ID: PMRREP5855| 199 Pages | 16 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

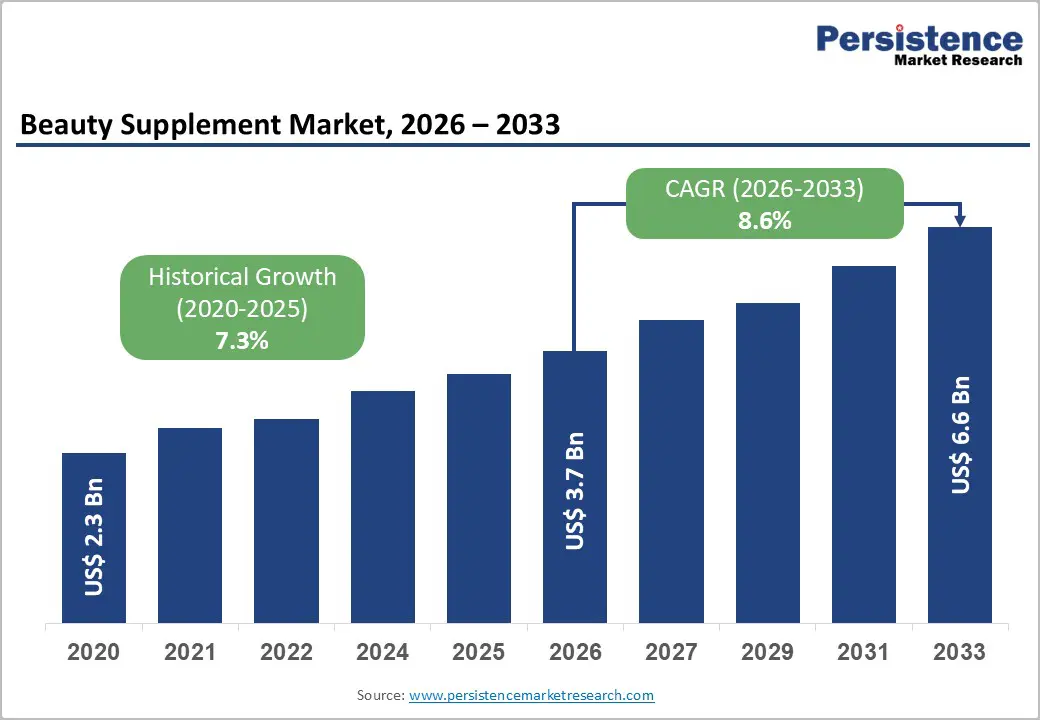

The global beauty supplement market size is likely to be valued at US$ 3.7 billion in 2026 to US$ 6.6 billion by 2033, growing at a CAGR of 8.6% during the forecast period from 2026 to 2033.

Beauty supplements are shifting from trend-driven add-ons to structured daily wellness routines. Backed by preventive nutrition thinking, digital education, and cross-category beauty influence, the market is evolving toward credibility, consistency, and long-term consumer engagement.

| Key Insights | Details |

|---|---|

| Global Beauty Supplement Market Size (2026E) | US$ 3.7 Bn |

| Market Value Forecast (2033F) | US$ 6.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.3% |

Mirror-checks are no longer the starting point for beauty decisions; long-term wellness is. Increasing acceptance of preventive and functional nutrition is reinforcing daily beauty supplement routines across global markets. Consumers now associate skin radiance, hair strength, and nail resilience with internal nourishment, encouraging consistent intake of collagen, antioxidants, vitamins, and botanicals as part of everyday health habits rather than occasional fixes.

This shift is driven by education, digital health content, and science-backed positioning that frames beauty supplements as proactive care. Capsules, gummies, and powders are integrated into morning rituals alongside probiotics and multivitamins. As aging prevention, stress management, and gut-skin connections gain visibility, beauty supplements transition from discretionary purchases to routine nutritional support, expanding frequency of use and lifetime consumer value.

Glossy promises often meet hard questions at the checkout counter. Scientific skepticism remains a key restraint in the global beauty supplement market, as consumers increasingly scrutinize efficacy claims. Many formulations rely on broad wellness associations rather than robust, peer-reviewed clinical validation, creating uncertainty around visible results. When outcomes vary or take time to appear, first-time users may hesitate to continue routine consumption.

Inconsistent clinical evidence further complicates repeat usage. Differences in dosage, bioavailability, and individual response make benefits difficult to standardize, weakening confidence. Regulatory limits on health claims restrict clear communication, while conflicting influencer narratives add confusion. Without transparent science, standardized trials, and measurable outcomes, beauty supplements risk being perceived as optional add-ons rather than credible, long-term wellness investments.

Trust travels faster when science, storytelling, and aesthetics move together. Collaborating with dermatologists, influencers, and beauty brands presents a powerful opportunity for companies in the global beauty supplement market to elevate credibility and accelerate adoption. Dermatologist partnerships add clinical authority, helping translate complex formulations into understandable benefits, while reinforcing safety and efficacy perceptions among cautious consumers.

Influencers and established beauty brands extend reach across skincare, haircare, and wellness routines, turning supplements into a natural extension of daily beauty rituals. Co-branded launches, expert-backed content, and routine-based regimens encourage trial and repeat usage. For startups and established players alike, these collaborations shorten trust-building cycles, unlock cross-category visibility, and position beauty supplements as integrated solutions rather than standalone products.

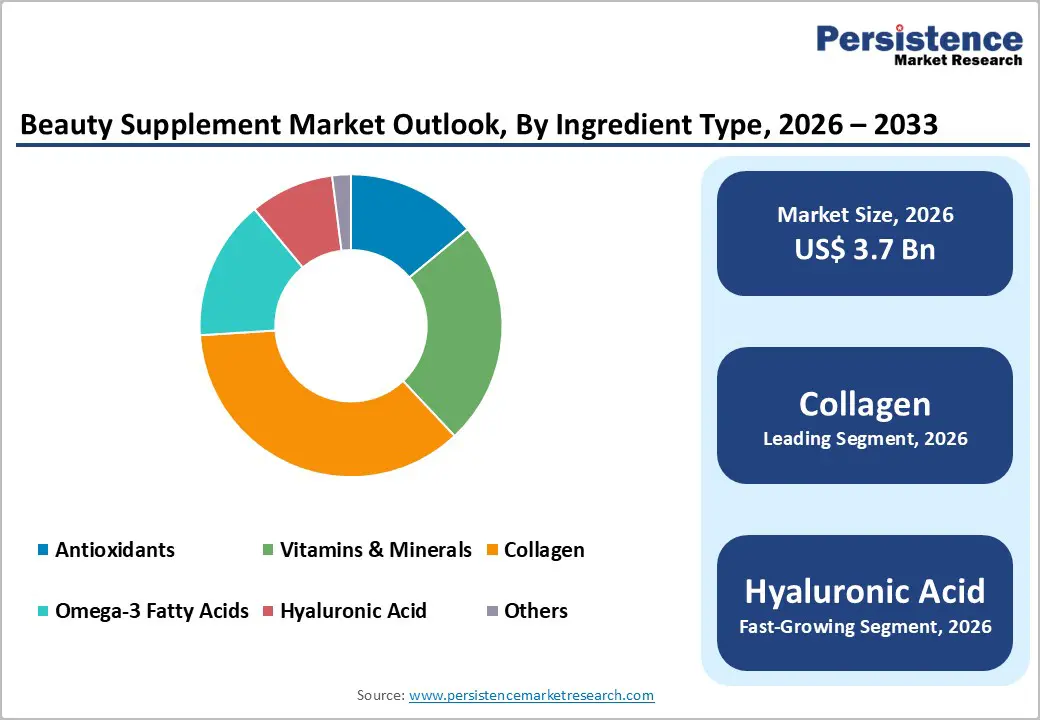

Collagen holds approx. 34% market share as of 2025, reflecting its central role in beauty-from-within routines. Once a clinical-sounding protein, collagen has become a mainstream beauty staple linked to skin elasticity, wrinkle reduction, hair strength, and nail resilience. Its strong consumer recognition, clear functional narrative, and compatibility with powders, liquids, capsules, and gummies support widespread adoption across age groups. Regular, daily consumption formats further reinforce collagen’s dominance, positioning it as a long-term regimen rather than a short-cycle supplement.

Other ingredients serve complementary roles. Antioxidants support cellular protection and skin radiance. Vitamins and minerals address deficiencies linked to hair and nail health. Omega-3 fatty acids contribute to skin barrier function and inflammation balance, while hyaluronic acid is valued for hydration support. Despite innovation across these categories, collagen remains the anchor ingredient due to visible, experiential benefits.

Online retail is projected to grow at a CAGR of 9.8% during the forecast period in the global beauty supplement market, reshaping how consumers discover, evaluate, and adopt beauty-from-within products. Digital platforms offer education-rich environments where ingredient science, clinical positioning, and user testimonials guide purchase decisions. This transparency reduces trial barriers for first-time users seeking targeted solutions for skin, hair, and nail health.

Direct-to-consumer models strengthen brand control over pricing, formulation storytelling, and customer engagement. Subscription plans, personalized regimens, and influencer-led content encourage repeat usage and routine adherence. Online channels also accelerate product launches and cross-border access, allowing niche and premium brands to scale quickly. As convenience, information depth, and personalization converge, online retail becomes a critical growth engine for beauty supplements.

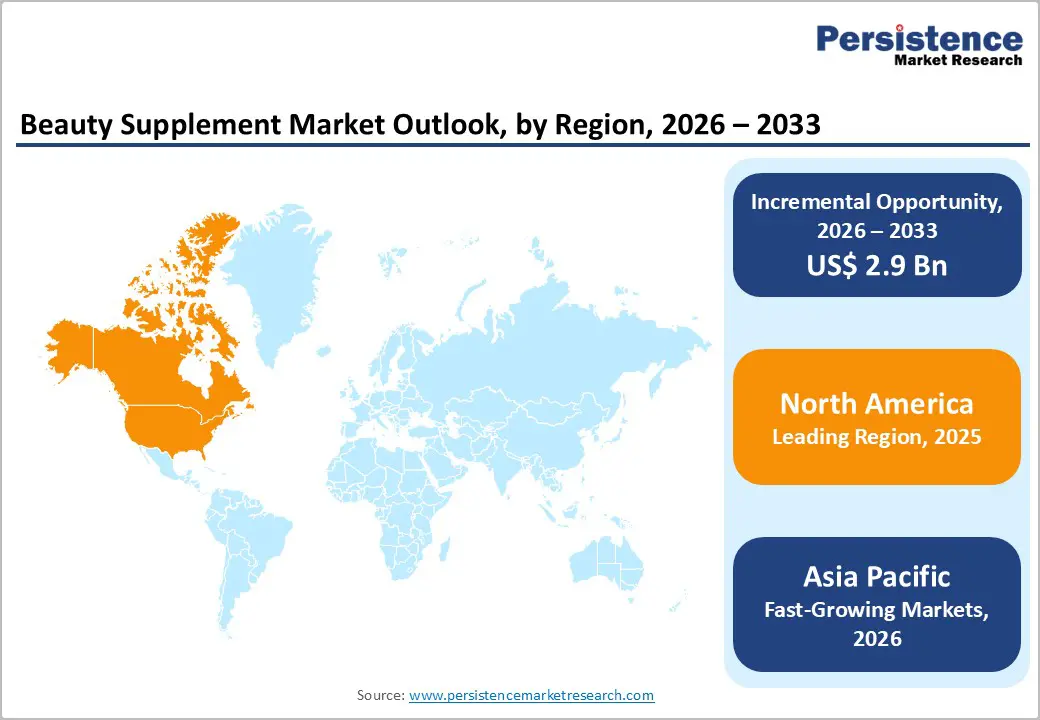

North America holds approximately 37% market share in the global beauty supplement market, reflecting a region where wellness and aesthetics increasingly intersect. Consumers are shifting from corrective beauty routines toward preventive, daily nutrition for skin radiance, hair strength, and healthy aging. Clean-label formulations, sugar-free gummies, and science-backed collagen blends are gaining traction, supported by strong awareness of ingredient transparency and lifestyle-driven self-care habits.

In the US, demand is rising for condition-specific supplements targeting menopause, gut-skin connection, and stress-related hair concerns, amplified by influencer education and direct-to-consumer brands. Canada shows steady growth in dermatologist-aligned products, plant-based capsules, and sustainably packaged beauty supplements. Regulatory scrutiny, subscription models, and omnichannel retail strategies continue to shape purchasing behavior across both markets.

Asia Pacific Beauty Supplement Market is expected to grow at a CAGR of 10.3%, shaped by beauty traditions merging with modern nutritional science. Consumers increasingly view supplements as part of daily grooming rituals, supporting skin clarity, hair density, and graceful aging. Formulations emphasizing collagen peptides, herbal extracts, and fermented ingredients resonate strongly, while beauty-from-within positioning aligns with preventive wellness mindsets across urban populations.

In China, demand is accelerating for premium ingestible beauty solutions promoted through digital platforms and live commerce. Japan emphasizes precision nutrition, favoring low-dose, clinically positioned supplements for long-term use. South Korea drives innovation in multifunctional beauty gummies and liquid shots linked to K-beauty trends. India shows rapid adoption of clean-label, Ayurveda-inspired beauty supplements as disposable incomes and awareness rise.

The global beauty supplement market shows a moderately fragmented structure, with established nutrition players competing alongside fast-moving startups. Leading companies are investing in clinically supported formulations, clean-label ingredients, and premium formats such as gummies, liquid shots, and ready-to-mix powders. Startups focus on niche concerns like hair fall, hormonal balance, and skin aging, often building brands around transparency, sustainability, and personalized nutrition.

Product innovation centers on bioavailable collagen, plant-based actives, and sugar-reduced delivery formats, while sustainability initiatives address ethical sourcing and recyclable packaging. Collaborations with dermatologists, beauty brands, and digital influencers are strengthening credibility. Aggressive digital marketing, social commerce, and cross-border e-commerce are driving geographic expansion, while tightening government regulations around health claims push companies toward stronger compliance and consumer education.

The global beauty supplement market is projected to be valued at US$ 3.7 Bn in 2026.

Increasing acceptance of preventive and functional nutrition supports daily beauty supplement routines is driving the global Beauty Supplement market.

The global Beauty Supplement market is poised to witness a CAGR of 8.6% between 2026 and 2033.

Collaborate with dermatologists, influencers, and beauty brands to enhance credibility and cross-category reach, unlocking a strong opportunity for companies operating in the Beauty Supplement industry.

Major players in the global Beauty Supplement market include Nestlé S.A., Unilever PLC, Amway Corporation, Herbalife Nutrition Ltd., Shiseido Company, Limited, Haleon, Church & Dwight Co., Inc., Bayer AG, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Ingredient Type

By Form

By Function

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author