ID: PMRREP35487| 192 Pages | 15 Jul 2025 | Format: PDF, Excel, PPT* | Industrial Automation

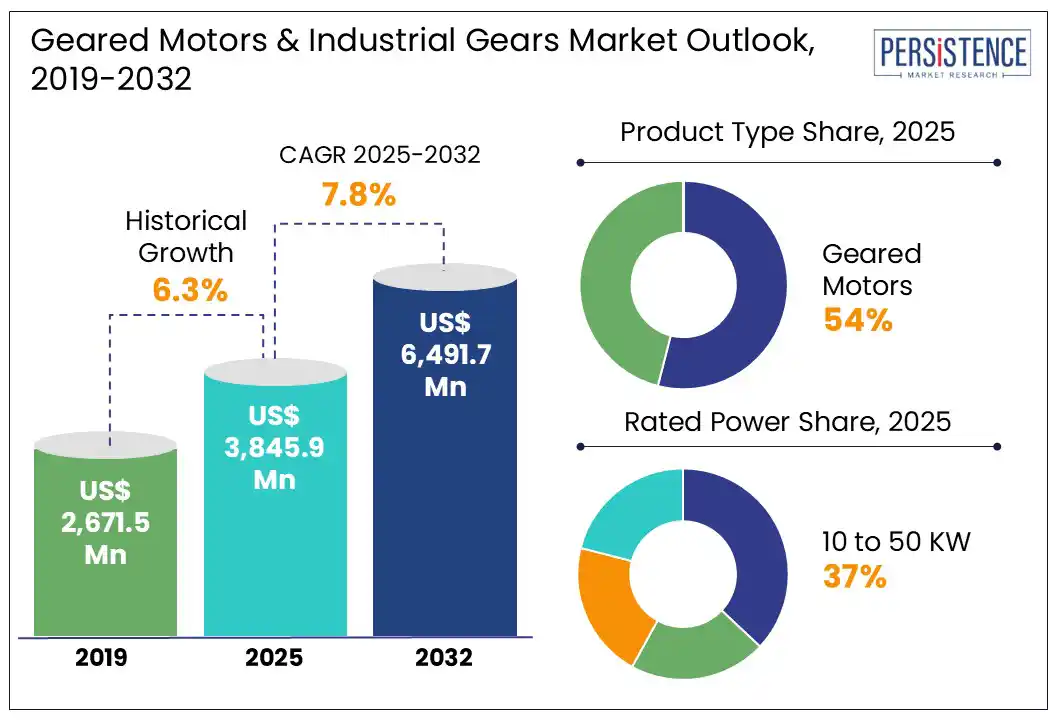

The global geared motors & industrial gears market size is likely to be valued at US$3,845.9 Mn in 2025 and is estimated to reach US$6,491.7 Mn in 2032, at a CAGR of 7.8% during the forecast period 2025 - 2032.

Innovations in compact and energy-efficient gear systems, along with the integration of smart monitoring technologies, are transforming performance standards. Furthermore, sustainability goals are driving the adoption of low-maintenance, high-efficiency gear solutions across various end-use industries. The geared motors and industrial gears market growth is driven by increasing automation in the manufacturing and logistics sectors.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Geared Motors & Industrial Gears Market Size (2025E) |

US$ 3,845.9 Mn |

|

Market Value Forecast (2032F) |

US$ 6,491.7 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.3% |

The global geared motors & industrial gears market is primarily driven by the rapid surge in industrial automation as industries prioritize efficiency and precision in manufacturing, logistics, and process-heavy sectors. With factories increasingly deploying automated conveyors, robotic arms, and precision machinery, the demand for robust, reliable gear systems capable of withstanding high duty cycles has surged.

Concurrently, technological innovation is evolving to cater to automation demands, and manufacturers are integrating IoT sensors, predictive maintenance software, and smart remote monitoring directly into gear systems. These innovations enhance uptime, reduce operational costs, and align with broader Industry 4.0 transformations, further reinforcing automation as the prime driver.

The U.S. Department of Energy report stated that motor-driven systems account for roughly 29% of national electricity consumption, highlighting the significant energy-saving potential of upgrading to efficient gear-motor systems. This opportunity drives manufacturers and end-users toward intelligent gear systems that enable automated, energy-efficient operations.

The global production of geared motors and industrial gears is currently facing notable constraints due to widespread supply chain disruptions. Extended lead times and reduced availability of essential components are becoming persistent challenges. Volatility in the supply of critical raw materials, such as steel, aluminum, and rare-earth elements is further complicating manufacturing processes. These issues are being intensified by ongoing geopolitical tensions and logistical bottlenecks that have strained global freight and trade routes. As a result, many manufacturers are encountering delays in deliveries and disruptions in production scheduling. OEMs are diversifying suppliers to reduce risks, but this slows innovation and weakens efficiency and competitiveness in the global market.

Gearbox and motor manufacturers experienced delays in obtaining key components such as bearings and precision castings, directly impacting the project timelines. As firms seek supply chain resilience through dual sourcing and onshoring, the pace of market expansion remains restrained, with manufacturers needing to balance lead-time optimization against higher operational complexity and cost.

The global geared motors and industrial gears market is poised for rapid growth, driven by an escalating pivot toward renewable energy infrastructure and industry-wide digital transformation. Renewable energy projects, particularly wind and solar power, are creating substantial demand for high-efficiency gear systems. Power-generation investments and smart grid sensor upgrades in Asia Pacific are driving the demand for reliable gear motors, supported by government clean energy policies and subsidies.

The integration of IoT sensors into geared motors enables predictive maintenance and real-time optimization, reducing downtime and boosting efficiency in Industry 4.0 factories. Manufacturers are responding by launching modular, customizable gear solutions tailored to specific automation applications across sectors such as automotive, logistics, and food processing.

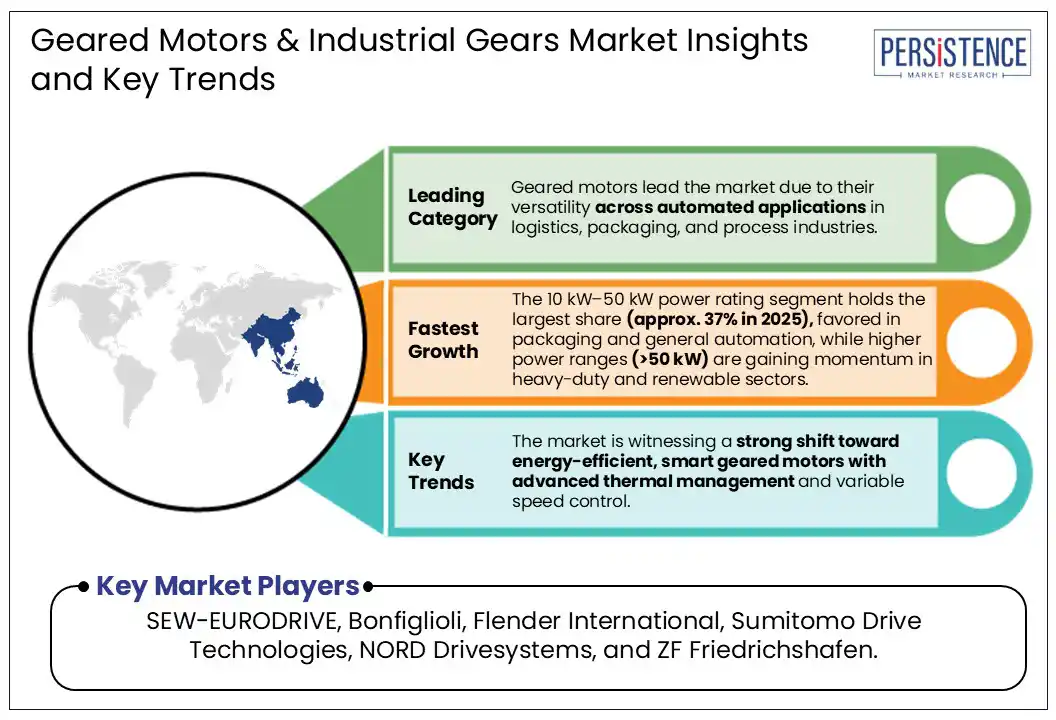

The geared motors segment is anticipated to dominate, capturing a market share of approximately 54% in 2025, due to the versatile use across automated systems, particularly in logistics, packaging, and process industries. This segment includes helical, bevel, worm, planetary, and cycloidal geared motors, each offering unique benefits in torque transmission, energy efficiency, and system compactness. Helical and bevel geared motors are widely adopted in conveyor systems and lifting applications, while worm geared motors are preferred for their self-locking capabilities in compact designs. Planetary and cycloidal geared motors are gaining momentum in robotics and high-precision environments due to their superior load-handling and compact nature.

The increasing shift toward modular, energy-efficient, and intelligent motor systems, especially in Europe and East Asia, strengthens the demand for advanced geared motors. With Industry 4.0 pushing decentralized automation, geared motors are being designed for digital control, predictive maintenance, and space-optimized installations, making them vital across modern industrial landscapes.

The rated power segment plays a crucial role in aligning geared motors and industrial gears with specific operational demands across end-use sectors. The 10 kW–50 kW segment currently leads the global market with an estimated 37% share, primarily due to its widespread adoption in mid-range industrial applications such as packaging, automation lines, and general-purpose machinery, offering a balanced mix of power efficiency, scalability, and cost-effectiveness. Meanwhile, the 50 kW–100 kW and above 100 kW categories are emerging as high-growth segments, driven by power-intensive applications in heavy-duty industries such as mining, cement, marine, wind energy, and bulk material handling. These segments serve operations requiring consistent torque delivery, overload resistance, and thermal efficiency under continuous load.

Geared motors up to 10 kW are preferred in compact applications such as robotics and food processing due to their efficiency and low noise levels. These systems are ideal for space-constrained environments requiring precise performance. The increasing demand for smart, energy-efficient drives is pushing innovation in thermal management, digital integration, and material advancement. However, reliability, cost-effectiveness, and regulatory compliance remain crucial across all power ranges, especially in the higher-rated categories, where failures can lead to significant downtime and operational losses.

Asia Pacific is projected to be the most dominant region in the global geared motors & industrial gears market in 2025, capturing a significant share of 43%, due to rapid industrialization, urban expansion, and energy diversification. Countries including China, India, Japan, and South Korea are witnessing extensive deployment of planetary, bevel, and worm geared motors across material handling, robotics, and solar energy applications. China leads with a strong manufacturing base and wind sector, driving demand for advanced geared motors and gearboxes under its “Made in China 2025” push for automation. India follows closely, driven by “Make in India,” with increased adoption of geared motors in automotive, packaging, and construction sectors.

Southeast Asia, led by Vietnam and Thailand, is gaining prominence through electronics manufacturing and intralogistics growth, while Japan and South Korea remain leaders in robotics and semiconductor-driven gear motor use. Regional growth is enhanced through infrastructure projects, clean energy initiatives, affordable manufacturing, local suppliers, and increased investments in smart factories.

North America remains a key region due to its mature industrial infrastructure and fast-paced adoption of energy-efficient technologies. The U.S. drives the region’s dominance, with strong investments in automated production, aerospace, and energy, where helical, worm, and planetary gear systems are heavily utilized. Industrial gears are widely integrated in HVAC systems, mining conveyors, and renewable energy platforms, supported by growing compliance with IE3/IE4 energy standards. The trend toward predictive maintenance and smart monitoring is also accelerating the adoption of digitalized gear motors across manufacturing clusters.

Canada complements this growth with increased deployment in packaging, automotive, and food processing plants, while also focusing on upgrading energy transmission systems. Across the region, government-backed industrial modernization programs and sustainability goals are motivating manufacturers to invest in low-maintenance, high-performance gear solutions. With rising automation penetration and energy-conscious retrofits in aging factories, North America continues to offer high-value opportunities for advanced gear system providers.

Europe holds a prominent position in the market, driven by its leadership in industrial automation, clean energy, and digital transformation. Germany stands at the forefront, with a strong demand for helical, planetary, and bevel geared motors in automotive assembly, robotics, and logistics. The country’s engineering strength and focus on high-efficiency systems fuel innovations in intelligent, sensor-integrated gear solutions. EU regulations such as the Ecodesign Directive are driving the demand for energy-efficient IE4 gear motors, while France and Italy boost investments in pharma and packaging sectors that need compact, hygienic, and precise gear systems.

Eastern Europe, led by Poland, the Czech Republic, and Hungary, is emerging as a key hub for mid-tier industrial gear production with skilled labor and cost advantages. Spain is driving demand through solar and water projects, while Europe’s focus on sustainability, R&D, and Industry 4.0 adoption fuels innovation in harmonic, hypoid, and worm gears, supporting steady long-term growth.

The global geared motors and industrial gears market is driven by smart manufacturing, modular designs, and sustainability-focused innovations. Key players are enhancing gear efficiency, integrating IoT diagnostics, and offering customized solutions for sectors such as robotics and renewable energy. Growing collaborations with OEMs and regional setups in Asia and North America are improving lead times and service, fostering competitive, innovation-led growth.

Gear manufacturers are diversifying suppliers, nearshoring, and forging long-term raw material partnerships to manage volatility, while distributors evolve into solution partners, supporting inventory and applications across key sectors, together ensuring a stable, innovation-driven global supply network.

The market is set to reach US$3,845.9 Mn in 2025.

The market is driven by rising industrial automation, energy efficiency mandates, and growing demand from renewable energy and heavy-duty applications.

The industry is estimated to rise at a CAGR of 7.8% from 2025 to 2032.

Key market opportunities include the integration of smart, IoT-enabled gear systems, rising demand from renewable energy sectors, and increased adoption of high-efficiency geared solutions in emerging industrial economies.

The major players dominating the global Geared Motors & Industrial Gears Market are SEW‑EURODRIVE, Bonfiglioli, Flender International, Sumitomo Drive Technologies, NORD Drivesystems, and ZF Friedrichshafen.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Rated Power

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author