ID: PMRREP20581| 184 Pages | 20 Jun 2025 | Format: PDF, Excel, PPT* | Food and Beverages

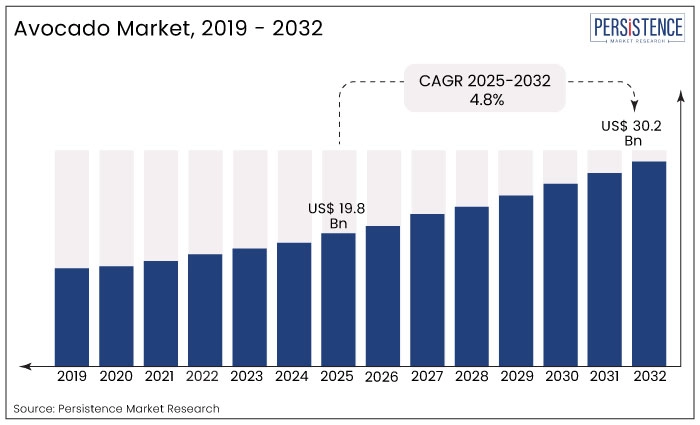

Global Avocado Market size is likely to be valued at US$ 19.8 billion in 2025 and is estimated to reach US$ 30.2 billion by 2032, growing at a CAGR of 6.2% during the forecast period 2025−2032.

Surging desire for entire fruits and low-carb foods is driving the avocado market growth. Avocados are well-known for their abundance of nutrients and for being used in popular recipes like avocado toast and guacamole.

According to the OECD/FAO Agricultural Outlook 2021-2030, avocados are poised to become the second-most traded major tropical fruit by 2030, surpassing both pineapples and mangoes in export volume. Europe, in particular, has emerged as a key market, with avocados now ranking as the second-most valuable imported fruit from developing countries. Meanwhile, rising urbanization and a growing appreciation for protein and calcium-rich snacks are propelling demand in markets like China, which imported over 26,000 metric tons of fresh avocados from Peru in 2021 alone. This dynamic growth, coupled with a focus from leading companies on high-quality and sustainable production, underscores the avocado market's vibrant and expanding trajectory.

Key Industry Highlights

|

Global Market Attributes |

Key Insights |

|

Global Avocado Market Size (2025E) |

US$ 19.8 Bn |

|

Market Value Forecast (2032F) |

US$ 30.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.2% |

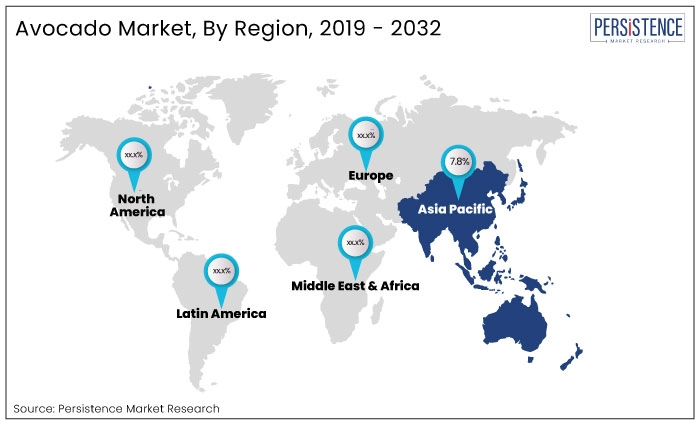

The avocado industry in North America is predominantly shaped by the U.S., which is projected to command 48.6% of the global market share in 2025, exhibiting a CAGR of 5.4% from 2025 to 2032.

The U.S. remains the cornerstone of the North American avocado market. In 2024, it accounted for over 80% of Mexico’s avocado exports by volume. The U.S. consistently relies on Mexico, which supplied approximately 88% of its total avocado imports, with peak shipments occurring from December to February, heavily influenced by Super Bowl demand. Hass avocados dominate these exports due to their superior shelf life, taste, and resilience during transit. In a move towards greater efficiency, the USDA revised its certification process in July 2024, shifting to remote monitoring of Mexican orchards and replacing in-person supervision with audit-based oversight. Avocados ranked as Mexico’s third-largest agricultural export, trailing only beer and tequila, underscoring their significant strategic value. As U.S. consumers continue to embrace nutrient-rich foods, the avocado's prominence is expected to grow, solidifying the U.S.'s role as a critical driver of North American market expansion. Domestically, California and Florida contribute up to 10% of the U.S.'s avocado consumption.

The avocado industry in Asia Pacific is anticipated to register a CAGR of 7.8% from 2025 to 2032, gaining 26.3% of the worldwide market share in 2025. The retail sector’s dominance and the surging demand from the food and beverage sector, especially in China, Japan, and India, are the main drivers in Asia Pacific. For example,

China's avocado market is experiencing modest growth, primarily driven by increasing imports from Peru and Chile. Distribution within the country is concentrated in urban retail channels, with high-end supermarkets like Ole and Sam's Club being key points of availability. Specialized fruit chains, such as Pagoda and Xianfeng, alongside major e-commerce platforms like JD.com and Tmall, are expanding avocado access across various cities. The emergence of online-to-offline (O2O) commerce models signifies a significant digital shift in fresh produce retail, aligning with the growing interest among Chinese consumers in nutrient-dense, premium fruits like avocados.

Raw avocados are predicted to dominate the avocado market, accounting for 79% of share in 2025. In supermarkets and farmer's markets, these are popular because of their high fiber content, health advantages, and rising customer desire for whole, unprocessed foods. For example,

In 2025, conventional avocado cultivation is set to dominate the market, holding 73% of the share due to its cost-efficiency and scalability. Despite the rising popularity of organic products, conventional farming remains the preferred method due to its ability to meet the global demand for avocados, reducing time-to-market and yields. For instance,

Growing knowledge of avocado's heart-healthy fats and vital elements has led to an increase in avocado consumption worldwide. For instance, according to studies, global avocado consumption exceeded 8 million metric tons in 2023, reflecting its popularity in the retail and food service sectors.

Rising demand for guacamole and other avocado-based dishes in Mexican and fusion restaurants drives commercial sales. For example,

While climate change and water constraints in traditional growing countries like Mexico stabilize supply and lower price volatility, Westfalia's SmartRipening System is a ripening technology that enhances worldwide distribution and extends shelf life.

The global avocado market recorded a CAGR of 4.8% in the historical period from 2019 to 2024. During the forecast period, worldwide sales of avocado products are anticipated to grow at a CAGR of 6.2%, offering significant value chain participants a profitable opportunity. For example,

Customers, especially from North America and Europe, are increasingly favoring avocado-based snacks due to the rising popularity of high-nutrient foods, seeking qualities like high protein, calcium, and overall nutritional value.

Rising Desire among Consumers for a Healthy Lifestyle to Support Growth

Rising healthy lifestyle preferences have boosted the consumption of nutritious food products, including tree nuts, organic fruits, vegetables, and avocados. The healthy trend is fueled by shifting eating habits among the rising middle class in developing countries, where increased disposable income and health awareness drive demand for nutrient-rich diets. For instance,

As consumers prioritize their diets and food intake, healthy ingredients continue to dominate global markets, driven by innovation and accessibility in the retail and food service sectors. This consumer-driven demand is expected to further propel the market, with ongoing innovation in avocado-based products, including convenient ready-to-eat options and diverse culinary applications. The continued emphasis on health and wellness, along with the rising popularity of organic and sustainably sourced offerings, indicates a strong future for global avocado market expansion.

Popularity of Ready-to-Eat Products to Influence Consumer Lifestyle

The growing convenience that busy customers want has led to an increasing popularity of processed and ready-to-eat avocado products, including guacamole, oil, and slices. For example,

The preference for healthy and convenient food options has driven brands like Calavo Growers and Mission Produce to introduce pre-packaged, processed avocado items tailored to modern consumer needs. Adoption of online grocery platforms is increasing accessibility to products like avocados, leading countries like Mexico to innovate supply chain solutions to maintain freshness and meet global demand. This is reflecting a global shift toward timesaving, nutritious food options.

Climate Change May Hamper the Production of Avocados

Avocado production is being impacted by climate change and water scarcity, which is causing supply volatility and price fluctuations. In important growing localities such as Mexico, California, and Chile, avocado production is extremely water-intensive, requiring up to 70 gallons of water per tree each day. As a result, it is susceptible to drought and shifting weather patterns. For example,

Increasing Production of Hass Avocado to Present Growth Prospects

The growing popularity of plant-based and low-carb diets, which prioritize nutrient-dense foods and healthy fats, is consistent with such qualities. Hass avocados' high-fat content, rich flavor, and creamy texture are projected to propel them to a 76% market share in 2025, dominating the worldwide avocado industry. For example,

According to a marketing campaign started by Westfalia Fruit in November 2023, Hass avocados, a fruit that is both flexible and healthy, have been heavily promoted in plant-based diets. Globally, Hass avocados remain the preferred option for customers and food service companies because of their exceptional flavor and extended shelf life.

Cosmetics and Personal Care Industry Rejuvenates Avocado-Infused Beauty Products

The cosmetics and personal care sector is experiencing an increasing demand for avocado oil and extracts due to their high nutritional profile and skincare advantages. Rich in fatty acids and vitamins A, D, and E, avocado oil is preferred for its anti-aging and moisturizing qualities. For example,

Leading brands like L'Oréal and The Body Shop are incorporating avocado oil into their skincare lines, promoting its hydrating and rejuvenating effects. For instance,

The avocado industry is seeing key players prioritize high-quality products, focusing on superior texture and innovative packaging to enhance consumer experience. As demand for avocados rises, producers are working to improve their production capabilities to meet the market's rising needs effectively.

The production of avocados is estimated to be influenced by climate change as well as the disturbance in the global trade of food and beverage products. Regional players in the market are envisioned to streamline the export and import operations of avocado and its by-products.

The avocado market profiles leading companies, with a detailed overview of the operations, business strategies, and financial performance reviews. Key industry players explore various business segments, product portfolios, and recent developments, highlighting how to adapt to market trends and consumer preferences.

Recent Industry Developments

The global Avocado market is projected to be valued at US$ 19.8 Bn in 2025.

The increasing popularity of processed and ready-to-eat avocado products is driving demand for Avocados.

The Global Avocado market is poised to witness a CAGR of 6.2% between 2025 and 2032

Capitalizing on Natural Skincare Demand is the key market opportunity.

Major players in the Global Avocado market include Calavo Growers, Inc., Fresh Del Monte Produce Inc., West Pak Avocado, Inc., Henry Avocado Corporation, McDaniel Fruit Co., Del Rey Avocado Co. Inc., and others

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Source

By Nature

By Form

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author