ID: PMRREP2785| 198 Pages | 13 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

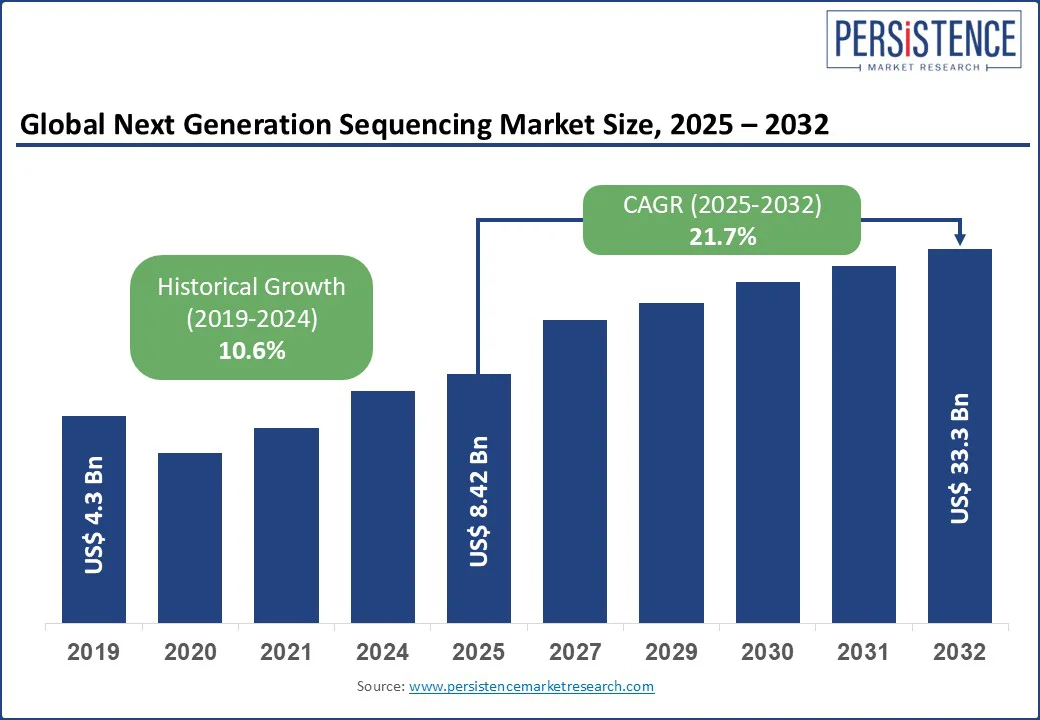

The global Next Generation Sequencing (NGS) Market size is projected to rise from US$ 8.42 Bn in 2025 to US$ 33.3 Bn by 2032, registering a CAGR of 21.7% during the forecast period from 2025 to 2032.

The NGS industry has experienced significant growth in recent years, driven by advancements in sequencing technologies, increasing demand for personalized medicine, and expanding technologies in genomics research. The sector is propelled by the need for high-throughput, cost-effective sequencing solutions that enable researchers and clinicians to analyze complex genetic data with unprecedented accuracy and speed.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Next Generation Sequencing Market Size (2025E) |

US$ 8.42 Bn |

|

Market Value Forecast (2032F) |

US$ 33.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

21.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.6% |

The rising focus on personalized medicine and genomics research is a pivotal driver of growth in the next-Generation sequencing (NGS) market. Personalized medicine aims to tailor medical treatment to the individual characteristics of each patient, and NGS plays a central role by enabling comprehensive genetic analysis with high accuracy and speed.

For instance, a 2023 study published in Nature Medicine found that NGS-based genomic profiling revealed actionable mutations in 65% of cancer patients, allowing oncologists to administer targeted therapies that significantly improve treatment outcomes. As cancer remains one of the leading global health concerns, the World Health Organization estimates that cancer cases will rise by 2040, underscoring the urgent need for advanced and precise diagnostic solutions such as NGS.

In addition, strong governmental support is playing a vital role in driving market expansion. The U.S. government has introduced major initiatives to advance genomics-based healthcare, such as the Precision Medicine Initiative, which promotes large-scale research and the integration of genetic data into clinical practice. Similarly, the UK’s 100,000 Genomes Project has established a solid foundation for incorporating genomics into routine medical care, setting a precedent for other nations.

The high initial costs of Next-Generation Sequencing (NGS) instruments and the required infrastructure present a significant barrier to market adoption, particularly in resource-limited environments. Establishing a fully functional NGS laboratory demands substantial capital investment in advanced sequencing platforms, secure data storage systems, and specialized bioinformatics tools.

For instance, high-end platforms such as Illumina’s NovaSeq X Plus require considerable financial commitment, even before factoring in ongoing maintenance and operational expenses. These costs often make it challenging for smaller research institutions, hospitals, and academic centers, especially in developing regions, to implement and sustain NGS capabilities.

Moreover, the successful operation of NGS technology relies on skilled personnel who can manage and interpret complex genomic data, which adds to the resource and training burden. These combined financial and workforce-related challenges continue to restrict widespread adoption of NGS, despite the gradual decrease in per-sample sequencing costs.

The expansion of Next-Generation Sequencing (NGS) into clinical diagnostics and non-invasive testing presents a significant opportunity for market growth. While NGS has traditionally been utilized in research, it is now increasingly being integrated into clinical practice for early disease detection, personalized treatment planning, and risk assessment. One prominent area of growth is non-invasive prenatal testing (NIPT), where NGS is used to analyze fetal DNA from maternal blood, offering high accuracy with minimal risk. Companies such as Natera and Roche have developed NIPT solutions that are widely adopted for the detection of chromosomal abnormalities.

NGS also plays a vital role in infectious disease diagnostics by enabling the rapid identification and monitoring of pathogens and their genetic mutations. For instance, during the COVID-19 pandemic, NGS was instrumental in tracking the emergence and evolution of SARS-CoV-2 variants across the globe.

In oncology, NGS is used to uncover actionable genetic mutations that inform targeted cancer therapies. Platforms such as FoundationOne CDx by Foundation Medicine support precision oncology by enabling clinicians to tailor treatment strategies based on a patient’s unique genetic profile. These expanding clinical Technologys highlight the growing importance of NGS in the broader shift toward precision medicine.

Consumables dominate the NGS market, expected to account for approximately 69.0% of the industry share in 2025. This segment’s leadership stems from the recurring demand for reagents, kits, and flow cells, which are essential for every sequencing run. The high-throughput nature of NGS requires frequent replenishment of consumables, ensuring steady revenue streams for manufacturers such as Illumina and Thermo Fisher.

The widespread adoption of NGS across research and clinical Technologys, coupled with the increasing number of sequencing projects, such as population-scale genomics studies, further drives demand for consumables. Their versatility across various sequencing platforms solidifies their market dominance.

The Instruments segment is the fastest-growing from 2025 to 2032. This growth is driven by the introduction of advanced sequencing platforms, such as Illumina’s NovaSeq X and Oxford Nanopore’s PromethION, which offer higher throughput, scalability, and automation. These innovations cater to large-scale research and clinical laboratories, where demand for high-performance sequencing systems is rising. Additionally, the push for decentralized sequencing in clinical settings and the development of portable instruments, such as Oxford Nanopore’s MinION, are accelerating adoption, particularly in emerging markets.

Sequencing By Synthesis (SBS) holds the largest next generation Sequencing market share, with 38.1% accounting for 2025. SBS, primarily driven by Illumina’s HiSeq and NovaSeq platforms, is favored for its high accuracy, scalability, and cost-effectiveness in high-throughput technologies. Its widespread adoption in genomics research, clinical diagnostics, and drug development underscores its dominance.

Nanopore Sequencing is the fastest-growing segment. Its growth is fueled by its portability, real-time sequencing capabilities, and applicability in field-based genomics, such as infectious disease surveillance. Oxford Nanopore’s MinION and PromethION devices enable rapid sequencing in resource-limited settings, making them ideal for technologies such as pathogen detection during outbreaks. The technology’s ability to sequence long reads also supports structural variant analysis, driving its adoption in research and clinical diagnostics.

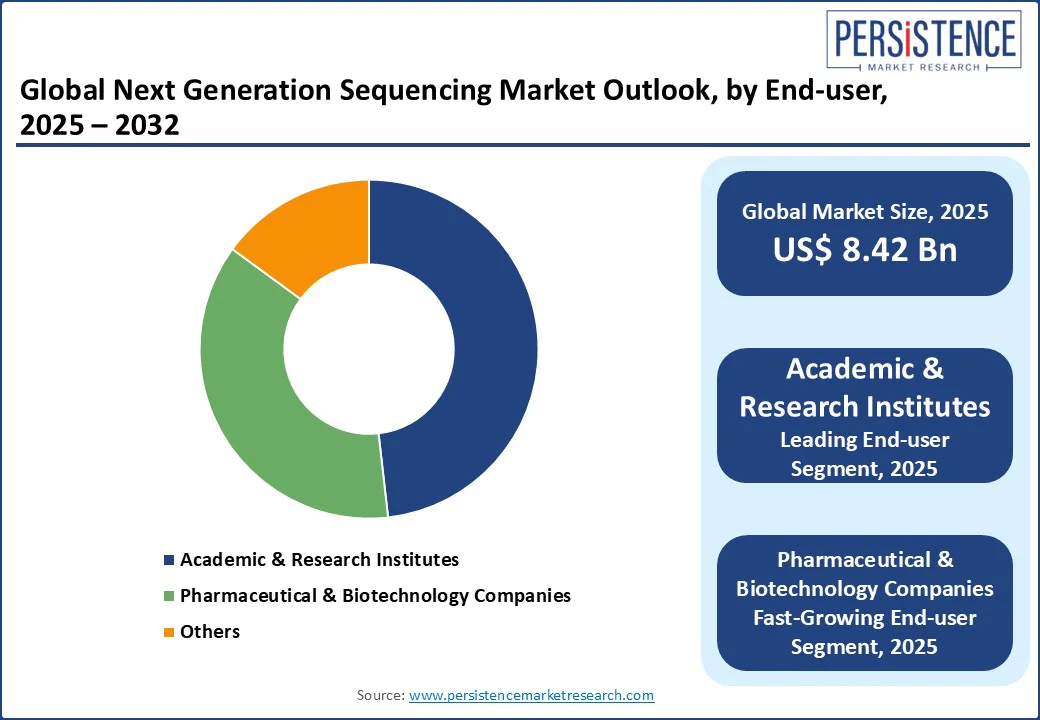

Academic institutions accounted for 48.4% of the global next generation sequencing NGS market revenue. Their involvement is driven by large-scale research initiatives, often supported by government grants and national genome programs that require high-throughput sequencing platforms. Additionally, these institutions are at the forefront of applying NGS in clinical settings, particularly in neonatal intensive care units (NICUs), where rapid whole-genome sequencing has shown strong clinical value. By accelerating diagnosis and improving patient outcomes, academic centers continue to advance both scientific discovery and clinical utility in genomics.

Pharmaceutical & biotechnology companies are the fastest-growing. It is driven by the extensive use of NGS in drug discovery, biomarker identification, and clinical trial optimization. Companies leverage NGS to identify genetic targets for precision medicine, with Technologys in oncology and rare disease research. For example, NGS-based companion diagnostics, such as those developed by Roche, are increasingly used to guide targeted therapies, boosting demand in this sector.

In North America, holding a 42% market share in 2025, the United States remains the leading force in the Next-Generation Sequencing (NGS) market. This dominance is supported by a strong biotechnology and healthcare infrastructure, as well as the presence of key industry players such as Illumina, Thermo Fisher Scientific, and Agilent Technologies.

The increasing demand for precision medicine is further accelerating the adoption of NGS, reinforced by national initiatives like the All of Us Research Program, which is focused on large-scale genome sequencing to advance individualized healthcare.

Clinical Technologys are expanding at a rapid pace. Companies such as Foundation Medicine are providing comprehensive cancer genomic profiling to guide personalized treatment decisions. Additionally, Tempus, a U.S.-based precision medicine firm, has recently expanded its AI-driven multi-omics platforms, reflecting the market’s growing focus on integrating NGS with artificial intelligence and big data analytics for enhanced diagnostic accuracy and efficiency. Despite this progress, challenges such as high equipment costs and complex regulatory frameworks continue to pose barriers, particularly for smaller laboratories and emerging startups looking to enter the space.

Europe holds the second-largest position in the global Next-Generation Sequencing (NGS) market, supported by robust governmental initiatives, advanced research infrastructure, and increasing clinical adoption.

Key contributors to regional growth include Germany, the UK, and France. Germany benefits from strong institutional support, with research centers such as the German Cancer Research Center (DKFZ) actively incorporating NGS into oncology and biomedical studies. In the UK, initiatives like the 100,000 Genomes Project and continued integration of NGS into National Health Service (NHS) diagnostics for rare diseases and cancer have made the country a regional leader in genomic medicine.

France is advancing rapidly through its national genomics strategy, which promotes large-scale research and innovation in sequencing technologies. At the European level, broader programs like Horizon Europe and regulatory efforts such as the EU AI Act are helping to accelerate technological advancement and NGS adoption across member states.

Despite this momentum, the region faces challenges in aligning with stringent data protection regulations such as the General Data Protection Regulation (GDPR), which can complicate data sharing and cross-border collaborations. Nonetheless, Europe’s NGS market is expected to maintain steady growth over the coming years, driven by clinical demand, research excellence, and supportive policy frameworks.

Asia Pacific is the fastest-growing region in the global Next-Generation Sequencing (NGS) market and is expected to hold a market share by 2025. The growth is primarily led by China and India, both of which are making significant investments in genomic research and healthcare innovation. China benefits from strong government backing through initiatives such as the National Genomics Data Center and the technological advancements of leading companies such as BGI Group, which continues to develop cost-effective NGS platforms.

In India, the GenomeIndia Project, aiming to sequence 10,000 genomes, along with increasing healthcare spending, is driving rapid market expansion. Indian companies such as Strand Life Sciences are playing a key role by offering NGS-based diagnostics for oncology and rare diseases. Moreover, the region’s large population, increasing demand for personalized medicine, and lower sequencing costs contribute to market acceleration. However, the underdeveloped healthcare infrastructure in rural areas remains a barrier to widespread adoption across the region.

The global Next-Generation Sequencing (NGS) market is characterized by intense technological competition, regional growth strategies, and a dynamic mix of established and emerging players. Key companies compete on speed, cost-efficiency, and clinical relevance. Illumina leads with its Sequencing by Synthesis (SBS) technology, supported by a $200 million annual R&D investment. Thermo Fisher advances its Ion Torrent platform for clinical technologies, while Oxford Nanopore disrupts the space with portable, real-time sequencers.

Emerging technologies such as single-molecule and nanopore sequencing add to the rivalry. Bioinformatics is a growing focus, with cloud partnerships such as with AWS, enhancing data analytics and integration in clinical workflows.

The Next Generation Sequencing market is projected to reach US$ 8.42 Bn in 2025.

Rising demand for personalized medicine and government-backed genomics initiatives are key drivers.

The Next Generation Sequencing market is poised to witness a CAGR of 21.7% from 2025 to 2032.

Expansion of NGS in clinical diagnostics and non-invasive testing is our key opportunity.

Illumina, Thermo Fisher Scientific, Inc., and Oxford Nanopore Technologies are key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Product Type

By Technology

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author