ID: PMRREP33543| 200 Pages | 26 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

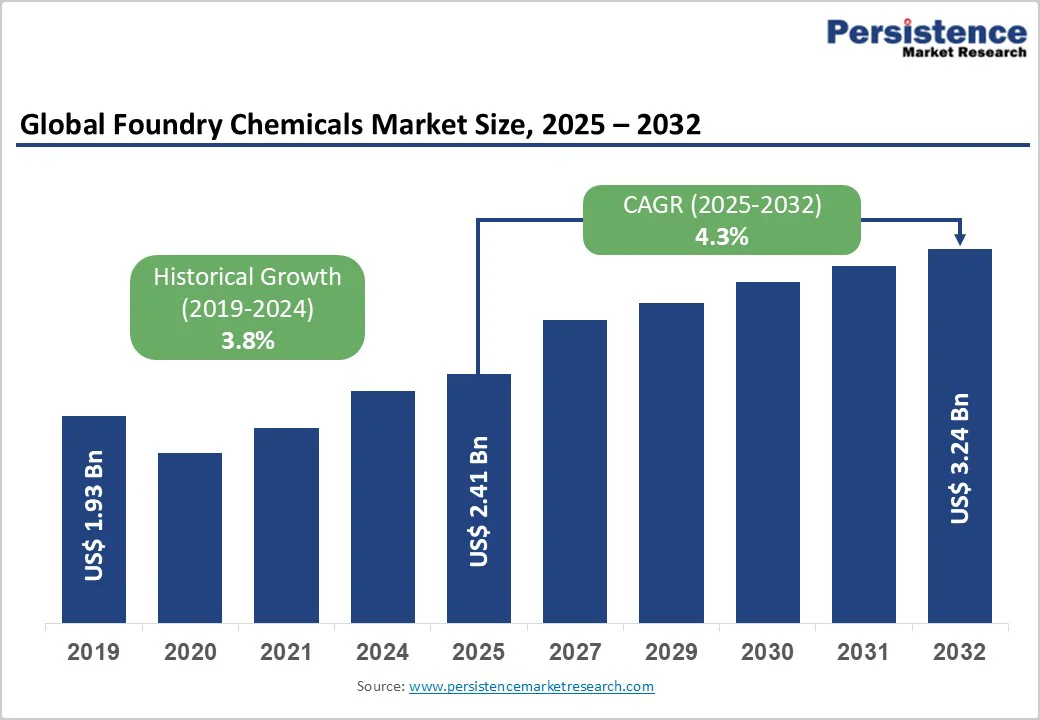

The global foundry chemicals market size is valued at US$2.41 billion in 2025 and is projected to reach US$3.24 billion, growing at a CAGR of 4.3% between 2025 and 2032. The primary drivers include surging demand from the automotive and construction sectors for high-quality castings, alongside advancements in eco-friendly chemical formulations that enhance casting efficiency and reduce emissions.

| Key Insights | Details |

|---|---|

|

Foundry Chemicals Market Size (2025E) |

US$2.41 Bn |

|

Market Value Forecast (2032F) |

US$3.24 Bn |

|

Projected Growth CAGR (2025-2032) |

4.3% |

|

Historical Market Growth (2019-2024) |

3.8% |

The expansion of the automotive industry is significantly driving growth in the Foundry Chemicals Market. Vehicles require complex cast metal parts, such as engine blocks and transmission housings. With global vehicle production projected to exceed 90 million units by 2027, foundries are relying on advanced binders and coatings to create precise, durable castings that meet the stringent lightweighting requirements for electric vehicles.

According to the U.S. Bureau of Economic Analysis, the seasonally adjusted annual vehicle production rate is expected to exceed 1.5 million units by 2025. The paints and coatings market is also growing, helping meet surface-finishing needs in foundry operations. This increased demand is reflected in the integration of specialty chemicals that can reduce defects by up to 30%, thereby enhancing production efficiency and supporting the industry's shift toward sustainable mobility solutions.

Global infrastructure growth increases demand for strong foundry chemicals used in manufacturing pipes, fittings, and structural parts vital for urban development. Construction investments have surged, with worldwide spending expected to reach $15 trillion by 2030. This trend encourages foundries to adopt high-performance auxiliaries and release agents to produce corrosion-resistant castings. Initiatives like India's Production Linked Incentive (PLI) programs have allocated over US$19.3 billion across various industries, directly fostering the expansion of domestic foundry capacities and chemical use. India's foundry sector, the second-largest globally with a predicted output of 12 million tons of castings in 2024, illustrates this growth, with more than 4,500 foundries employing over 500,000 workers both directly and indirectly.

Statistics from industry associations indicate that these chemicals improve casting yield by 25%, reducing waste and costs in large-scale projects like bridges and buildings. This growth is further bolstered by the Paints and Coatings Market's parallel evolution, where similar chemical innovations enhance surface treatments for long-lasting infrastructure durability.

Regulatory pressures pose a major barrier to the foundry chemicals market, as governments enforce limits on volatile organic compounds and hazardous emissions from traditional binders and coatings. In the European Union, the REACH framework has mandated reductions in phenolic resin usage, increasing compliance costs by an estimated 15-20% for manufacturers and slowing adoption in smaller foundries.

The European Union also introduced comprehensive Best Available Techniques (BAT) conclusions in December 2024, establishing stringent emission limits for approximately 1,000 ferrous and non-ferrous foundries across member states, with existing installations required to achieve full compliance within four years. These regulations mandate the substitution of traditional chemical binders with low-emission or formaldehyde-free alternatives, compelling manufacturers like BASF and ASK Chemicals to reformulate product portfolios at considerable research and development expense. Such rules have led to operational disruptions, with some facilities facing fines exceeding €100,000 for non-compliance, ultimately hindering innovation and market penetration in eco-sensitive regions.

Fluctuating prices of petrochemicals and minerals vital for foundry chemicals disrupt supply chains and increase production costs. For instance, in 2024, costs for bentonite and resin rose by over 20% due to geopolitical tensions, squeezing suppliers' margins and hindering R&D investments. This instability has led to project delays and lower output in cost-sensitive markets, limiting overall market growth as end-users look for cheaper options.

According to the American Foundry Society, foundry operating costs soared during 2021-2022 amid historic inflation in the US, but recent data shows the producer price index for foundry industries has cooled to 2.2% for 2023-2024. Small foundry chemical producers without vertical integration face particular challenges in absorbing input cost increases while staying competitive.

The push for sustainable practices opens avenues for market players to innovate low-emission binders and biodegradable additives, capitalizing on regulatory incentives like tax credits under the U.S. Inflation Reduction Act. With the global emphasis on green manufacturing, demand for these chemicals is expected to grow by 6% annually, as seen in recent pilots reducing VOC emissions by 50% without compromising casting quality.

Companies can target the expanding Foundry Services Market, where eco-chemicals enhance service efficiency for automotive and machinery clients, fostering long-term contracts and revenue streams in environmentally conscious regions. Industry leaders, including ASK Chemicals, launched advanced low-emission phenolic urethane no-bake binder systems in late 2023, specifically designed to reduce harmful emissions during casting processes while enhancing mold strength and dimensional accuracy. Similarly, Hüttenes-Albertus announced strategic investments in research and development for inorganic binder technologies in early 2024, focusing on silicate-based systems for aluminum casting applications that eliminate volatile organic compound emissions.

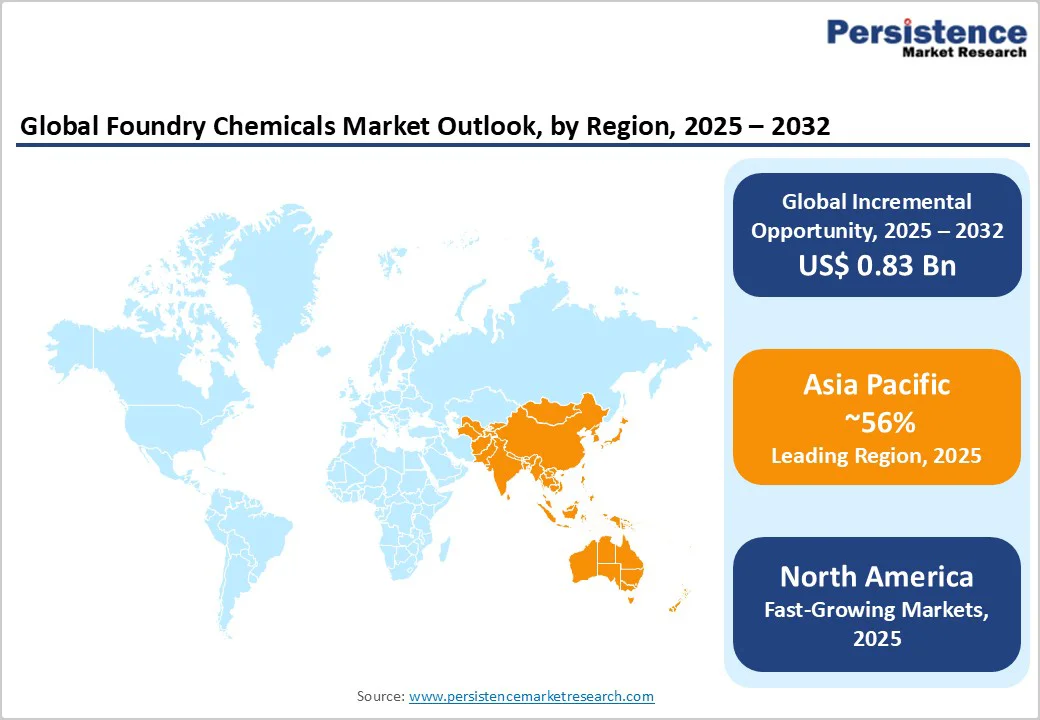

Rapid industrialization in the Asia Pacific presents opportunities for suppliers to penetrate high-growth foundries through localized production of auxiliaries and coatings. India's manufacturing sector is projected to add $500 billion in output by 2025, driven by policies like Make in India, creating demand for chemicals that support non-ferrous castings in electronics and renewables.

Vesuvius strategically acquired the Molten Metal Systems business from Morgan Advanced Materials in August 2025 for £92.7 million, specifically to enhance its non-ferrous market presence and expand manufacturing capabilities in the rapidly growing Indian market.

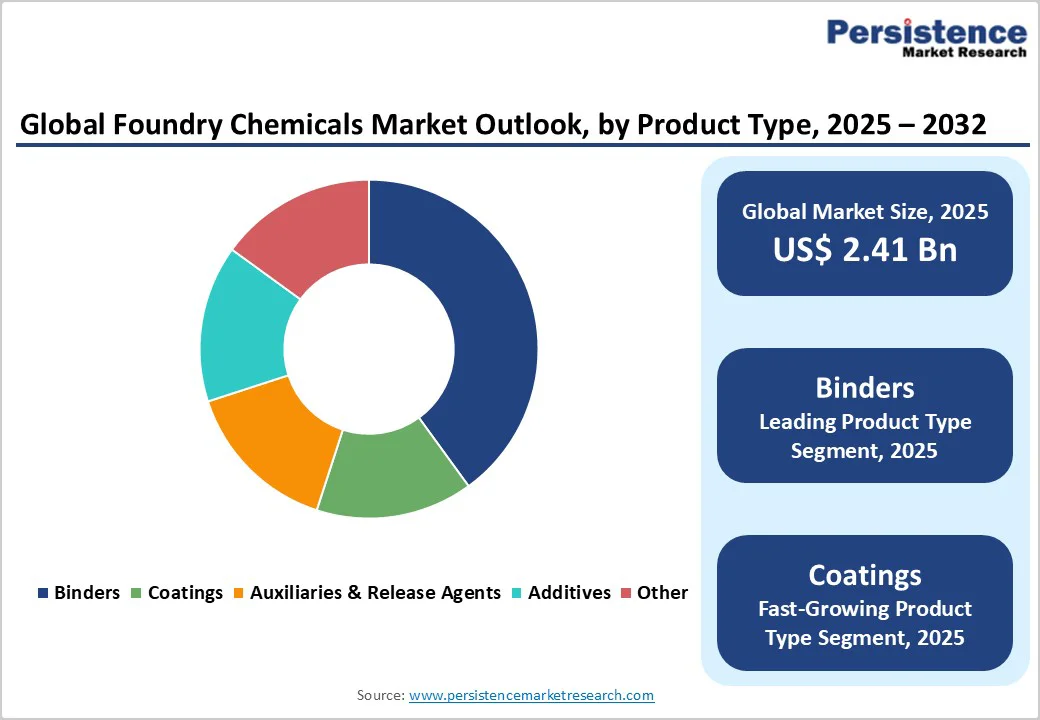

Binders hold about 40% of the market share in the foundry chemicals sector, mainly because they are essential for creating stable molds and cores for metal casting. Their leadership is due to their excellent adhesion and heat resistance, which helps lower defects in large-scale production. For instance, phenolic urethane binders have boosted casting yields by 35% in iron foundries, as industry data shows.

The segment's significance is also growing with ongoing R&D into water-based options, supporting sustainability and consistent performance across various uses. Forace Polymers, India's top foundry resins and coatings producer, offers a wide range of binders for advanced automotive, material handling, railway, and earthmoving sectors, producing large quantities annually. Innovations in cold box binders, no-bake systems, and gas-cured formulas help foundries increase production speed, cut emissions, and improve surface finishing quality.

The Steel and Alloy segment leads the foundry type category, capturing around 50% of the market due to its widespread use in heavy-duty components for machinery and vehicles. According to the World Steel Association, the global crude steel production was 1,882.6 Mt in 2024, with China capturing more than 50% market share. Following China, India produced 150 Mt, and Japan produced 84 Mt in 2024.

The foundry services market evolution toward integrated manufacturing solutions reinforces chemical demand across ferrous casting operations requiring precision tolerances and defect-free surface quality. Steel and alloy foundries serving power generation, oil and gas infrastructure, and mining equipment sectors consume substantial volumes of specialty coatings and release agents designed for extreme operating conditions and complex geometries require consistent chemical performance throughout extended production runs.

The Automotive sector dominates the Industry category with approximately 45% share, driven by the need for precise engine and chassis parts amid increasing vehicle electrification. This segment benefits from chemicals that support lightweight aluminum castings, reducing vehicle weight by up to 15% and enhancing fuel efficiency in line with automotive standards. This is justified by the sector's large scale, with over 40% of global castings used in automotive applications, supported by innovations in coatings that improve corrosion resistance in EV batteries.

Global automakers are under growing pressure to meet strict emission regulations, such as the Corporate Average Fuel Economy standards outlined by the National Highway Traffic Safety Administration, which requires passenger vehicles to reach 54.5 miles per gallon by 2025. This drives strong demand for lightweight aluminum castings, which require specialized foundry chemical formulations. According to the U.S. Bureau of Labor Statistics, automotive manufacturing employed 47.7 thousand workers in Michigan alone as of August 2025, illustrating the sector's ongoing manufacturing activity despite the shift toward electrification.

North America drives the foundry chemicals market, with the U.S. at the forefront due to a strong innovation ecosystem in automotive and aerospace foundries. The American Foundry Society reported a 3% shipment increase in 2024, despite economic challenges. In 2024, the Society also secured a $4 million federal appropriation for aluminum casting research, highlighting the government's commitment to enhancing domestic competitiveness and technological innovation. This investment supports the development of advanced binder systems and digitalization initiatives across its 1,075 corporate members.

Regulatory frameworks such as the EPA's Clean Air Act are driving investments in green chemicals to meet sustainability goals. Additionally, tax relief legislation passed in July 2025 is encouraging capital investment in foundry modernization. Market players like Vesuvius plan to invest in a new North American facility to meet 75% of regional demand while boosting production efficiency and sustainability.

Europe's Foundry Chemicals Market demonstrates resilience through harmonized regulations across Germany, the U.K., France, and Spain, emphasizing low-VOC formulations to meet EU REACH standards. The EU’s Best Available Techniques (BAT) conclusion, implemented in December 2024, mandates dramatic reductions in air and water emissions while promoting circular economy objectives through enhanced energy efficiency, raw material substitution, and waste minimization.

Germany's automotive prowess contributes significantly, with foundry output supporting 25 million vehicles annually and driving demand for eco-coatings that cut emissions by 40%. Germany's engineering sector, contributing to 20% of global machine tools, relies on advanced coatings for alloy castings. Recent developments include France's investments in circular economy initiatives for chemical recycling in steel foundries. Regulatory harmonization fosters cross-border innovation, ensuring compliance while boosting efficiency in a mature market.

Asia Pacific exhibits dynamic growth in the Foundry Chemicals Market, led by China, Japan, India, and ASEAN nations, leveraging manufacturing advantages like low costs and skilled labor. China's dominance is underscored by its policies, such as the 14th Five-Year Plan, promoting advanced chemicals for high-speed rail castings, achieving 5% annual volume growth.

India's position as the world's second-largest casting producer with 12 million tons of annual output in 2024 demonstrates the region's manufacturing momentum supported by over 4,500 foundries and substantial direct employment. Government initiatives, including Make in India and Production Linked Incentive schemes, provide tax benefits and subsidies encouraging foundry modernization, clean energy adoption, and digitalization practices that drive advanced chemical consumption. Japan's precision focus enhances additive adoption, capitalizing on export-oriented foundries for automotive parts.

The global foundry chemicals market is moderately consolidated, with a handful of global leaders controlling more than half of the market share through integrated R&D and distribution networks. Companies pursue expansion via acquisitions and joint ventures, such as recent non-ferrous segment entries, while investing 5-7% of revenues in sustainable formulations to differentiate on eco-performance. Key strategies include localized production in Asia to cut logistics costs and digital tools for process optimization. Emerging models emphasize circular economy approaches, recycling chemical waste to reduce environmental impact, and appeal to green-focused clients.

ASK Chemicals (Hilden, Germany): A leader in binders and coatings, ASK commands influence through its global footprint and R&D focus on low-emission products, serving automotive giants with customized solutions that reduce defects by 25%. Its 2025 volume growth underscores portfolio strength in sustainable innovations.

Vesuvius (London, U.K.): Dominant in foundry fluxes and refractories, Vesuvius excels in revenue from steel and non-ferrous segments, leveraging acquisitions like Morganite to expand in the high-growth India market. Maturity in compliance-driven technologies positions it for 20% new product sales ratio.

Hüttenes-Albertus International (Düsseldorf, Germany): Renowned for resin binders, this firm influences via technical expertise in core-making, with strong automotive ties yielding high-strength formulations. Its emphasis on digital integration enhances efficiency, solidifying market maturity and client loyalty.

The foundry chemicals market is valued at US$2.41 Bn in 2025 and expected to reach US$3.24 Bn by 2032, reflecting steady growth.

Key drivers include automotive production surges and infrastructure investments, boosting the need for precision castings and efficient chemicals.

Binders lead with a 40% share, essential for mold stability in metal casting processes across industries.

Asia Pacific leads, driven by China's manufacturing scale and India's emerging foundry expansions.

Developing eco-friendly formulations offers potential, aligning with global sustainability regulations for low-emission products.

Leading players include ASK Chemicals, Vesuvius, and Hüttenes-Albertus International, known for innovative binders and global reach.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Foundry Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author