ID: PMRREP33550| 199 Pages | 29 Nov 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

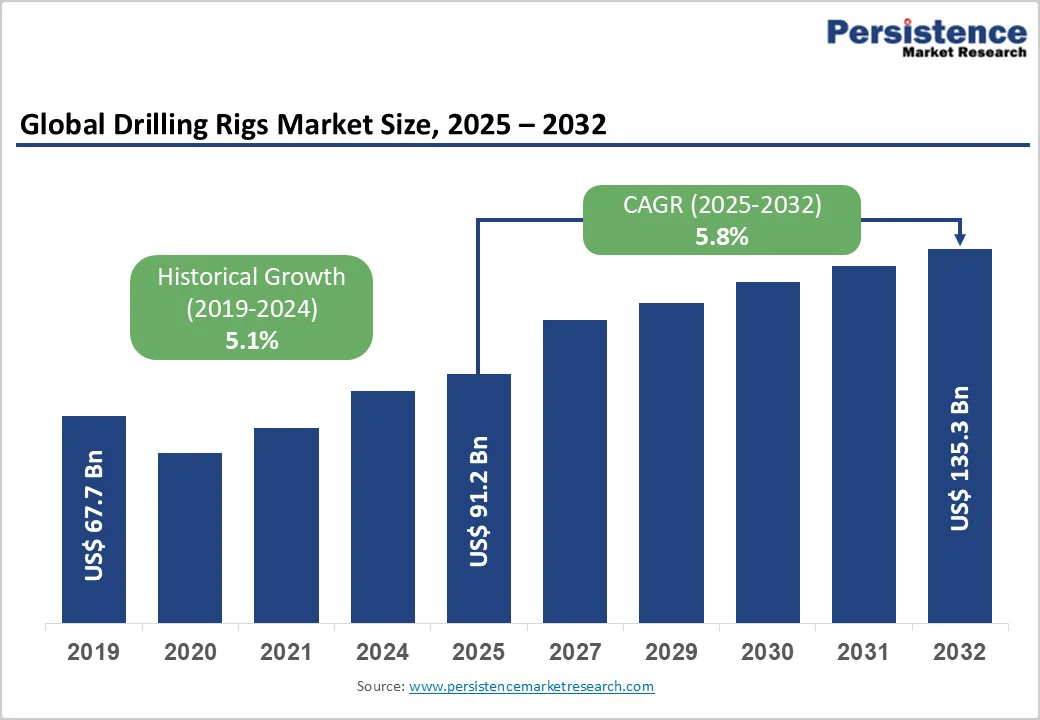

The global drilling rig market size is valued at US$ 91.2 billion in 2025 and is projected to reach US$ 135.3 billion, growing at a CAGR of 5.8% between 2025 and 2032. Market expansion is driven by accelerating global oil and gas demand, supporting increased exploration and production investment, rapid depletion of onshore reserves requiring offshore and deepwater exploration, and technological advancements enabling drilling operations in challenging environments. Rising capital expenditure across E&P companies, energy security priorities supporting domestic production, and recovery in drilling activity following commodity price stabilization, sustain market growth through enhanced operational efficiency and global energy demand fulfillment.

| Key Insights | Details |

|---|---|

| Drilling Rig Market Size (2025E) | US$ 91.2 Bn |

| Market Value Forecast (2032F) | US$ 135.3 Bn |

| Projected Growth CAGR(2025-2032) | 5.8% |

| Historical Market Growth (2019-2024) | 5.1% |

Rising global oil and gas consumption continues to create strong demand for drilling rigs, particularly as countries prioritize energy security and long-term supply stability. Global petroleum demand is projected to reach 100 million barrels per day by 2030, up from the current 82 million barrels per day, reinforcing the need for sustained exploration and production activity. Rapid depletion of mature onshore reserves is accelerating the shift toward offshore, deepwater, and ultra-deepwater exploration, driving the need for advanced, high-specification rigs. Unconventional resource development, especially shale and tight oil, further boosts demand for land rigs equipped with horizontal drilling and multistage fracturing technologies.

OPEC+ producers including Saudi Arabia, Iraq, and the UAE are executing large-scale production expansion plans, supported by major capital programs such as ADNOC’s US$10 billion rig contract commitments. Intensifying geopolitical focus on energy independence and domestic production enhancement across developed and emerging economies continues to reinforce long-term rig deployment needs. Collectively, these factors indicate a structural shift toward deeper and more complex drilling environments as global energy demand expands.

Technological innovation is a critical enabler of growth in the drilling rigs market. Advanced systems such as autonomous drilling, real-time monitoring, and digital well optimization are improving safety, operational efficiency, and drilling accuracy. Dynamic positioning systems allow precise well placement in harsh offshore environments, supporting deepwater and ultra-deepwater operations. AI- and machine-learning-driven optimization helps reduce non-productive time by 20–30%, while predictive analytics enhances preventive maintenance and reduces operational downtime.

High-performance drillships capable of operating beyond 3,500 meters are expanding access to pre-salt and frontier reservoirs. Horizontal drilling, multistage fracturing, and automated rig systems are strengthening unconventional resource development. Overall, technology?driven efficiency improvements are reducing per-well capital requirements while enabling production growth, making advanced drilling rigs an essential component of modern upstream operations.

Market Restraints

Commodity price fluctuations limiting exploration and production investment decisions constraining rig deployment growth. Petroleum prices exhibiting volatility between US$ 45-100 per barrel creating operational uncertainty. Operator capital discipline limiting aggressive rig deployment despite commodity price recovery moderating industry activity. High operational costs restricting rig deployment in deepwater and ultra-deepwater environments particularly for non-integrated E&P companies. Reduced investment budgets and emphasis on cash flow limiting exploration activity.

Substantial rig construction and acquisition costs restricting market entry and capacity expansion. Rig construction costs exceeding US$ 500 million for ultra-deepwater drillships limiting operator investment capacity. Stringent environmental and safety regulations increasing operational complexity and compliance expenses. Environmental restrictions limiting drilling activities in certain regions reducing addressable market.

Ultra-deepwater and deepwater basins represent the fastest-growing opportunity in the global drilling rigs market. Deepwater production is projected to increase by 60% between 2022 and 2030, rising from 6% to 8% of global upstream output. The deepwater drilling market is expected to grow from US$6.02 billion in 2024 to US$11.62 billion by 2034, at a 6.80% CAGR.

Key hotspots, including Brazil’s pre-salt fields, the Gulf of Mexico, and West Africa, require state-of-the-art drillships and semi-submersibles to unlock complex reservoirs. Advances in ultra-deepwater capabilities exceeding 3,500 meters allow operators to access high-yield deposits that justify premium rig deployment. These developments position ultra-deepwater assets as core growth engines for global drilling investment.

Unconventional resource development offers robust long-term opportunities, supported by major advancements in horizontal drilling and multistage fracturing. The onshore segment accounts for 75.2% of global drilling rig demand due to lower development costs, widespread reserves, and well-established infrastructure.

The United States remains the global leader, with shale output reaching a record 13.644 million barrels per day and strong activity in the Permian, Bakken, and Eagle Ford basins. Emerging markets including China and India are rapidly scaling shale exploration efforts, creating new demand for technologically advanced land rigs. Efficiency improvements enabling 20–30% reductions in capital requirements continue to enhance project economics and drive sustained rig deployment in the onshore segment.

Onshore drilling remains the dominant segment in the global drilling rigs market, capturing nearly 75% of total market share due to its cost efficiency, operational accessibility, and extensive recoverable reserves. Onshore projects typically require significantly lower capital expenditure per well compared to offshore developments, making them more attractive for operators, especially in price-sensitive environments. The rapid expansion of shale and tight oil exploration, particularly across North America and key Middle Eastern basins, continues to strengthen onshore drilling activity.

Well-established surface infrastructure, streamlined logistics, and lower operating costs contribute to favorable project economics. Advancements in horizontal drilling and multistage hydraulic fracturing have further enhanced recovery rates from unconventional reservoirs, reinforcing the strategic importance of onshore drilling within the global market.

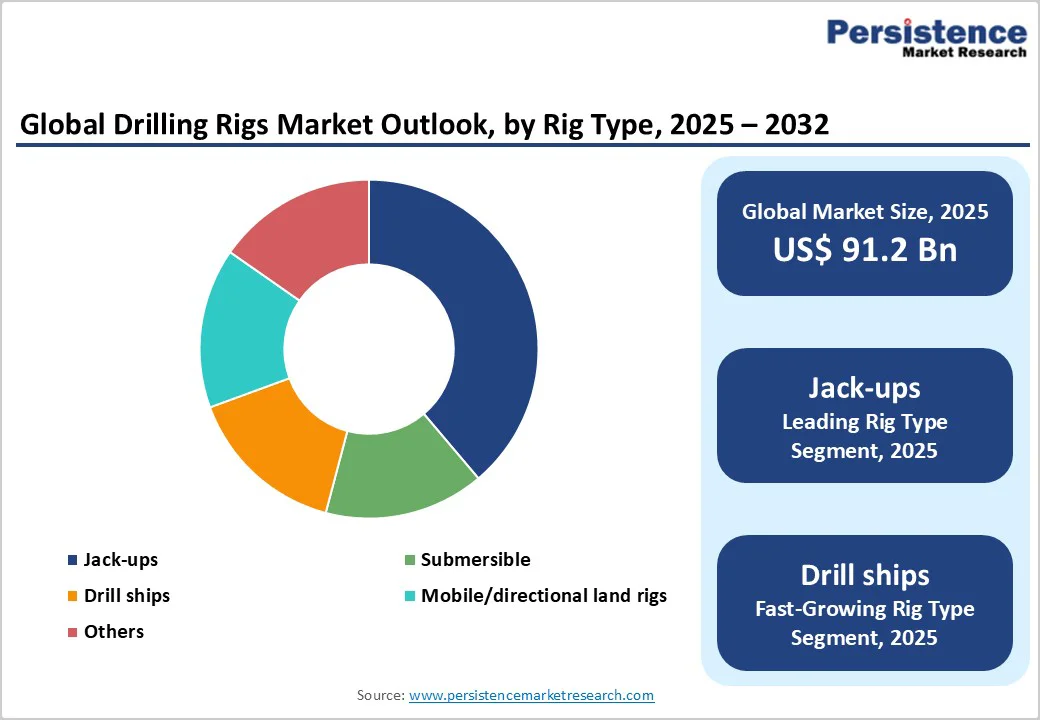

Jack-up rigs represent the largest share of the offshore drilling rig market, accounting for roughly 45% of total offshore rig demand, primarily due to their strong suitability for shallow-water operations and competitive cost structure. Designed to operate efficiently in water depths of up to 400 feet, jack-up rigs support a significant portion of global offshore exploration and development activities. Their extensive deployment across the Middle East, Southeast Asia, and other shallow-water basins underscores their strategic importance in accessing nearshore hydrocarbon reserves.

The ability to mobilize quickly, combined with relatively lower operational and maintenance costs, enhances their overall economic appeal. Recent technological advancements, including improved leg designs, enhanced jacking systems, and upgraded drilling packages, are expanding the operational range of modern jack-up rigs, enabling deployment in harsher environments and moderately deeper waters.

Shallow-water drilling rigs constitute the leading application segment in the global drilling rigs market, representing nearly 52% of total demand. This dominance is supported by the widespread presence of shallow-water hydrocarbon reserves and the comparatively lower development and operating costs associated with these projects. Shallow-water fields continue to account for a substantial share of global offshore exploration and production activities, ensuring steady utilization of jack-up rigs and other shallow-water-capable units.

Key regions such as the Gulf of Mexico, the Middle East, and Southeast Asia remain major contributors, where mature and emerging shallow-water basins sustain robust drilling programs. The combination of operational simplicity, faster mobilization, and favorable project economics reinforces shallow-water drilling as the most active application category in the global market.

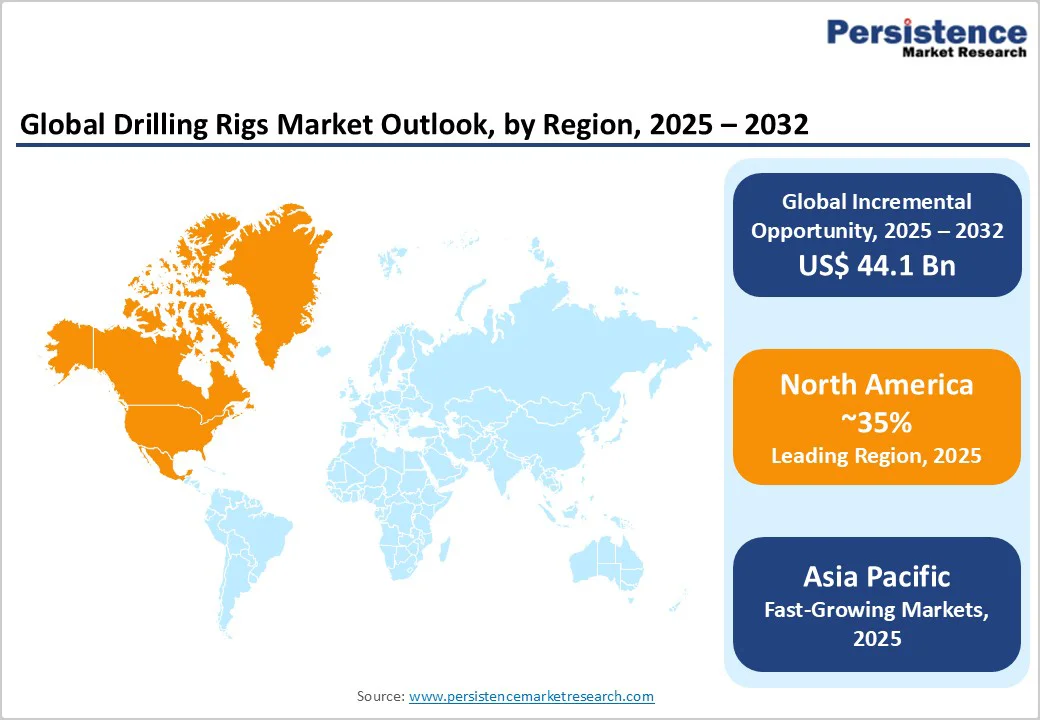

North America leads the global drilling rig market, capturing approximately 38.5% of total market share, supported by robust shale production growth and sustained offshore activity in the Gulf of Mexico. The United States remains the region’s largest revenue contributor, driven by aggressive drilling activity across major shale basins. With a rig count of 546 active units and record crude oil output reaching 13.644 million barrels per day, the U.S. continues to demonstrate exceptional operational efficiency.

Key unconventional basins, including the Permian, Bakken, and Eagle Ford, are fueling steady onshore drilling momentum, supported by advanced horizontal drilling and high-intensity completion technologies. Offshore, the Gulf of Mexico maintains strong utilization rates for deepwater and ultra-deepwater projects, reflecting stable long-term development plans. Strategic focus on energy security, combined with favorable regulatory frameworks and investment incentives, is sustaining multi-year drilling programs and reinforcing North America’s leadership in global drilling activity.

Europe is exhibiting a steady recovery in drilling activity, driven primarily by ongoing offshore developments in the North Sea and the Mediterranean. Norway and the United Kingdom remain the region’s core contributors, leveraging their mature reserves, advanced offshore infrastructure, and long-standing operational expertise to support sustained investment in offshore projects. Major developments such as Johan Sverdrup and Johan Castberg continue to bolster Norway’s drilling activity, prompting the deployment of modern, high-specification rigs. The North Sea’s robust supply chain, extensive service ecosystem, and decades of technical experience enable operators to execute cost-efficient drilling programs even in challenging environments.

Meanwhile, selective exploration initiatives in the Mediterranean are expanding regional offshore activity, particularly in gas-focused basins. Progress in European regulatory harmonization is helping streamline operational frameworks across member states, while growing energy security and independence priorities are encouraging renewed investment in domestic oil and gas production within traditional upstream regions.

Asia Pacific has emerged as the fastest-growing region in the global drilling rig market, supported by expanding exploration programs, rising energy demand, and increasing investment across both onshore and offshore environments. China remains the largest contributor, with sustained onshore shale exploration in the Sichuan Basin and other key regions driving continuous drilling activity. Offshore, developments in Bohai Bay and the South China Sea are accelerating deepwater rig demand as Chinese operators expand high-specification rig deployments. India is also ramping up offshore and deepwater exploration to strengthen energy security, resulting in increased utilization of modern rigs.

Across Southeast Asia, abundant shallow-water reserves continue to support strong jack-up rig activity, particularly in Thailand, Indonesia, and Malaysia. Government-led localization programs and manufacturing incentives are attracting new rig deployments and building regional supply capabilities. Additionally, growing investment by ASEAN member countries in domestic exploration is further boosting regional drilling momentum and reinforcing the Asia Pacific’s position as the key high-growth market.

The global drilling rigs market is moderately consolidated, with leading operators such as Transocean Ltd., Nabors Industries, Valaris Limited, and Noble Corporation collectively holding an estimated 40–45% market share. These companies maintain strong competitive positions through extensive and diverse rig fleets, deep operational expertise across offshore and onshore environments, and long-standing relationships with national and international oil companies. Their ability to deliver high-performance drilling services, combined with strong safety records and global operational reach, continues to reinforce their leadership in the market.

Companies across the sector prioritize technology-driven efficiency improvements, enhanced safety systems, electrification and low-emission rig designs, and strong customer service to improve operational reliability and secure long-term partnerships. These strategic initiatives continue to support competitive positioning and enable sustained market share expansion in a recovering global drilling landscape.

The global drilling rig market was valued at US$ 91.2 billion in 2025 and is projected to reach US$ 135.3 billion by 2032, representing a CAGR of 5.8% during the forecast period.

Rising global oil and gas exploration and production activities, especially in offshore deepwater and unconventional reserves, are the primary drivers of drilling rig demand. Additionally, increasing energy consumption and investments in field development projects further accelerate rig deployment across major markets.

Jack-up Rigs command the dominant offshore segment at approximately 45% market share, driven by shallow-water suitability, cost competitiveness, rapid deployment capability, and wide geographic deployment supporting mainstream market activity.

North America dominates with 38.5% global market share, driven by U.S. shale production representing 13.644 million barrels daily, Gulf of Mexico offshore development, and established rig infrastructure supporting sustained investment.

Ultra-deepwater drilling represents the highest-value opportunity with market projected to reach US$ 11.62 billion by 2034 at 6.80% CAGR, driven by pre-salt basin development, frontier exploration, and advanced technology enabling operations exceeding 3,500 meters.

Market leaders include Transocean Ltd. (Switzerland) with extensive deepwater and ultra-deepwater rig fleet, Nabors Industries Ltd. (United States) dominating onshore drilling, and Valaris Limited (Bermuda) with diverse offshore portfolio, collectively representing approximately 40-45% market concentration.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Location

By Rig Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author