ID: PMRREP35265| 130 Pages | 5 May 2025 | Format: PDF, Excel, PPT* | Healthcare

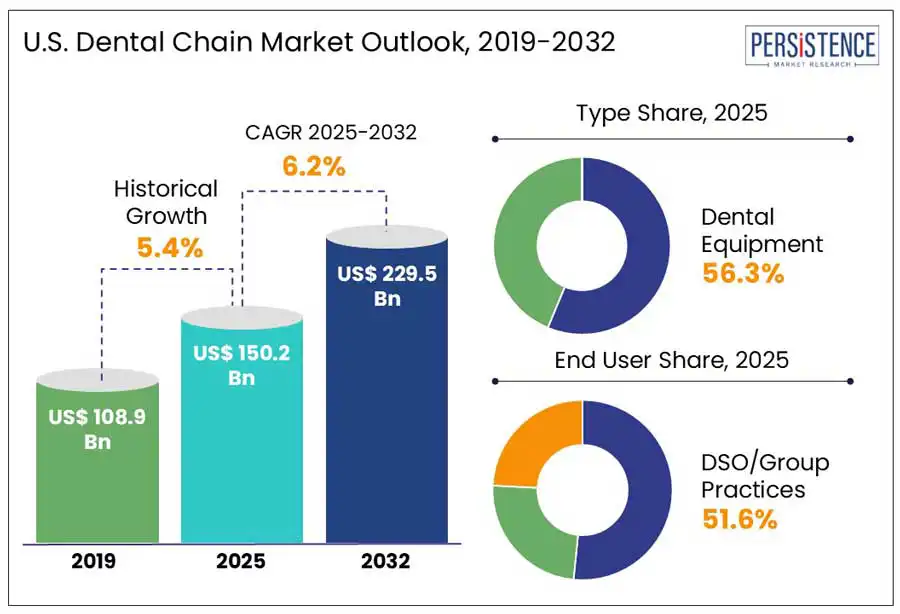

The U.S. dental chain market size is projected to rise from US$ 150.2 Bn in 2025 to US$ 229.5 Bn by 2032. It is anticipated to witness a CAGR of 6.2% during the forecast period from 2025 to 2032. High demand for various dental services, such as treatment, diagnosis, and prevention of dental issues is expected to spur the development of structured dental chains in the U.S. Increasing prevalence of oral cancer and various periodontal ailments is another factor poised to boost development. Rising preference for laser and aesthetic dentistry will also likely push demand for dental chains, finds Persistence Market Research.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. Dental Chain Market Size (2025E) |

US$ 150.2 Bn |

|

Market Value Forecast (2032F) |

US$ 229.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.4% |

The rise in focus of renowned dental chains such as Heartland Dental and Aspen Dental on expansion strategies is expected to augment the market growth. Heartland Dental is considered one of the most prominent Dental Support Organizations (DSOs) in the U.S. It supported more than 1,700 practices in 38 states in 2023. It has exhibited steady growth across Arizona, Texas, and Florida, where rising population has created a surging demand for high-quality, accessible dental services. The DSO also joined hands with local dental practices to enhance transitions and acquisitions under the Heartland model.

Aspen Dental, on the other hand, is currently focusing on developing innovative clinics in underserved rural areas and high-traffic retail spaces. It had more than 1,000 locations across 45 states as of 2024. It has further invested huge sums in digital dentistry tools, including AI-backed diagnostics and intraoral scanners, to offer accurate and quick care. It emphasizes same-day services and walk-in availability, which appeal to patients prioritizing quick access to care and high convenience. Hence, as these chains broaden across semi-urban and suburban areas, the U.S. dental chain market growth is envisioned to remain strong through 2032.

State-level regulatory variation will likely be a major hindrance to the U.S. market growth in the foreseeable future. When it comes to who can operate and own dental clinics, dental practice norms vary significantly in the country by state. In states such as Michigan, North Carolina, and New York, for example, only those dentists having licenses are allowed to own dental practices.

The norm makes it difficult for DSOs to fully control their operations. It is projected to result in complicated joint-venture models where DSOs can only offer administrative services, hampering their ability to maintain or scale uniform service delivery.

Significant dental chains across the U.S. are projected to gain new opportunities with developments in geriatric and pediatric-focused dental care. They are likely to extend their services, catering to both children and senior citizens. Abra Health Group, for example, recently acquired All About Kids Pediatric Dentistry in Connecticut. It aims to add four new locations to its network and plans to open a clinic in Bridgeport in 2025. Also, the surge of tele-dentistry is predicted to improve access to pediatric and geriatric dental care, mainly in underserved areas, by offering remote follow-ups and consultations.

Dental chains are further responding to the rising demand from aging populations by providing innovative prosthodontic services and opening new denture centers. Pacific Dental Services, for example, collaborated with Epic to promote comprehensive care for senior citizens with chronic ailments. Hence, the rapid integration of medical and dental records is speculated to create lucrative growth avenues.

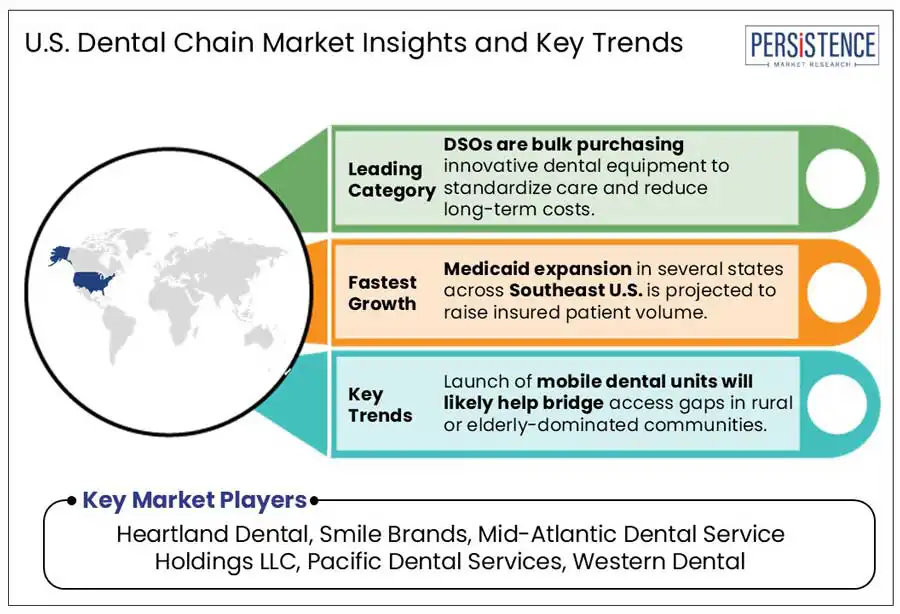

Based on type, the market is bifurcated into dental consumables and dental equipment. Among these, dental equipment is poised to generate a share of nearly 56.3% in 2025. The emphasis on maintaining high-quality, standardized patient care is rising with rapid expansion of dental chains across multiple locations. High-quality care is heavily reliant on innovative dental equipment. Several dental chains are currently investing in novel technologies such as CAD/CAM milling units and 3D imaging systems to lower turnaround times for restorations and prosthetics, thereby bolstering growth.

Dental consumables, on the other hand, are assessed to showcase decent growth through 2032. This is due to high demand for disposable instruments, impression materials, composites, and bonding agents from dental chains. The ongoing shift of patients toward cosmetic and restorative dentistry, which are material-intensive, is also expected to drive the segment. Dental chains are presumed to provide value-added services, including composite restorations, veneers, and teeth whitening as part of their standard service packages. These procedures are predicted to spur demand for consumables such as finishing strips, etching gels, and resin composites.

In terms of end-user, the market is segregated into solo practices and DSO/group practices. Out of these, DSO/group practices are projected to dominate with about 51.6% of the U.S. dental chain market share in 2025. DSO/group practices have high capital access and purchasing power due to backing from various private equity firms. It makes them suitable stakeholders for dental chains requiring huge investments in infrastructure, staffing, and technology.

Solo practices are expected to witness an average CAGR from 2025 to 2032. It is attributed to stringent norms in certain states that restrict dentists without licenses from owning dental practices. DSOs often come to the rescue by providing non-clinical and administrative support services, right from compliance and billing to IT and marketing. This model tends to make DSOs the standard interface between patients and dental chains in various states, thereby outpacing solo practices.

In the West, Washington, California, Nevada, and Arizona are considered the key targets for dental chain expansion. It is due to their increasing acceptance of private equity-backed healthcare delivery models. California, however, has strict regulatory frameworks under the Knox-Keene Act, which hinders the scope of non-dentist ownership. Hence, dental chains in the state mainly operate under difficult legal structures where management services are offered by separate entities, while clinical operations are owned by dentists.

Arizona is speculated to provide a flexible environment with fewer complications to entry. An increasing retiree population in Scottsdale and Phoenix is anticipated to propel demand for cosmetic procedures, implants, and prosthodontics. In Nevada, dental chains are gaining traction by offering weekend appointments and extended hours to attract the younger demographic. Washington is also seeing an influx of these chains, specifically across Spokane and Seattle. These chains are investing in integrated dental-medical models and preventive care to cater to varying patient demands.

The Southeast U.S. will likely account for a share of around 34.2% in 2025. Rising insurance coverage under Medicaid expansion programs is predicted to spur demand in Georgia and Florida. Cities, including Savannah and Atlanta in Georgia, have witnessed a surge in mid-sized dental chains providing personalized alternatives to mega DSOs. Local DSOs such as Pure Dental Brands strive to develop a strong presence by acquiring family-run clinics and modernizing them with cloud-based patient management.

In Florida, chains such as Dental Care Alliance (DCA) have gained prominence due to expansion across Miami, Orlando, and Tampa. Sarasota-based DCA, for instance, manages more than 390 affiliated practices in the U.S., with a dense concentration in Florida. The state is showing a considerable demand for high-margin procedures, including periodontal care and dentures due to the rising retiree population.

In the Midwest U.S., Illinois has recently emerged as a leading hub for group practice affiliations. Renowned DSOs are constantly extending their presence by acquiring conventional practices and turning them into multi-specialty, digital-first clinics. In Ohio, chain-operated clinics focus on value-based care due to rising demand from Cleveland, Cincinnati, and Columbus. North American Dental Group (NADG), with its strong presence in Ohio, recently collaborated with local dentists to provide easy access to care by integrating digital patient tracking systems.

Michigan has been facing a rural access gap in recent years. In Lansing, Grand Rapids, and Detroit, dental chains such as Great Expressions Dental Centers are broadening their footprint through hybrid models. They are doing so by blending satellite offices with urban clinics in underserved areas. They aim to extend Medicaid access and improve service delivery with telehealth triage systems and AI-based scheduling tools.

The U.S. dental chain market houses several companies striving to provide diverse services. Both well-known conglomerates and specialized dental service providers are focusing on consolidating their operations. The market is currently fragmented, with no individual entity holding a leading share over the others. This fragmentation is bolstering innovation and accessibility as multiple firms are attempting to capture consumer interest with novel offerings.

The U.S. dental chain market is projected to be valued at US$ 150.2 Bn in 2025.

Adoption of expansion strategies by renowned DSOs and digitization of traditional family-owned clinics are the key market drivers.

The market is poised to witness a CAGR of 6.2% from 2025 to 2032.

Rise of pediatric dental clinics and increasing retiree population in several states are the key market opportunities.

Heartland Dental, Smile Brands, and Mid-Atlantic Dental Service Holdings LLC are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By End-user

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author