ID: PMRREP13666| 220 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

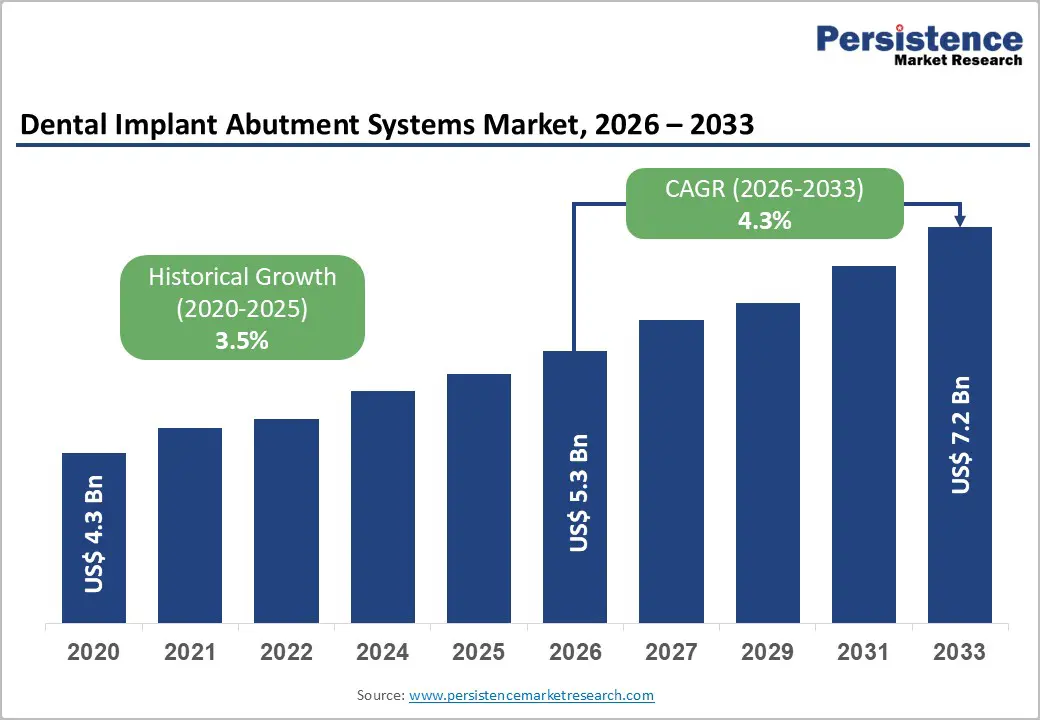

The global dental implant abutment systems market size is likely to be valued at US$ 5.3 billion in 2026 to US$ 7.2 billion by 2033. The market is projected to record a CAGR of 4.3% during the forecast period from 2026 to 2033.

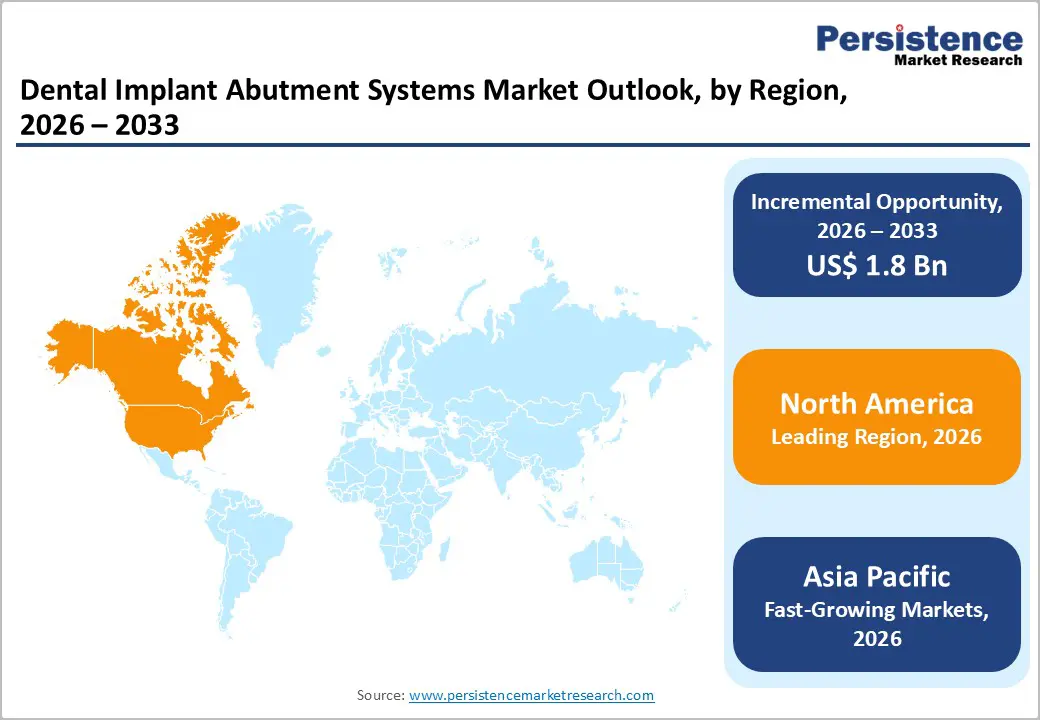

The market is growing steadily, driven by rising tooth loss, increasing demand for aesthetic dental restorations, and the adoption of implant-based treatments. North America leads due to high implant uptake and advanced dental care infrastructure, while Asia Pacific is the fastest-growing region, supported by expanding healthcare access and dental tourism.

| Key Insights | Details |

|---|---|

|

Dental Implant Abutment Systems Market Size (2026E) |

US$ 5.3 Bn |

|

Market Value Forecast (2033F) |

US$ 7.2 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.3% |

|

Historical Market Growth (CAGR 2020 to 2025) |

3.5% |

Rising tooth loss significantly underpins demand for dental implant abutment systems, as lost or severely damaged teeth reduce oral function and aesthetics, driving adoption of restorative treatments. Globally, the average prevalence of complete tooth loss (edentulism) among adults aged 20 years or older is estimated at nearly 7 percent, rising to 23 percent among those over 60, indicating large unmet prosthetic needs in older populations. Additionally, in the U.S., about 15 percent of adults aged 65 and over have lost all natural teeth, and about 26 percent have lost eight or more teeth, representing substantial opportunities for implant-based solutions to restore chewing ability and quality of life.

Periodontal diseases, a primary cause of adult tooth loss, also drive demand for implant abutments because they compromise the supporting structures of teeth, making preservation difficult. According to CDC-linked data, approximately 42.2 percent of U.S. adults aged 30 or older have some form of periodontitis, with higher prevalence in defined risk groups, and severe forms contribute disproportionately to tooth loss. Globally, nearly 1 billion individuals are affected by severe periodontal disease, and oral diseases overall impacted over 3.6 billion people as of 2021, underscoring persistent widespread periodontal conditions. These high burden figures reflect a growing substitute demand for dental implants and abutment systems to replace lost teeth and support long-term oral health.

Despite high overall success rates, the risk of implant-related complications acts as a restraint on the Dental Implant Abutment Systems Market, influencing clinician decision-making and patient acceptance. Clinical evidence from large observational studies shows that biological complications such as peri-implant mucositis affect nearly 45–50% of implant patients, while peri-implantitis occurs in around 20–25% of patients over long-term follow-up. Mechanical issues, including abutment loosening, screw fracture, and prosthetic misfit, are also reported in routine clinical practice. These complications can compromise implant stability, increase treatment complexity, and negatively impact patient satisfaction, particularly in individuals with systemic risk factors such as diabetes or smoking history.

Complication risks also lead to higher maintenance requirements, additional chair time, and increased long-term treatment costs, which can deter both patients and providers. While implant survival rates commonly exceed 95–97%, the need for ongoing monitoring and potential corrective procedures adds clinical and economic burden. Long-term data indicate that peri-implant inflammation and bone loss can develop within two to five years post-placement if hygiene or prosthetic design is suboptimal. As a result, concerns about predictability, long-term outcomes, and post-implant care limit broader adoption, particularly in cost-sensitive markets and less-specialized dental settings.

The rapid adoption of custom and CAD/CAM abutments represents a significant growth opportunity for the dental implant abutment systems market because digital workflows are increasingly integrated into everyday dental practice. Data from dental practitioners shows that over 64 percent of respondents use digital dentistry technologies, including intraoral scanning and CAD/CAM systems, reflecting broad integration of digital design tools into clinical workflows. Digital fabrication allows for highly precise, patient-specific abutments, improving fit and reducing adjustment time compared with traditional methods. These digital benefits enhance clinical outcomes and patient satisfaction, encouraging more clinicians to invest in CAD/CAM capabilities within implant prosthetic planning.

Wider adoption of dental CAD/CAM systems and digital workflows is evident across dental practices and laboratories, reflecting a structural shift toward digital manufacturing. Globally, approximately 55 percent of digital dentistry devices are CAD/CAM systems, and more than 65 percent of implant-supported prosthetics are now fabricated using digital workflows, demonstrating active use in implant restorations. Custom abutments designed digitally improve biomechanical compatibility and esthetics, creating differentiated value for practices focused on premium restorative outcomes. Furthermore, intraoral scanning and CAD/CAM milling reduce production errors and turnaround times, making custom digital abutments increasingly attractive to both clinicians and patients seeking efficient, personalized dental care.

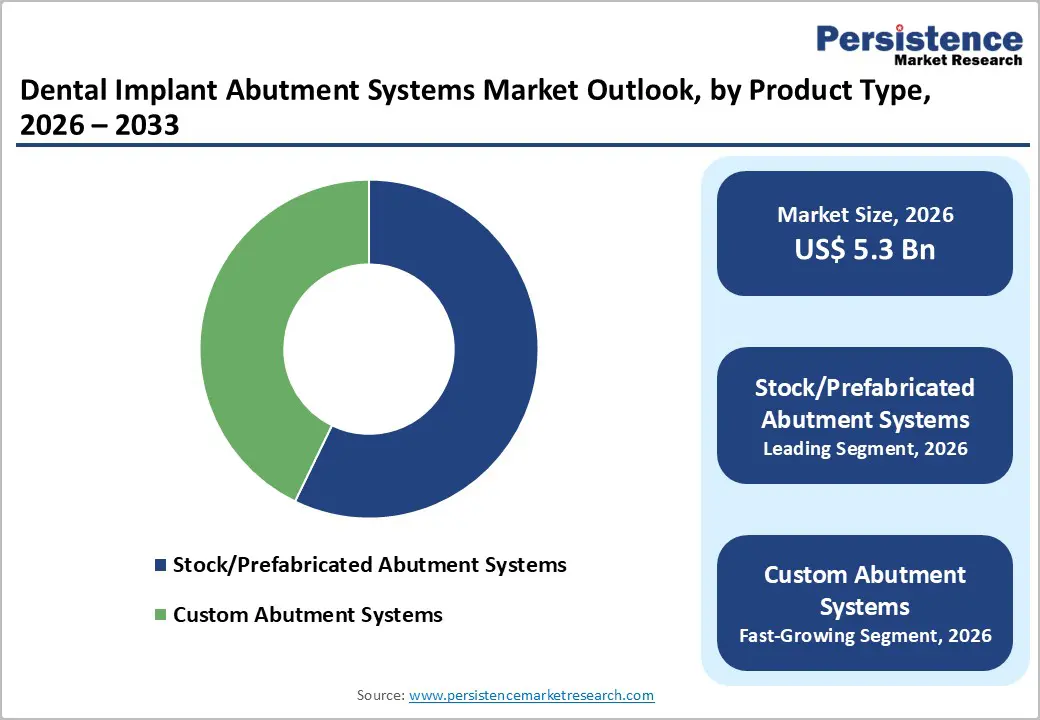

Stock/Prefabricated Abutment Systems occupy 57.2% of the global market in 2025, as they offer ready-to-use solutions that reduce chair time and overall treatment cost compared with fully custom-fabricated abutments. These systems are manufactured in standardized sizes and shapes to fit commonly used implant platforms, enabling clinicians to complete restorative procedures more efficiently without extensive laboratory customization. Data from dental practice surveys show that more than half of general dentists and implant specialists routinely select stock abutments for straightforward cases due to predictable fit and lower material costs. Additionally, many dental clinics lack in-house CAD/CAM capabilities, making prefabricated options more accessible. For patients without comprehensive insurance coverage, lower procedural costs with stock abutments improve affordability and further reinforce their widespread use in everyday clinical practice.

Pre-mill applications dominate the market because they represent the most established and widely used workflow in restorative dentistry, offering predictable outcomes without requiring full digital infrastructure. Pre-milling allows dental laboratories to use standardized manufacturing processes to fabricate abutments with controlled fit and strength, and many clinics worldwide still rely on conventional impression and milling techniques. According to surveys of dental laboratories and prosthodontists, a majority of implant restorations—often cited at over 60 percent—are produced using traditional pre-mill methods, reflecting the slower transition to fully digital workflows in everyday practice. Clinics without in-house CAD/CAM systems favor pre-mill abutments due to lower upfront equipment costs and compatibility with existing analog processes. For practices managing high case volumes, pre-mill solutions balance cost, quality, and scalability, sustaining their leading share.

North America dominates the dental implant abutment systems market with 36.6% share in 2025, due to high adoption of dental implants, advanced clinical infrastructure, and strong patient awareness. In the U.S., dental implant prevalence among adults with missing teeth increased from approximately 0.7% in 1999–2000 to 5.7% by 2015–2016, reflecting growing acceptance of implant-based restorations. Millions of adults are affected by tooth loss, with nearly 40 million fully edentulous, creating substantial demand for durable and aesthetic implant solutions, including abutments. High insurance coverage and access to specialized implantology clinics further support uptake. Combined with widespread clinician expertise and the presence of major implant manufacturers, these factors position North America as the leading regional market, maintaining dominance in both stock and custom abutment adoption, and driving continuous market growth.

Europe is a leading region in the dental implant abutment systems market due to high prevalence of tooth loss and periodontal diseases, which drives demand for implant-based restorations. In the WHO European Region, approximately 25 percent of adults aged 20 and above experience tooth loss, and among those over 60, around 31 percent are completely edentulous, creating a significant need for dental implants and abutment systems. Well-established dental infrastructure, availability of skilled clinicians, and advanced laboratories across countries such as Germany, France, the UK, Italy, and Spain support broad adoption of implant procedures. Combined with favorable insurance coverage and growing patient awareness of functional and aesthetic benefits, these factors position Europe as a leading market, sustaining high demand for both stock and custom abutments.

Asia Pacific is the fastest-growing region in the market due to rising oral disease prevalence, a large aging population, and expanding access to dental care. In the Western Pacific region, approximately 800 million people suffer from oral diseases, including dental caries and periodontal conditions, with around 92 million adults missing all teeth, creating a strong demand for implants and abutments. Rapidly aging populations in China and Japan over 250 million people aged 60+ in China and 28 percent of Japan’s population aged 65+—increase tooth loss incidence and restorative needs. Improved dental infrastructure, growing oral health awareness, and increasing affordability of implant procedures in countries like India, Indonesia, and Thailand further support market expansion, driving Asia Pacific’s leading growth trajectory in dental implant abutment systems.

Leading companies in the dental implant abutment systems market focus on innovative, precise, and patient-friendly solutions. They invest in advanced materials, digital workflows, and CAD/CAM technologies, enhance abutment fit and durability, and collaborate with dental clinics and laboratories. R&D emphasizes aesthetics, safety, and cost-effectiveness, supporting broader adoption across implant restorations globally.

The global dental implant abutment systems market is projected to be valued at US$ 5.3 Bn in 2026.

Rising tooth loss, periodontal diseases, demand for aesthetic restorations, growing implant procedures, and adoption of digital CAD/CAM workflows drive growth.

The global dental implant abutment systems market is poised to witness a CAGR of 4.3% between 2026 and 2033.

Opportunities include CAD/CAM and custom abutments, digital workflows, advanced materials, dental tourism, value-priced solutions, and partnerships with clinics and labs.

Zest Anchors, Zimmer Dental, Nobel Biocare Services AG, Dynamic Abutment Solutions, Institut Straumann AG, Ditron Dental.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author