ID: PMRREP11644| 199 Pages | 3 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

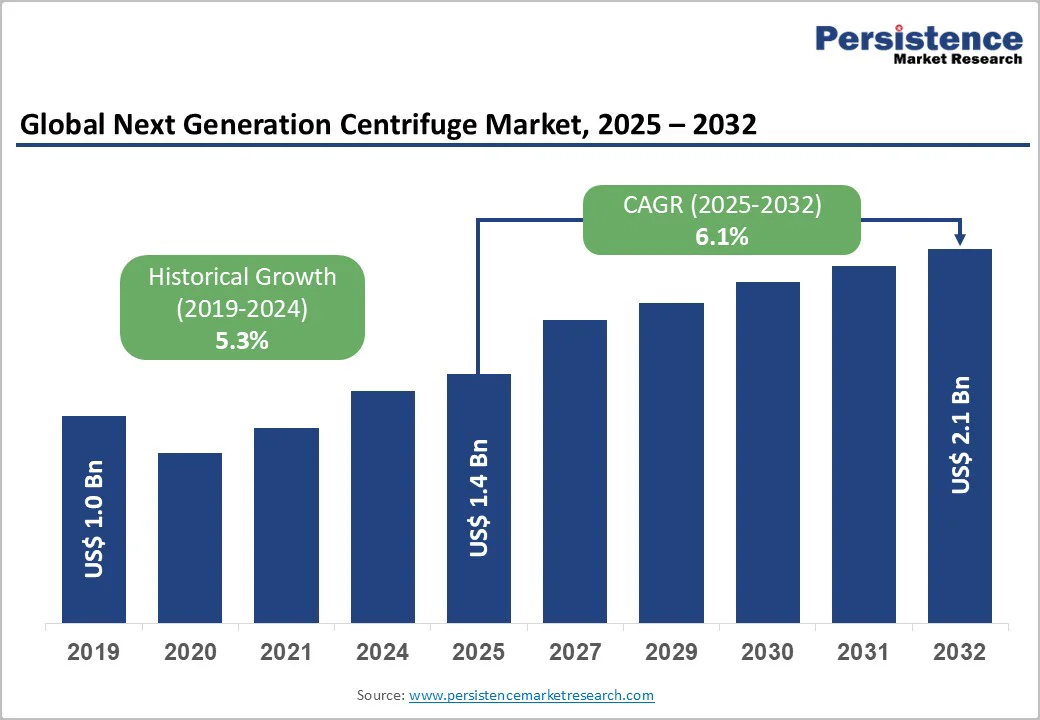

The global next-generation centrifuge market is valued at US$1.4 billion in 2025 and is projected to reach US$2.1 billion, growing at a CAGR of 6.1% from 2025 to 2032.

The next-generation centrifuge market is experiencing strong momentum as laboratories transition toward automated, high-precision workflows. Growth is primarily fuelled by rising demand for high-throughput clinical diagnostics, expanding biopharmaceutical R&D pipelines, and rapid adoption of precision medicine across developed economies. Increasing investments in biomedical research further strengthen the need for advanced separation technologies that offer accuracy, speed, and gentle sample handling.

| Key Insights | Details |

|---|---|

| Next Generation Centrifuge Market Size (2025E) | US$1.4 Bn |

| Market Value Forecast (2032F) | US$2.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.3% |

Advancements in clinical and medical fields have heightened awareness of the need for a better healthcare system. Various government amendments to research and development and diagnostic services are expected to enhance growth in the next-generation centrifuge market during the forecast period. Increasing government initiatives to expand access to healthcare are expected to play a key role in the market's growth.

The S10 Instrumentation Program is one such program initiated by the National Institute of Health (NIH) that allows NIH-supported investigators to purchase or upgrade a single item of specialized or commercially available instrumentation or an integrated system that costs at least US$100,000.

The high-end instrumentation grant program of NIH allows investigators to purchase a single major item of equipment for biomedical research that costs at least US$750,000. Various government initiatives, in collaboration with other organizations, to encourage R&D in medical science are expected to boost market growth.

The high cost of installing next-generation centrifuges remains a significant barrier to broader market adoption. Advanced models, particularly floor-standing and high-speed systems, require substantial upfront investment not only in equipment but also in specialized laboratory infrastructure, safety features, and energy-efficient cooling systems.

Many small laboratories, academic institutes, and healthcare facilities face financial constraints that prevent them from upgrading to these technologically advanced units. In addition, service contracts, calibration, rotor replacements, and periodic maintenance increase long-term operational expenses, further stretching budgets.

For many organizations, recovering these costs is uncertain and heavily dependent on throughput, including the number of diagnostic samples processed or research outputs achieved. Institutions with lower sample volumes may find it difficult to justify the investment, delaying modernization.

Moreover, the adoption of next-generation centrifuges is closely tied to the availability of advanced medical and research facilities, which remain scarce in several developing regions. Delays in reimbursement approvals, limited government funding, and slow procurement cycles also contribute to hesitancy in adopting high-cost centrifuge technologies. Collectively, these financial and infrastructural challenges significantly restrain market growth.

The rapid expansion of personalized medicine and advanced molecular diagnostics is creating a major growth opportunity for the next-generation centrifuge market. With increasing adoption of cell therapy, gene therapy, and precision oncology, laboratories now require centrifuges that offer highly controlled, gentle, and accurate sample processing to protect fragile cells, nucleic acids, and viral vectors.

This shift is driving strong demand for smart, programmable, multi-rotor, and high-throughput systems that can support omics workflows, bio-banking, and advanced sample preparation. As pharmaceutical and biotech companies scale up translational research and clinical-grade manufacturing, there is a rising need for centrifuges that integrate automation, digital monitoring, and workflow standardization.

Additionally, the growing number of specialized testing laboratories worldwide, especially those focused on genomics, proteomics, and regenerative medicine, opens new avenues for product penetration.

Manufacturers offering energy-efficient, low-noise, contamination-controlled, and compliance-ready centrifuges can capture significant revenue from both research and clinical markets. Overall, the evolution toward precision healthcare positions next-generation centrifuges as essential tools supporting advanced diagnostics and therapeutics.

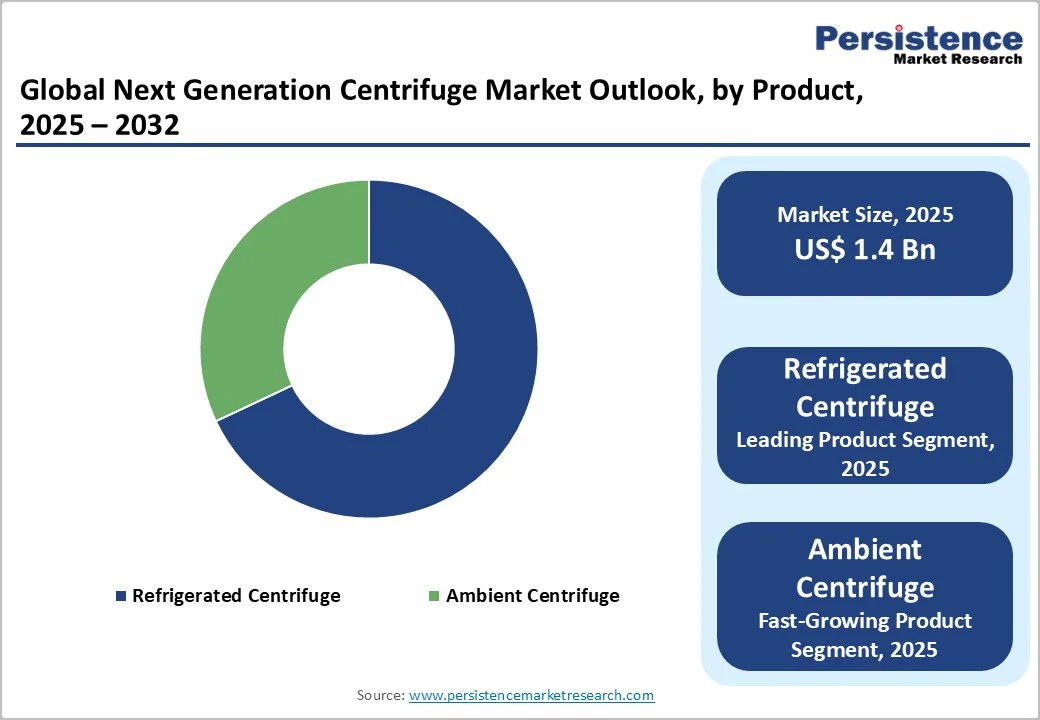

The refrigerated centrifuge segment continued to lead the next-generation centrifuge market in 2025, capturing nearly 68% of the overall share. The growing need for controlled, low-temperature processing across research, clinical diagnostics, and biopharmaceutical applications largely drives this dominance.

Refrigerated models, both benchtop and floor-standing, are widely preferred for handling temperature-sensitive samples, including proteins, nucleic acids, cell pellets, and viral particles, to ensure sample integrity during high-speed separation.

Their strong adoption is further supported by continuous technological upgrades, including the use of eco-friendly refrigerants, improved compressor efficiency, and quieter operation systems, which align with modern laboratory sustainability goals.

Enhanced digital interfaces, programmable settings, and real-time performance monitoring add to their appeal, enabling precise, reproducible workflows. With expanding demand from genomics labs, bioprocessing facilities, and advanced diagnostic platforms, refrigerated centrifuges remain the equipment of choice for applications requiring consistent thermal control.

Hospitals emerged as the leading end-user segment in 2024, accounting for about 41% of the total market share. Their dominance is closely linked to the rising demand for advanced clinical diagnostics, expanding blood management programs, and the increasing need for fast and accurate pathogen detection within hospital laboratories.

With hospitals handling a large volume of routine and emergency tests each day, the requirement for dependable, high-performance centrifuges continues to grow.

The adoption of next-generation systems is further strengthened by integrating laboratory information systems, which support smoother workflows and improve sample traceability. Hospitals increasingly prioritize equipment that ensures consistent sample quality, minimizes errors, and promotes rapid turnaround times mandated by regulatory and accreditation standards.

Upgrades in infection control protocols, expansion of critical care units, and the shift toward point-of-care and precision diagnostics also encourage continuous investment in modern centrifuge technologies. These factors collectively place hospitals at the forefront of next-generation centrifuge utilization and procurement.

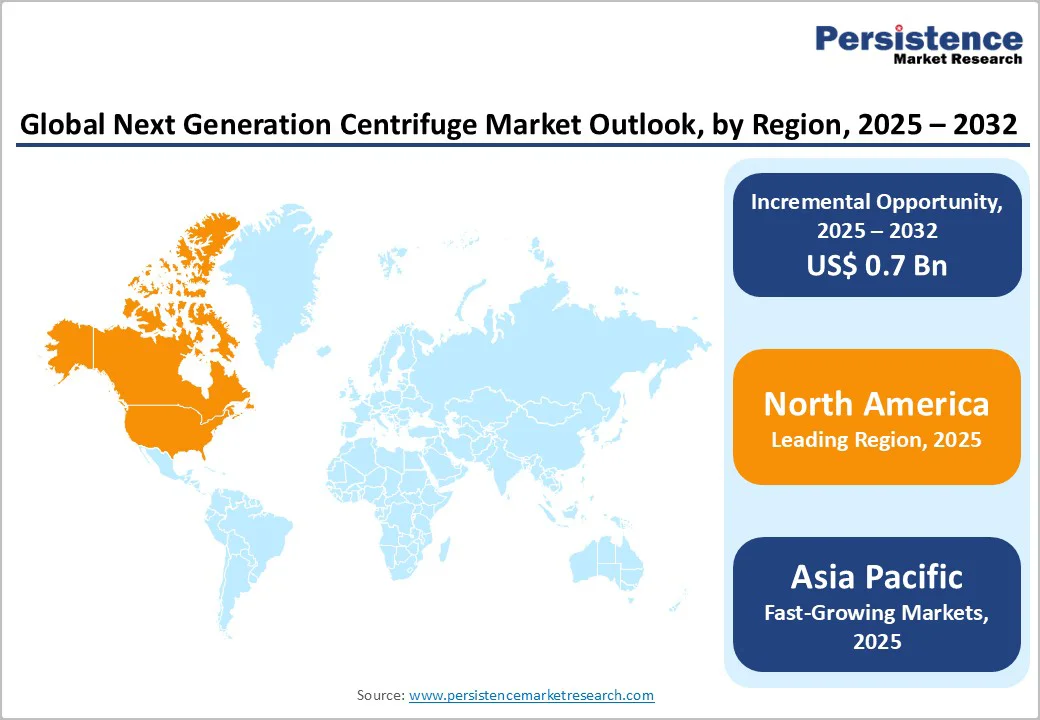

North America continues to dominate the next-generation centrifuge market, with the U.S. leading due to substantial investments in biomedical and life sciences research. Advanced university hospital networks and a strong focus on translational medicine create high demand for precision, automated centrifuge systems. Regulatory oversight by the FDA ensures product reliability, safety, and compliance, while simultaneously encouraging technological innovation.

Collaboration between public research institutions and private enterprises accelerates the adoption of advanced centrifuge systems, particularly in diagnostics, genomics, and cell therapy applications. Hospitals, research laboratories, and biotechnology firms increasingly prioritize smart, high-throughput centrifuges to improve workflow efficiency and reproducibility.

The presence of key manufacturers with strong regional bases further reinforces North America’s leadership in the market. Additionally, government funding and initiatives supporting biomedical innovation, coupled with high R&D expenditure, drive consistent demand for next-generation centrifuges.

Emerging trends include the integration of IoT-enabled monitoring, automated sample handling, and compact benchtop designs that cater to both large-scale laboratories and specialized research settings, helping the region maintain its global competitive edge.

The Asia Pacific next-generation centrifuge market is experiencing rapid growth, driven by significant investments in healthcare and life sciences infrastructure across China, Japan, and India. Expansion of pharmaceutical manufacturing facilities, coupled with government incentives to modernize laboratory equipment, has created a conducive environment for adopting advanced centrifuge technologies.

Local production and assembly capabilities offer cost advantages, enabling manufacturers to provide high-quality centrifuge systems at competitive prices. Multinational companies are increasingly establishing regional R&D and service centers to leverage skilled scientific talent and favorable regulatory frameworks, facilitating faster product development and market rollout.

Rising research activities in genomics, biotechnology, and clinical diagnostics are increasing the demand for automated, high-throughput centrifuge solutions.

Additionally, growing awareness among hospitals and research institutions about precision, reproducibility, and workflow efficiency is fueling the procurement of next-generation centrifuges. The region’s expanding healthcare infrastructure, coupled with increasing collaborations between global and local players, positions Asia Pacific as the fastest-growing market for next-generation centrifuge technologies, offering both production and innovation advantages.

The Next Generation Centrifuge market is moderately concentrated, with industry leaders Eppendorf, Thermo Fisher Scientific Inc., and Danaher Corporation (Beckman Coulter) collectively accounting for a significant global share. These companies invest heavily in product innovation, digitalization, and global service networks.

Emerging business models focus on connected devices, pay-per-use laboratory infrastructure, and fully automated workflow solutions. Key differentiators include end-to-end integration, compliance expertise, tailored applications for niche research fields, and end-user customization options.

The global next generation centrifuge market is projected to be valued at US$ 1.4 Bn in 2025.

Rising demand for high-throughput diagnostics, biopharmaceutical manufacturing growth, automation adoption, and increasing need for precise sample processing drive the next-generation centrifuge market.

The global next generation centrifuge market is expected to witness a CAGR of 6.1% between 2025 and 2032.

Expanding personalized medicine, cell and gene therapy growth, advanced omics research, digitalized smart centrifuges, and increasing investments in biobanking present strong market opportunities.

Leading companies include Eppendorf, Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter), Polypipe (Nuaire), and Others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author