ID: PMRREP31927| 201 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

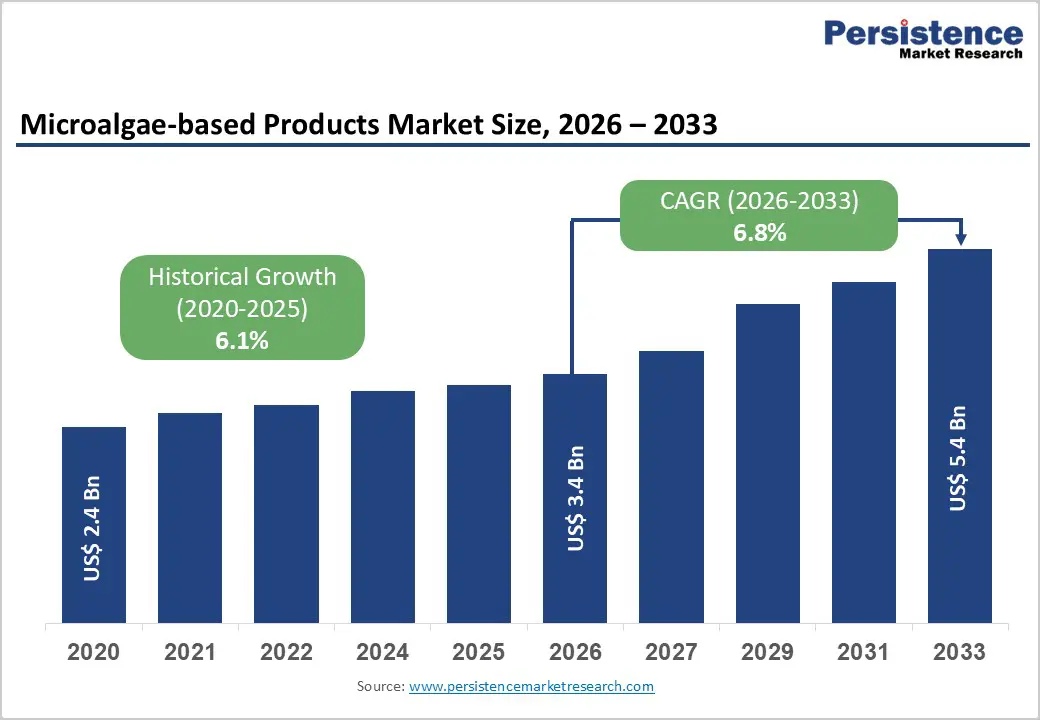

The global Microalgae-based Products market size is expected to be valued at US$ 3.4 billion in 2026 and projected to reach US$ 5.4 billion by 2033, growing at a CAGR of 6.8% between 2026 and 2033

The market for microalgae-based products is fundamentally driven by a global structural shift toward sustainable, plant-derived nutritional solutions and the intensifying demand for high-value bioactive compounds in the nutraceutical and functional food sectors. As consumers prioritize long-term wellness and environmental stewardship, microalgae have emerged as a premier source of high-purity Omega-3 fatty acids, proteins, and powerful antioxidants such as Astaxanthin and Lutein. Furthermore, the increasing industrial adoption of microalgae biomass in animal feed and aquaculture as an alternative to traditional fishmeal is significantly expanding the addressable market, supported by advancements in large-scale cultivation technologies like photobioreactors and open pond systems.

| Global Market Attributes | Key Insights |

|---|---|

| Global Microalgae-based Products Market Size (2026E) | US$ 3.4 Bn |

| Market Value Forecast (2033F) | US$ 5.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.1% |

The primary driver of the global Microalgae-based Products Market is the accelerating consumer preference for clean-label, natural, and sustainable ingredients across the food and supplement industries. Microalgae, characterized by their rapid growth cycles and high photosynthetic efficiency, require significantly less land and fresh water compared to conventional terrestrial agriculture. According to the Food and Agriculture Organization (FAO), the global demand for sustainable protein sources is expected to rise as the world population approaches 10 billion by 2050. Microalgae such as Spirulina and Chlorella provide a complete amino acid profile, making them highly attractive to the surging vegan and vegetarian demographics. This trend is further bolstered by organizations like the European Food Safety Authority (EFSA), which has authorized various algal strains as safe for human consumption, thereby facilitating market entry for innovative functional products.

A significant barrier to the widespread commercialization of microalgae-based products remains the substantial capital and operational expenditure required for high-tech cultivation systems. While open pond systems are more cost-effective, they are highly susceptible to environmental contamination and offer limited control over growth parameters. Conversely, advanced photobioreactors (PBRs) provide superior control and higher biomass yields but involve immense upfront infrastructure costs and energy-intensive maintenance. The cost of harvesting—which often involves centrifugation or filtration can account for up to 30% of the total production cost due to the microscopic size of the cells and low culture density. These financial hurdles often restrict the entry of small and medium-sized enterprises (SMEs), leading to a market dominated by large, vertically integrated corporations with the capacity to absorb long-term research and development costs.

The burgeoning field of algal biotechnology offers immense potential in the development of novel pharmaceutical drugs and clinical nutrition products. Microalgae serve as "biological cell factories" capable of producing rare therapeutic proteins, antimicrobials, and anti-inflammatory agents that are difficult to synthesize chemically. Ongoing clinical trials are exploring the efficacy of algal-derived pigments in inhibiting cancer cell growth and managing metabolic syndrome. Furthermore, the demand for specialized clinical nutrition—such as enteral feeding formulas fortified with algal DHA for infant development or geriatric support—represents a high-margin opportunity. Companies that successfully secure clinical validation for these "medical-grade" algal compounds can differentiate themselves from the crowded retail supplement market, capturing significant value through patent-protected innovative therapies and exclusive partnerships with healthcare providers.

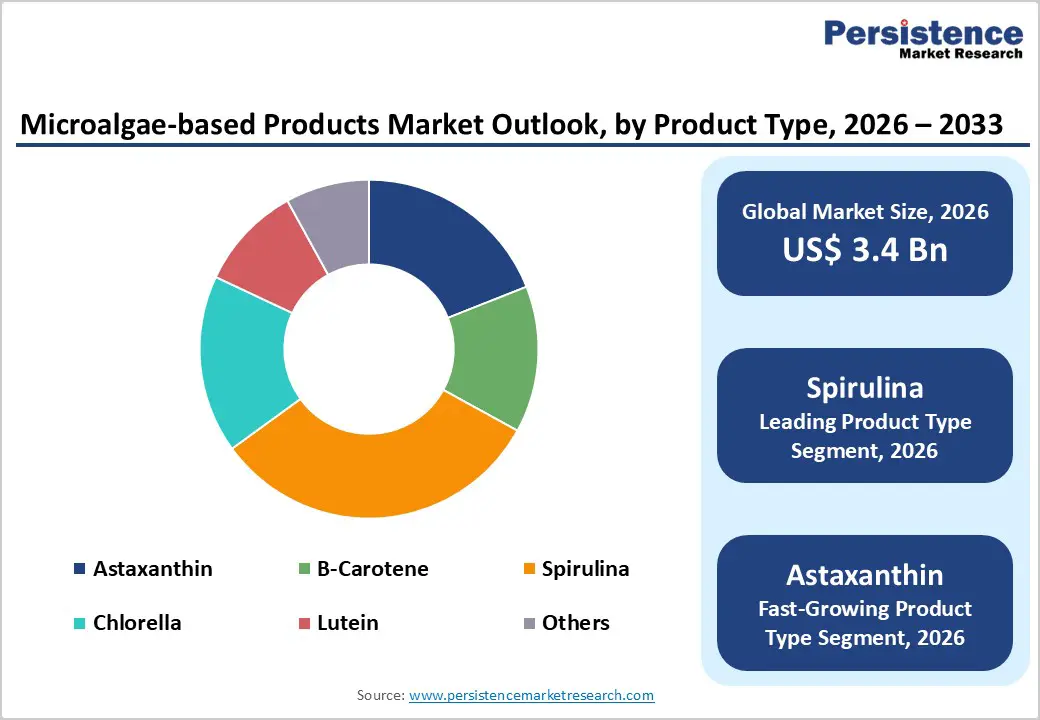

The Spirulina segment currently holds the leading position in the Microalgae-based Products Market, accounting for a dominant 32% market share in 2025. This leadership is attributed to its long history of safe use, well-established large-scale production facilities globally, and its status as a "superfood" with exceptional protein content (up to 70% of dry weight). Spirulina is widely utilized in dietary supplements, functional beverages, and natural food colorants (phycocyanin). Conversely, Astaxanthin is identified as the fastest-growing segment, projected to record a significant CAGR between 2025 and 2032. This rapid growth is driven by its skyrocketing popularity as a premium ingredient in anti-aging skincare and high-performance sports supplements. Advances in the cultivation of Haematococcus pluvialis are enabling higher concentrations and more cost-effective production, making Astaxanthin more accessible for a wider range of mass-market personal care and wellness applications.

The Dietary Supplement & Pharmaceutical segment is the leading end-use category, capturing approximately 38% of the total market share in 2025. This dominance is fueled by the widespread global adoption of daily vitamins and the increasing medical recognition of the benefits of algal pigments and fatty acids in managing systemic inflammation and metabolic health. The high concentration of bioactive compounds in microalgae makes them ideal for high-potency formulations. However, the Food & Beverage segment is recognized as a high-growth area, as mainstream food manufacturers integrate algal biomass into products ranging from protein bars and smoothies to gourmet plant-based seafood alternatives. The demand for natural food colors like Spirulina-blue and B-Carotene-orange to replace synthetic dyes is a major driver within this segment, aligning with the "naturality" trend in global consumer goods.

North America holds a significant share of the global landscape, characterized by a highly mature nutraceutical industry and a robust innovation ecosystem. The United States is the regional leader, home to pioneering companies such as Cyanotech Corporation and Earthrise Nutritionals, which have operated large-scale algal farms in Hawaii and California for decades. A key trend in this region is the aggressive integration of algal Omega-3 into prenatal and pediatric vitamins, as well as the rising use of Astaxanthin in high-end cosmetic serums marketed for UV-protection and skin repair.

The regulatory framework in the U.S., governed by the FDA, has recently seen an increase in GRAS notifications for various algal extracts, facilitating faster commercialization of innovative functional foods. Furthermore, substantial government and private investment in algal biotechnology research focused on both human nutrition and sustainable aviation fuels is fostering technological breakthroughs in strain optimization and harvesting efficiency. The region's consumers are among the most health-conscious globally, with a high willingness to pay premiums for organic-certified and sustainably sourced algal products, ensuring continued market strength through 2033.

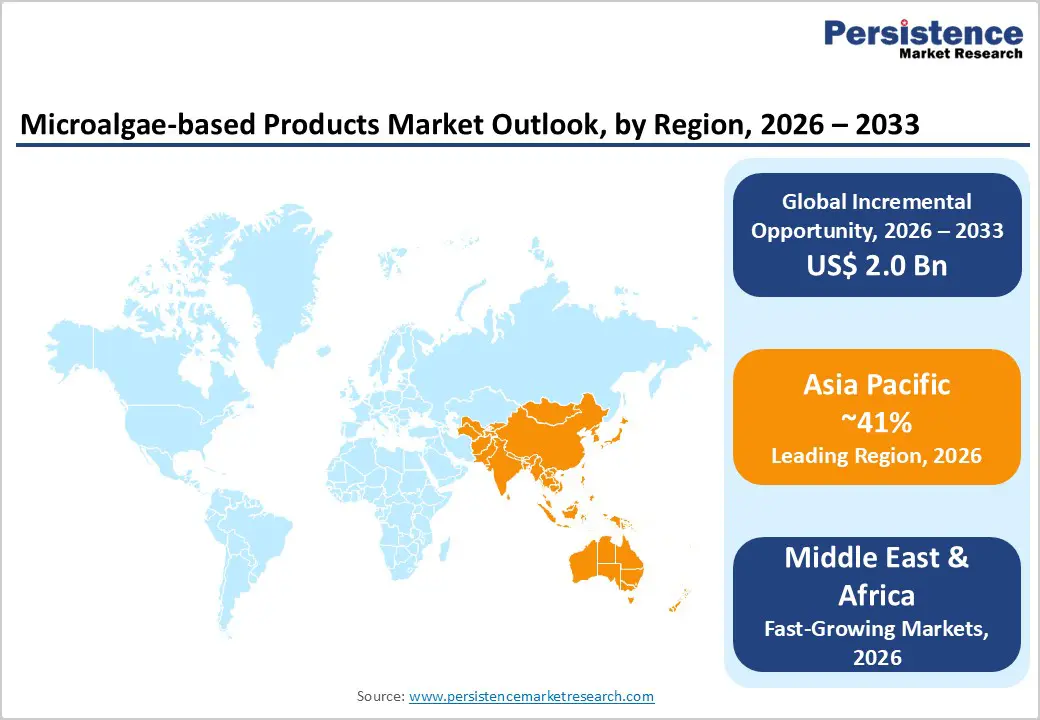

The Middle East & Africa Microalgae-based Products Market is expected to grow at a CAGR of 7.9%, supported by increasing interest in climate-resilient nutrition, sustainable feed inputs, and domestic bioresource development. In the GCC, governments and private investors are advancing controlled-environmental cultivation using desalination by-products and solar energy, positioning microalgae as a strategic solution for food security, aquaculture pigments, and nutraceutical ingredients under extreme climate conditions.

In Egypt, expanding aquaculture production along the Nile Delta is driving demand for microalgae-derived astaxanthin and spirulina to improve fish health and coloration while reducing reliance on imports. Across Sub-Saharan Africa, pilot-scale algae projects are gaining momentum in animal feed, biofertilizers, and dietary supplements, supported by low-cost cultivation potential and rising awareness of protein diversification. The region is gradually moving from experimental initiatives toward commercially viable algae value chains.

The Microalgae-based Products Market is characterized by a high degree of fragmentation at the primary cultivation level, balanced by moderate consolidation among the large industrial processors and pigment extractors. Dominant global players such as DSM N.V, DIC Corporation, and Cyanotech Corporation maintain their leadership through extensive vertical integration controlling the supply chain from strain selection to finished dosage forms. These market leaders employ aggressive strategies centered on Research and Development (R&D) to optimize downstream processing and achieve proprietary stabilization techniques for sensitive pigments like Astaxanthin.

Emerging business models are increasingly focused on "Circular Bioeconomy" principles, where companies like Corbion and Algatechnologies Ltd. utilize industrial side-streams as nutrient sources for algal growth. Key differentiators employed by market leaders include the attainment of third-party certifications (such as USP, NSF, and Organic), which are critical for securing high-value contracts in the pharmaceutical and infant nutrition sectors. The competitive intensity is expected to rise as traditional food ingredient giants and petrochemical firms (exploring algal biofuels) enter the high-value nutritional space to diversify their sustainability portfolios.

The global market size is expected to reach approximately US$ 3.4 billion in 2026, growing steadily from its historical base as demand for plant-based nutrition intensifies.

The demand is primarily driven by the rising consumer focus on sustainable protein sources and the powerful antioxidant health benefits of algal compounds like Astaxanthin and Omega-3.

Asia Pacific is the leading region, holding a 41% market share in 2025, primarily due to the massive cultivation capacities of China and high consumption in Japan.

Significant opportunities lie in developing high-value pharmaceutical treatments and providing sustainable aquafeed alternatives for the rapidly expanding global aquaculture industry.

Major players include Cyanotech Corporation, DSM N.V, DIC Corporation, EID Parry (India) Ltd, and Corbion Group Netherlands B.V, and others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author