ID: PMRREP22015| 185 Pages | 12 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

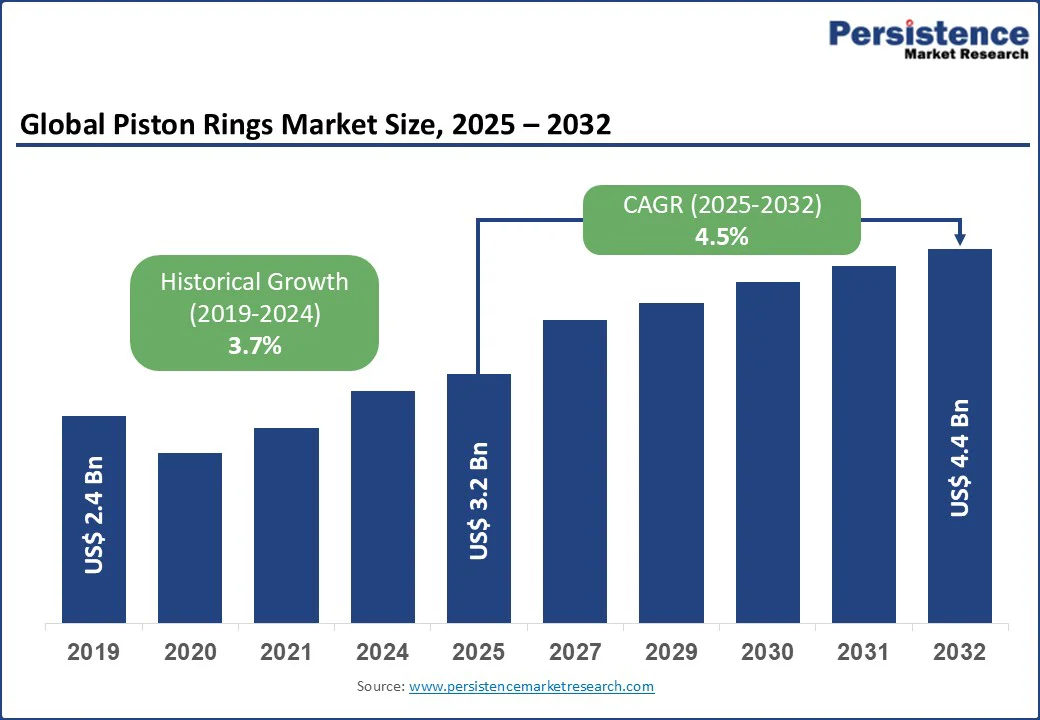

The global piston rings market size is likely to value at US$ 3.2 Bn in 2025 and is expected to reach US$ 4.4 Bn by 2032, growing at a CAGR of 4.5% during the forecast period from 2025 to 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Piston Rings Market Size (2025E) | US$ 3.2 Bn |

| Market Value Forecast (2032F) | US$ 4.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.7% |

The piston rings are made of metal and are located between the piston and the cylinder, accurately enabling the engine to function seamlessly. Piston rings primarily seal the cylinder walls to prevent combustion gases from leaking, while also regulating lubricant levels and dissipating heat from ignition. Additionally, they act as a buffer to avoid direct contact between the piston and cylinder walls, reducing wear and friction.

Governments worldwide are actively promoting the adoption and production of hybrid vehicles as part of broader efforts to reduce greenhouse gas emissions and improve fuel efficiency. These initiatives include substantial investments in infrastructure, subsidies, regulatory mandates, and tax incentives aimed at accelerating hybrid and electric vehicle adoption. Infrastructure developments, such as charging stations and battery recycling facilities, are further supporting the growth of hybrid mobility.

As the sales for hybrid vehicles increase, the demand for high-performance engine components, including piston rings, is also rising. Piston rings play a vital role in ensuring engine efficiency, durability, and compliance with stricter emission standards.

Since hybrid vehicles combine internal combustion engines with electric power, they require advanced piston ring designs capable of withstanding higher stresses, temperatures, and operational complexities. By aligning with government policies that prioritize environmental sustainability and clean transportation, hybrid vehicle growth is directly contributing to the expansion and technological advancement of the piston ring market.

The rising popularity of electric vehicles (EVs) acts a key restraint. EVs do not rely on internal combustion engines and eliminate the need for any combustion. As governments worldwide strengthen policies to reduce carbon emissions, significant incentives, subsidies, and infrastructure investments are being directed toward EV adoption.

This shift is further supported by automotive manufacturers increasing their EV production capacity to meet the rise in consumer demand. With advancements in battery technology, extended driving ranges, and falling costs, EVs are becoming more accessible to mainstream buyers.

Battery-electric vehicles roughly contain 20 moving parts versus 2,000 for ICEs, eliminating piston rings. EV sales in India jumped 158% year-on-year in FY24, illustrating the headwind even in traditionally cost-sensitive markets. Suppliers must hedge by entering hydrogen-ICE and fuel-agnostic component niches.

As a result, the long-term demand for piston rings is expected to decline, especially in developed markets where EV penetration is accelerating. This transition poses a major challenge to piston ring manufacturers, limiting growth opportunities in traditional ICE-focused segments.

The growing demand for fuel-efficient, sustainable, and high-performance engines is accelerating innovation in piston manufacturing through advanced technologies and alternative materials. A key focus is the adoption of lightweight materials such as aluminum alloys and composites.

For example, forged aluminum variants such as MAHLE’s ECOFORM reduce weight while enhancing strength and heat resistance, making them suitable for modern engines. Steel pistons are also gaining traction in turbocharged and high-performance engines due to their superior durability and thermal stability.

Surface technologies such as diamond-like carbon (DLC) and thermal barrier coatings (TBC) improve wear resistance, reduce friction, and manage heat in high-stress applications. Plasma-sprayed ceramics further enhance durability in hybrid and downsized engines, meeting regulatory efficiency requirements.

Carbon pistons, nearly 30% lighter than aluminum, can lower reciprocating mass, reduce vibrations, and boost rpm capabilities. Advanced manufacturing processes, including 3D printing and high-pressure die casting (HPDC) as demonstrated by Abilities India enable intricate, lightweight designs, minimize material waste, and reduce CO2 emissions, underscoring the industry’s shift toward sustainable innovation.

Passenger cars accounted for about 60-65% of the regional demand for automotive pistons in 2025, driven by their dominant production share. Global passenger car production rose from 62.8 million units in 2021 to 69.2 million units in 2023, representing a 17.8% increase and around 76% of worldwide production in 2024. Major producers such as China, the US, Japan, Germany, and India continue to lead in internal combustion engine (ICE) passenger cars, while China saw a notable shift towards electric vehicles, with nearly 50% of sales in 2024.

In developing regions, CNG vehicles with smaller engines are gaining popularity due to lower fuel costs. SUVs increasingly dominate the market, making up 40-45% of passenger car sales in 2024. Many OEMs are expanding their lineups of gasoline direct injection (GDI) engines, especially in compact SUVs in Asia, while European and North American markets see more hybrids. The rise of EVs won't eliminate the ongoing need for ICE and hybrid vehicles, thus maintaining a strong market for passenger car pistons.

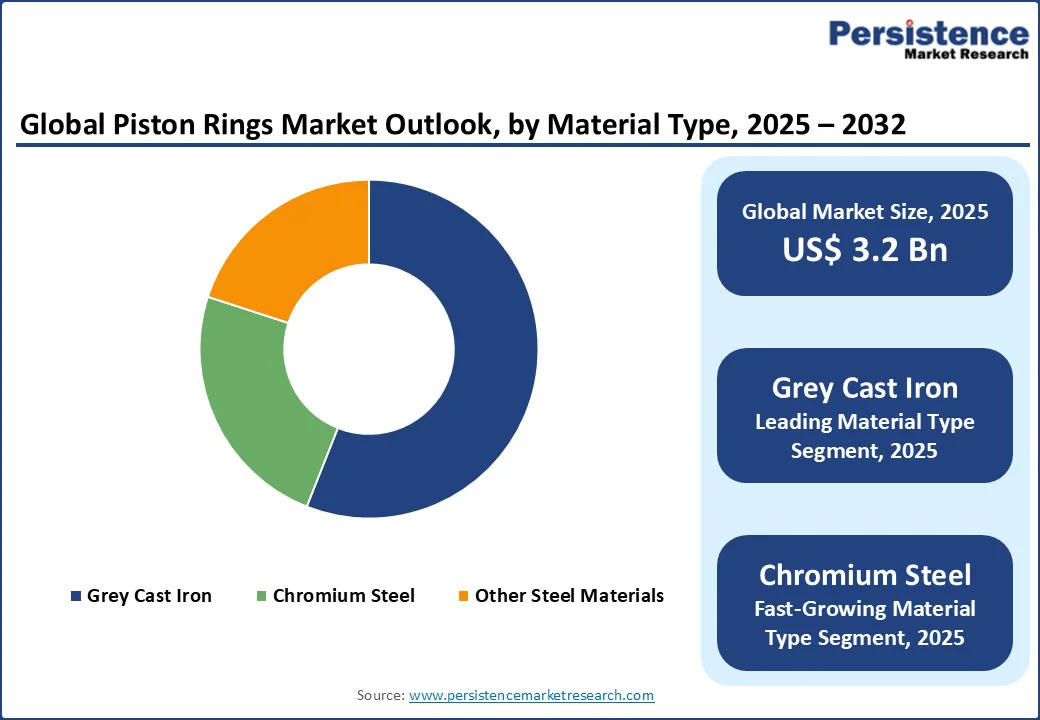

The gray cast iron segment represents the largest share in 2025 and account for nearly 50% of the market revenue. It is a sort of iron with a Gray tone and appearance brought about by graphite cracks in the material. It is perhaps the least expensive sort of iron casting used for creating different parts, for example, Cinderblocks, Sewer vent covers, Circle Brake Rotors, Siphon Lodgings, Cogwheels, Pressure driven parts, Auto suspension parts, Valves, Linkages, Oven parts, Guiding knuckles, and that's only the tip of the iceberg.

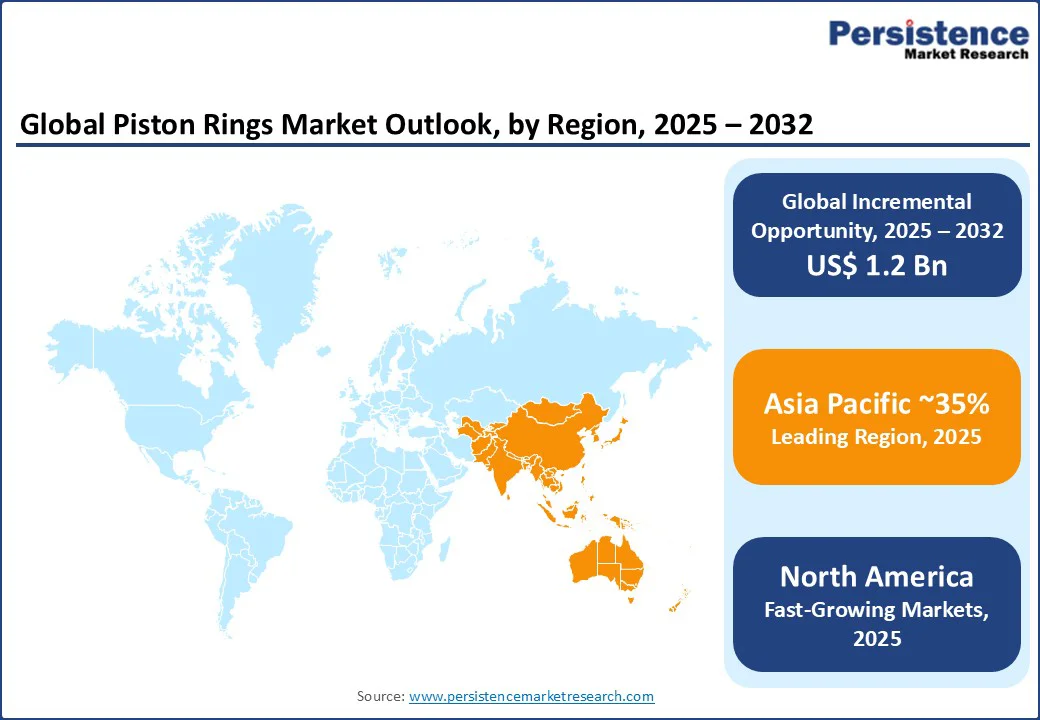

In 2025, the Asia Pacific region held a dominant position, accounting for more than 50% of the share in 2025. This region is expected to maintain its leadership due to significant contributions from countries such as China, Japan, South Korea, and India. Collectively, these countries contributed over 60% of global passenger car production and 75% of commercial vehicle production in 2024. This region's automobile industry is flourishing, especially in South Asian countries.

Though the demand for electric vehicles has been increasing in the last 3-4 years, most countries, except China, will continue to adopt gasoline-dominant engines. The demand for 3-cylinder and 4- cylinder engines is high in Asia as it is a significant hub for economy car production.

The rapid growth in gasoline-powered compact & mid-size SUVs with GDI engines fuels the demand for automotive pistons in the Asia Pacific region. The region is home to key piston manufacturers like AISIN CORPORATION, Dongsuh Federal-Mogul, NPR-Riken Corporation (Japan), and Shriram Piston & Rings Ltd.

China’s automotive output, exceeding 26.8 million units in 2024, fuels substantial demand for high-performance pistons, with industry leaders such as IP Rings Manufacturing spearheading innovation. Japan’s production of 8.2 million vehicles, alongside South Korea’s 4.1 million and India’s 6 million, reinforces the region’s dominance.

North America piston market has experienced steady growth, driven by robust automotive manufacturing and technological advancements. In 2025, the integration of advanced piston technologies in vehicles to meet stricter emission standards played a significant role.

For instance, the shift towards electric and hybrid vehicles by major manufacturers such as General Motors and Ford has increased demand for high-performance pistons. In addition, investments in R&D by companies such as Mahle have further propelled market growth.

In the U.S., the piston market has been sustained by a strong automotive sector and a focus on performance and efficiency. Key trends have been the launch of new, high-performance vehicle models and the adoption of advanced piston materials.

For instance, in 2023, Ford’s introduction of high-efficiency engines in its new lineup has driven demand for advanced piston components. The emphasis on reducing emissions and improving fuel economy has led to increased innovation and market expansion.

The global piston rings market is fragmented. Dynamics of the automotive industry have been posing their potential impact on suppliers of piston rings. Moreover, a plausible manufacturing outlook for automobiles and piston rings has boosted the sentiments of manufacturers. In terms of market structure, the market exhibits a highly competitive scenario, where leaders are facing fierce competition for the market share.

Just about 20% of the global market is led by top 8-10 brands which is the consequence of sustained consumer demand for cheaper products during repair and maintenance.

Key strategies adopted by market players are many. These strategies include expansion of production capacities, branding of new products, enhancing the distributor network, and partnerships and joint ventures with regional market leaders.

The piston rings market size is estimated to be valued at US$ 3.2 Bn in 2025.

The key demand driver for the piston rings market is the rise in global production of passenger and commercial vehicles, coupled with stricter emission regulations that require high-performance, fuel-efficient engines.

In 2025, the Asia Pacific region dominates with an exceeding 35% revenue share in the global Piston Rings market.

Among the Vehicle Type, Passenger Cars Segment hold the highest preference, capturing beyond 62.4% of the market revenue share in 2025, surpassing other products.

The key players in the Piston Rings market are ASIMCO, Federal-Mogul LLC, MAHLE GmbH, RIKEN CORPORATION and IP.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Ring Type

By Surface Coating

By Material Type

By Engine Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author