ID: PMRREP33656| 200 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

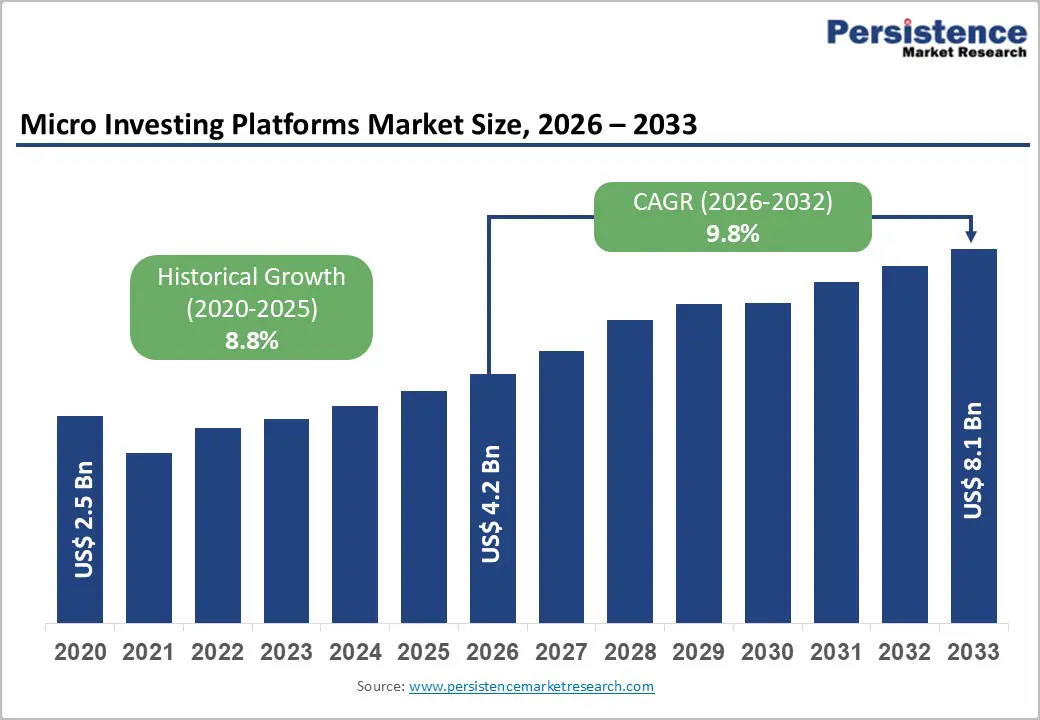

The global Micro Investing Platforms Market size was valued at US$ 2.5 billion in 2026 and is projected to reach US$ 8.1 billion by 2033, growing at a CAGR of 9.8% between 2026 and 2033.

The market is primarily driven by the democratization of finance, a surge in smartphone penetration, coupled with the rising popularity of fractional share trading, enabling individuals to invest small monetary amounts. enables individuals to invest small monetary amounts, often "spare change", into diversified portfolios. This shift is further accelerated by the growing financial literacy among Millennials and Gen Z, who favor mobile-first, gamified user experiences over traditional brokerage models.

| Key Insights | Details |

|---|---|

|

Micro Investing Platforms Market Size (2026E) |

US$ 4.2 Bn |

|

Market Value Forecast (2033F) |

US$ 8.1 Bn |

|

Projected Growth CAGR(2026-2033) |

9.8% |

|

Historical Market Growth (2020-2025) |

8.8% |

The widespread availability of fractional share trading is a foundational growth driver for the global micro-investing platforms market, as it eliminates the traditional barrier of high upfront capital. By enabling investors to purchase fractions of high-priced equities, such as leading technology or blue-chip stocks, for as little as US$ 1, platforms such as Robinhood and Stash have democratized access to capital markets. This model has significantly broadened participation among students, gig workers, and first-time investors who were previously excluded from equity investing.

The growth of fractional trading is reinforced by the industry-wide shift toward zero-commission trading, which has structurally altered revenue models. Instead of relying on transaction fees, platforms increasingly monetize through subscription plans, securities lending, and payment-for-order-flow mechanisms, allowing them to scale profitably even with small-ticket investments. Industry data indicates that over 50–55% of newly opened retail brokerage accounts in North America engage with fractional share functionality, while average initial investment sizes have declined by nearly 70% compared to traditional brokerage models. Automated “round-up” features that invest spare change from everyday purchases reduce behavioral friction, increasing transaction frequency and steadily growing assets under management (AUM) over time.

The rapid increase in digital financial literacy, driven by social media, creator-led finance education, and mobile-first learning, is significantly boosting the adoption of micro-investing platforms. Younger demographics, particularly Millennials and Gen Z, are demonstrating a strong preference for self-directed and app-based financial tools. Surveys show that Gen Z investors are nearly three times more likely to learn about investing through social media platforms, short-form videos, and online communities than through formal education or traditional financial advisors.

Micro-investing platforms capitalize on this shift by embedding gamification mechanics, including progress tracking dashboards, achievement milestones, streak rewards, and simplified portfolio visualizations. These features reduce perceived complexity and transform investing into a habitual behavior rather than a high-stakes financial decision. Platforms offering integrated education and community-driven insights, such as Coinbase and Public.com, have reported higher user retention rates and longer average session durations. Empirical trends suggest that users who engage with in-app learning modules increase their monthly investment contributions by 1.5–2.0× within the first 12 months, directly driving AUM growth and long-term platform monetization.

The global expansion of micro-investing platforms is significantly hampered by a complex, fragmented regulatory landscape. Platforms operating across borders must navigate distinct frameworks, such as the SEC regulations in the United States, MiCA in Europe, and ASIC guidelines in Australia. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) norms imposes high operational costs, often stalling market entry into emerging regions. For instance, stringent PFOF (Payment for Order Flow) restrictions in jurisdictions such as the United Kingdom force companies to restructure their core revenue models, thereby limiting profitability. This regulatory friction creates a high barrier to entry for new startups and slows down the international scalability of established players like Webull or eToro.

As fintech platforms aggregate sensitive financial data and personal identification information, they become prime targets for cyberattacks, creating a significant restraint on consumer trust. High-profile data breaches or service outages can cause immediate reputational damage and user churn. In an era where data is the new oil, users are increasingly wary of how their transaction history is monetized or shared with third parties.

A 2024 industry survey revealed that over 30% of potential users hesitate to link their primary bank accounts to third-party apps due to security fears. The cost of implementing military-grade encryption and maintaining continuous threat monitoring puts pressure on operating margins, specifically for smaller platforms lacking the capital depth of banking giants.

The integration of artificial intelligence and machine learning into micro-investing platforms presents a high-impact opportunity to move beyond basic investing automation toward personalized financial orchestration. AI-powered robo-advisory engines can dynamically tailor portfolios based on user risk tolerance, income volatility, spending patterns, and life-stage goals, such as education savings or retirement planning. Unlike static allocation models, these systems continuously adapt to market conditions and user behavior, improving long-term outcomes and perceived value.

Advanced AI tools also enable predictive cash-flow analysis, allowing platforms to recommend optimal investment amounts without compromising short-term liquidity. This enhances user trust and reduces churn during economic uncertainty. Market estimates suggest that platforms successfully deploying proprietary AI advisory capabilities can increase average revenue per user (ARPU) by approximately 20–25%, as customers migrate from free tiers to premium, advice-led subscription plans. Over time, this evolution positions micro-investing platforms as comprehensive financial wellness ecosystems, rather than single-purpose investment tools, expanding lifetime customer value.

Emerging economies across the Asia Pacific, Latin America, and parts of Africa represent a substantial untapped growth opportunity for micro-investing platforms, supported by rising smartphone penetration, improving internet access, and accelerating digital payment adoption. Countries such as India, Indonesia, Vietnam, Brazil, and Mexico have large underbanked populations but are experiencing rapid fintech-led inclusion. For example, India’s real-time payments infrastructure, UPI, and Brazil’s instant payment system, Pix, have normalized digital transactions even among lower-income users, creating ideal distribution rails for micro-investing services.

Localized platforms that support regional languages, domestic currencies, and culturally familiar asset classes, including local equities, government bonds, ETFs, and gold-backed instruments, are better positioned to achieve scale. Demographic trends further strengthen this opportunity, as the middle-class population in these regions is projected to grow significantly by 2030, driving demand for accessible and goal-oriented wealth creation tools. As a result, emerging markets are expected to deliver double-digit CAGR, substantially outpacing mature markets in North America and Western Europe, where user penetration is approaching saturation.

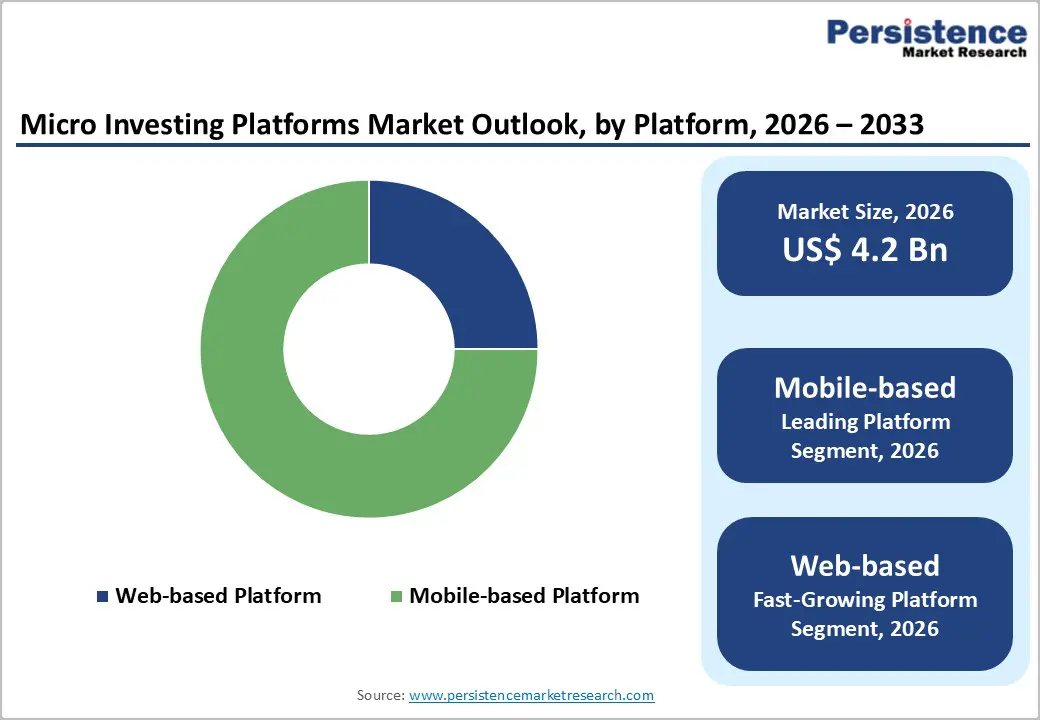

The mobile-based platform segment dominates the global micro-investing platforms market, accounting for an estimated ~78% market share, driven by the inherently “on-the-go” nature of micro-investing behavior. Core features such as push notifications, real-time portfolio updates, biometric authentication, and impulse-driven saving mechanisms, such as automated round-ups on everyday purchases, are optimally delivered through smartphones. Mobile applications enable investing to occur passively and continuously, embedding financial activity into daily consumption patterns.

The ubiquity of smartphones has allowed platforms such as Acorns and Raiz to integrate seamlessly with digital wallets, including Apple Pay and Google Pay, creating a frictionless ecosystem where investing happens almost invisibly in the background. In contrast, web-based platforms retain a limited niche, primarily catering to older demographics or advanced users who require detailed analytics, tax reports, or multi-screen portfolio monitoring. The strategic direction across the industry is decisive, mobile-first development has become the standard, with web interfaces increasingly serving as secondary support tools rather than primary engagement channels.

Individual users represent the leading end-user segment, accounting for approximately ~85% of total market share, reflecting the fundamental design philosophy of micro-investing platforms. These solutions are purpose-built to aggregate small, recurring investments from millions of retail participants rather than attract large institutional capital. The segment’s dominance is reinforced by the sustained influx of first-time investors from Millennial and Gen Z cohorts, who are drawn to ultra-low entry barriers, simplified onboarding, and minimum investment thresholds ranging from US$ 0 to US$ 5.

User-friendly interfaces, behavioral nudges, and automated contribution features have significantly lowered psychological barriers to investing, encouraging consistent participation. While the commercial and business user segment is gradually expanding, driven by small enterprises adopting treasury micro-investment tools or employers offering financial wellness benefits, it remains a secondary contributor to overall revenue. The bulk of transaction volume, user growth, and long-term AUM expansion continues to originate from individual retail investors focused on wealth preservation, inflation hedging, and long-term capital accumulation.

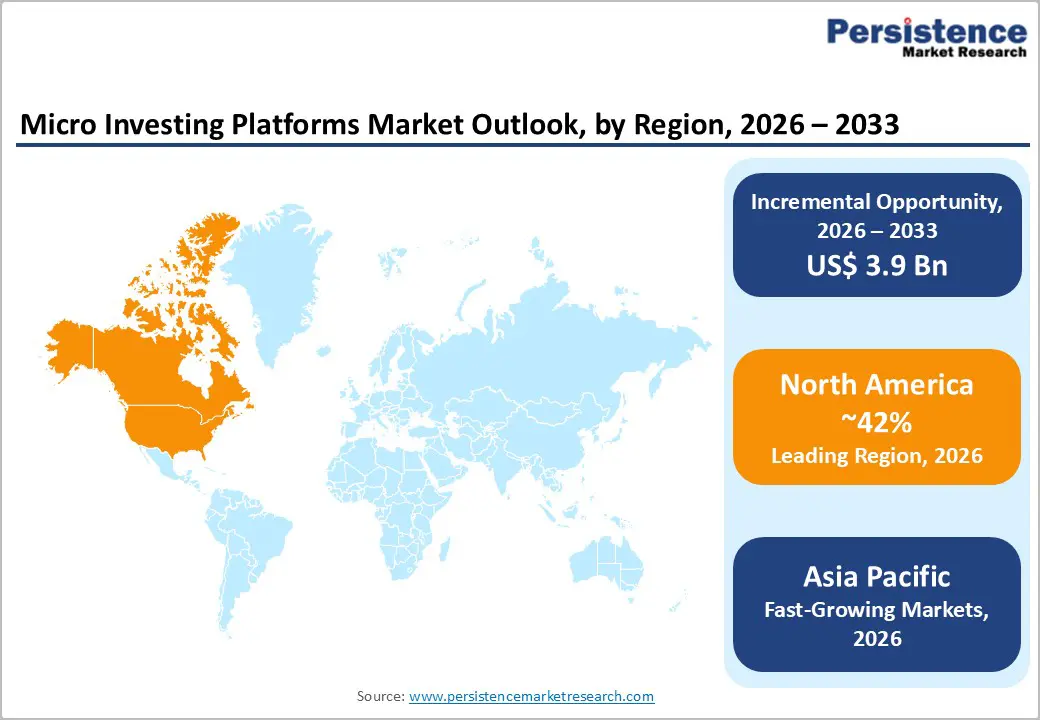

North America remains the dominant regional market, underpinned by a mature fintech ecosystem, high financial literacy, and strong disposable income levels, particularly in the United States. The region features intense competition among established platforms such as Robinhood, SoFi Invest, and Betterment, which has accelerated innovation across product offerings. Key differentiators increasingly include high-yield cash management accounts, crypto trading, fractional ETFs, and direct indexing solutions.

A notable regional trend is service consolidation, with platforms evolving into financial “super apps” that integrate banking, credit, insurance, and investing within a single interface. However, increased regulatory oversight, particularly from the U.S. Securities and Exchange Commission, around gamification, behavioral nudges, and digital engagement practices, is reshaping growth strategies. Firms are responding by emphasizing transparency, risk disclosures, and educational content. Despite relative market maturity, North America continues to attract new users through expanded asset classes and enhanced personalization features.

The European micro-investing platforms market is characterized by fragmented yet resilient growth, shaped heavily by regulatory harmonization efforts such as MiCA and PSD2. These frameworks promote transparency, interoperability, and cross-platform data access, enabling fintech innovation while maintaining consumer protection. The United Kingdom remains a key fintech hub, led by platforms such as Freetrade and Revolut, while Germany demonstrates strong adoption driven by a culturally ingrained savings-oriented mindset.

A defining regional trend is the strong preference for ESG-focused investment portfolios, as European investors exhibit higher sensitivity to sustainability, climate impact, and ethical governance than global averages. While cross-border expansion remains complex due to tax regimes, language diversity, and national compliance requirements, EU “passporting” rights enable scalable growth across member states. As a result, platforms are progressively capturing value in secondary markets such as France, the Netherlands, and the Nordics.

Asia Pacific represents the fastest-growing regional market, supported by a vast mobile-first population, rapid digital payment adoption, and government-led financial inclusion initiatives. High-growth economies such as India and China are generating massive user volumes, with local champions like Zerodha and Ant Group redefining ultra-low-cost investing at scale. The dominant trend in the region is the integration of investing features within lifestyle and payment-driven super apps, making investment activity automatic, contextual, and deeply embedded in daily digital behavior.

In developed markets such as Australia, platforms like Stake and Raiz have achieved strong penetration by aligning micro-investing solutions with the country’s robust superannuation (pension) ecosystem. The region’s growth trajectory is further amplified by a young demographic actively seeking protection against inflation, currency depreciation, and income volatility. This has accelerated adoption of platforms offering exposure to U.S. equities, ETFs, and digital assets, positioning Asia Pacific as the primary engine of future market expansion.

The market structure is moderately fragmented but consolidating, with a few dominant "unicorns" controlling significant share in major jurisdictions (e.g., Robinhood in the US, Zerodha in India), while a long tail of niche players targets specific demographics or regions. Competition is fierce, driving companies to pivot from pure-play investing apps to holistic financial platforms.

Key differentiators now include high-yield savings accounts, retirement planning tools, and debit cards that reinvest spend. Research and development spend is heavily skewed toward AI/ML for personalized insights and blockchain integration for faster settlement. Mergers and acquisitions are accelerating as larger traditional banks and fintech conglomerates seek to acquire established user bases to lower their customer acquisition costs.

The global micro investing platform market was valued at US$ 4.2 billion in 2026 and is projected to reach US$ 8.1 billion by 2033, growing at a robust CAGR of 9.8% from 2026 to 2033.

Key drivers include the proliferation of fractional share trading, widespread smartphone adoption, and increased financial literacy among younger generations seeking low-barrier entry to wealth creation.

The Mobile-based Platform segment is the dominant category, accounting for the majority of the market share due to the convenience of app-based, on-the-go investing features.

The Asia Pacific region is anticipated to be the fastest-growing market, fueled by a rapidly expanding middle class, digital payment integration, and government support for financial inclusion in countries like India and China.

A significant opportunity lies in integrating AI-powered robo-advisory services to offer hyper-personalized financial planning, which can increase user engagement and average revenue per user.

Prominent players in the market include Robinhood, Acorns, Zerodha, Webull, Stash, Betterment, and Wealthsimple, among others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Platform

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author