ID: PMRREP35509| 177 Pages | 24 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

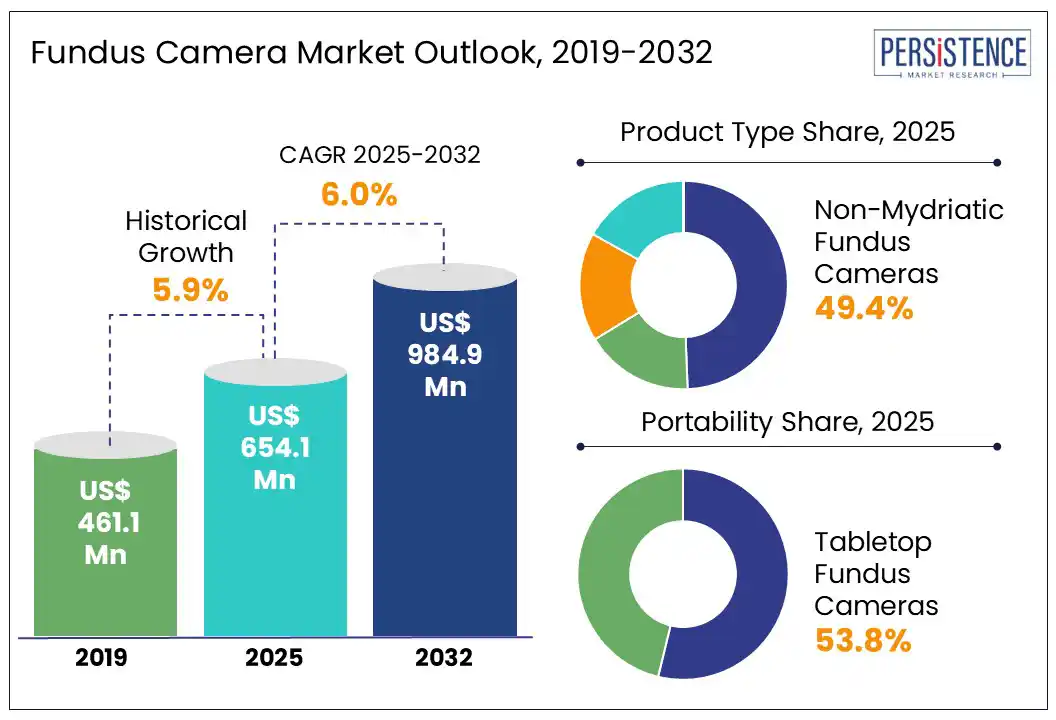

The global fundus camera market size is likely to be valued at US$ 654.1 Mn in 2025 and is expected to reach US$ 984.9 Mn by 2032, growing at a CAGR of 6% in the forecast period from 2025 to 2032. The fundus camera market is witnessing steady growth, driven by the rising prevalence of retinal disorders such as diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD). These conditions are increasingly common due to aging populations and the global surge in chronic diseases such as diabetes and hypertension.

Fundus camera captures detailed images of the retina and acts as an essential tool for early diagnosis and monitoring of these conditions. Technological advancements, particularly in portable, non-mydriatic, and smartphone-compatible devices, are enhancing accessibility and efficiency in ophthalmic care. With the rise in awareness for eye health and improvement in healthcare infrastructure, especially in emerging economies, the demand for fundus cameras is expected to significantly grow through 2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Fundus Camera Market Size (2025E) |

US$ 654.1 Mn |

|

Market Value Forecast (2032F) |

US$ 984.9 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.9% |

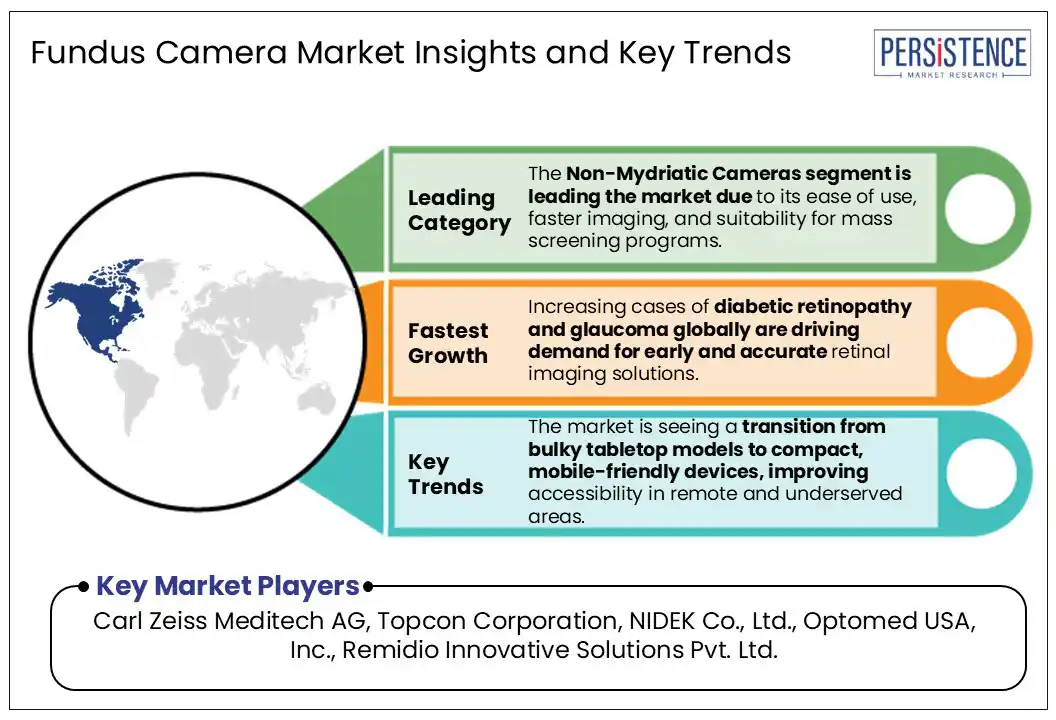

The growing demand for retinal imaging devices for diabetic retinopathy screening is a key factor for market expansion. Healthcare providers increasingly rely on non-mydriatic fundus cameras for primary eye care diagnostics, especially in outpatient and community settings. These devices offer quick, pupil-friendly imaging, making them ideal for mass screening programs. The rise in portable fundus cameras for teleophthalmology applications is improving access to eye care in remote regions.

Technological innovation continues to fuel growth, particularly with the integration of AI-powered fundus photography systems that enhance diagnostic precision and workflow efficiency. The increasing focus on early detection of age-related macular degeneration using advanced retinal imaging tools is also boosting adoption. As awareness of retinal health grows globally, especially in aging populations, the demand for accurate and accessible imaging solutions is expected to surge.

High costs associated with advanced fundus photography systems for ophthalmic diagnostics limit adoption, especially in low-resource settings. Many healthcare providers in developing regions struggle to invest in non-mydriatic fundus cameras for diabetic eye screening, despite rising demand. The lack of skilled personnel to operate and interpret retinal imaging devices hampers effective deployment in rural and semi-urban areas.

Limited reimbursement policies for retinal imaging procedures in primary care settings further restrict market growth. Regulatory challenges in approving AI-integrated fundus imaging devices for clinical use also slow innovation. Moreover, concerns around data privacy and integration with electronic health records (EHRs) affect the adoption of cloud-based imaging platforms, especially in regions with strict compliance norms.

The rising adoption of AI-enabled fundus imaging systems for predictive eye disease analysis presents a major growth opportunity. These systems can automate diagnosis and improve screening efficiency, especially in high-volume clinical settings. Expanding use of portable fundus cameras for teleophthalmology in rural healthcare programs is also opening new avenues for market penetration. Governments and NGOs are increasingly investing in mobile eye care units to reach underserved populations.

Emerging markets offer strong potential due to increasing demand for low-cost fundus cameras for diabetic retinopathy screening. The integration of cloud-based retinal imaging platforms for remote diagnostics is gaining traction among healthcare providers. As digital health ecosystems evolve, manufacturers can capitalize on the need for scalable, interoperable imaging solutions tailored to diverse clinical environments.

The Non-Mydriatic Fundus Cameras segment leads the market, accounting for 49.4% of the global market share. These cameras are preferred for their ease of use, faster imaging, and suitability for mass screening without the need for pupil dilation. Hybrid fundus cameras are emerging as the fastest-growing sub-segment due to their dual functionality and adaptability across clinical settings.

Tabletop fundus cameras dominate this category, with a market share of 53.8% due to their high-resolution imaging and integration capabilities with electronic health records (EHRs). These devices are widely used in hospitals and specialized ophthalmic clinics. However, handheld fundus cameras are gaining momentum, especially in teleophthalmology and mobile screening programs, driven by their portability and cost-effectiveness.

Diabetic Retinopathy Diagnosis is the leading application segment, driven by the global rise in diabetes cases. This segment accounts for a significant portion of the market, as fundus cameras are essential for early detection and monitoring of retinal changes. Other key applications include glaucoma and age-related macular degeneration (AMD), both of which are increasing due to aging populations.

Hospitals represent the largest end-user segment, owing to their comprehensive diagnostic infrastructure and high patient volumes. These institutions prefer advanced tabletop models for detailed retinal imaging. Ophthalmology clinics and optometrist offices are also expanding their use of fundus cameras for routine eye exams and chronic disease management.

North America continues to lead the market with a share of 36.4%. The region benefits from a well-established healthcare infrastructure, high awareness of retinal diseases, and widespread adoption of advanced diagnostic technologies. The U.S. is at the forefront, driven by a growing diabetic population and increasing cases of age-related macular degeneration (AMD). The use of portable fundus photography cameras in emergency and outpatient settings is transforming care delivery, especially in teaching hospitals and teleophthalmology programs. Additionally, the integration of AI-powered diagnostic tools is accelerating clinical decision-making and improving patient outcomes.

Europe holds a significant share of the market, with the region experiencing strong growth due to rising investments in digital health, early screening initiatives, and the adoption of hybrid fundus cameras. Countries such as Germany and France are expanding their use of non-mydriatic fundus cameras in primary care settings, supported by national diabetic retinopathy screening programs. The European market is also benefiting from favorable reimbursement policies and increasing collaborations between medical device companies and public health agencies.

Asia Pacific is the fastest-growing regional market, fueled by a surge in diabetes and hypertension cases, particularly in India and China. Governments across the region are investing in low-cost fundus cameras for rural and semi-urban screening programs, often supported by mobile health units and telemedicine platforms. The growing middle-class population, increasing healthcare access, and rising awareness of eye health are driving demand for handheld and smartphone-compatible fundus imaging devices. Local manufacturers are entering the market with affordable, AI-integrated solutions tailored to regional needs.

The global fundus camera market features a mix of established global players and emerging regional manufacturers, each offering a range of fundus imaging solutions. While companies such as Carl Zeiss Meditech AG, Topcon Corporation, and NIDEK Co., Ltd. hold significant market shares due to their advanced product portfolios and global presence, numerous smaller firms are entering the space with cost-effective and portable fundus cameras, especially in Asia-Pacific and Latin America. With many players offering similar products, pricing becomes a key differentiator, especially in emerging markets. Smaller manufacturers often tailor products to meet local clinical and regulatory needs, increasing adoption in underserved areas.

The global Fundus Camera Market is projected to reach USD 654.1 million in 2025.

By 2032, the market is expected to reach USD 984.9 million, reflecting steady growth.

The market is expected to grow at a CAGR of 6.0% from 2025 to 2032, driven by rising demand for early retinal disease detection.

Key trends include the rise of AI-powered fundus imaging, growing demand for portable and smartphone-compatible devices, and increasing adoption in teleophthalmology and rural screening programs.

The Non-Mydriatic Fundus Camera segment leads the market, accounting for 49.4% of the global share in 2024.

Major players with strong portfolios include, Carl Zeiss Meditech AG, Topcon Corporation, NIDEK Co., Ltd., Optomed USA, Inc., Remidio Innovative Solutions Pvt. Ltd.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Modality

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author