders.

Industrial manufacturing represents the dominant industry segment, accounting for approximately 35% market share in 2025, driven by high emissions intensity, stringent environmental regulations, and substantial sustainability pressures. Manufacturing facilities generate significant greenhouse gas emissions from energy consumption, production processes, and supply chain activities. Aerospace and aviation industries are experiencing the fastest growth with a projected CAGR of 18% from 2026 to 2033, driven by regulations including the EU Emissions Trading System (EU ETS), the International Civil Aviation Organization’s CORSIA program, and the ReFuelEU regulation requiring 70% sustainable aviation fuel adoption by 2050.

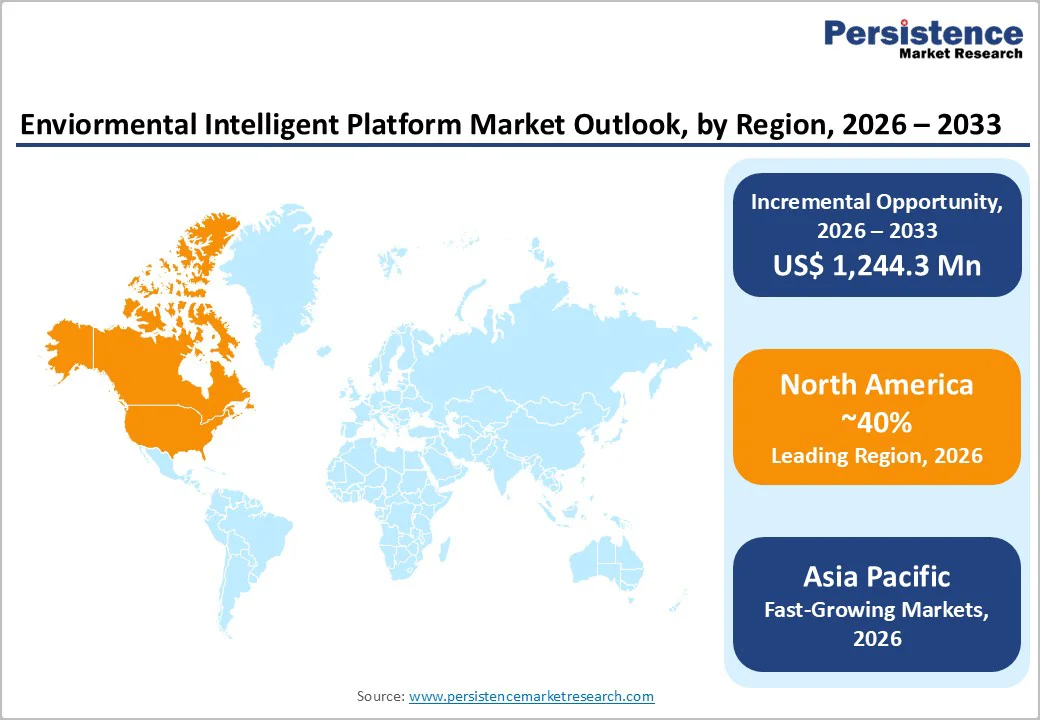

North America dominates the global environmental intelligent platform market, commanding approximately 40% market share in 2025, driven by mature regulatory frameworks, advanced technological infrastructure, and strong organizational sustainability commitments. The United States leads regional adoption through stringent EPA regulations, SEC climate-related disclosure requirements, and widespread corporate climate commitments, further accelerated by growing engagement in the carbon credit market to offset emissions and meet net-zero targets.

North American organizations invest heavily in environmental intelligence platforms to track sustainability performance, report environmental metrics to investors, reduce regulatory compliance risks, and enhance corporate social responsibility initiatives. The region’s leadership in technology innovation drives continuous platform enhancements in artificial intelligence, machine learning, and real-time environmental monitoring capabilities.

Canada contributes to regional market expansion through governmental environmental policies and corporate sustainability requirements. The region’s advanced digital infrastructure, widespread cloud computing adoption, and mature IT service provider ecosystem facilitate rapid environmental intelligent platform deployment and adoption. North American enterprises establish sustainability benchmarking initiatives and industry peer comparisons, driving competitive pressure for platforms that deliver superior environmental insights and regulatory compliance capabilities.

Europe represents the second-largest regional market, characterized by stringent environmental regulations and rapid sustainability platform adoption. Germany commands the largest European market share, with the country’s industrial base driving substantial demand for environmental compliance platforms. Germany’s Hospital Future Act and manufacturing sector environmental requirements create institutional demand for environmental intelligence solutions. The United Kingdom demonstrates strong platform adoption through NHS sustainability initiatives and the Climate Change Act’s mandatory emissions reduction targets. France and Spain contribute to regional growth through EU Green Deal compliance requirements and national climate action programs.

The European Union’s Corporate Sustainability Reporting Directive (CSRD) represents a transformational regulatory driver affecting 50,000 companies globally, with European organizations leading compliance initiatives. European environmental intelligence platform vendors continue expanding capabilities to address CSRD requirements, integrate with EU Taxonomy frameworks, and support double materiality assessments. Regional investors increasingly mandate sustainability disclosures, compelling European enterprises to implement comprehensive environmental intelligence platforms. EU ETS regulations requiring carbon emissions monitoring and reporting from covered sectors drive continued platform investments across aviation, power generation, and industrial manufacturing industries.

Asia-Pacific emerges as the fastest-growing regional market, projected to expand at CAGR of 16% from 2025 to 2032, driven by rapid urbanization, manufacturing sector growth, and government-led environmental initiatives. China dominates regional market expansion through aggressive smart city development, 14th Five-Year Plan environmental targets, and industrial sector modernization. The Chinese carbon market, launched in June 2025, creates institutional demand for environmental intelligence platforms enabling emissions monitoring and compliance tracking.

China’s emissions trading system encompasses manufacturing and power generation sectors, driving platform adoption across industrial enterprises. India represents a critical growth market, with SEBI’s Business Responsibility and Sustainability Reporting (BRSR) framework mandating environmental disclosures for listed companies. India’s newly operationalized Carbon Credit Trading Scheme (CCTS) creates demand for environmental intelligent platforms supporting emissions data collection, verification, and carbon credit trading. India’s agricultural sector digitalization initiatives create applications for environmental monitoring in precision agriculture.

Japan demonstrates steady growth through advanced manufacturing sector, environmental compliance requirements and technological sophistication. ASEAN countries, including Vietnam, Thailand, and Indonesia represent emerging opportunities as manufacturing sectors expand and foreign multinational corporations establish sustainability reporting requirements across supply chains. Manufacturing cost advantages and outsourcing trends positioning Asia-Pacific as a critical manufacturing hub drive demand for environmental intelligence platforms, enabling compliance across dispersed production facilities.

The environmental intelligent platform market exhibits characteristics of moderate consolidation with substantial competition from both established enterprise software vendors and specialized environmental technology companies. Approximately 45-50% of market revenue concentrates among major players, including IBM Corporation, Intelex Technologies, Enablon, and IsoMetrix, while mid-sized and specialized vendors continue competing through differentiation in industry-specific solutions and advanced analytics capabilities. IBM’s acquisition and expansion of environmental monitoring capabilities through investments in AI and sustainability platforms strengthens its market position among enterprise customers.

Market consolidation trends include IFS’s partnership with PwC to launch sustainability management modules within cloud platforms and Enablon’s continuous expansion of environmental compliance and sustainability reporting capabilities. Market leaders employ strategies including platform integration with enterprise resource planning systems, development of industry-specific environmental solutions, and investment in artificial intelligence-driven analytics. Key differentiators include real-time environmental data processing, automated compliance reporting, predictive environmental analytics, and industry-specific domain expertise. Emerging business model trends include subscription-based software licensing, managed services for implementation and data management, and specialized vertical solutions for high-value industry segments including aerospace, energy, and manufacturing.

The market is projected to reach US$ 2,226.7 million by 2033 from US$ 982.4 million in 2026.

Stricter environmental regulations and advances in AI, IoT, and cloud technologies are the key growth drivers.

Sustainability management is the fastest-growing application segment.

North America leads with about 40% market share in 2025.

Aerospace and aviation sustainability compliance offers the strongest market opportunity.

Leading market players include IBM Corporation, Intelex Technologies, Enablon, IsoMetrix, IFS, SAP SE, BreezoMeter, Cerensa, Ecochain Technologies B.V., Dakota Software Corporation, Envirosuite Ltd., etc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Solution

By Application

By Industry

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author