ID: PMRREP27637| 196 Pages | 3 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

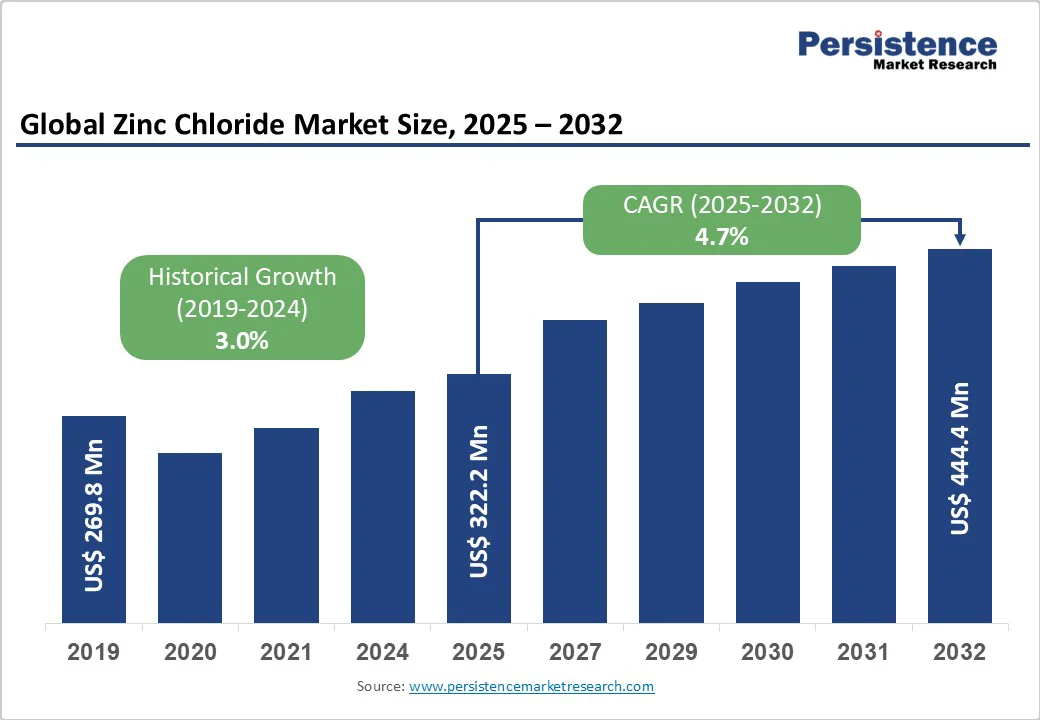

The global zinc chloride market size is likely to value US$ 395.4 million in 2025 and is projected to reach US$ 622.6 million by 2032, growing at a CAGR of 6.7% between 2025 and 2032. The market expansion is primarily driven by increasing demand for battery-grade zinc chloride in energy storage solutions and the growing adoption of zinc chloride in industrial applications, including metal surface treatment, water treatment, and textile processing. These factors collectively contribute to the robust growth trajectory as industries worldwide prioritize sustainable and efficient chemical solutions.

| Key Insights | Details |

|---|---|

|

Zinc Chloride Market Size (2025E) |

US$ 395.4 million |

|

Market Value Forecast (2032F) |

US$ 622.6 million |

|

Projected Growth CAGR (2025-2032) |

6.7% |

|

Historical Market Growth (2019-2024) |

5.7% |

The shift toward renewable energy and electrification has intensified the role of zinc chloride as a crucial electrolyte in zinc-ion batteries. Research has shown that concentrated ZnCl2 electrolytes can achieve nearly 99.95 % coulombic efficiency and stable cycling over 500 cycles in pouch cells, offering energy densities close to 100 Wh/kg. This makes them competitive with other sustainable storage chemistries. Unlike lithium-ion, zinc-based systems use safer, abundant raw materials and operate at lower costs, which is attractive for large-scale stationary storage and electric vehicle applications.

Beyond zinc-ion systems, high-purity ZnCl2 continues to improve zinc-carbon and hybrid battery performance, delivering deeper discharge capacity and lower internal resistance. Companies are actively developing formulations with ionic additives to further boost cycle life. With global EV sales projected to surpass 30 million units annually by 2030, the demand for battery-grade ZnCl2 is set to accelerate, reinforcing its position in the energy storage supply chain.

Zinc chloride is finding expanding applications in wastewater treatment due to its dual ability to function as a flocculant and contaminant remover. For example, ZnCl2-activated biochar derived from carob shells achieved over 80 % removal efficiency of heavy metals in controlled studies. In another case, ion-exchange sorption using resins demonstrated uptake capacities of up to 46.5 mg ZnCl2 per gram, effectively treating acidic and chlorinated discharges. Such versatility makes ZnCl2 a cost-effective option for industrial and municipal facilities seeking to meet tightening environmental norms.

In the Asia Pacific, particularly India and China, stricter wastewater discharge regulations are driving the adoption of zinc chloride-based treatment systems. Reports indicate that bacterial precipitation techniques using ZnCl2 precursors have achieved more than 93 % removal of cadmium and zinc from effluents. This effectiveness, combined with growing global attention to water scarcity and sustainability, ensures that zinc chloride will remain integral to environmental remediation technologies.

Stringent environmental regulations regarding heavy metal waste disposal pose significant constraints on zinc chloride market growth. The compound's classification under hazardous materials requires specialized handling, storage, and disposal procedures, increasing operational costs for manufacturers and end-users. European Union regulations under REACH compliance and similar frameworks in North America mandate extensive documentation and safety protocols, creating barriers for small-scale manufacturers. Additionally, toxicity concerns including skin irritation and respiratory issues necessitate advanced safety equipment and training, further elevating production expenses and limiting market accessibility in cost-sensitive regions.

Fluctuating zinc metal prices directly impact zinc chloride production costs, creating market instability and pricing pressures. Supply chain disruptions, particularly from mining operations and refining facilities, affect the consistent availability of high-purity feedstock required for specialized applications. The concentration of zinc production in specific geographic regions makes the market vulnerable to geopolitical tensions and trade restrictions. These factors collectively limit manufacturers' ability to maintain stable pricing structures and long-term contracts, potentially restraining market growth in price-sensitive applications.

The rise of zinc-ion batteries is opening strong opportunities for zinc chloride producers, particularly those able to supply ultra-high-purity formulations. Zinc-ion systems are increasingly seen as safer and more cost-effective alternatives to lithium-ion batteries, with studies showing cycle lives extending beyond 4,900 hours when zinc chloride electrolytes are used. Unlike lithium, zinc is more abundant and less prone to thermal runaway, making it highly suitable for large-scale stationary storage and electric vehicle applications.

China and other Asia Pacific nations are leading the commercialization of zinc-ion technologies, with multiple pilot plants and demonstration projects already underway. Automotive companies and energy storage developers are channeling significant R&D investments into chloride-based electrolytes, recognizing their ability to improve stability and reduce costs. As demand for grid-scale and EV battery systems accelerates, suppliers of battery-grade zinc chloride are positioned to capture a fast-growing, multi-billion-dollar niche within the energy storage value chain.

The pharmaceutical and personal care industries represent another high-value opportunity for zinc chloride. USP-grade and EP-compliant formulations are increasingly used in drug synthesis, dental products, and antimicrobial solutions due to the compound’s antiseptic and astringent properties. Its incorporation into mouthwashes, throat lozenges, and topical treatments reflects rising consumer preference for zinc-based therapeutics. Additionally, demand is supported by zinc’s role in immune system support and wound healing, aligning with global health awareness trends.

The personal care segment is also benefiting, as zinc chloride finds applications in deodorants, skin care formulations, and oral hygiene products. Growing consumer awareness of wellness and hygiene in markets such as North America, Europe, and the Asia Pacific is driving adoption. Pharmaceutical-grade zinc chloride commands premium pricing, rewarding producers who can consistently meet stringent regulatory standards. This creates attractive margin opportunities for suppliers catering to the expanding global healthcare, nutraceutical, and cosmetic industries.

The shift toward renewable energy and electrification has intensified the role of zinc chloride as a crucial electrolyte in zinc-ion batteries. Research has shown that concentrated ZnCl2 electrolytes can achieve nearly 99.95 % coulombic efficiency and stable cycling over 500 cycles in pouch cells, offering energy densities close to 100 Wh/kg. This makes them competitive with other sustainable storage chemistries. Unlike lithium-ion, zinc-based systems use safer, abundant raw materials and operate at lower costs, which is attractive for large-scale stationary storage and electric vehicle applications.

Beyond zinc-ion systems, high-purity ZnCl2 continues to improve zinc-carbon and hybrid battery performance, delivering deeper discharge capacity and lower internal resistance. Companies are actively developing formulations with ionic additives to further boost cycle life. With global EV sales projected to surpass 30 million units annually by 2030, the demand for battery-grade ZnCl2 is set to accelerate, reinforcing its position in the energy storage supply chain.

Zinc chloride is finding expanding applications in wastewater treatment due to its dual ability to function as a flocculant and contaminant remover. For example, ZnCl2-activated biochar derived from carob shells achieved over 80 % removal efficiency of heavy metals in controlled studies. In another case, ion-exchange sorption using resins demonstrated uptake capacities of up to 46.5 mg ZnCl2 per gram, effectively treating acidic and chlorinated discharges. Such versatility makes ZnCl2 a cost-effective option for industrial and municipal facilities seeking to meet tightening environmental norms.

In the Asia Pacific, particularly India and China, stricter wastewater discharge regulations are driving the adoption of zinc chloride-based treatment systems. Reports indicate that bacterial precipitation techniques using ZnCl2 precursors have achieved more than 93 % removal of cadmium and zinc from effluents. This effectiveness, combined with growing global attention to water scarcity and sustainability, ensures that zinc chloride will remain integral to environmental remediation technologies.

Stringent environmental regulations regarding heavy metal waste disposal pose significant constraints on zinc chloride market growth. The compound's classification under hazardous materials requires specialized handling, storage, and disposal procedures, increasing operational costs for manufacturers and end-users. European Union regulations under REACH compliance and similar frameworks in North America mandate extensive documentation and safety protocols, creating barriers for small-scale manufacturers. Additionally, toxicity concerns including skin irritation and respiratory issues necessitate advanced safety equipment and training, further elevating production expenses and limiting market accessibility in cost-sensitive regions.

Fluctuating zinc metal prices directly impact zinc chloride production costs, creating market instability and pricing pressures. Supply chain disruptions, particularly from mining operations and refining facilities, affect the consistent availability of high-purity feedstock required for specialized applications. The concentration of zinc production in specific geographic regions makes the market vulnerable to geopolitical tensions and trade restrictions. These factors collectively limit manufacturers' ability to maintain stable pricing structures and long-term contracts, potentially restraining market growth in price-sensitive applications.

The rise of zinc-ion batteries is opening strong opportunities for zinc chloride producers, particularly those able to supply ultra-high-purity formulations. Zinc-ion systems are increasingly seen as safer and more cost-effective alternatives to lithium-ion batteries, with studies showing cycle lives extending beyond 4,900 hours when zinc chloride electrolytes are used. Unlike lithium, zinc is more abundant and less prone to thermal runaway, making it highly suitable for large-scale stationary storage and electric vehicle applications.

China and other Asia Pacific nations are leading the commercialization of zinc-ion technologies, with multiple pilot plants and demonstration projects already underway. Automotive companies and energy storage developers are channeling significant R&D investments into chloride-based electrolytes, recognizing their ability to improve stability and reduce costs. As demand for grid-scale and EV battery systems accelerates, suppliers of battery-grade zinc chloride are positioned to capture a fast-growing, multi-billion-dollar niche within the energy storage value chain.

The pharmaceutical and personal care industries represent another high-value opportunity for zinc chloride. USP-grade and EP-compliant formulations are increasingly used in drug synthesis, dental products, and antimicrobial solutions due to the compound’s antiseptic and astringent properties. Its incorporation into mouthwashes, throat lozenges, and topical treatments reflects rising consumer preference for zinc-based therapeutics. Additionally, demand is supported by zinc’s role in immune system support and wound healing, aligning with global health awareness trends.

The personal care segment is also benefiting, as zinc chloride finds applications in deodorants, skin care formulations, and oral hygiene products. Growing consumer awareness of wellness and hygiene in markets such as North America, Europe, and the Asia Pacific is driving adoption. Pharmaceutical-grade zinc chloride commands premium pricing, rewarding producers who can consistently meet stringent regulatory standards. This creates attractive margin opportunities for suppliers catering to the expanding global healthcare, nutraceutical, and cosmetic industries.

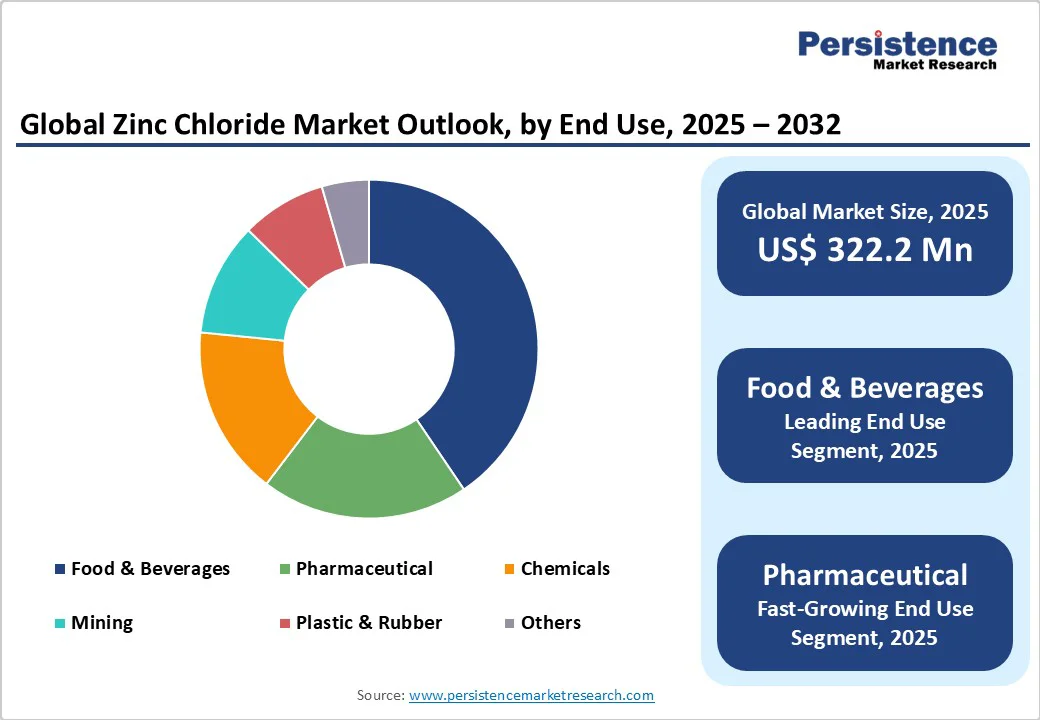

The industrial-grade segment dominates the zinc chloride market, accounting for around 60% of consumption. It is widely used in water treatment, galvanizing, and general chemical manufacturing due to its reliable performance and cost-effectiveness. Its accessibility and suitability for high-volume industrial applications make it the preferred choice for many manufacturers.

In contrast, the battery-grade segment is witnessing the fastest growth, driven by increasing demand for high-purity electrolytes in advanced battery systems. This grade requires 99.9% purity and stringent control of heavy metals, with iron impurities kept below 5 PPM. Premium pricing and specialized production processes create opportunities for established chemical producers to diversify portfolios and cater to the growing energy storage sector.

Liquid zinc chloride solutions hold the largest market share, approximately 55%, thanks to their ease of handling and direct application in industrial processes. The ready-to-use format eliminates additional dissolution steps, making it ideal for water treatment, textile processing, and other high-volume operations.

However, solid forms, including granules and pellets, are growing faster due to logistical and storage advantages. They offer extended shelf life, superior stability, and reduced transportation costs while minimizing risks in cold climates. This shift toward solid zinc chloride is particularly notable in regions prioritizing supply chain efficiency and long-term storage, supporting broader adoption across industrial sectors.

Metal surface treatment remains the largest end-use segment, accounting for roughly 45% of zinc chloride consumption. In galvanizing, ZnCl2 acts as a flux, cleaning metal surfaces and ensuring strong zinc coating adhesion, thanks to its ability to dissolve oxides and enhance metallurgical bonding.

The catalyst and reactant segment is growing rapidly, fueled by demand in petrochemical refining and organic synthesis. Zinc chloride’s Lewis acid properties make it essential for n-butane isomerization and various chemical transformations. Increasing reliance on ZnCl2 in industrial catalysis highlights its expanding role in high-value chemical and refining applications.

North America maintains a significant market position driven by advanced manufacturing infrastructure and stringent quality standards in the United States. The region's robust automotive and electronics industries create substantial demand for high-purity zinc chloride in battery manufacturing and specialized chemical processes. Recent regulatory improvements in mining permits have enhanced domestic zinc supply chains, though transportation bottlenecks continue to affect pricing dynamics.

The U.S. Environmental Protection Agency guidelines promote the adoption of zinc chloride in municipal water treatment systems, particularly for heavy metal removal and disinfection applications. Investment in grid-scale energy storage projects and electric vehicle infrastructure development supports growing demand for battery-grade formulations. Labor cost increases and intermittent freight capacity constraints contribute to elevated production expenses, but strong downstream demand from automotive and chemical sectors maintains market stability.

Europe represents a key growth region with Germany, United Kingdom, France, and Spain leading market development through technological innovation and environmental stewardship. The region's commitment to circular economy principles drives demand for zinc chloride in textile recycling and waste treatment applications. European manufacturers are pioneering ZnCl2-enabled cellulose dissolution technologies that align with sustainability targets.

Germany's advanced chemical and automotive manufacturing sectors prioritize high-purity zinc chloride for electronics applications and energy storage solutions. Stringent EU regulations regarding heavy metal waste management are encouraging the adoption of solid zinc chloride forms to facilitate closed-loop recovery systems. Rising electricity and natural gas costs impact production economics, but strong demand from galvanizing and pharmaceutical industries supports continued market expansion across the region.

Asia Pacific dominates the global zinc chloride market with 45% market share, led by China's extensive manufacturing base and India's rapid industrialization. The region benefits from proximity to zinc mining operations and cost-effective production capabilities, supporting competitive pricing structures. China leads zinc-ion battery development initiatives, creating substantial demand for ultra-high purity zinc chloride formulations.

India's expanding pharmaceutical sector, valued at USD 49.9 billion, drives demand for pharmaceutical-grade zinc chloride in drug synthesis and formulation applications. Government initiatives promoting sustainable industrial practices and water treatment infrastructure development further support market growth. The region's focus on electric vehicle adoption and renewable energy integration creates substantial opportunities for battery chemical suppliers, positioning Asia Pacific as both the largest and fastest-growing regional market.

The zinc chloride market is highly competitive, characterized by continuous innovation and diversification of product portfolios. Key players focus on developing high-purity battery-grade formulations, enhancing industrial-grade efficiency, and expanding into emerging applications such as advanced batteries, pharmaceuticals, and environmental remediation. Strategic investments in R&D, quality control, and production technology are critical for maintaining market position and meeting stringent regulatory standards.

Market competition also emphasizes supply chain optimization and customer-focused solutions. Manufacturers are increasingly adopting flexible production capacities, exploring new distribution channels, and enhancing logistics for both liquid and solid forms. This competitive intensity drives innovation, efficiency, and broader adoption across end-use industries.

The global zinc chloride market was valued at US$ 395.4 million in 2025 and is projected to reach US$ 622.6 million by 2032, growing at a CAGR of 6.7% during the forecast period.

Key demand drivers include rising adoption of battery-grade zinc chloride in energy storage applications, expanding water treatment infrastructure, and increasing industrial applications in metal surface treatment and textile processing.

Industrial grade zinc chloride holds the largest market share at approximately 60%, primarily serving galvanizing, water treatment, and general chemical manufacturing applications.

Asia Pacific dominates the global market with 45% market share, driven by China's manufacturing capabilities and India's pharmaceutical sector expansion.

The emerging zinc-ion battery technologies present substantial growth opportunities, with potential market value exceeding USD 500 million as automotive manufacturers prioritize sustainable energy storage solutions.

Leading companies include TIB Chemicals AG, Weifang Dongfangsheng Chemical Co., Ltd, Global Chemical Co., Ltd, Apex Chemicals Corporation, Eurocontal SA, and Flaurea Chemicals.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Grade

By Form

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author