ID: PMRREP33044| 199 Pages | 2 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

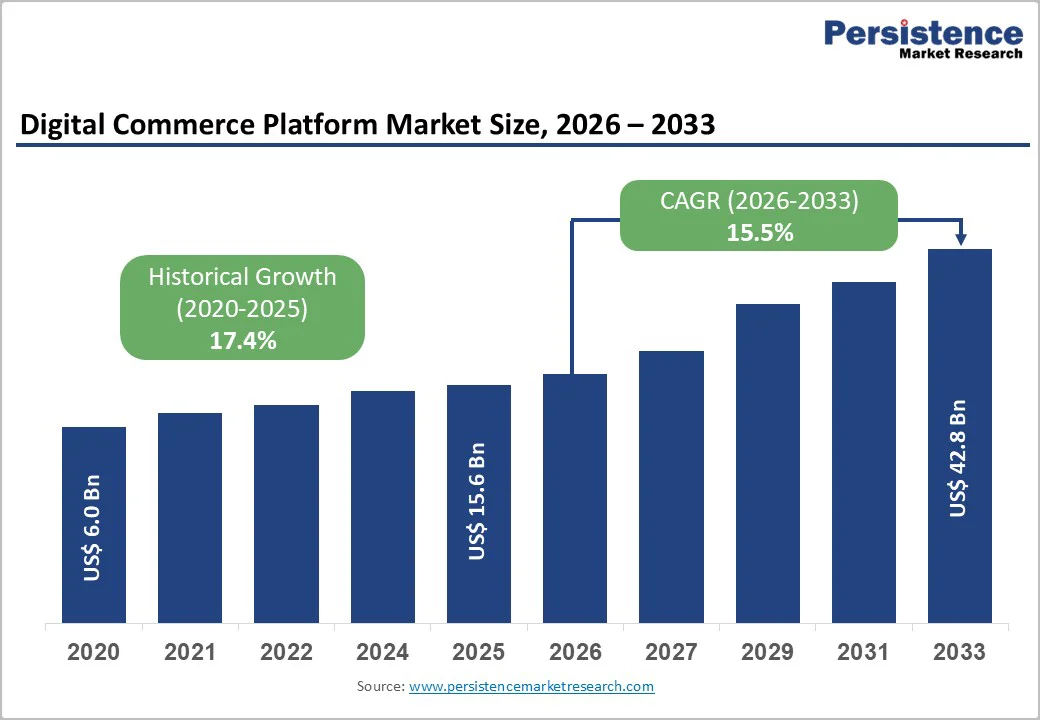

The global digital commerce platform market size is likeky to be valued at US$ 15.6 billion in 2026 and projected to reach US$ 42.8 billion by 2033, growing at a CAGR of 15.5% between 2026 and 2033.

This remarkable expansion reflects the accelerating shift toward digital-first commerce models, with businesses of all sizes recognizing the imperative to establish robust online selling capabilities. The market growth is fundamentally driven by the exponential rise in internet penetration and mobile device adoption across emerging markets, particularly in Asia Pacific regions, where smartphone users are projected to exceed 2 billion by 2025. The intensifying competitive pressure compelling traditional retailers to establish a digital presence and optimize omnichannel operations, further pushing the market growth.

| Key Insights | Details |

|---|---|

| Digital Commerce Platform Size (2026E) | US$ 15.6 billion |

| Market Value Forecast (2033F) | US$ 42.8 billion |

| Projected Growth CAGR (2026 - 2033) | 15.5% |

| Historical Market Growth (2020 - 2025) | 17.4% |

The fundamental driver propelling digital commerce platform expansion is the industry-wide transition toward integrated omnichannel selling models. Enterprises increasingly recognize that single-channel selling strategies limit addressable market opportunities and reduce customer lifetime value, spurring investment in unified commerce platforms that seamlessly orchestrate selling across e-commerce websites, mobile applications, social commerce channels, marketplaces, and physical point-of-sale systems.

A critical catalyst is the behavioral shift among B2B buyers, where millennials and Generation Z now represent 70% of professional purchasers, demanding consumer-grade interface intuitiveness combined with B2B-specific functionality such as multi-level approval workflows and dynamic pricing. Research from Shopify demonstrates that merchants operating unified commerce platforms report up to 150% omnichannel GMV growth and maintain 22% lower total cost of ownership due to consolidated data infrastructure and eliminated system silos.

Artificial intelligence integration represents the second dominant growth vector, transforming digital commerce platforms from transaction facilitators into intelligent commerce systems capable of orchestrating entire customer journeys with contextual precision. Modern AI-powered personalization engines now deliver approximately 20% higher conversion rates compared to batch-processing approaches, through real-time context awareness that adapts product recommendations, pricing, messaging, and fulfillment routing based on individual behavioral patterns and market conditions.

The sophistication extends to predictive inventory optimization powered by machine learning, which analyzes demand signals across channels and geographies to prevent stock-outs during peak periods while minimizing overstock conditions that typically plague seasonal retailers. Adobe Commerce, powering approximately 130,000 active storefronts globally, exemplifies this evolution, with mobile commerce now constituting 50.8% of total sales and AI-driven mobile conversion rates reaching 3.7%, substantially exceeding industry benchmarks of 2.9%.

The expansion of digital commerce surfaces and the increasing financial volume processed through online platforms have created proportional growth in sophisticated cyber threats and fraud mechanisms targeting merchants and consumers alike. Online scams and cybersecurity incidents represent material competitive constraints, particularly for mid-market and smaller merchants lacking dedicated security infrastructure, with enterprises increasingly mandated to implement Zero Trust Architecture, advanced encryption protocols, and multi-factor authentication across customer touchpoints.

Financial losses from fraud and security breaches extend beyond direct monetary impact to encompass brand reputation damage and customer acquisition cost elevation, with merchants compelled to invest in continuous security monitoring, threat intelligence, and forensic investigation capabilities. The international complexity amplifies constraints, as merchants operating across multiple jurisdictions must maintain compliance postures aligned with divergent regulatory frameworks and rapidly evolving cybersecurity mandates.

Despite significant technological advancements in logistics infrastructure, the physical execution of order fulfillment and last-mile delivery remains operationally complex and economically challenging, particularly across geographies with underdeveloped distribution networks or geographic dispersal. The escalating consumer expectation for expedited delivery-exemplified by same-day and next-day delivery service demands-compels merchants and platforms to subsidize fulfillment economics through logistics partnerships, inventory positioning, and fulfillment network investments that compress margins.

Third-party logistics providers, while essential for operational scalability, introduce vendor management complexity, service quality variability, and cost predictability challenges that complicate financial modeling. The constraint intensifies during peak demand periods such as Black Friday, where infrastructure capacity limitations and carrier network congestion create service delivery risks.

The convergence of social media platforms and e-commerce functionality represents a transformative opportunity reshaping consumer purchasing behavior and merchant distribution strategies. Social commerce adoption demonstrates exceptional momentum across geographies, with more than 60% of online shoppers in Southeast Asia having completed purchases through social platforms, including TikTok Shop, Instagram Shopping, and Facebook Marketplace, during the preceding twelve months. The opportunity extends beyond developed markets-apparel represented 26% of social commerce sales in North American markets in 2024, with fashion categories demonstrating disproportionately high social conversion propensity due to visual product presentation and influencer credibility.

Platform providers are responding by integrating native social commerce capabilities, including live-stream selling infrastructure, shoppable posts, and influencer collaboration management tools that systematically reduce friction between product discovery and transaction completion. This represents a 35-billion-dollar annual opportunity across emerging markets, where social platforms serve as a primary internet access vector and influencer culture commands exceptional consumer engagement.

Market expansion opportunities exist within vertical commerce platforms addressing specific industry requirements and operational complexities that generalist platforms inadequately serve. Healthcare e-commerce, encompassing online pharmacies and telemedicine integration, demonstrates comparable momentum reflecting regulatory harmonization around digital prescription management and expanding consumer acceptance of online pharmaceutical channels.

The food and beverage vertical presents distinct opportunities around subscription models, dynamic pricing responsive to commodity cost fluctuations, and supply chain transparency that modern platforms must architect. Vertical specialists possess the capability to embed compliance frameworks, industry-specific workflows, and specialized integrations that create material competitive advantages over generalist platforms and justify premium pricing. The opportunity intensity is highest within healthcare, financial services, and automotive verticals, where regulatory requirements and transaction complexity create defensible platform differentiation and reduce competitive commoditization.

The Business-to-Consumer (B2C) model remains the dominant revenue generator in the digital commerce platform market, accounting for 46% of total market share and representing the largest global GMV pool. Its leadership is supported by high-frequency consumer purchases, broad merchant participation, and continuous innovation in omnichannel shopping, personalization, and mobile-first experiences. B2C platforms benefit from significant investments in AI-led recommendations, frictionless checkout flows, and cross-border commerce enablement that expand customer reach. Although B2B and D2C models are growing rapidly, B2C retains structural advantages due to its scale, diversified product categories, and robust ecosystem of merchants, logistics partners, and payment providers that reinforce sustained user engagement and transaction growth worldwide.

Cloud-based deployment leads the digital commerce platform landscape, holding nearly 60% market share and serving as the default architecture for new implementations across enterprises and SMEs. Its dominance stems from unmatched scalability, allowing merchants to efficiently handle traffic surges while aligning infrastructure expenditure with demand levels. Cloud models also eliminate costly on-premise infrastructure, reduce IT maintenance burdens, and accelerate deployment timelines. Seamless integration with APIs, headless architectures, and customer data platforms further strengthens adoption. Security patch automation and continuous feature updates enhance platform reliability. SMEs, in particular, demonstrate strong cloud uptake due to affordable pricing and managed service models, cementing cloud’s position as the most preferred and economically rational deployment approach globally.

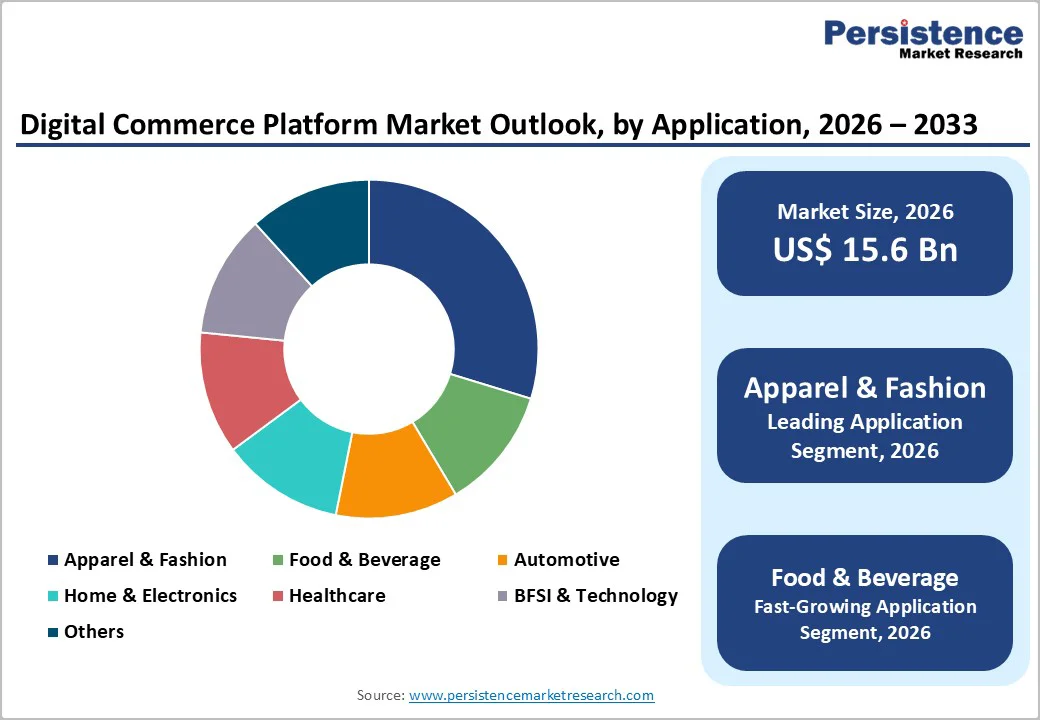

Apparel & Fashion is the largest application segment in the digital commerce platform market, capturing 28% market share and exhibiting advanced digital adoption across both fast fashion and premium retail.

The segment benefits from strong consumer affinity for online shopping, increasingly influenced by social commerce, influencer-driven campaigns, and mobile-first discovery. Retailers extensively deploy technologies such as AI-powered sizing tools, virtual try-on solutions, and hyper-personalized product recommendations to reduce returns and enhance conversion rates. Fashion e-commerce, valued at about US$ 750 billion in 2025, is projected to cross US$ 1 trillion by 2030 at 7.5% CAGR, driven by expanding cross-border fashion demand, rapid catalog refresh cycles, and seamless omnichannel fulfillment capabilities.

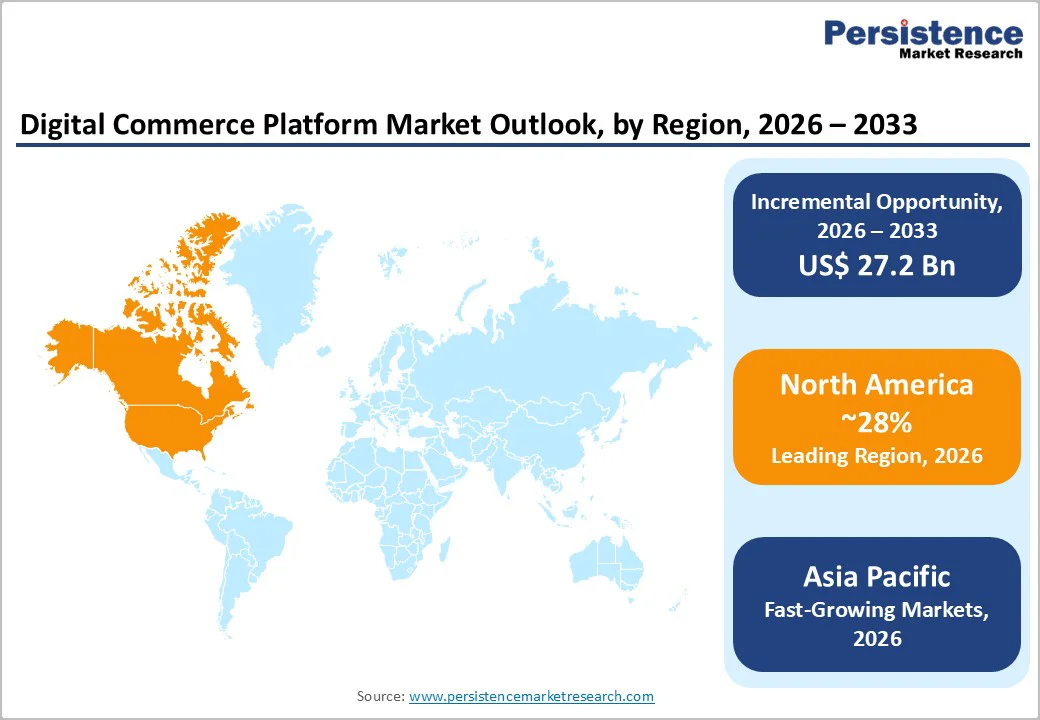

North America remains the most mature market for digital commerce platforms, anchored by the United States’ leadership with over US$ 1.25 trillion in e-commerce spending in 2025 and continued expansion at 10.71% CAGR through 2030. This maturity is driven by exceptionally high internet penetration-surpassing 90% in Canada-and advanced broadband coverage across the U.S., along with a highly developed payment ecosystem featuring digital wallets, BNPL, and early cryptocurrency checkout options.

The region also benefits from robust third-party logistics networks that enable same-day delivery across major metropolitan areas, reinforcing merchant competitiveness. Shopify leads the regional platform landscape with 30% share, supported by strong API extensibility and omnichannel features. North America’s fastest-growing segment is B2B commerce, expanding at 12.1% CAGR due to rapid digitalization of procurement workflows, AI-driven cataloging, and embedded credit capabilities.

Europe stands out as the fastest-growing developed market for digital commerce platforms, with regional revenues projected to cross US$ 10.0 billion by 2033, supported by harmonized regulatory frameworks that simplify cross-border trade and compliance. The European Union’s unified standards for taxation, privacy, and consumer rights have significantly reduced operational friction, enabling merchants to scale across multiple markets with greater ease. Growth is concentrated in innovation hubs such as Germany, the U.K., France, and Spain, where enterprises are rapidly adopting headless commerce to integrate flexible frontends with modular backend architectures.

Sustainability is a defining differentiator in Europe, with platforms integrating carbon tracking tools, ethical sourcing verification, and circular commerce capabilities to meet stringent consumer expectations. Cross-border commerce intensity is among the highest globally, requiring multilingual and multicurrency operations as baseline functionality. Subscription commerce is particularly advanced, with SaaS-based commerce models accounting for 55% of platform revenue, reflecting widespread enterprise adoption of recurring-revenue digital ecosystems.

Asia Pacific is the fastest-growing global market for digital commerce platforms, forecast to expand at an exceptional 20.5% CAGR through 2033, driven by the world’s highest mobile commerce penetration and rapid digital payment adoption. China leads the region with 42% revenue share, though its growth is stabilizing due to urban saturation and strengthened platform regulation. The country remains a global innovation hub, pioneering live-stream commerce through platforms such as Taobao Live and Douyin, which have redefined purchasing behaviors by merging entertainment and shopping.

India represents the region’s strongest growth engine, supported by about 900 million smartphone users by 2025 and booming adoption of digital wallets like Paytm and PhonePe. WooCommerce leads India’s SME-focused market with 44% share. Southeast Asia-Thailand, Vietnam, Indonesia, and the Philippines-continues to surge as platforms like Shopee and Tokopedia deliver hyper-localized marketplaces, seamless digital wallets, and seller-enablement programs. Mobile-first behavior dominates, necessitating optimized PWAs and lightweight payment integrations.

The digital commerce platform market displays a moderately fragmented structure, with higher consolidation in mature regions and more dispersed competition in emerging markets where regional platforms retain strong footholds. Market leadership is shaped by the scale of merchant onboarding, depth of application ecosystems, and maturity of omnichannel capabilities rather than purely on transaction processing features, which have become commoditized. Enterprise platforms increasingly differentiate through advanced personalization, complex catalog management, multi-store administration, and integrated B2B commerce workflows, while SMB-focused platforms compete on affordability, ease of deployment, and plug-and-play integrations.

Strategically, vendors are shifting toward composable and API-driven architectures, enabling businesses to assemble customized technology stacks and avoid monolithic suites. Headless commerce adoption is accelerating as retailers seek greater frontend flexibility and faster experimentation cycles. Competitive advantage increasingly hinges on unified payments, real-time inventory visibility, AI-driven merchandising, and embedded supply-chain intelligence, reflecting the market’s transition toward experience-centric digital commerce innovation.

The market is projected to reach US$ 42.8 billion by 2033, up from US$ 15.6 billion in 2026.

Adoption is mainly driven by the shift toward integrated omnichannel commerce, which boosts sales efficiency and reduces system complexity.

North America leads with 28.2% market share, and Asia Pacific records the highest growth at 20.5% CAGR.

The largest opportunity lies in healthcare e-commerce, which is expanding rapidly due to telemedicine and online pharmacy adoption.

Key players include Shopify, WooCommerce, Adobe Commerce, Salesforce Commerce Cloud, BigCommerce, and regional leaders such as Shopee, Tokopedia, Mercado Libre, and Amazon.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Business Model

By Deployment

By Application

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author