ID: PMRREP27052| 200 Pages | 26 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

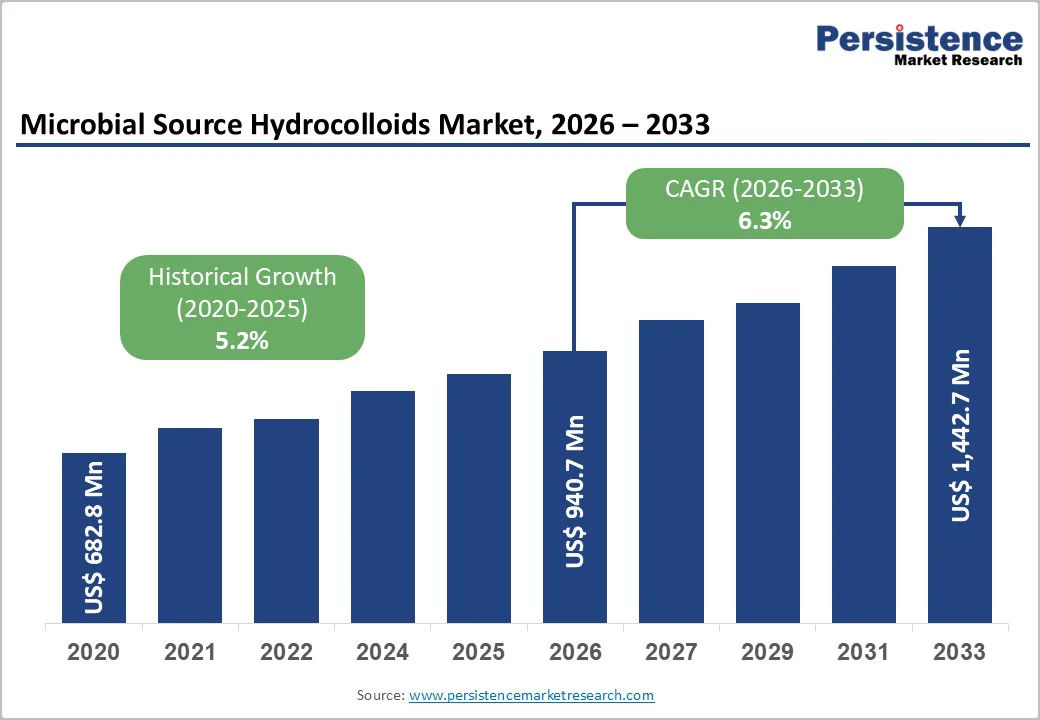

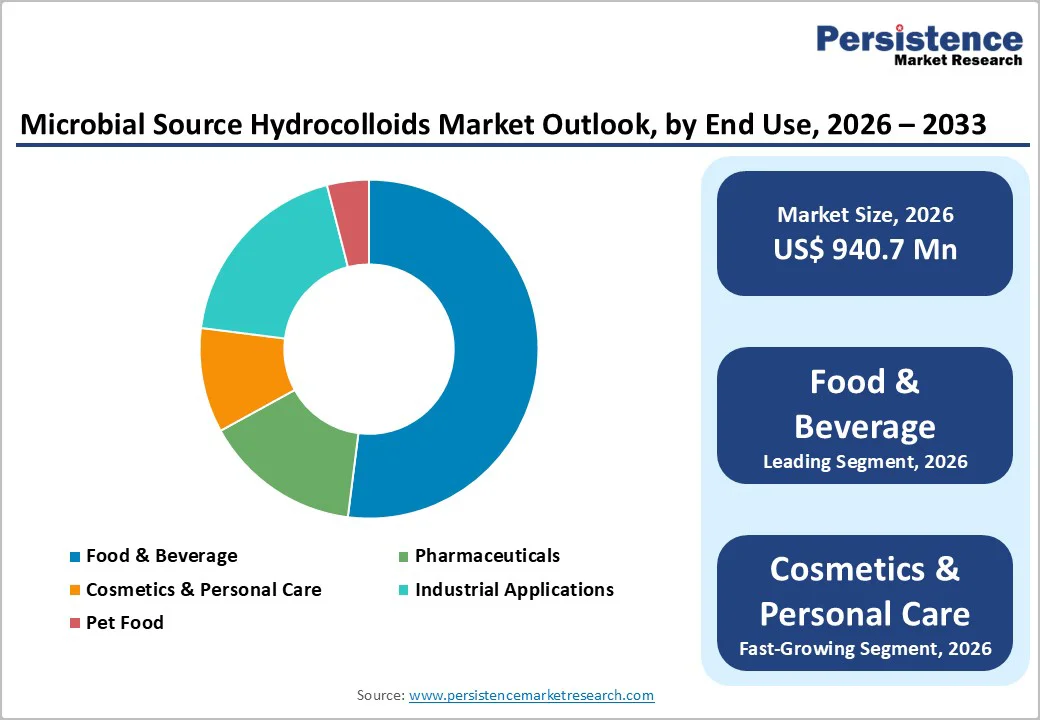

The global microbial source hydrocolloids market size is estimated to grow from US$ 940.7 million in 2026 to US$ 1,442.7 million by 2033 growing at a CAGR of 6.3% during the forecast period from 2026 to 2033.

A global shift toward precision fermentation, clean textures, and climate-resilient ingredients is reshaping the competitive dynamics of microbial source hydrocolloids. Companies that can scale fermentation efficiency and deliver specialty hydrocolloids tailored to next-gen formulations are gaining a decisive edge across food, cosmetics, and biopharma applications.

| Key Insights | Details |

|---|---|

| Global Microbial Source Hydrocolloids Market Size (2026E) | US$ 940.7 Mn |

| Market Value Forecast (2033F) | US$ 1,442 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.2% |

A rapid restructuring of global eating habits is amplifying demand for microbial source hydrocolloids as ready-to-eat and convenience foods anchor modern consumption patterns. Manufacturers are under pressure to deliver meals that retain stability, appealing mouthfeel, and uniform texture through freezing, reheating, and long distribution cycles, making hydrocolloids indispensable functional ingredients. Fermentation-derived gums are gaining priority due to their clean processing profiles and consistent performance across sauces, bakery fillings, plant-based meats, and instant meals. As brands race to extend shelf life, prevent syneresis, and improve viscosity control, microbial hydrocolloids emerge as the most versatile tools for meeting multi-environment processing needs. The surge in convenience-driven formulations ultimately accelerates adoption across global retail and foodservice channels.

A growing wave of price-sensitive purchasing across food and beverage manufacturing is intensifying the restraint posed by low-cost gums in the microbial source hydrocolloids market. Cheaper alternatives such as guar gum, cassia gum, and modified starches often attract formulators seeking functional adequacy at lower input costs, especially in high-volume bakery, dairy, and snack applications. This cost-driven substitution challenges microbial hydrocolloid suppliers to justify premium pricing through performance advantages like stability under extreme processing or cleaner production methods. The issue becomes sharper during commodity price fluctuations, where procurement teams prioritize budget protection over technical superiority. As economic pressures deepen, competitive displacement from low-cost gums continues to slow expansion for higher-value microbial ingredients.

A new wave of formulation priorities is creating a clear opening for innovators as industries accelerate the shift toward natural, fermentation-derived ingredients in the microbial source hydrocolloids market. Brands seeking cleaner labels and traceable production are fueling rapid interest in bioengineered gums that offer consistent quality and minimal environmental impact. This momentum gives startups room to introduce precision-fermented variants with tailored viscosity, thermal stability, or gelling behavior suited to next-generation foods, beverages, and personal care products. Established players are expanding pilot-scale fermentation lines and investing in proprietary strains that enhance yield efficiency. As sustainability expectations intensify across global supply chains, companies capable of delivering high-performance, biotech-driven hydrocolloids stand to gain long-term commercial advantage and premium partnerships.

Xanthan Gum holds approx. 76% market share as of 2025, underscoring its position as the most widely adopted microbial hydrocolloid across food, beverage, pharmaceutical, and industrial applications. Its strong emulsification, stability under extreme pH, and ability to maintain viscosity during heat processing keep it indispensable for formulators seeking consistent performance at scale. Gellan Gum is gaining ground in premium beverages and plant-based dairy for its clean mouthfeel and gel strength, yet its adoption remains application-specific. Curdlan attracts interest in processed foods that require heat-induced gelation, particularly in Asian markets, but remains smaller in commercial volume. Dextran finds niche traction in pharmaceuticals and biotech processes where controlled viscosity and biocompatibility are essential.

Cosmetics & personal care is projected to grow at a CAGR of 7.3% during the forecast period, and this momentum reflects how fast brands are pivoting toward safer, bio-derived hydrocolloids for texture, stability, and sensorial enhancement. As consumers prioritize skin-friendly formulations, microbial hydrocolloids are gaining traction for their clean rheology, moisturizing benefits, and compatibility with natural actives. Companies are reformulating creams, gels, and serums to replace synthetic thickeners with fermentation-based alternatives that offer smoother spreadability and improved suspension of botanical ingredients. Growth is further reinforced by rising demand for sulfate-free shampoos, lightweight lotions, and high-functionality makeup bases. With beauty brands scaling innovation in green chemistry and microbiome-friendly formulations, hydrocolloids are becoming central to next-generation cosmetic product development.

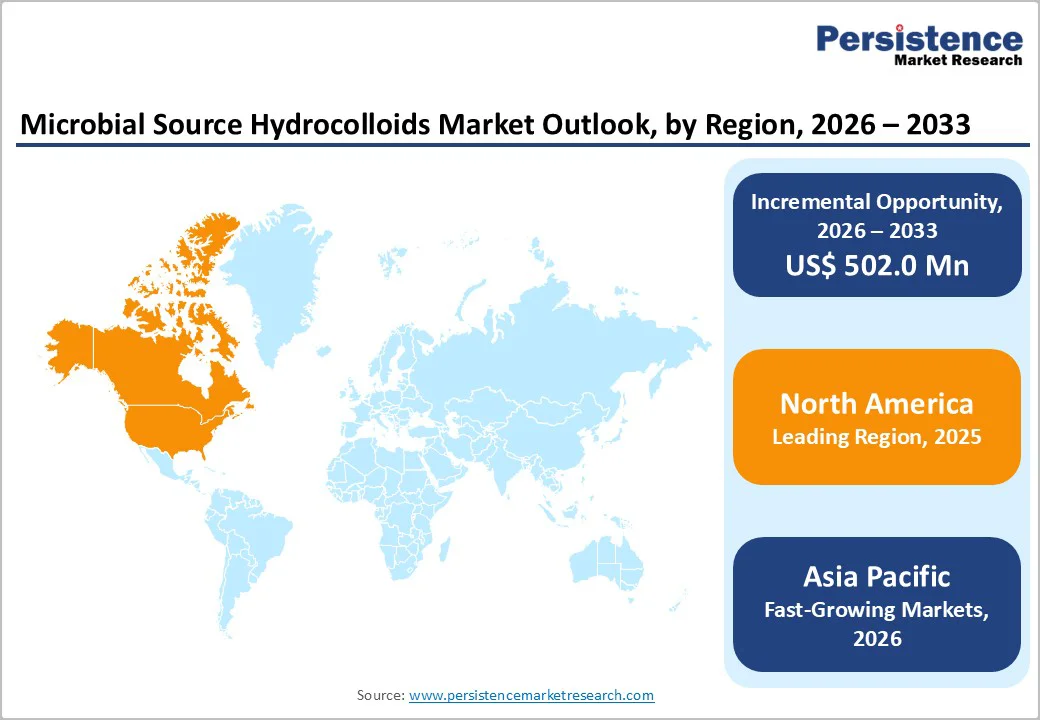

North America holds approximately 36% share in the global microbial source hydrocolloids market. The U.S. is witnessing a shift toward fermentation-driven texturizers in clean-label bakery, dairy alternatives, and premium beverages as brands tighten control over ingredient transparency and stability performance. Canada is moving toward hydrocolloids with stronger sustainability credentials as processors prioritize reduced-waste fermentation inputs and low-energy production routes. Across the region, formulators are leaning into precision fermentation to secure consistent viscosity profiles, enhance freeze-thaw resilience, and diversify away from crop-dependent gums vulnerable to climate shifts. The rise of specialized hydrocolloids for plant-forward foods is accelerating partnerships between biotech labs and large-scale food manufacturers.

Asia Pacific Microbial Source Hydrocolloids Market is expected to grow at a CAGR of 7.4%, driven by a region where scaling capacity, evolving dietary patterns, and aggressive food-tech investments are reshaping ingredient choices at speed. China is pushing rapid adoption of fermentation-derived thickeners as major processors optimize cost stability amid volatile agricultural gum supplies. India is expanding the use of microbial hydrocolloids in value-added dairy, frozen snacks, and nutraceutical beverages as formulators chase consistent texture across varied climates. Japan is advancing high-purity, specialty hydrocolloids for premium confectionery and functional foods driven by strict quality expectations. South Korea is accelerating demand for fermentation-based stabilizers as K-food exporters seek ingredients that enhance shelf stability for global logistics.

The market landscape remains moderately consolidated, shaped by a handful of large fermentation specialists expanding capabilities while agile regional producers compete through niche innovations. Leading companies are accelerating product development around cleaner textures, improved solubility, and thermo-stable hydrocolloids tailored for plant-based, low-sugar, and high-protein formulations. B2B expansion is intensifying as suppliers build deeper partnerships with food, personal care, and biopharma manufacturers to secure long-term ingredient pipelines. Collaborations with biotech labs and universities are rising to advance strain engineering and precision fermentation. Acquisitions and mergers are focused on securing fermentation assets and microbial culture IP. R&D spending is increasing as players respond to evolving regulatory guidance on processing aids, contaminant limits, and labeling transparency across major regions.

The global microbial source hydrocolloids market is projected to be valued at US$ 940.7 Mn in 2026.

The expanding consumption of ready-to-eat and convenience foods is boosting the need for advanced texture enhancers, fueling growth in the global microbial source hydrocolloids market.

The global Microbial Source Hydrocolloids market is poised to witness a CAGR of 6.3% between 2026 and 2033.

The accelerating move toward natural, fermentation-driven ingredients is opening a strong pathway for innovation, creating significant growth prospects for forward-looking industry players.

Major players in the global Microbial Source Hydrocolloids market include J.M. Huber Corporation, Tate & Lyle, Ingredion, IFF, Cargill, Incorporated, ADM, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author