ID: PMRREP17998| 170 Pages | 15 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

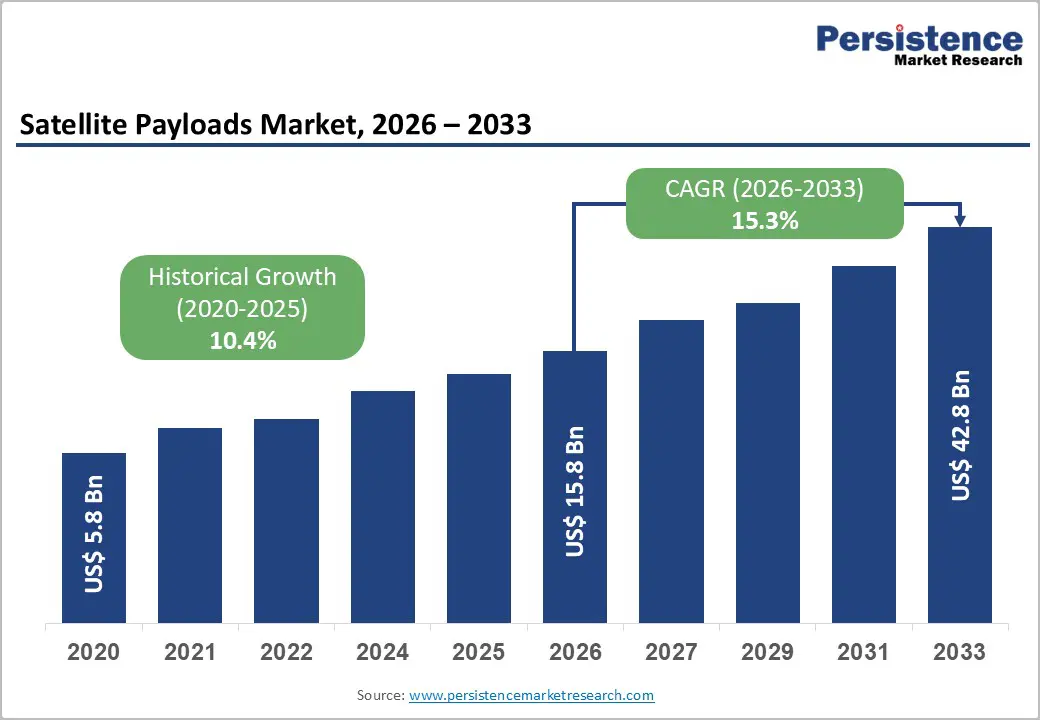

The global Satellite Payloads Market size was valued at US$ 15.8 Billion in 2026 and is projected to reach US$ 42.8 Billion by 2033, growing at a CAGR of 15.3% between 2026 and 2033. The satellite payloads market is experiencing substantial growth driven by the exponential expansion of Low Earth Orbit (LEO) mega-constellations for broadband connectivity, increased government investments in defense and national security applications, and the rapid advancement of satellite miniaturization technologies enabling cost-effective deployment of sophisticated payload systems across commercial and military domains.

| Key Insights | Details |

|---|---|

| Satellite Payloads Market Size (2026E) | US$ 15.8 6 Bn |

| Market Value Forecast (2033F) | US$ 42.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 15.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 10.3% |

The deployment of large-scale Low Earth Orbit (LEO) satellite constellations represents one of the most significant growth catalysts for the satellite payloads market. SpaceX's Starlink, Amazon's Project Kuiper (rebranded as Amazon LEO), and the European Union's IRIS2 initiative are collectively deploying thousands of satellites that require advanced communication and navigation payloads. Amazon Leo has already deployed over 150 satellites in orbit as of 2026, with plans to eventually operate a constellation of 3,200 spacecraft. The LEO segment accounts for approximately 25% of the overall satellite communication market, driven by the demand for low-latency connectivity, high-resolution Earth observation capabilities, and reduced deployment costs associated with satellite miniaturization.

The accelerating investment in defense-grade satellite payloads is driving significant market expansion, particularly in the North American and European regions. The U.S. Space Development Agency (SDA) awarded $3.5 billion in December 2026 for 72 new missile warning and tracking satellites across four contractors including Lockheed Martin, Northrop Grumman, L3Harris Technologies, and Rocket Lab, marking the largest contract award to date for its low-orbit constellation. These satellites require sophisticated electro-optical infrared payloads, synthetic aperture radar (SAR) systems, and advanced signal intelligence capabilities to support global missile defense and military communications infrastructure. Military applications, including signals intelligence (SIGINT) payloads and earth observation systems with synthetic aperture radar (SAR) technology, are experiencing heightened demand due to evolving geopolitical threats and modernization initiatives across defense departments globally.

The development and integration of advanced satellite payloads involve substantial technical complexity, extended timelines, and significant capital requirements that can impede market growth. Software-defined payloads, which offer flexibility through reconfigurable frequency bands and dynamic beam coverage, require sophisticated field-programmable gate array (FPGA) technology, advanced onboard processors, and complex software validation protocols that extend development timelines to 3-5 years or longer. The certification and qualification standards mandated by space agencies such as NASA and the European Space Agency (ESA) necessitate rigorous testing protocols, environmental validation, and redundancy verification, increasing development costs and limiting the pace of new payload introductions to the market. Additionally, the shortage of skilled aerospace engineers and payload specialists in the global workforce has created bottlenecks in design and manufacturing capacity, particularly for customized military and government-contracted payloads that require classified development and integration procedures.

The rapid proliferation of mega-constellations and the launch of thousands of satellites have intensified concerns regarding orbital debris accumulation and the long-term sustainability of space operations. The European Space Agency (ESA) and international regulatory bodies have implemented increasingly stringent space debris mitigation requirements, including mandatory satellite deorbiting within 25 years of mission completion and active debris avoidance maneuvers. SpaceX has reported that over 400 of its Starlink satellites are currently non-operational, contributing to orbital debris concerns and regulatory scrutiny. These sustainability requirements mandate that satellite payloads be designed with enhanced propulsion systems, autonomous collision-avoidance capabilities, and deorbiting mechanisms, which increase payload weight, power consumption, and manufacturing costs.

The integration of artificial intelligence (AI) and edge computing technologies into satellite payloads represents a transformative opportunity for market participants to differentiate their offerings and unlock new revenue streams. AI-powered payloads can perform autonomous data processing, pattern recognition, and real-time decision-making capabilities onboard satellites, eliminating the latency associated with ground-based processing and enabling immediate response to surveillance, disaster response, and precision agriculture applications. Software-defined payloads equipped with AI algorithms can dynamically allocate bandwidth, optimize beam steering, and adapt coverage patterns based on demand fluctuations, extending satellite operational life and reducing per-bit transmission costs by up to 40% compared to traditional fixed-function payloads. The convergence of 5G and 6G standards with satellite technology is creating demand for highly integrated digital technologies operating at 7nm process nodes, particularly for the European Union's IRIS2 constellation and U.S. military next-generation communication systems.

The growing emphasis on climate change monitoring, disaster response, and precision agriculture is generating substantial demand for advanced earth observation payloads with hyperspectral imaging and synthetic aperture radar capabilities. The NASA-ISRO Synthetic Aperture Radar (NISAR) mission, launched in July 2026, represents a landmark international collaboration featuring dual-frequency SAR payloads capable of detecting surface movements as small as 1 centimeter and monitoring changes to ice sheets, wetlands, and forests every 12 days. The mission demonstrates the critical importance of advanced SAR payloads for disaster management, climate research, and infrastructure monitoring, with applications spanning earthquake detection, flood forecasting, and biomass estimation across developing nations. India's satellite program under the Indian Space Research Organisation (ISRO) is deploying remote sensing payloads for agricultural monitoring through programs such as FASAL (Forecasting Agricultural Output Using Space, Agro-Meteorology and Land-Based Observations), generating demand for multispectral imaging and synthetic aperture radar payloads tailored to crop monitoring and drought assessment applications.

The Low Earth Orbit (LEO) segment is emerging as the dominant deployment architecture, commanding approximately 55% of the satellite payloads market by 2026. LEO satellites, operating at altitudes between 160-2,000 kilometers, offer substantial competitive advantages including reduced signal latency of 20-50 milliseconds, higher spatial resolution for earth observation applications, and significantly lower launch costs per satellite due to compatibility with multiple commercial launch vehicles. The proliferation of LEO constellations including Starlink, Amazon Leo, OneWeb, and government-backed programs such as the European IRIS2 initiative is driving demand for compact, lightweight, and energy-efficient payloads optimized for rapid deployment and modular architecture. LEO payloads benefit from technological advancements in miniaturization, enabling satellites weighing as little as 500 kilograms to carry sophisticated communication, imaging, and navigation instruments that previously required multi-ton GEO satellites.

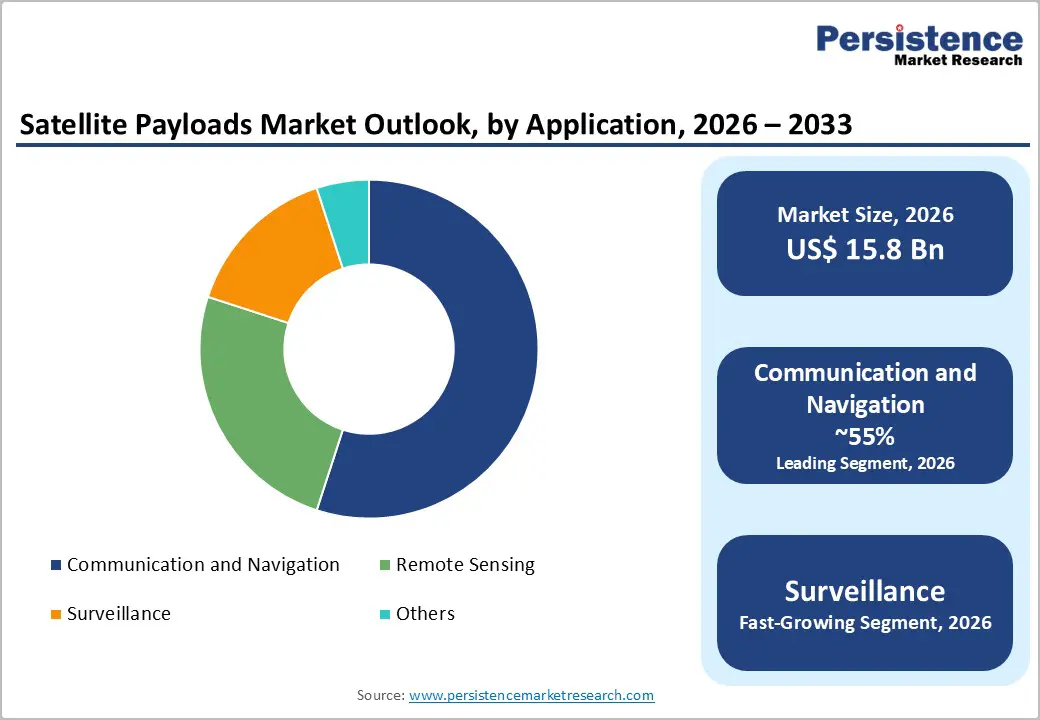

Communication and Navigation payloads represent the largest application segment, commanding approximately 55% of the overall satellite payloads market by revenue in 2026. Communication payloads, including RF (radio frequency) transponders, laser/optical communication systems, and regenerative payloads with onboard signal processing, are essential for broadband services, direct-to-home (DTH) television, mobile backhaul, and enterprise networking applications across telecommunications operators. The integration of 5G and satellite connectivity is generating unprecedented demand for high-throughput communication (HTS) payloads capable of delivering multi-gigabit per second data rates, with market projections indicating the satellite-based 5G network segment growing at an exceptional 50% CAGR through 2035. Navigation payloads, including Global Navigation Satellite System (GNSS) components and precision timing and ranging (PNT) instruments, are critical for GPS modernization initiatives, autonomous vehicle operations, and precision agriculture applications, particularly in the United States, China, and European markets.

The Commercial end-use segment is the fastest-growing category, commanding approximately 50-55% of the satellite payloads market and demonstrating robust growth trajectories across broadband connectivity, earth observation analytics, and enterprise satellite services. Commercial satellite operators including SpaceX, Amazon, Eutelsat, and SES are aggressively expanding constellation deployments and investing in next-generation payload technologies to capture market share in the global broadband and data relay services market. Commercial earth observation companies such as Planet Labs, Maxar Technologies, and emerging startups are deploying hyperspectral and synthetic aperture radar payloads for precision agriculture, urban planning, and environmental monitoring, with market applications generating $500 million to $1 billion in annual commercial revenue. The commercial segment's growth trajectory is supported by declining satellite manufacturing costs, reduced launch expenses through reusable rocket technologies, and accelerating demand for satellite-based Internet of Things (IoT) connectivity, with the satellite IoT market projected to grow at 26% CAGR through 2030, surpassing $4.7 billion in cumulative revenue.

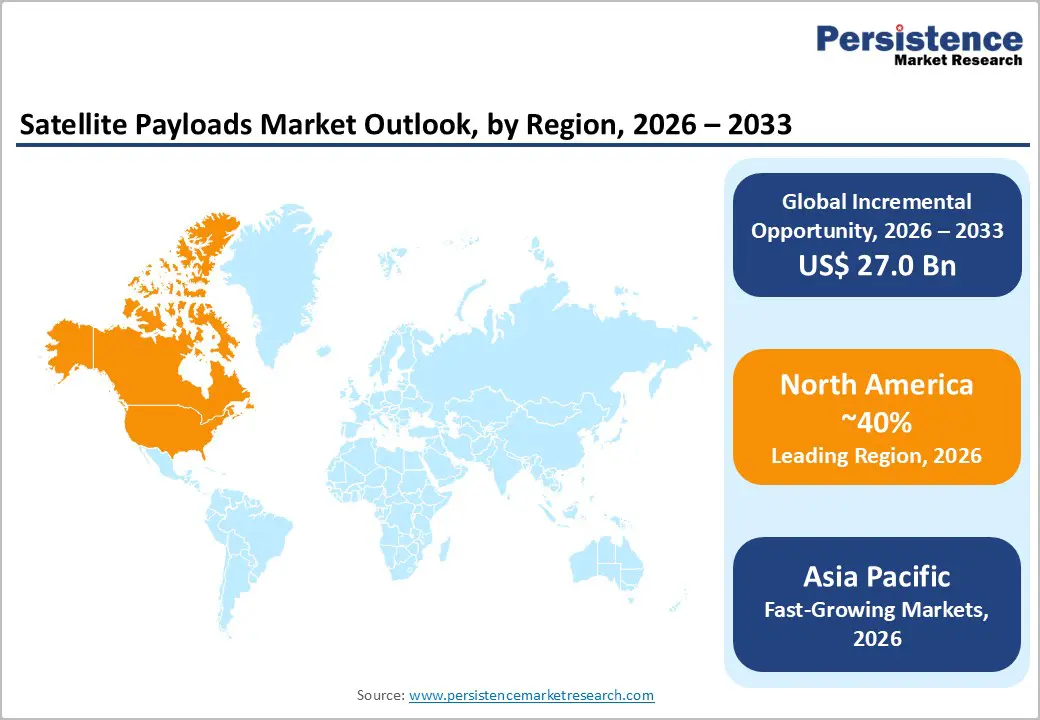

North America, particularly the United States, is establishing itself as the dominant regional market for satellite payloads, commanding approximately 38-40% of global market revenue in 2026, driven by extensive LEO mega-constellation deployments, advanced defense applications, and robust private sector innovation. The U.S. space industry is characterized by strategic partnerships between government agencies including NASA, the Space Force, and the Space Development Agency (SDA), combined with private companies such as SpaceX, Amazon, Lockheed Martin, and Northrop Grumman, creating an ecosystem that accelerates payload innovation and deployment cycles.

Regulatory support through the Federal Communications Commission (FCC) frequency spectrum allocations, coupled with U.S. government incentives for rural broadband deployment, has catalyzed investments in satellite payload development targeting underserved geographic regions. The U.S. market is expected to grow at a CAGR of 11.2% through 2035, slower than Asia-Pacific but representing the largest absolute market opportunity globally due to the concentration of aerospace manufacturing capabilities, advanced research institutions, and government space spending estimated at $60+ billion annually.

Europe represents the second-largest regional market for satellite payloads, accounting for approximately 25-28% of global revenue in 2026, supported by the European Union's IRIS2 constellation initiative, Thales Alenia Space leadership in communications satellite payloads, and advanced earth observation programs. The EU's €10.6 billion IRIS2 program, signed in December 2024 with the SpaceRISE consortium comprising Eutelsat, SES, and Hispasat, represents a watershed investment in sovereign European satellite payload capabilities for secure government communications, defense applications, and commercial broadband services. IRIS2 will deploy 264 LEO satellites at 1,200 kilometers altitude and 18 MEO satellites at 8,000 kilometers, requiring advanced payload systems including 5G-compatible digital technologies, hyperspectral imaging capabilities, and laser inter-satellite communication links.

Germany, the United Kingdom, and France are emerging as strategic payload development hubs, with Germany hosting Thales Alenia Space facilities, UK-based Airbus Defence and Space operations, and France supporting the OneWeb constellation expansion through Eutelsat ownership and Airbus Defence and Space satellite manufacturing.

Asia-Pacific is emerging as the fastest-growing regional market for satellite payloads, commanding approximately 20% of global market share in 2026 with projected growth accelerating to 30% CAGR through 2033, driven by China's aggressive satellite constellation deployments, India's expanding remote sensing programs, and Japan's advanced earth observation capabilities. China is leading regional growth with a remarkable 28.4% CAGR through 2035, supported by large-scale government-backed mega-constellation projects including China Aerospace Science and Technology Corporation (CASC) and China Aerospace Science and Industry Corporation (CASIC) initiatives for 6G testing satellites, lunar telemetry payloads, and navigation constellation upgrades such as the BeiDou Navigation Satellite System.

India's satellite payload market is projected to grow at 19.4% CAGR through 2030, reaching US$ 929.9 million in cumulative revenue, supported by ISRO's expanding portfolio of earth observation, communication, and navigation satellites. India's agricultural satellite program leveraging ISRO's Resourcesat, Cartosat, and RISAT series of satellites equipped with advanced multispectral and synthetic aperture radar payloads is delivering crop production forecasting, drought assessment, and disaster management capabilities through programs including FASAL (Forecasting Agricultural Output Using Space, Agro-Meteorology and Land-Based Observations) and NADAMS (National Agricultural Drought Assessment and Monitoring Systems).

The satellite payloads market exhibits a moderately consolidated competitive structure dominated by established aerospace and defense contractors that control approximately 60-65% of global market revenue, while emerging space technology companies and specialized payload manufacturers capture growing market share in niche segments. Tier 1 players including Airbus Defence and Space, Lockheed Martin, Northrop Grumman, L3Harris Technologies, and Thales Alenia Space leverage vertically integrated manufacturing capabilities, decades of heritage in space systems development, and established relationships with government agencies to maintain dominant market positions in communication, navigation, and military-grade payload segments.

Market consolidation is evident through strategic mergers and acquisitions, with Lockheed Martin acquiring Terran Orbital to secure satellite bus production capacity, Airbus Defence and Space expanding manufacturing facilities to support OneWeb constellation expansion with 340 additional satellites through 2026, and Thales Alenia Space securing multiple government contracts for next-generation payloads.

The global Satellite Payloads Market is projected to reach US$ 42.8 Billion by 2033, growing from US$ 15.8 Billion in 2026 at a CAGR of 10.4%, driven by expanding LEO mega-constellations, defense modernization programs, and advancing earth observation technologies for climate monitoring and precision agriculture applications.

The market is primarily driven by the proliferation of LEO mega-constellations including Starlink, Amazon Leo, and European IRIS2 requiring advanced communication payloads; escalating defense investments in missile tracking and surveillance satellites; and increasing demand for hyperspectral imaging and synthetic aperture radar payloads for climate monitoring, agricultural analytics, and disaster response applications across government and commercial sectors.

command the largest market share at approximately 50-55% of total revenue, encompassing high-throughput communication (HTS) systems, 5G-integrated satellite links, and GNSS augmentation technologies supporting broadband connectivity, telecommunications infrastructure, and precision positioning applications globally.

North America collectively command approximately 40% of global satellite payloads market revenue, supported by SpaceX Starlink, Amazon Leo constellation, U.S. Space Development Agency defense programs, and extensive private sector innovation in payload technologies.

The satellite payloads market is dominated by Airbus Defence and Space, Lockheed Martin Corporation, Thales Alenia Space), and L3Harris Technologies.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Market Segmentation

Orbit Type

Application Type

End-Use Segment

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author