ID: PMRREP34721| 199 Pages | 7 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

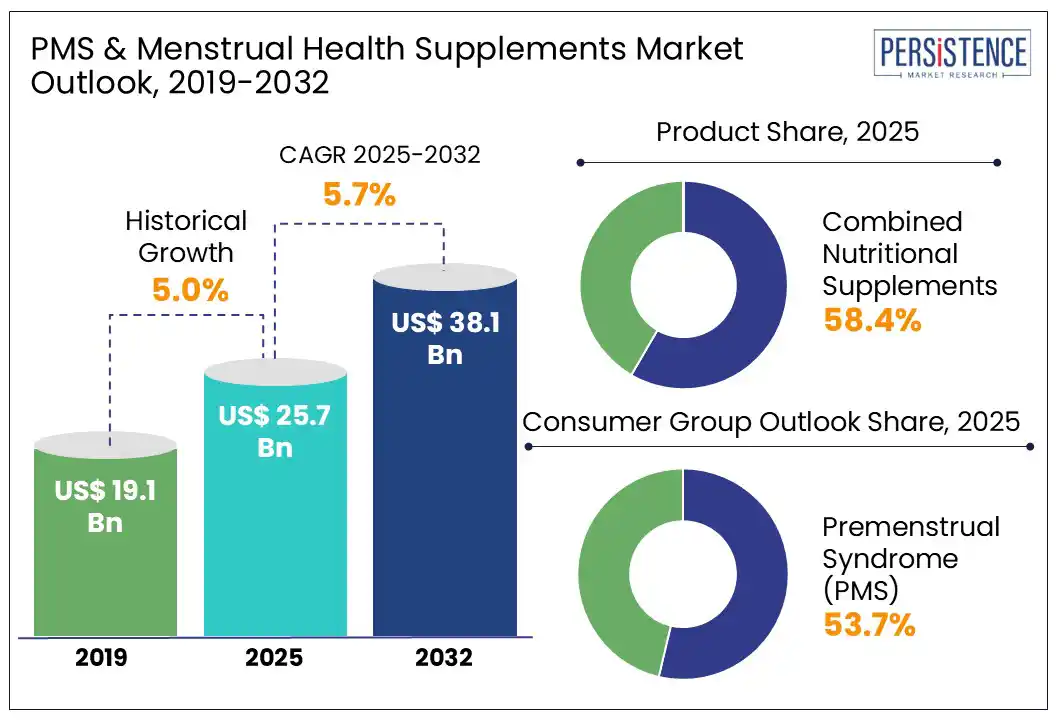

According to the Persistence Market Research report, the global PMS & menstrual health supplements market size is likely to be valued at US$ 25.7 Bn in 2025 and is expected to reach US$ 38.1 Bn by 2032, growing at a CAGR of 5.7% during the forecast period from 2025 to 2032.

The PMS & menstrual health supplements market is witnessing robust growth driven by increasing awareness of menstrual health issues and advancements in supplement formulations. Consumers are seeking natural and effective solutions to manage symptoms related to PMS, dysmenorrhea, and hormonal disorders such as PCOS. Trends such as the integration of AI for personalized supplement recommendations and the rise of herbal, plant-based ingredients are shaping the market landscape. Growing demand, coupled with technological innovations, is fuelling expansion in the global market.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

PMS & Menstrual Health Supplements Market Size (2025E) |

US$ 25.7 Bn |

|

Market Value Forecast (2032F) |

US$ 38.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

Increasing awareness of premenstrual syndrome (PMS) and its widespread impact on women’s health is a key driver of the global PMS & menstrual health supplements market. Despite some regional declines, the overall prevalence of PMS has surged significantly over the decades. The pooled prevalence of reproductive age women affected with PMS worldwide amounts to 47.8% as per recent studies. This growing burden among women affected by hormonal disorders such as PCOS (Polycystic Ovary Syndrome), fuels demand for effective symptom management solutions.

Lifestyle factors, including diet, stress, urbanization, and improved access to e-commerce platforms further boost supplement consumption. Additionally, innovations including AI-driven recommendations for personalized supplement, wearable menstrual tracking technology, and novel ingredient formulations such as plant extracts and probiotics, are enhancing product efficacy and consumer engagement. These advancements, combined with rising health consciousness and increased pharmaceutical research, are propelling market growth. Collectively, these factors underscore the expanding opportunities in the global market.

The global PMS & menstrual health supplements market faces several restraints hinder its growth despite increasing demand. One of the primary challenges is the high level of market competition, making it difficult for brands to differentiate their products. With many similar offerings, capturing consumer attention requires a strong value proposition and clear communication of benefits.

Additionally, the lack of robust scientific evidence supporting the efficacy of certain supplements and limited availability of comprehensive clinical research contribute to consumer skepticism. Furthermore, strict regulatory requirements delay product approvals and market entry.

The rising popularity of complementary and alternative medicine (CAM), including traditional remedies and non-supplement therapies, also presents competition, diverting consumer interest. To overcome these barriers, companies must invest in innovation, scientific validation, and transparent marketing strategies. These factors continue to shape the challenges within the global market.

The increasing awareness and growing acceptance of menstrual health issues offer notable growth opportunities to supplement manufacturers globally. As more consumers seek solutions to manage PMS, dysmenorrhea, and Premenstrual Dysphoric Disorder (PMDD), demand for effective and safe supplements continues to rise.

Companies are investing in research and development to create advanced formulations, such as those incorporating herbal ingredients like chasteberry, passionflower, and citrus bioflavonoids, which offer natural relief. The popularity of holistic wellness is also boosting interest in herbal and plant-based supplements.

Additionally, increasing demand for menstrual hygiene products creates a complementary market for PMS-related solutions. Educational initiatives and targeted marketing are expanding consumer understanding, further driving adoption. Companies are also tailoring offerings to address cultural and regional needs, broadening market reach. As consumer demand, innovation, and health awareness continue to align, these factors present significant growth opportunities in the global PMS & menstrual health supplements market.

Combined nutritional supplements are projected to capture a dominant revenue share of around 58.4% in 2025 due to their enhanced effectiveness in managing PMS symptoms compared to single nutritional supplements such as vitamins, minerals, and herbal supplements, among others. Many vitamins and minerals work synergistically to provide better relief. For example, magnesium paired with vitamin D3 helps regulate mood and reduce cramps, while omega-3 combined with vitamin E supports inflammation reduction.

Similarly, magnesium and zinc together improve hormonal balance and reduce discomfort. These combinations offer a more comprehensive approach to symptom management, making them more appealing to consumers seeking holistic and efficient solutions, thus driving their leading revenue share.

The Premenstrual Syndrome (PMS) segment is expected to hold a significant revenue share in the global PMS & menstrual health supplements market, accounting for around 53.7% in 2025. This is largely due to the high prevalence and widespread awareness of PMS symptoms affecting a large population of women of reproductive age. Epidemiological studies show that while 80–90% of women experience PMS symptoms, about 2.5–3% suffer from premenstrual dysphoric disorder (PMDD), a more severe and debilitating form of PMS that significantly affects daily activities and social interactions.

PMS causes a range of physical and emotional symptoms that directly impact daily life, driving strong demand for effective supplements. Compared to the Perimenopause segment, which targets a narrower age group undergoing hormonal transition, PMS affects a broader demographic with recurring monthly symptoms, increasing the need for continuous management. This sustained demand and consumer focus on symptom relief contribute to PMS’s dominant market position.

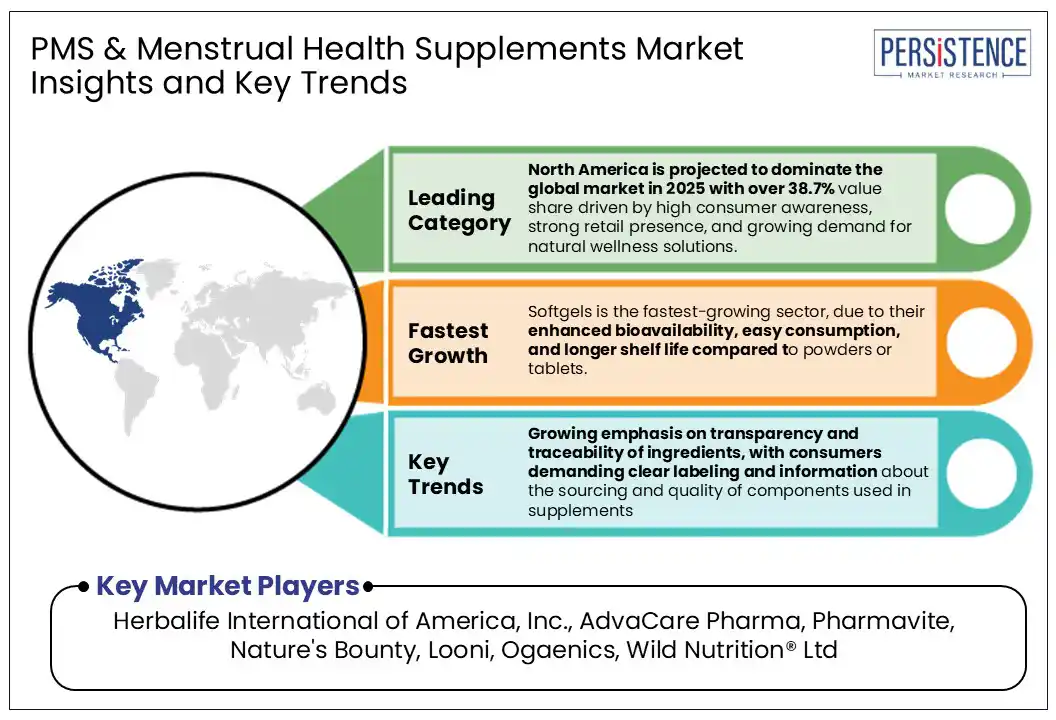

North America is anticipated to dominate the global market accounting for 38.7% value share in 2025. The region has a strong emphasis on research and development in supplements targeting PMS symptoms and hormone balance. The region benefits from high health awareness, significant purchasing power, and the convenience of e-commerce and direct-to-consumer platforms, which improve product accessibility.

Efforts to enhance menstrual health education and equity are also gaining momentum through impactful campaigns. For example, in May 2024, Midol partnered with non-profit PERIOD. to launch the "PeriodTalk with Midol" campaign, addressing menstrual discomfort and promoting open dialogue. In March 2025, The Period Purse initiated a national campaign in Canada to combat period poverty and raise awareness year-round through community events and partnerships. These initiatives highlight North America’s commitment to advancing menstrual health and supporting women’s well-being.

Europe is emerging as a key region within the global market, supported by rising health consciousness and increasing demand for natural, plant-based supplements that address PMS and menstrual health. Consumers in countries such as Germany, the UK, and France favour hormone-free, clean-label products with transparent sourcing and sustainable packaging.

Regulatory support and product standardization boost consumer trust, further expanding the market. For example, in March 2024, SIRIO Pharma launched a personalized women’s health platform at Vitafoods Europe, featuring 25 formulations for life stages from puberty to post-menopause. This portfolio includes PMS, fertility, prenatal, and menopause products, backed by clinical research and premium ingredients. Notable products showcased include the MenoBalance gummy featuring Novasoy® and the InnoFolate prenatal softgel with Quatrefolic. These developments reflect Europe’s growing influence in advancing menstrual health supplement innovation.

Asia Pacific market is rapidly expanding, driven by growing awareness of women’s health, evolving lifestyles, and rising disposable incomes. Key markets such as India, China, Japan, and South Korea are leading the shift as urbanization and education improve understanding of menstrual health issues.

India PMS & menstrual health supplements market shows strong demand for natural and Ayurvedic supplements, rooted in traditional wellness practices. The rise of e-commerce enhances product accessibility in urban and semi-urban areas. Government initiatives and the influence of social media and health influencers further boost consumer engagement. For instance, in March 2024, Amway India launched the #HerHealthFirst campaign to promote women’s well-being and entrepreneurship. With a large reproductive-age population and increasing focus on holistic health, Asia Pacific is poised to be a major growth driver in the global market.

The PMS & menstrual health supplements market is highly competitive, with a diverse mix of global pharmaceutical companies, specialized supplement manufacturers, and emerging start-ups targeting women’s health. Companies are expected to navigate stringent regulatory frameworks, which, while challenging, help ensure product safety and efficacy ultimately boosting consumer confidence and supporting long-term market growth.

The global PMS & Menstrual Health Supplements market is set to reach US$ 25.7 Bn in 2025.

The market is projected to record a CAGR of 5.7% during the forecast period from 2025 to 2032.

Demand for PMS & menstrual health supplements are growing globally due to rising health awareness and demand for natural, non-pharmaceutical symptom relief.

Herbalife International of America, Inc., AdvaCare Pharma, Pharmavite, Nature's Bounty, Looni, Ogaenics, and Wild Nutrition® Ltd. are a few leading players.

North America is projected to dominate the global market in 2025.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Mn/Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Consumer Group Outlook

By Formulation

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author