ID: PMRREP33678| 199 Pages | 30 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

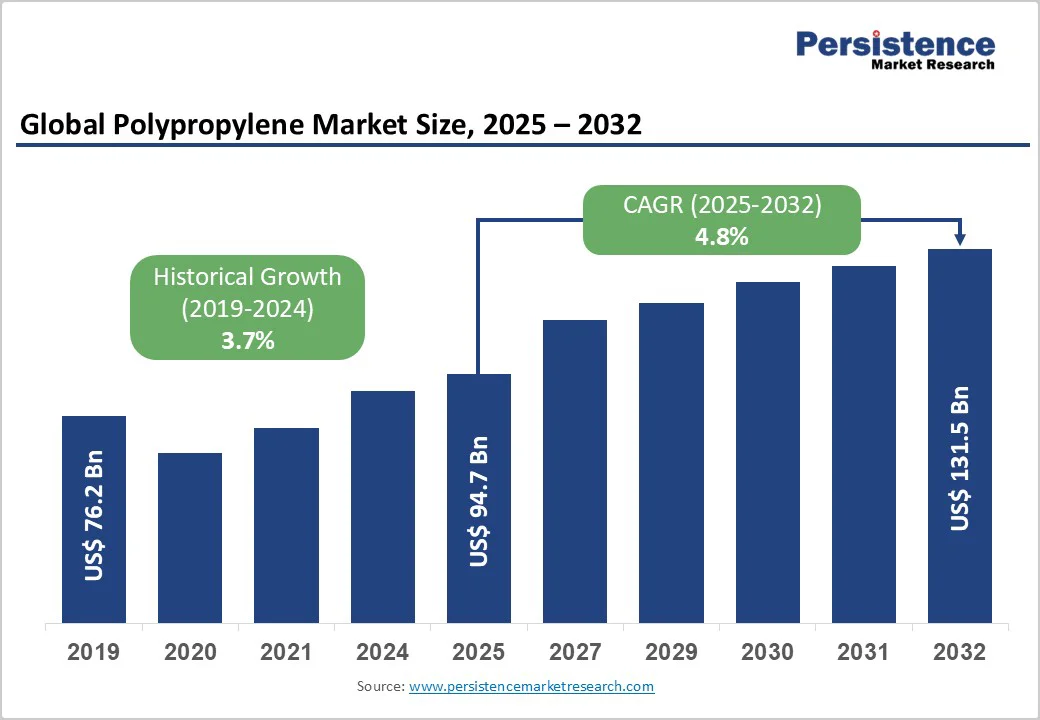

The global Polypropylene Market size is likely to be valued at US$94.7 Bn in 2025 and is projected to reach US$131.5 Bn by 2032, growing at a CAGR of 4.8% between 2025 and 2032. The market's expansion is primarily fueled by surging demand in the packaging and automotive sectors due to polypropylene's lightweight, durable, and cost-effective properties that enhance product efficiency and sustainability.

Furthermore, supportive policies from the International Energy Agency (IEA) promote bio-based variants, addressing environmental concerns while expanding market accessibility across emerging economies.

| Key Insights | Details |

|---|---|

|

Polypropylene Market Size (2025E) |

US$94.7 Bn |

|

Market Value Forecast (2032F) |

US$131.5 Bn |

|

Projected Growth CAGR (2025-2032) |

4.8% |

|

Historical Market Growth (2019-2024) |

3.7% |

The growing need for lightweight and versatile materials in the packaging industry serves as a primary driver for the Polypropylene Market, propelled by the global surge in e-commerce and consumer goods consumption. Polypropylene's excellent barrier properties against moisture and chemicals ensure product freshness, particularly in food and beverage applications, where it accounts for over 50% of flexible packaging usage according to data from the Plastics Industry Association. This demand is underscored by a 15% year-on-year increase in packaging production reported by the United Nations Industrial Development Organization (UNIDO) in 2024, driven by urbanization in the Asia-Pacific regions.

Furthermore, advancements in Biaxially Oriented Polypropylene (BOPP) films have enhanced printability and sealability, making polypropylene indispensable for retail branding and extending shelf life by up to 20%, thereby reducing food waste and supporting economic efficiency. As supply chains prioritize sustainability, integrating recycled polypropylene into packaging aligns with circular economic goals, further amplifying market growth by attracting eco-conscious brands and helping them comply with global standards such as those set by the European Plastics Converters (EuPC).

Efforts to reduce vehicle weight for improved fuel efficiency and electric vehicle (EV) performance are significantly boosting polypropylene adoption in the automotive sector, a key growth driver amid stringent global emissions regulations. Polypropylene compounds offer a 25-30% weight reduction over metals, contributing to lower carbon emissions, as highlighted in reports from the International Council on Clean Transportation (ICCT), which note that automakers aim for 10% lighter components by 2030.

In 2024, global EV sales reached 14 million units, according to the International Energy Agency (IEA), increasing demand for polypropylene in bumpers, interiors, and under-the-hood parts due to its thermal stability up to 150°C and recyclability. This trend is particularly evident in Europe and North America, where regulations like the EU CO2 Emission Standards mandate 95 g/km fleet averages, pushing manufacturers to incorporate more polypropylene, resulting in 15-20% cost savings per vehicle. The material's compatibility with advanced processes like injection molding further supports scalability, ensuring robust market expansion as the automotive industry transitions to sustainable mobility solutions.

Volatility in crude oil and natural gas prices poses a major restraint on the Polypropylene Market, as polypropylene is derived from propylene, a petroleum byproduct, leading to unpredictable production costs that deter investment and squeeze manufacturers' margins. In 2024, propylene prices fluctuated by 25% due to geopolitical tensions in the Middle East, as reported by the U.S. Energy Information Administration (EIA), impacting downstream pricing and reducing competitiveness against alternatives like polyethylene. This instability has led to a 10% decline in planned capacity expansions in developing regions, according to the World Bank's economic outlook, as producers face higher input costs averaging $1,200 per ton.

Small and medium enterprises, which constitute 60% of global polypropylene processors according to the Organization for Economic Co-operation and Development (OECD), are particularly vulnerable, often passing costs to consumers and slowing market penetration in price-sensitive sectors like consumer goods. Consequently, this restraint hampers innovation and supply chain reliability, emphasizing the need for diversified feedstocks to mitigate long-term risks.

Increasing regulatory scrutiny of plastic waste and carbon emissions is restraining polypropylene market growth, as bans and recycling mandates complicate production and raise compliance costs across the value chain. The EU Packaging and Packaging Waste Regulation (PPWR), effective from 2025, requires 30% recycled content in packaging by 2030, forcing producers to invest in costly sorting technologies, as outlined in European Commission directives, leading to a projected 15% rise in operational expenses.

In Asia, China's Plastic Pollution Control Action Plan has curtailed exports of recycled materials, causing supply shortages and 20% price hikes for post-consumer resins, per IEA data. These policies, while promoting sustainability, have slowed expansion in non-compliant regions, with global plastic waste generation reaching 400 million tons annually according to the United Nations Environment Program (UNEP), diverting resources from new projects and fostering uncertainty that limits market confidence and investment.

The rising focus on circular economy principles presents a significant opportunity for market participants through expanded use of recycled polypropylene, particularly in packaging and automotive applications, where demand for sustainable materials is projected to grow 20% annually, according to PlasticsEurope reports. Innovations in mechanical and chemical recycling technologies, such as advanced sorting via near-infrared spectroscopy, have improved the quality of recycled polypropylene, enabling 50% higher incorporation rates without compromising performance, as demonstrated in pilot projects by the Ellen MacArthur Foundation.

Recent developments, including a 2024 partnership between industry leaders and the U.S. Department of Energy, aim to scale recycled content to 25% of total production by 2030, unlocking $10 Bn in value through reduced virgin resin dependency. This opportunity is bolstered by consumer preferences, with 70% of global shoppers favoring eco-friendly products according to Nielsen surveys, driving premium pricing and market differentiation for compliant firms.

Emerging technologies for bio-based polypropylene production offer lucrative opportunities, especially in healthcare and consumer products, as governments incentivize renewable alternatives to fossil-based polymers to meet climate goals. The Bio-based Polypropylene Market is anticipated to expand rapidly, with production costs dropping 15% due to enzymatic processes using sugarcane feedstocks, as per IEA bioenergy assessments from 2024.

Policies like the U.S. BioPreferred Program mandate federal procurement of bio-based content, creating demand for medical devices that leverage biocompatibility to reduce infection risks by 30%, supported by Food and Drug Administration (FDA) approvals. In Europe, the Circular Economy Action Plan targets 10 million tons of recycled and bio-based plastics by 2025, fostering investments exceeding $5 Bn, per European Commission data, and enabling companies to tap into high-growth segments like textiles with lower carbon footprints of 2.5 tons CO2 per ton versus 4 tons for conventional polypropylene.

In the Polypropylene Market, the homopolymer segment leads with approximately 55% market share, driven by its superior stiffness, chemical resistance, and cost-effectiveness, which make it ideal for rigid applications such as containers and automotive components. This dominance is justified by its widespread use in injection molding, where it constitutes 60% of global output according to PlasticsEurope statistics from 2024, owing to the high melting point of 160-170°C, enabling durable end-products.

Homopolymer's versatility in blending with additives enhances processability, supporting a 40% share in packaging films. At the same time, its recyclability aligns with sustainability mandates, as evidenced by a 12% rise in adoption rates reported by the American Chemistry Council (ACC). Compared to copolymers, homopolymers' lower production complexity reduces costs by 10-15%, solidifying their position as the preferred choice for high-volume manufacturing.

The extrusion process holds approximately 40% share in the Polypropylene Market, owing to its efficiency in producing films, sheets, and pipes for diverse applications such as construction and agriculture. This dominance is evidenced by extrusion's ability to handle high volumes at speeds up to 500 m/min, reducing energy consumption by 15% compared to other methods, as per Society of Plastics Engineers (SPE) technical reports. It supports 70% of global profile and sheet production, with blow and cast extrusion variants enabling precise thickness control for packaging. Recent advancements in twin-screw extruders have improved melt homogeneity, boosting output by 20%, according to American Society for Testing and Materials (ASTM) guidelines, making extrusion the go-to for cost-effective, scalable manufacturing.

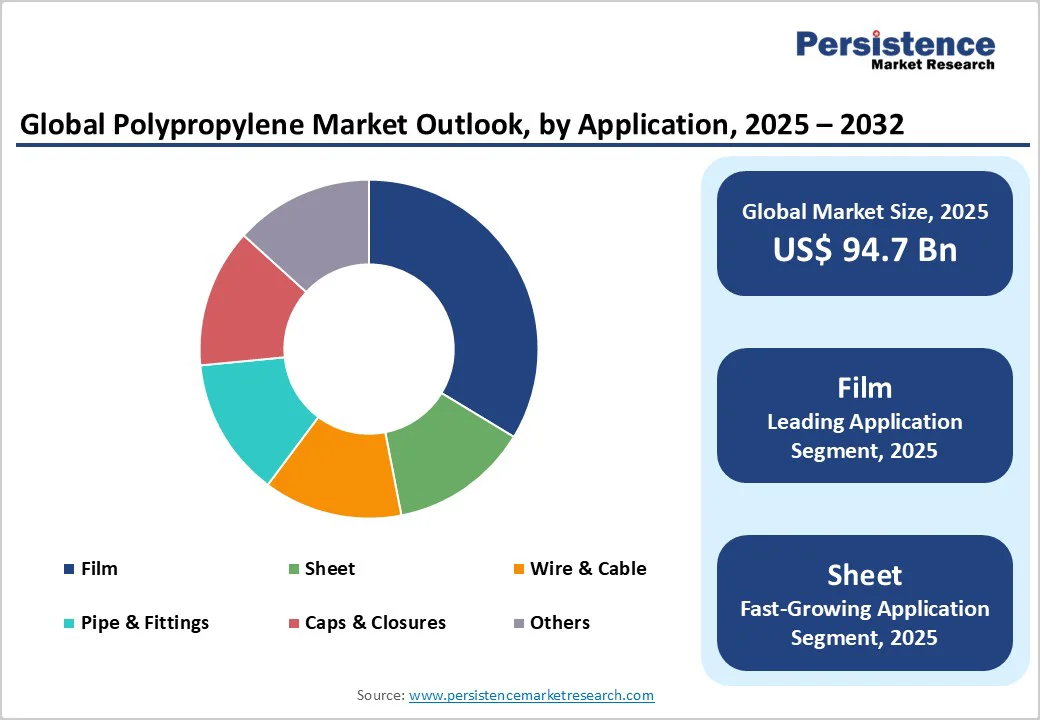

Within applications, the film segment commands roughly 35% market share in the Polypropylene Market, attributed to its critical use in flexible packaging, agricultural covers, and labeling where transparency and strength are paramount. This preeminence is supported by the material's high tensile strength of 30-40 MPa, enabling thin-gauge films that cut material usage by 25%, as documented in International Organization for Standardization (ISO) testing standards.

Films excel in food wrapping, accounting for 60% of supermarket applications according to Grocery Manufacturers Association insights, thanks to their sealability up to 140°C. The Melt-blown Polypropylene Filters Market growth in healthcare post-pandemic has further propelled demand, with nonwoven films in masks and filters surging 18% in 2024, per World Health Organization (WHO) supply chain analyses, underscoring the film's versatility and economic viability.

The packaging industry dominates the end-use category in the Polypropylene Market, with about 45% share, driven by its essential role in flexible and rigid solutions that protect products and extend shelf life in food, beverages, and consumer goods. This leadership stems from polypropylene's lightweight nature, which reduces transportation emissions by 20% according to World Economic Forum logistics reports, and its barrier properties against oxygen and moisture, critical for 70% of global fresh produce packaging, per Food and Agriculture Organization (FAO) data.

The Flexible Plastic Packaging Market integration further boosts efficiency, with biaxially oriented films holding 50% of the segment due to superior printability. Rising e-commerce volumes, up 25% in 2024 according to United Nations Conference on Trade and Development (UNCTAD), amplify demand, positioning packaging as the cornerstone for market stability and innovation.

The U.S. market leadership in the North American polypropylene sector stems from robust automotive manufacturing presence, advanced petrochemical infrastructure, and substantial investment in capacity expansion projects that enhance regional self-sufficiency in propylene feedstock supply. The U.S. Environmental Protection Agency (EPA) has driven recycled content mandates, resulting in a 22% increase in post-consumer resin use in 2024, particularly in automotive lightweighting, where polypropylene reduces vehicle weight by 10%. Innovations like advanced compounding at facilities in Texas have enhanced material performance for EVs, aligning with the Department of Energy's $2 Bn investment in clean manufacturing.

This region's trends are further shaped by trade policies, with tariffs on imports fostering domestic capacity expansions by 15%, per U.S. International Trade Commission data, bolstering supply chain resilience amid global volatility.

Europe's Polypropylene Market is characterized by stringent regulatory harmonization across Germany, the U.K., France, and Spain, focusing on circularity under the PPWR, which mandates 25% recycled content by 2025, spurring an 18% growth in recycling infrastructure. In Germany, the Federal Ministry for Economic Affairs and Climate Action supports bio-based initiatives, with Borealis AG expanding facilities to produce 100,000 tons of renewable polypropylene annually in 2024, enhancing automotive applications.

Performance analysis reveals France and Spain leading in packaging, where the European Chemicals Agency (ECHA) enforces REACH compliance, reducing hazardous additives by 30% and promoting the Polypropylene Random Copolymer Market for pipes with improved durability, as per Eurostat waste management reports.

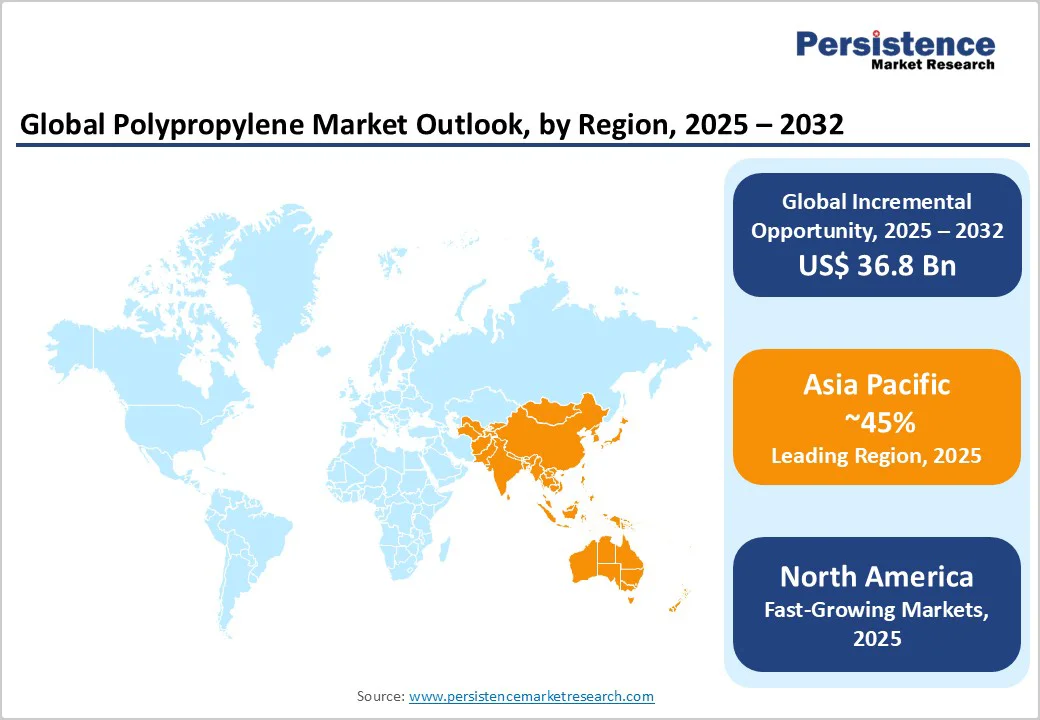

Asia Pacific emerges as the dominant regional market, with approximately 45% volume share in 2024, propelled by China, India, and Japan's extensive manufacturing bases across automotive, electronics, packaging, construction, and consumer goods sectors, which drive unprecedented polypropylene consumption. China's capacity surge to 30 million tons in 2025, per National Development and Reform Commission, has shifted it to net exporter status, with exports up 25% impacting global balances, while India's infrastructure boom drives 12% annual demand via Reliance Industries expansions.

Japan focuses on high-tech applications, with Mitsui Chemicals innovating in electronics, supported by subsidies from the Ministry of Economy, Trade and Industry. ASEAN growth, at an 8% CAGR, benefits from low-cost production in Thailand and Indonesia, where agricultural films dominate, as noted in the Asian Development Bank's economic outlooks.

The global polypropylene market exhibits a consolidated structure, with the top five players accounting for over 40% of the market share through integrated operations and strategic expansions. Companies prioritize R&D in sustainable variants, investing $3 Bn annually in recycling tech per industry associations, while mergers like those in 2024 enhance portfolio diversity. Key differentiators include advanced catalysis for high-performance grades, and emerging models like bio-based licensing foster growth in green segments.

LyondellBasell Industries Holdings B.V. (Netherlands) leads with a diverse portfolio of homopolymers and compounds, generating $45 Bn in 2024 revenues through global expansions and recycling innovations, and holding 15% market share via integrated naphtha crackers.

Exxon Mobil Corporation (United States) excels in high-volume production, with $344 Bn total revenues in 2024, leveraging upstream integration for cost advantages and focusing on lightweight automotive solutions to capture 12% share.

SABIC (Saudi Arabia) dominates the Middle East with advanced technologies, achieving $40 Bn in chemical revenues in 2024, and emphasizing sustainable grades and partnerships to achieve 10% global penetration in packaging.

The global Polypropylene Market is valued at US$ 94.7 Bn in 2025 and expected to reach US$ 131.5 Bn by 2032, reflecting steady growth driven by packaging and automotive demands.

Key drivers include rising packaging needs for lightweight materials and automotive lightweighting for emission reductions, with global e-commerce boosting flexible films by 15% annually.

The packaging segment leads with 45% share, due to polypropylene's moisture resistance and cost-efficiency in food and consumer goods applications.

North America leads, supported by U.S. innovations in recycling and automotive uses, with regulatory frameworks enhancing 20% recycled content adoption.

Advancements in bio-based Polypropylene Market present opportunities, enabling sustainable production in healthcare with 20% lower emissions and policy incentives.

Leading players include LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, and SABIC, dominating through integrated production and sustainability initiatives.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Polymer Type

By Process

By Application

By End-use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author