ID: PMRREP30827| 191 Pages | 29 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

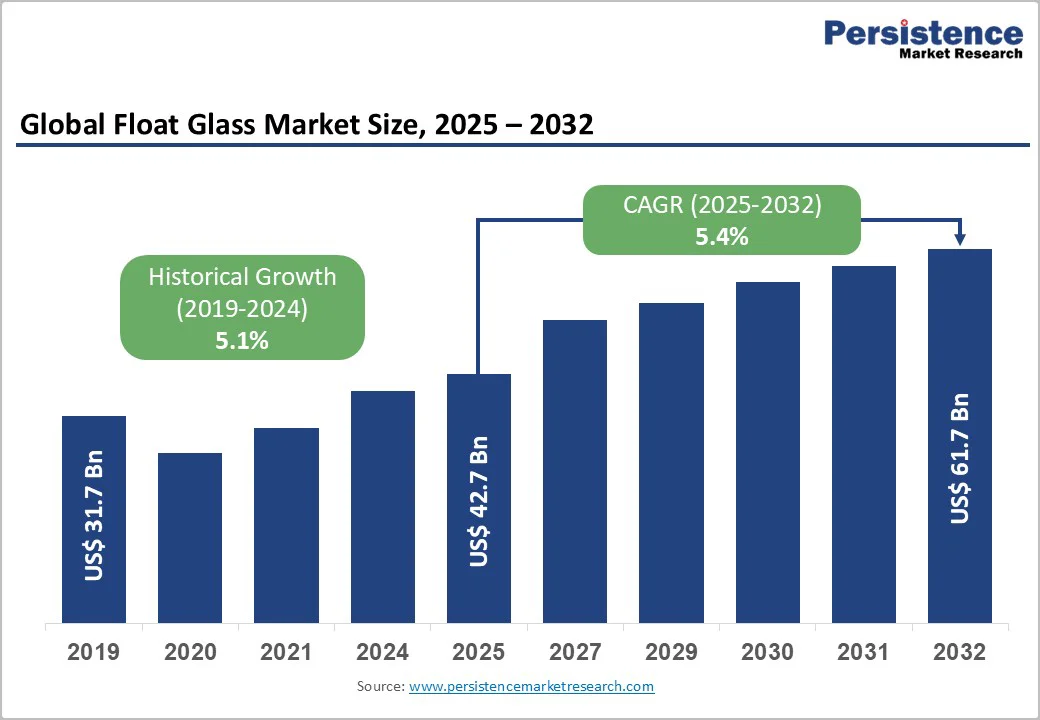

The global float glass market size was valued at US$42.7 Billion in 2025 and is projected to reach US$61.7 Billion by 2032, growing at a CAGR of 5.4% between 2025 and 2032, driven by rapid urbanization and infrastructure development in emerging economies, increasing demand for energy-efficient building materials, and the expanding automotive industry’s adoption of advanced glazing solutions. Advancements in smart glass and low-emissivity coatings, increasing focus on sustainable construction, and expanding use in solar energy systems that demand high-performance glass substrates for maximum energy conversion efficiency will also drive market growth.

| Key Insights | Details |

|---|---|

|

Float Glass Market Size (2025E) |

US$42.7 Bn |

|

Market Value Forecast (2032F) |

US$61.7 Bn |

|

Projected Growth CAGR(2025-2032) |

5.4% |

|

Historical Market Growth (2019-2024) |

5.1% |

The rapid urbanization in emerging economies, especially in Asia Pacific, is driving strong demand for float glass through large-scale construction and infrastructure projects. India’s urban population is projected to reach 600 million by 2036, requiring US$840 Billion in infrastructure investment, while China’s construction sector is set to invest US$4.2 Trillion during 2021–2025, focusing on energy-efficient and green buildings. This growth fuels demand for specialized glass solutions for facades, curtain walls, and energy-efficient glazing. Urban initiatives such as smart cities, airports, metro systems, and commercial complexes are further boosting the need for high-performance float glass products that meet architectural and sustainability standards.

The global construction industry’s focus on sustainability and energy efficiency is driving strong demand for advanced float glass with superior thermal performance. EU directives targeting 25% thermal improvement by 2025, along with LEED, BREEAM, and Energy Star certifications, are boosting the adoption of low-emissivity and solar control glass. With buildings consuming nearly 40% of total energy in the U.S., high-performance glazing can cut heating and cooling costs by up to 30%. Government policies promoting green and net-zero energy buildings, combined with innovations in double- and triple-glazed, smart, and photovoltaic-integrated glass, are creating significant opportunities for multifunctional, energy-efficient float glass solutions.

Float glass manufacturing is highly energy-intensive, with furnace operations above 1,500°C accounting for 60-70% of production costs. Natural gas price volatility has raised costs 15-20% annually since 2020, notably affecting European producers during the Russia-Ukraine crisis. Specialized equipment, skilled labor, and strict quality controls limit new entrants and production scalability, while fluctuating raw material prices for soda ash, silica, and limestone further pressure margins in a competitive market.

The float glass industry faces growing competition from alternatives such as polycarbonate, acrylic, and laminated plastics, which offer similar optical properties with lower weight and cost. Polymer-based glazing is favored for impact resistance, lighter automotive use, and easier installation, reducing labor expenses. Traditional plate and rolled glass also compete in price-sensitive segments, creating pricing pressure and limiting float glass adoption, especially in regions with established supply chains and less stringent architectural quality requirements.

The global automotive shift toward EVs, autonomous vehicles, and premium comfort features is driving demand for advanced float glass applications. Manufacturers are integrating larger glass surfaces, panoramic sunroofs, and smart glass technologies to enhance aesthetics and passenger experience. EVs specifically require lightweight, thermally insulating glazing to protect battery life and extend range. According to OICA, global vehicle production is expected to reach 35 million units by 2025, with China leading. The smart glass segment is projected to grow at a 19% CAGR through 2032, fueled by consumer demand for privacy, glare control, and energy-efficient, value-added glass solutions.

The global shift toward renewable energy is driving strong demand for specialized float glass in solar panels and photovoltaic systems. Solar applications require ultra-clear, low-iron glass with light transmittance above 91% to maximize energy conversion, representing a high-value segment. According to the IEA, solar installations doubled between 2016 and 2018, with continued growth projected through 2032. China, producing over 70% of global solar panels, drives regional demand for high-performance solar glass. Government incentives, including tax credits and net-zero commitments, along with emerging BIPV and agrovoltaics applications, are further expanding the market for multifunctional, energy-efficient float glass solutions.

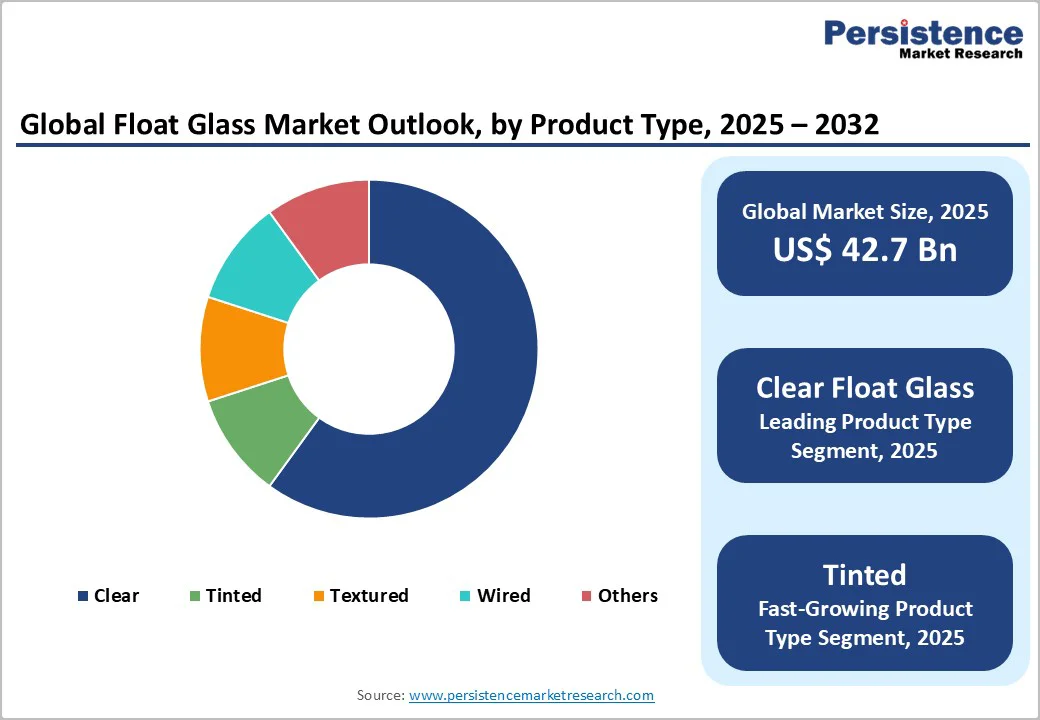

Product Type Insights

Clear float glass dominates the market with a 60% market share in 2025, primarily due to its versatility, superior optical clarity, and widespread applicability across diverse end-use segments, including construction, automotive, and electronics applications. This leadership position stems from clear glass’s fundamental role as the base material for numerous secondary processing applications, including tempering, laminating, coating, and insulated glass unit manufacturing.

The segment benefits from float glass’s inherent properties, including 87% light transmittance, uniform thickness ranging from 0.4mm to 25mm, and exceptional optical consistency that makes it ideal for applications requiring distortion-free vision. Clear float glass demonstrates superior performance in architectural applications where maximum natural light penetration is desired, contributing to energy efficiency through reduced artificial lighting requirements and improved occupant comfort.

Manufacturing innovations have enhanced production efficiency and quality control, enabling consistent delivery of high-performance clear glass products that meet stringent architectural and automotive specifications. However, tinted float glass is gaining increasing interest driven by growing emphasis on green building practices and energy efficiency requirements that favor solar control properties and glare reduction capabilities in commercial and residential construction projects.

Application Insights

The building & construction segment maintains its position as the largest application area for float glass, driven by sustained global construction activity and increasing emphasis on energy-efficient building practices across residential, commercial, and institutional projects. This dominance reflects float glass’s essential role in modern architecture through applications including windows, doors, facades, curtain walls, skylights, and interior partitions that provide both functional and aesthetic benefits.

The segment benefits from strong regulatory support through updated building codes mandating improved thermal performance, with many jurisdictions requiring R-values ranging from R-20 to R-60, depending on climate zones and building types. Green building certifications such as LEED, BREEAM, and Energy Star increasingly specify high-performance glazing solutions that contribute to overall building sustainability goals and energy efficiency targets. However, Automotive & Transportation applications are gaining significant momentum, reflecting the industry’s evolution toward electric vehicles, autonomous driving systems, and premium comfort features that require advanced glazing solutions.

North America demonstrates steady market growth supported by robust construction activity, infrastructure investments, and advanced manufacturing capabilities in both architectural and automotive glass applications. The U.S. leads regional consumption through major construction projects, commercial building developments, and automotive manufacturing operations that require high-performance glazing solutions. The region benefits from established innovation ecosystems and R&D investments focusing on smart glass technologies, energy-efficient coatings, and building-integrated photovoltaics that position North American manufacturers at the forefront of technological advancement.

The Infrastructure Investment and Jobs Act (IIJA) provides substantial funding for construction and infrastructure projects that will drive float glass demand across multiple applications, including commercial buildings, transportation facilities, and renewable energy installations. Advanced manufacturing technologies and Industry 4.0 implementations enable North American producers to maintain competitive advantages through improved production efficiency, quality control, and custom product development capabilities. The region’s emphasis on net-zero energy buildings and carbon emission reduction targets creates opportunities for high-performance float glass products that contribute to building sustainability goals and energy efficiency requirements.

European float glass markets exhibit steady growth driven by comprehensive regulatory frameworks promoting energy efficiency, sustainable construction practices, and technological innovation across member states. The European Green Deal initiatives targeting carbon neutrality by 2050 create substantial opportunities for advanced glazing solutions meeting Passivhaus and Nearly Zero Energy Building (NZEB) standards. Germany, France, and the United Kingdom lead regional adoption through extensive building retrofitting programs and stringent energy performance requirements that favor high-performance float glass products.

The region’s focus on circular economy principles encourages float glass adoption due to its unlimited recyclability and potential for reuse in construction applications, aligning with EU sustainability objectives. However, the Russia-Ukraine conflict has significantly impacted the European float glass industry through natural gas supply disruptions and energy cost increases, forcing some manufacturers to halt or suspend operations temporarily. Progressive building standards such as Germany’s GEG (Building Energy Act) and France’s RE2020 regulation mandate thermal performance levels that favor float glass’s superior insulation characteristics and energy efficiency contributions over conventional alternatives.

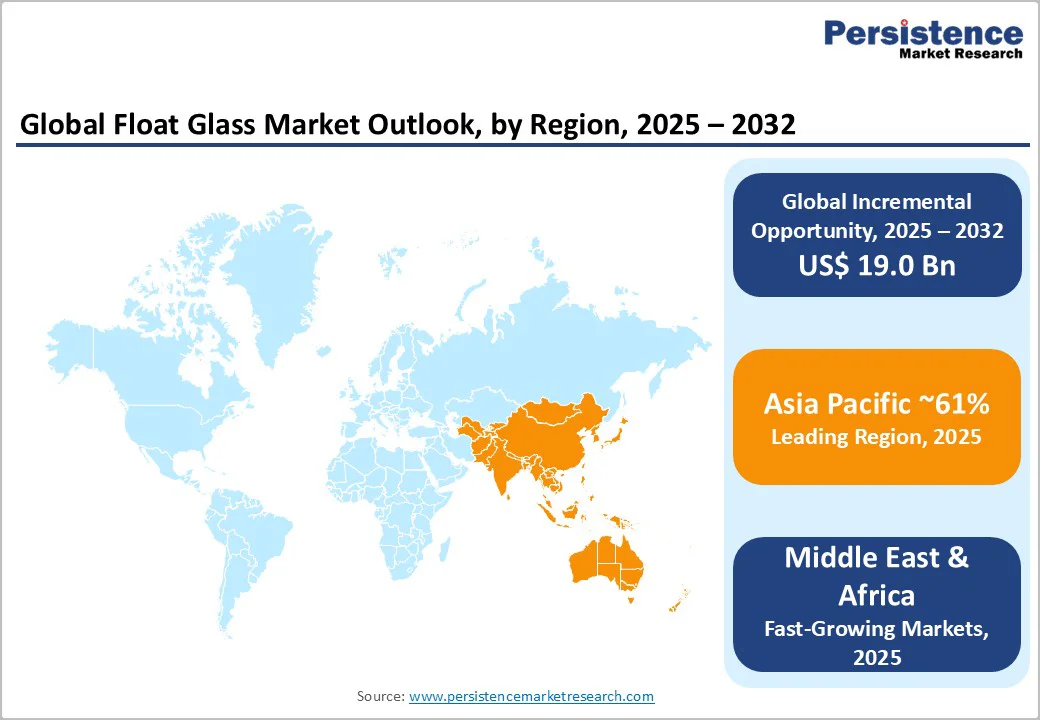

Asia Pacific dominates the global market with 61% market share in 2025, driven by rapid industrialization, urbanization, and massive infrastructure investments across China, India, and Southeast Asian countries. China represents the largest single market, contributing over 45% of regional consumption through continuous construction activity, automotive production, and solar panel manufacturing that requires substantial float glass inputs. The country’s 14th Five-Year Plan emphasizes technology advancement and carbon neutrality goals, creating favorable conditions for high-performance float glass adoption across building and renewable energy applications.

India’s rapidly expanding construction sector, supported by government programs such as Smart Cities Mission and Housing for All, drives substantial demand for float glass products in both residential and commercial segments. The country’s float glass manufacturing capacity has exceeded 1 million tons annually, with companies such as Gold Plus Glass Industry achieving 26.1% capacity share following major facility expansions. ASEAN countries demonstrate strong growth potential driven by economic development, infrastructure investments, and increasing adoption of modern construction practices that favor float glass applications. The region’s manufacturing advantages, including proximity to raw materials, competitive production costs, and established supply chains, support both domestic consumption and export capabilities to global markets requiring high-quality float glass products.

Key growth strategies include capacity expansion, regional market penetration, strategic acquisitions, and the development of value-added products such as coated, laminated, and smart glass. Innovation emphasizes energy efficiency, sustainable manufacturing, digital integration, and specialized solutions to meet evolving demands across diverse end-use applications.

The float glass market was valued at US$42.7 Billion in 2025 and is projected to reach US$61.7 Billion by 2032, representing a compound annual growth rate of 5.4% during the forecast period.

Key growth drivers are urbanization, rising demand for energy-efficient materials, sustainable construction focus, and increased automotive adoption of advanced glazing solutions.

Clear float glass dominates the market with a 60% market share in 2025, driven by its superior optical clarity, versatility across diverse applications, and essential role as base material for secondary processing applications in construction and automotive sectors.

Asia Pacific leads the float glass market with 61% market share in 2025, primarily driven by rapid industrialization, urbanization, and massive infrastructure investments across China, India, and Southeast Asian countries.

Solar panels/solariums applications represent a significant growth opportunity, supported by the global renewable energy transition, government incentives for solar installations, and technological advances in photovoltaic systems requiring specialized ultra-clear glass substrates.

Major market players include AGC Inc., Saint-Gobain S.A., Guardian Industries, Nippon Sheet Glass Co. Ltd., Fuyao Glass Industry Group, Cardinal Glass Industries, Xinyi Glass Holdings, Sisecam Group, and SCHOTT Group.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author