ID: PMRREP33311| 120 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

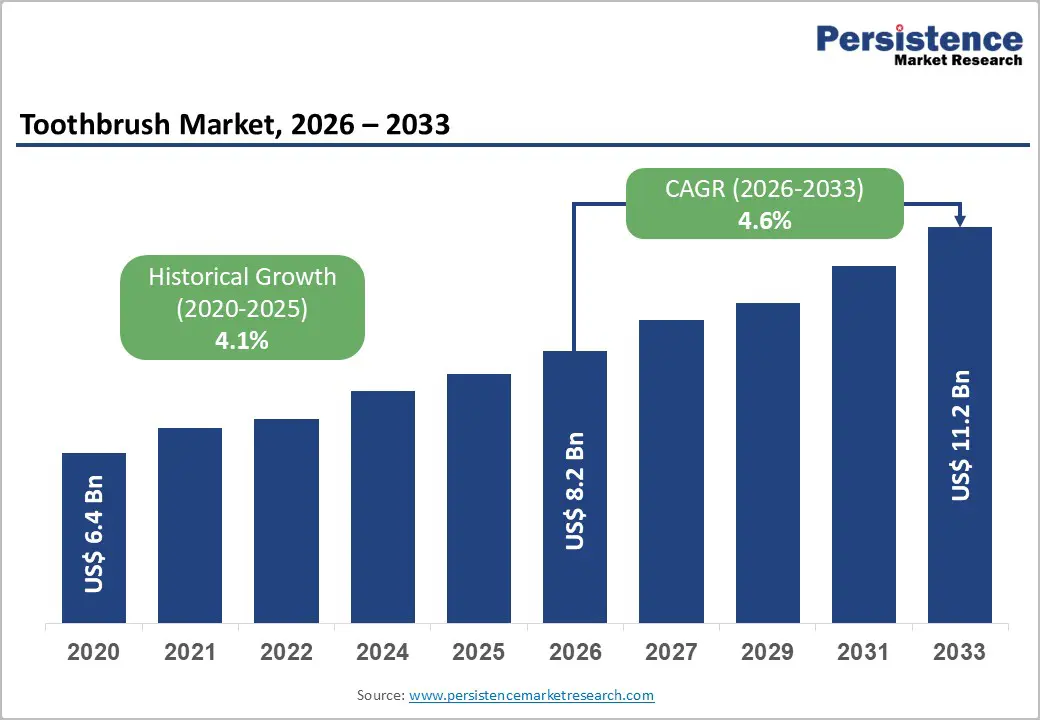

The global toothbrush market is projected to be valued at US$ 8.2 billion in 2026 and is expected to reach US$ 11.2 billion by 2033, expanding at a CAGR of 4.6% during the forecast period. Market growth is driven by rising global awareness of preventive oral healthcare and the widespread prevalence of dental diseases.

According to the World Health Organization, billions of people are affected by oral health conditions, driving consistent demand for effective oral hygiene products. Advancements in electric toothbrush technologies, rising disposable incomes in emerging economies, especially in the Asia-Pacific region, and the rapid expansion of e-commerce and eco-friendly toothbrush solutions are further supporting market growth worldwide.

| Key Insights | Details |

|---|---|

| Toothbrush Market Size (2026E) | US$ 8.2 Billion |

| Market Value Forecast (2033F) | US$ 11.2 Billion |

| Projected Growth CAGR (2026 - 2033) | 4.6% |

| Historical Market Growth (2020 - 2025) | 4.1% |

The increasing prevalence of oral diseases worldwide is a primary growth driver for the toothbrush market. According to global health authorities, billions of individuals suffer from dental caries, periodontal diseases, and other oral conditions, prompting heightened awareness of preventive oral hygiene. Consumers increasingly understand the importance of regular toothbrushing in preventing plaque buildup, cavities, and gum infections, resulting in consistent demand for toothbrushes across age groups and income segments.

This awareness is further reinforced by recommendations from dental associations and large-scale public health campaigns linking oral hygiene to overall systemic health. Younger demographics, particularly millennials and Generation Z, are actively adopting structured oral care routines and premium hygiene products. As preventive healthcare becomes integral to daily wellness practices, demand for both manual and advanced toothbrush solutions continues to grow steadily across developed and emerging markets.

Technological innovation is significantly transforming the global toothbrush market, particularly through the growing adoption of electric and smart toothbrushes. Advanced features such as artificial intelligence, pressure sensors, sonic vibrations, and real-time performance monitoring are improving cleaning efficiency and user experience. These innovations address common brushing inefficiencies, making electric toothbrushes increasingly attractive to consumers seeking superior oral hygiene outcomes.

Integration with mobile applications enables personalized brushing guidance, usage tracking, and long-term oral health monitoring, enhancing consumer engagement and perceived value. Tech-enabled toothbrushes support premium pricing strategies while fostering brand loyalty among digitally inclined consumers. As disposable incomes rise and digital health adoption accelerates, smart toothbrush solutions are expected to witness sustained penetration across both developed and emerging economies.

Despite increasing oral health awareness, affordability remains a major constraint in the global toothbrush market, particularly within developing and price-sensitive economies. Premium electric and smart toothbrushes remain inaccessible to large consumer segments in regions such as India, China, and Southeast Asia due to higher price points. Rural populations often depend on low-cost manual toothbrushes, limiting penetration of technologically advanced oral care solutions.

Limited retail infrastructure, logistical challenges, and uneven product availability further restrict market expansion in remote areas. Currency volatility, import duties, and taxation increase product costs, discouraging widespread adoption. Additionally, low awareness regarding toothbrush quality differentiation outside urban centers sustains demand for basic commodity products, constraining revenue growth despite substantial untapped consumer potential in these regions.

Increasing environmental awareness is creating challenges for traditional plastic toothbrush manufacturers, especially in developed markets. Billions of discarded toothbrushes contribute significantly to global plastic waste, raising concerns among environmentally conscious consumers. This shift in sentiment is accelerating demand for sustainable alternatives such as bamboo, biodegradable, and recyclable toothbrush options, potentially diverting share from conventional plastic products.

Regulatory authorities in Europe and North America are introducing stricter mandates on plastic reduction and sustainability, increasing compliance costs for manufacturers. Transitioning to eco-friendly materials requires capital-intensive investments in sourcing, production processes, and supply chain restructuring. These adjustments may temporarily pressure profit margins and slow growth for traditional players during the transition toward sustainable manufacturing models.

The children’s electric toothbrush segment presents a high-growth opportunity as parental focus on early-stage oral hygiene intensifies. Increasing awareness that childhood dental habits influence lifelong oral health is driving the adoption of specialized products designed for younger users. Manufacturers are introducing child-friendly electric toothbrushes featuring softer bristles, ergonomic grips, interactive timers, and age-appropriate brushing modes to improve compliance and effectiveness.

Gamification, character-based theming, and mobile app integration are transforming brushing into an engaging routine, particularly among children aged 6-13 years, which represents the largest purchasing demographic. Strategic collaborations with entertainment franchises and educational initiatives in schools further strengthen brand recall, foster early loyalty, and create long-term customer value through repeat purchasing behavior across life stages.

The rapid expansion of e-commerce platforms is creating significant opportunities for toothbrush manufacturers to scale distribution and enhance consumer engagement. Online retail enables broader geographic reach, particularly in underserved regions, while offering cost efficiencies by reducing dependence on traditional intermediaries. Digital platforms also support subscription-based models for brush head replacements, generating predictable recurring revenue streams.

E-commerce channels empower consumers with detailed product information, reviews, and comparison tools, thereby supporting the adoption of premium and niche products. Social media marketing, influencer partnerships, and targeted digital advertising allow brands to reach younger, tech-savvy consumers with precision. The integration of direct-to-consumer strategies enhances customer retention, improves data-driven personalization, and supports scalable long-term growth.

Manual toothbrushes dominate the global toothbrush market, accounting for approximately 70.7% of total demand due to affordability, long-established usage habits, and wide accessibility. Their low cost, ease of use, minimal maintenance requirements, and availability across urban and rural regions support sustained dominance. Continuous improvements in bristle design, ergonomic handles, and eco-friendly materials further reinforce demand, while major brands maintain strong visibility through extensive retail and distribution networks.

Electric toothbrushes represent the fastest-growing product type as consumers increasingly seek advanced oral care solutions. Rising disposable incomes, technological innovation, and growing awareness of superior plaque removal benefits are accelerating adoption. Features such as pressure sensors, sonic motion, and smart connectivity are reshaping brushing habits, particularly among urban and health-conscious consumers, driving rapid premium segment expansion.

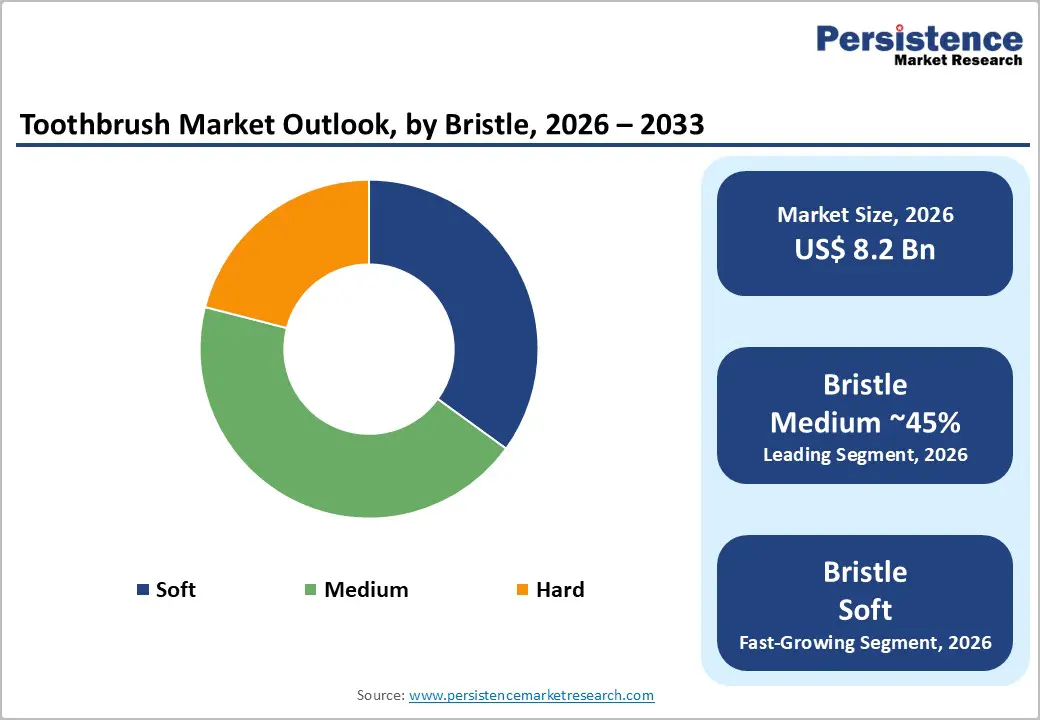

Medium-soft bristles lead the global toothbrush market with approximately 45% share, reflecting strong endorsement from dental professionals for balancing effective plaque removal with gum protection. Their widespread recommendation for everyday use has driven high consumer acceptance. Soft bristles also maintain notable demand among sensitivity-prone users, while hard bristles continue to decline due to associated risks of enamel wear and gum recession.

Specialized bristle innovations represent the fastest-growing area within this segment. Demand is rising for ultra-soft, tapered, charcoal-infused, and antibacterial bristles designed to address specific oral health needs. Manufacturers are increasingly investing in advanced materials and durability technologies to differentiate products, supporting premiumization and catering to consumers seeking customized oral care solutions.

Adults constitute the dominant end-user segment, accounting for approximately 75.8% of global toothbrush consumption. Higher purchasing power, established brand preferences, and demand for premium and electric toothbrushes contribute to this dominance. Adult consumers span multiple subgroups, including cosmetic-focused users, professionals, and elderly individuals requiring gentle oral care solutions, sustaining broad-based demand across product types.

Children represent the fastest-growing end-user category, driven by heightened parental focus on early oral hygiene and preventive care. Innovative designs incorporating gamification, character branding, and ergonomic features are increasing adoption. Additionally, the expanding elderly population is creating new growth opportunities for age-specific toothbrush solutions addressing sensitivity, dexterity limitations, and gum health concerns.

Supermarkets and hypermarkets dominate toothbrush distribution, holding approximately 50.5% market share, driven by high foot traffic, convenience, and integration with routine grocery shopping. Pharmacies, drug stores, and specialty oral care retailers also contribute significantly, benefiting from professional recommendations and consumer trust in health-oriented retail environments. Physical retail remains critical for product visibility and brand-driven purchasing decisions.

Online channels are the fastest-growing distribution segment, supported by rapid digital adoption and expanding e-commerce infrastructure. Consumers increasingly favor online platforms for convenience, broader product selection, subscription-based replenishment, and access to premium and niche toothbrush offerings. Direct-to-consumer models, influencer marketing, and digital promotions are further strengthening momentum for online channels globally.

North America leads the global toothbrush market, accounting for approximately 40.1% share, supported by high oral health awareness, strong preventive care culture, and advanced healthcare infrastructure. Consumers in the region demonstrate a strong preference for premium and electric toothbrushes, driven by higher disposable incomes and widespread dental insurance coverage. Major manufacturers maintain strong regional dominance through innovation, broad retail presence, and aggressive marketing strategies.

Market growth is increasingly influenced by sustainability-focused purchasing behavior and digital retail adoption. Demand for eco-friendly toothbrushes, recyclable packaging, and direct-to-consumer sales models continues to rise. While the market remains mature with high penetration levels, ongoing product differentiation, smart toothbrush innovation, and sustainability-led branding are essential for manufacturers to sustain growth momentum.

Europe represents a mature and well-regulated toothbrush market, characterized by strong quality standards and high consumer trust in certified oral care products. The region benefits from advanced dental infrastructure and widespread adoption of electric toothbrushes, particularly in countries such as Germany, the UK, and France. Premium positioning and regulatory compliance create high entry barriers, reinforcing market stability and brand loyalty.

Europe is projected to expand at a CAGR of 5.2%, driven by rising demand for sustainable toothbrush alternatives and technologically advanced products. Environmental regulations promoting plastic reduction and circular economy practices are accelerating the adoption of biodegradable and recyclable toothbrushes. Manufacturers emphasizing scientific validation, sustainability, and premium innovation are well-positioned to capture future growth.

Asia Pacific accounts for approximately 38.3% of the global toothbrush market, driven by its vast population base, rapid urbanization, and expanding middle-class demographics. China, India, and Japan serve as key demand centers, supported by increasing healthcare awareness and improving access to oral care products. Manual toothbrushes dominate volume consumption, particularly across price-sensitive consumer segments.

Asia Pacific represents the fastest-growing regional market, supported by rising disposable incomes, digital commerce expansion, and growing acceptance of electric toothbrushes in urban areas. Strong e-commerce growth enhances product accessibility, while manufacturers adapting pricing and distribution strategies can address both premium urban consumers and cost-sensitive rural populations, unlocking significant long-term growth potential.

The global toothbrush market features a moderately fragmented competitive landscape, with leadership concentrated among well-established multinational players supported by strong brand equity, broad distribution reach, and advanced research and development capabilities. Market leaders compete through continuous innovation, offering comprehensive product portfolios that span manual, electric, and smart toothbrush solutions tailored to diverse consumer needs and regional markets.

Competition is intensifying as emerging players introduce disruptive technologies, premium designs, and direct-to-consumer models that bypass traditional retail channels. Strategic acquisitions, professional partnerships, and subscription-based revenue models are increasingly reshaping competitive dynamics, enabling companies to strengthen customer loyalty, expand digital engagement, and diversify revenue beyond conventional product sales.

The global toothbrush market is valued at US$ 8.2 billion in 2026 and is projected to reach US$ 11.2 billion by 2033, growing at a 4.6% CAGR driven by preventive oral care adoption and product innovation.

Market growth is driven by the rising global burden of oral diseases, increasing preventive care awareness, rapid adoption of electric and smart toothbrushes, higher disposable incomes in emerging markets, and expanding e-commerce accessibility.

Medium-soft bristles lead the market with approximately 45% share, supported by strong dental professional recommendations for optimal plaque removal and gum protection.

North America dominates the global toothbrush market with a 40.1% share, driven by high oral health awareness, advanced healthcare systems, and strong demand for premium electric toothbrushes.

E-commerce represents the most significant growth opportunity, driven by direct-to-consumer models, subscription-based replenishment, wider product availability, and rising adoption among digitally engaged consumers.

Colgate-Palmolive Company, Procter & Gamble (Oral-B), and Koninklijke Philips N.V. maintain dominant competitive positions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Bristle Type

By End User

By Sales Channel

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author