ID: PMRREP29272| 190 Pages | 4 Nov 2025 | Format: PDF, Excel, PPT* | Consumer Goods

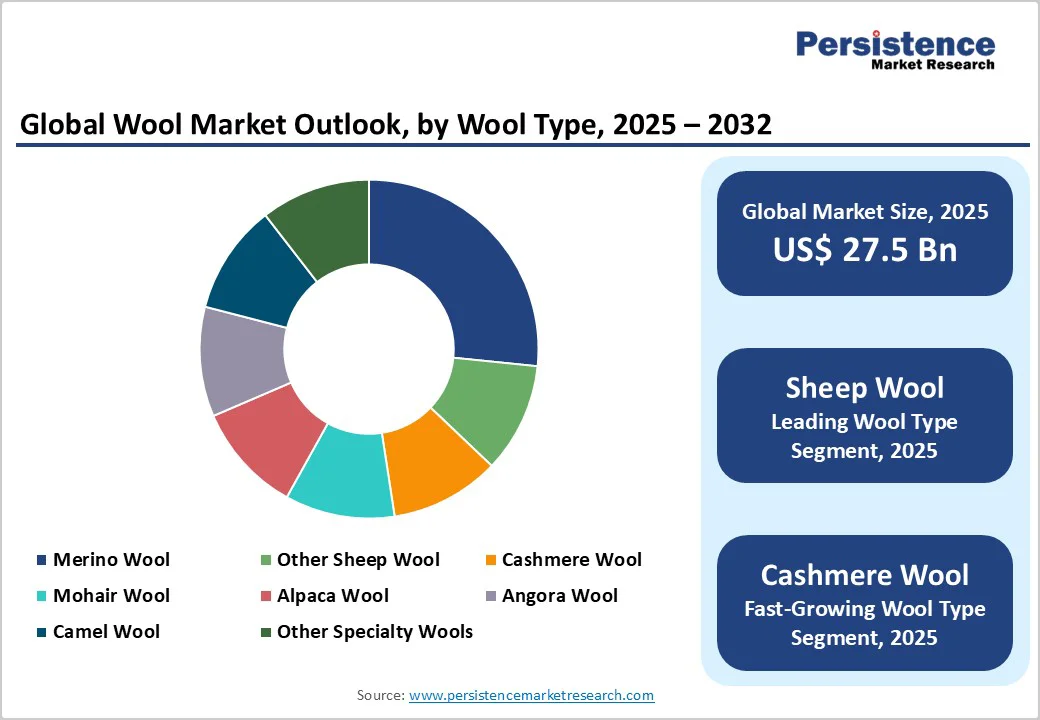

The global wool market size is likely to value US$ 27.5 billion in 2025 and is projected to reach US$ 36.0 billion by 2032, growing at a CAGR of 3.9% between 2025 and 2032. This growth trajectory reflects a steady rooted in wool’s unique thermal properties and sustainable fiber profile, maintained even as synthetic alternatives dominate the textile sector.

| Key Insights | Details |

|---|---|

|

Wool Market Size (2025E) |

US$ 27.5 Bn |

|

Market Value Forecast (2032F) |

US$ 36.0 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.1% |

Macroeconomic parameters, including government support for wool-producing sectors and steady global sheep populations, affect market supply and demand foundations. Global sheep numbers reached 1.266 billion in 2021, led by a 2.8% wheat in Australia and a 2% increase in India, driving stable raw wool availability despite minor production drops in countries like China and New Zealand. This supports a resilient supply chain critical for wool textile manufacturing, with clean wool production increasing by 0.2%, especially reflecting a 3% rise in Australia. Population demographics in large wool-consuming markets shape wool demand patterns as sustainability-centric textile consumption slowly gains ground in developed economies.

Recent improvements in wool processing technology, such as traceability systems implemented by British Wool, have elevated operational efficiencies and enhanced product differentiation. These advancements enable the industry to meet escalating demands for provenance and traceability by brands, fostering premiumization.

Traceability premiums have been applied to over 700 tonnes of British wool recently, signalling market acceptance. Efficiency gains from depot relocations and service integration contribute to cost optimisation and supply chain robustness, ultimately supporting better price realisations and consumer confidence in wool products.

Government policy frameworks and industry organizations actively promote sustainable wool production aligned with international environmental goals. The Ministry of Textiles in India, through its Integrated Wool Development Programme (IWDP), which allocates US$ 1.66 million till 2026, focuses on quality enhancement, supply chain harmonisation, and skill development.

Globally, collaborative initiatives like the Campaign for Wool and the International Wool Textile Organisation seek to counter synthetic fiber dominance (synthetics comprise 70% of textile markets) by promoting provenance and traceability. Regulatory emphasis on eco-friendly textile manufacturing enhances wool’s market appeal amid tighter environmental compliance worldwide.

The wool market faces price pressures aggravated by commodity price fluctuations and high shearing costs. For instance, British Wool auction prices averaged 81.9p per kilo in 2023, below the £1.20 per kilo threshold needed to cover shearing expenses, impacting producer profitability. Supply-side constraints caused by adverse weather conditions, such as drought leading to lighter fleeces and reduced volumes, further stress cost structures and revenue potential. These financial challenges affect supply chain stability and may deter smallholder participation in the wool sector.

Structural challenges in maintaining consistent wool production persist, highlighted by a declining trend in greasy wool output since 2015 and production dips in major countries like New Zealand (2.4%) and China (0.4%) in recent years. Variability in clean wool yields, ranging from 76% in Australia to about 40% in China, complicates supply management and cost forecasting.

Transporting, grading, and processing infrastructure needs continual modernisation to meet evolving market demands, with inefficiencies often creating bottlenecks that hinder timely product delivery and quality consistency.

Expanding wool consumption in emerging markets offers significant actionable potential. For instance, Turkey’s wool sector, employing over 8,000 workers and hosting 110 companies focused on wool yarn manufacturing, leverages domestic raw wool imports to produce high-value textiles such as carpets and apparel. Export volumes exceeding $700 million reflect strong external demand.

India’s export-oriented wool sector, valued at $1.74 billion in FY24, with extensive product lines, benefits from government schemes aimed at competitiveness and quality improvement. These regions provide fertile ground for wool value addition amid growing sustainability awareness.

Technological convergence through innovations in traceability and labelling system integration helps establish transparent, sustainable value chains that meet rising consumer demand for provenance. British Wool’s recent success in traceability applied premiums to substantial volumes, indicating a market shift towards authenticated wool products. This creates opportunities for collaborations and partnerships across the supply chain, enabling producers to command price premiums and differentiate within a commoditised industry space, further enhancing profitability and market positioning.

Merino wool leads the wool type category with a 45.3% share, driven by its fine texture, softness, and versatility in high-quality clothing applications. Its adaptability across various climates and growing consumer preference for premium apparel underpin its market dominance. Merino’s superior fiber attributes support luxury and performance wear sectors, maintaining its strategic importance within the industry.

Cashmere wool is the fastest-growing segment, propelled by consumer demand for luxury and sustainable textiles. Its characteristics of warmth, softness, and hypoallergenic properties increase appeal in high-end fashion markets. The growing emphasis on sustainable luxury further supports cashmere’s expansion as consumers seek environmentally responsible alternatives, boosting its role in future market growth.

The apparel/garments segment is the largest application, accounting for 55% share in 2025. It spans luxury fashion to everyday clothing, reflecting wool's versatility and comfort advantages. Demand is sustained by the textile industry’s preference for natural fibers that provide thermal regulation and breathability, essential for quality apparel lines.

Industrial Textiles represent the fastest growing application segment, including technical textiles used in insulation, filtration, and speciality fabrics. Their functional properties, such as durability and thermal performance, make wool valuable for industrial applications beyond traditional clothing, presenting new avenues for market penetration and product innovation.

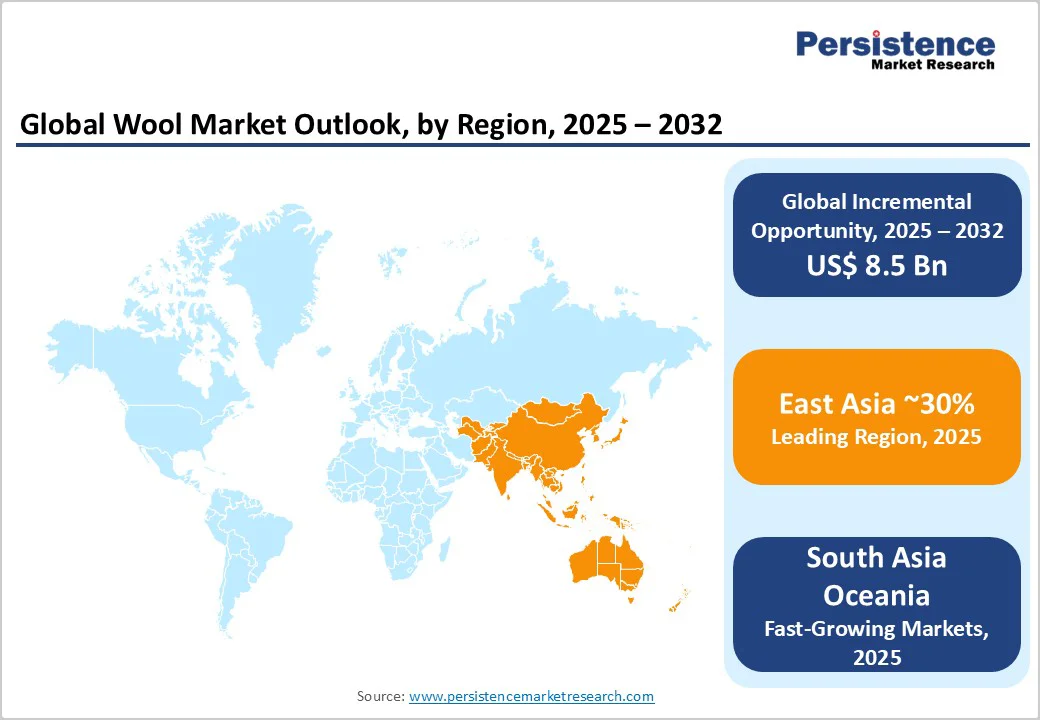

East Asia holds approximately 30% of the global wool market. Dominated by China, Japan, and South Korea, this region combines a vast textile manufacturing base with significant wool consumption.

China led global production in 2023 with 367.5K tonnes, supported by government initiatives to modernise the textile sector. Despite minor production declines, the region’s demand is reinforced by expanding apparel production and sustainability drives encouraging blended textiles incorporating wool. Regulatory frameworks increasingly promote eco-compliance, influencing domestic wool processing and export dynamics.

South Asia Oceania commands around 23% of the global market, with India, Australia, and New Zealand pivotal in production. Australia stands as a major wool producer and exporter, with a 3% rise in clean wool production in 2021 after drought recovery.

India, producing mainly carpet and apparel-grade wool, supports 1.2 million jobs in the organised sector and delivers substantial exports valued at US$1.74 billion in FY24. The Indian government’s Integrated Wool Development Programme allocates significant funding toward improving quality, production efficiency, and exports between 2022 and 2026. Upcoming infrastructure and policy projects aim to strengthen domestic supply chains and global competitiveness.

Europe accounts for approximately 25% of the global wool market, with strong emphasis on luxury textiles, premium apparel, and advancing sustainable practices. The United Kingdom’s British Wool organisation continues operational optimisations, focusing on traceability and premium pricing despite challenging commodity price environments.

European regulatory bodies emphasise environmental sustainability, directly influencing textile manufacturing and product standards. Wool-based textile exports remain robust, supported by growing consumer demand for provenance and eco-friendly materials, representing a mature and innovation-driven market sector.

The global wool market is highly fragmented, with numerous small and medium-sized companies operating alongside a few larger players. Competition is primarily driven by product quality, brand reputation, and the ability to supply specialised and fine wools for apparel and luxury textiles.

Key market players include American Woolen Company, Pendleton Woolen Mills, Woolrich, Inc., Baa Ram Ewe, and Brown Sheep Company, Inc. Companies focus on differentiating through sustainable practices, traceability, and innovation in yarns and fabrics. While there are some dominant regional players, no single company holds a significant global market share, keeping the market competitive and diverse.

The global wool market is projected at US$ 27.5 Bn in 2025.

The Merino wool segment is expected to hold around 43.5% share in 2025, driven by Fine, high-demand wool for apparel globally.

The wool market is poised to witness a CAGR of 3.9% from 2025 to 2032.

The wool market is driven by stable global sheep populations, government support for wool sectors, technological advancements in processing and traceability, and sustainability-focused policies promoting eco-friendly, premium, and traceable wool products.

Key opportunities in the global wool market include expanding demand in emerging regions, technological integration for traceability and provenance, and government-backed programs enhancing quality, supply chains, and export potential.

The top key market players in the global Wool Market include American Woolen Company, Pendleton Woolen Mills, Woolrich, Inc., Baa Ram Ewe, Brown Sheep Company, Inc., Harris Tweed Hebrides, Rochford & Co., Laxtons, Südwolle Group, Modern Woollens, Jaya Shree Textiles (Grasim Industries), Monte Carlo Corporate, Blue Sky Fibers, Highland Wool, Australian Wool Innovation (AWI), New Zealand Wool Services International (WSI).

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Region Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Wool Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author