ID: PMRREP22966| 193 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

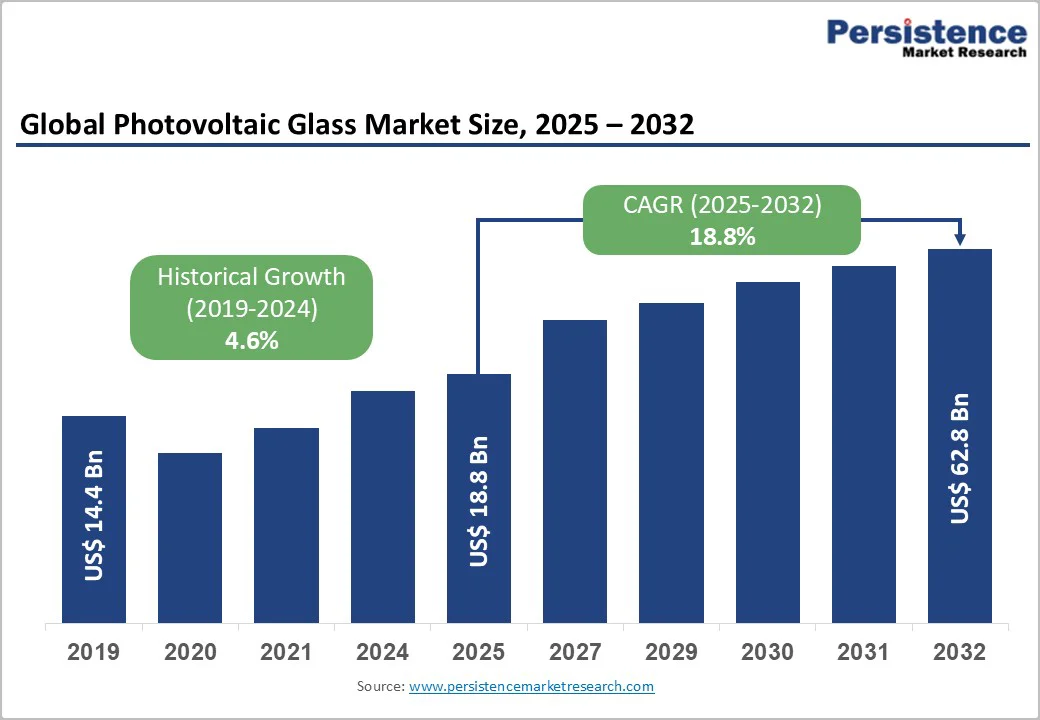

The global photovoltaic (PV) glass market is expected to reach US$18.8 billion in 2025. It is projected to reach US$62.8 billion by 2032, growing at a CAGR of 18.8% during the forecast period 2025 - 2032.

Market expansion is driven by accelerating global renewable energy adoption, supported by government incentives and declining solar panel costs, rapid expansion of utility-scale and rooftop solar installations across residential and commercial sectors, and increasing emphasis on sustainable construction practices and green building certifications.

Technological advancements in tempered glass, anti-reflective coatings, and transparent conductive oxide materials, combined with favorable regulatory frameworks supporting solar energy integration, sustain market growth by enhancing photovoltaic efficiency and improving product durability.

| Key Insights | Details |

|---|---|

| Photovoltaic (PV) Glass Market Size (2025E) | US$18.8 Bn |

| Market Value Forecast (2032F) | US$62.8 Bn |

| Projected Growth CAGR (2025 - 2032) | 18.8% |

| Historical Market Growth (2019 - 2024) | 4.6% |

The global renewable energy transition is creating exceptional market opportunities driven by government mandates, climate commitments, and incentive programs, accelerating solar adoption. In the U.S., solar electricity production reached approximately 283 TWh in 2024, boosting demand for photovoltaic glass. The International Energy Agency (IEA) projects that renewable electricity will account for 50% of global generation by 2030.

Key policies such as the U.S. CHIPS Act, which offers a 25% investment tax credit for solar ingot and wafer manufacturing, and India's National Bioenergy Programme demonstrate strong governmental support. Corporate commitments to sustainability and net-zero targets are further elevating premium demand for rooftop solar in commercial sectors.

Declining solar panel costs and enhanced module technologies are also fueling market growth by enabling widespread solar adoption. The cost of solar photovoltaic systems has dropped about 90% over the past decade due to manufacturing automation, supply chain efficiencies, and improved module efficiency. Innovations such as tempered glass with anti-reflective coatings reduce light reflection losses considerably, increasing system efficiency.

Leading manufacturers such as Jinko Solar and Trina Solar are adopting advanced cell technologies, including perovskites, to surpass 25% efficiency targets. The use of transparent conductive oxide glass in heterojunction and tandem cells also supports next-generation photovoltaic performance, while improvements in mass production and quality control make specialized glass types increasingly accessible across residential and commercial markets.

Scarcity of tellurium and supply challenges for cadmium telluride (CdTe) constrain the growth of the thin-film photovoltaic glass market, especially in cost-sensitive utility-scale applications. With global tellurium production declining, demand pressure has intensified across both the photovoltaic and thermoelectric markets.

Environmental regulations, notably in Europe, limit cadmium use due to toxicity concerns, hindering market expansion in environmentally conscious regions. Moreover, limited glass substrate availability and manufacturing capacity, especially for specialized coatings and transparent conductive oxide products, lead to intermittent supply constraints and pricing volatility.

Strict environmental and health regulations reduce technology adoption by imposing stringent controls on cadmium telluride toxicity and emissions during manufacturing, particularly in plasma-enhanced chemical vapor deposition processes. Compliance with end-of-life recycling mandates adds operational costs and administrative burdens for producers.

Thin-film technologies experience lower productivity and efficiency than crystalline silicon alternatives, limiting mainstream market acceptance despite their niche advantages. Emerging policies in Europe emphasize sustainable production and safe handling, erecting high barriers for CdTe adoption but also stimulating innovation in encapsulation and material efficiency to meet evolving regulatory standards.

BIPV and smart photovoltaic glass technologies offer exceptional market opportunities by addressing energy efficiency and aesthetic needs in modern construction. BIPV systems, which integrate solar functionality into building envelopes, support energy self-sufficiency and reduce grid dependency. Technologies such as TCO glass enable dynamic light control alongside energy generation, creating unique aesthetic advantages that justify premium pricing.

Green building certifications such as LEED and BREEAM further incentivize BIPV adoption in commercial office buildings, shopping centers, and data centers. Smart window technologies, incorporating switchable glazing with photovoltaic capabilities, meet the growing demand for adaptive, energy-efficient building envelopes.

Government energy efficiency standards and renewable integration mandates in new construction propel sustained BIPV market growth and expand addressable segments beyond traditional rooftop installations.

Thin-film photovoltaic glass technologies, including CdTe and copper indium gallium diselenide (CIGS), represent the fastest-growing segment, fueled by cost competitiveness and expanding utility-scale solar projects. CdTe offers cost advantages and automated manufacturing processes that support large-scale deployment, while also providing favorable lifecycle assessments with energy payback times exceeding one year.

Advancements in CIGS technology and the scaling of pilot production are addressing efficiency and reliability concerns to enable broader adoption. Utility-scale solar developments, including mega-projects exceeding 1 GW, drive demand for specialized large-format photovoltaic glass products for premium applications.

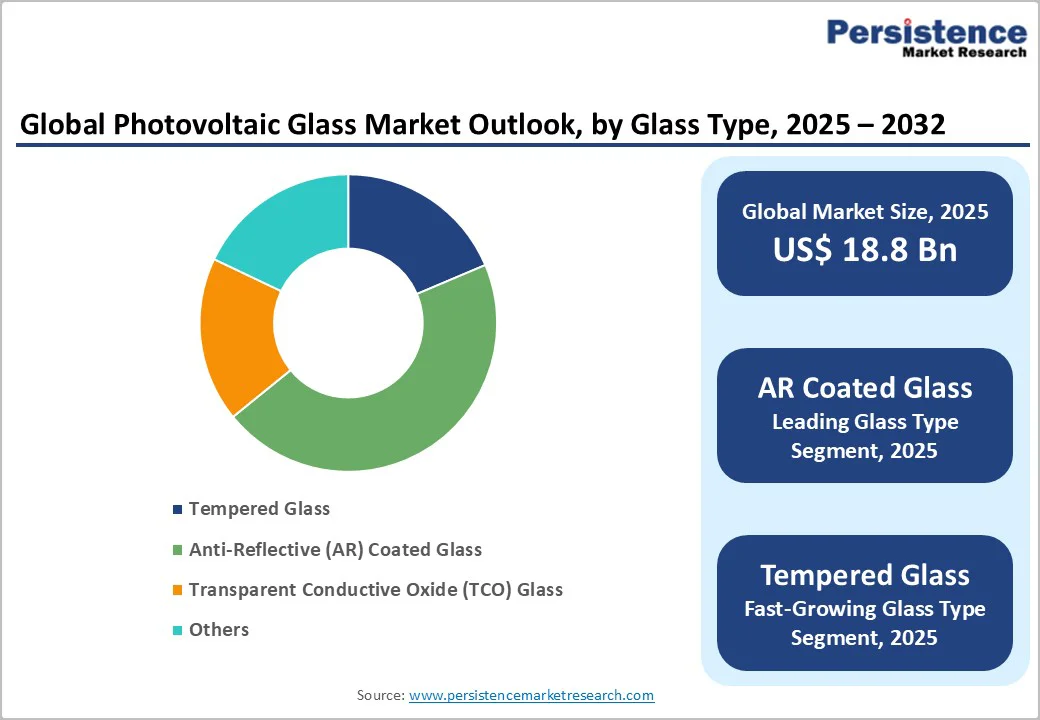

Anti-reflective (AR) coated glass dominates the photovoltaic glass market, holding approximately 57% of the revenue share in 2025 due to its widespread adoption in crystalline silicon photovoltaic modules and its proven ability to enhance light capture.

These coatings, typically made from silicon nitride and applied through plasma-enhanced chemical vapor deposition (PECVD), effectively reduce surface reflection losses, thereby improving overall system efficiency. The use of standardized manufacturing processes and established quality assurance protocols ensures consistent product performance across various producers, supporting reliability and durability in diverse environments.

The compatibility of anti-reflective coatings with traditional float glass production infrastructure enables cost-effective manufacturing at scale, making AR-coated glass an economically attractive option for many solar panel manufacturers.

Moreover, advancements such as duplex coatings that combine anti-reflective and hydrophobic properties are further enhancing performance and durability, safeguarding market share while enabling higher average selling prices. These benefits make AR-coated glass the preferred choice in both utility-scale and commercial solar projects, where maximizing energy conversion efficiency and product longevity are critical for economic viability and long-term sustainability.

Crystalline silicon technology is projected to capture approximately 73% of the photovoltaic glass market revenue share in 2025 on account of its established maturity and proven performance record.

Both monocrystalline and polycrystalline silicon modules hold overwhelming market shares across residential, commercial, and utility-scale solar installations, benefiting from decades of development that have pushed commercial production efficiencies beyond conventional limits.

This technology’s leadership is reinforced by its manufacturing cost advantages and a mature, well-integrated supply chain, which enable competitive product positioning and broad accessibility.

The sustained dominance of crystalline silicon is supported by continuous improvements in wafer quality, surface passivation techniques, and anti-reflective coatings, which optimize energy conversion and system reliability. Its scalability and cost effectiveness make it the technology of choice for large-scale renewable energy projects, including utility photovoltaic farms and commercial rooftop installations.

As renewable energy deployment expands globally, the proven durability and high efficiency of crystalline silicon reinforce its central role in meeting growing demand for solar power, securing its position as the industry standard for photovoltaic applications worldwide.

The commercial sector leads the PV glass market in 2025, accounting for approximately 47% of total revenue, driven by the widespread adoption of BIPV across commercial infrastructure such as office complexes, shopping malls, airports, and educational institutions. Commercial buildings are increasingly incorporating PV glass for façades, curtain walls, and skylights, enabling both energy generation and architectural aesthetics.

The sector benefits from the growing emphasis on net-zero energy buildings, stringent green building standards such as LEED and BREEAM, and favorable government incentives. Technological advancements in transparent and anti-reflective glass coatings enhance solar efficiency and design flexibility, accelerating photovoltaic glass deployment.

Corporations and real estate developers are investing heavily in sustainable energy infrastructure, making the commercial sector a key growth driver for the PV glass market. The growing focus on energy cost reduction and ESG compliance is driving the adoption of durable, lightweight glass solutions for rooftop and building-mounted photovoltaic systems.

Incentives such as federal tax credits in the United States and clean energy funds in the European Union (EU) further stimulate market expansion, particularly in warehouses, data centers, and retail spaces where solar installations reduce operational costs and support environmental goals.

In North America, the PV glass market is experiencing strong growth powered by ambitious renewable energy targets and supportive policy frameworks. The United States alone produced over 283 TWh of solar electricity in 2024, fueled by significant capacity expansions in Sunbelt states and boosted by the extended Investment Tax Credit (ITC) that supports both rooftop and utility-scale solar projects through the 2030s.

Net metering policies further encourage residential solar adoption, especially in California and the Northeastern states. The commercial real estate sector is also a major contributor, deploying substantial rooftop solar PV capacity to meet corporate sustainability goals and optimize energy costs.

The solar market in Mexico is also expanding rapidly, driven by government renewable energy auctions and electricity privatization, which facilitate the development of utility-scale projects. Meanwhile, in Canada, private and public utilities are integrating solar generation with hydroelectric and wind resources to meet provincial climate targets.

This multi-national momentum across North America underscores the region’s leadership in renewable energy deployment, supported by targeted incentives and regulatory frameworks that are accelerating the transition to a cleaner, more distributed energy system.

Europe maintains its leadership in photovoltaic (PV) glass technology and in integrating sustainability, driven by stringent environmental regulations and ambitious renewable energy mandates. The European Union’s directive to achieve 40% renewable energy by 2030 underpins sustained regulatory support, with Germany leading adoption through over 15 GW of annual domestic production capacity backed by government subsidies and feed-in tariff programs.

Countries such as France and Spain are expanding utility-scale solar farms fueled by renewable energy auctions and corporate power purchase agreements (PPAs), while the U.K. is increasing solar installations via floating solar farms and rooftop systems, advancing grid decarbonization goals.

Regulatory harmonization across the region enables streamlined product certification and cross-border technology deployment, facilitating a more integrated European photovoltaic glass market.

This leadership is further bolstered by robust investments in green building standards and BIPV systems, which have increased demand for premium PV glass products, including TCO glass. Germany is projected to maintain a dominant market share, supported by solar modernization programs in Berlin and Munich.

The PV glass market in Europe also benefits from strong governmental support, sizable refurbishment cycles, and increasing solar capacity installations that collectively advance energy efficiency and climate targets through 2035 and beyond.

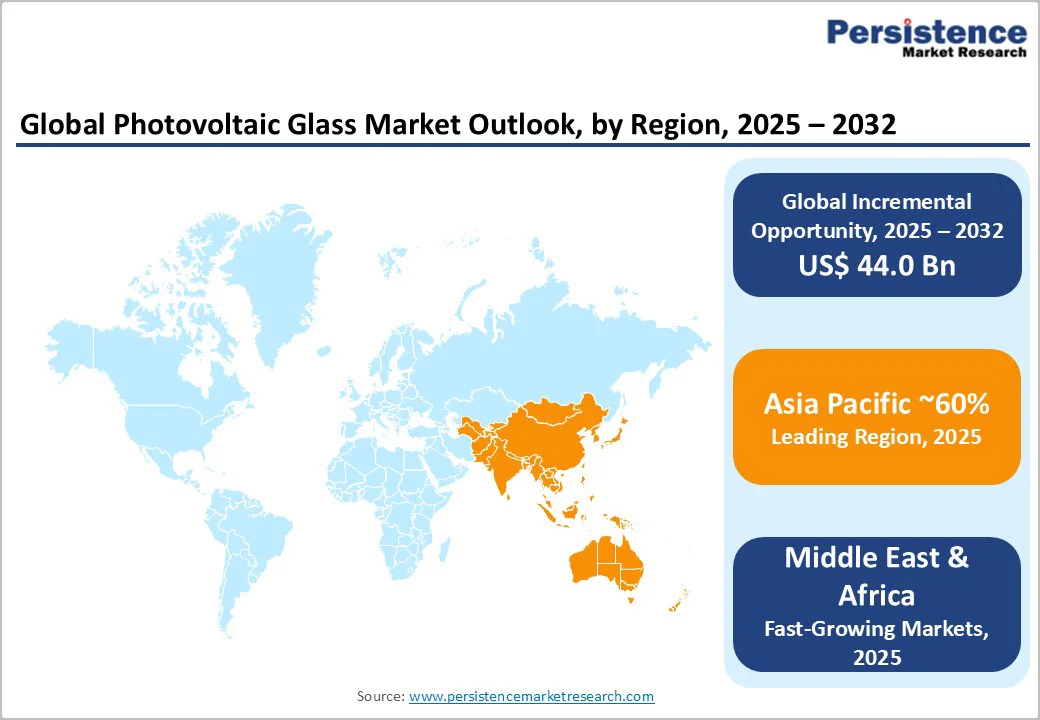

Asia Pacific dominates with an estimated 60% of the photovoltaic glass market share, fueled by exceptional renewable energy adoption and large-scale manufacturing. China, as the world's largest photovoltaic producer, accounts for roughly 45% of global demand, backed by its massive manufacturing capacity and high installation volumes.

The Chinese government targets 1,200 GW of cumulative solar capacity by 2030, driving unprecedented infrastructure investment. India aims for 500 GW solar capacity by 2030, driving substantial glass procurement across residential, commercial, and utility sectors. Japanese manufacturers such as Asahi Glass and Nippon Sheet Glass lead in advanced coating technologies, fulfilling global performance and quality standards.

In Southeast Asia, Vietnam and Thailand are expanding solar manufacturing infrastructure, supporting regional supply chain growth. Government localization programs and manufacturing incentives attract global manufacturers, promoting cost-competitive production and improving market accessibility and affordability.

This dynamic ecosystem not only accelerates photovoltaic glass market expansion but also enhances supply chain resilience and innovation throughout the Asia Pacific, establishing it as the fastest-growing regional PV glass market for the foreseeable future.

The global photovoltaic glass market structure is moderately consolidated, with leading manufacturers such as Saint-Gobain, Asahi Glass, Nippon Sheet Glass, and Taiwan Glass a sizable portion of revenues. These companies are utilizing their extensive product portfolios, advanced coating technologies, and well-established distribution networks to maintain competitive advantages.

Tier-two players, including Flat Glass Group, Xinyi Energy, and Borosil Glass Works, have managed to capture significant regional segments through cost-competitive offerings and specialized applications.

China-based manufacturers such as Flat Glass Group and Xinyi Energy are capitalizing on cost advantages and large-scale manufacturing capabilities to penetrate emerging markets and drive volume growth.

Industry participants prioritize strategic capacity expansions, investment in advanced TOC coating technologies, development of innovative anti-reflective coatings, and achieving sustainability certifications. Efforts to localize supply chains are also aiding competitive positioning and enabling market expansion by differentiating premium photovoltaic glass products.

The global photovoltaic (PV) glass market is projected to reach US$ 18.8 billion in 2025.

Surging renewable energy adoption, government incentives, declining solar system costs, and corporate renewable energy commitments are driving the market.

The market is poised to witness a CAGR of 18.8% from 2025 to 2032.

Building-integrated photovoltaics and smart window technologies targeting green building certifications, net-zero construction, and aesthetic architectural integration offer highly lucrative opportunities.

Saint-Gobain, Asahi Glass Co., Ltd., and Xinyi Energy Holdings Limited are some of the key market players.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Glass Type

By Technology

By Application

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author