ID: PMRREP33114| 297 Pages | 20 Mar 2025 | Format: PDF, Excel, PPT* | Healthcare

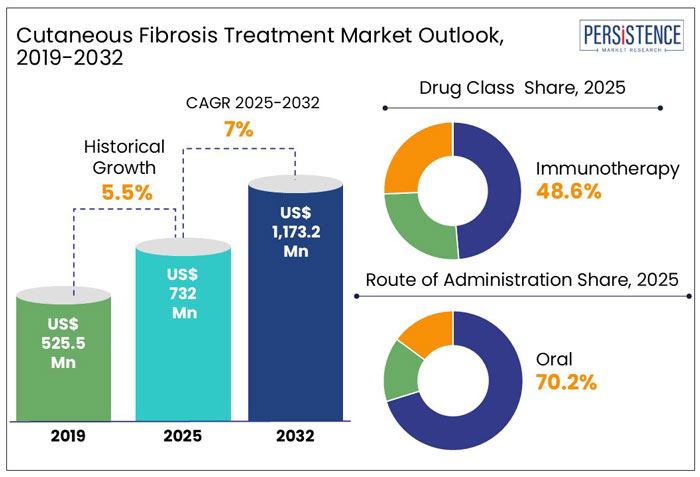

The global cutaneous fibrosis treatment market was valued at US$ 732.0 Mn in 2025, with a projected CAGR of 7.0% between 2025 and 2032, which indicates highly positive market growth.

Detailed industry analysis reveals that revenue from cutaneous fibrosis treatment will surge to a market valuation of US$ 1,173.2 Mn by the end of 2032.

In the previous decade, numerous research activities on cutaneous fibrosis treatment have been conducted to examine treatment choices and disease epidemiology, with the goal of better understanding the disease prognosis.

Although the exact incidence of cutaneous fibrosis is yet to be determined, the prevalence of related disorders, such as scleroderma and keloids, is widely known across the world. There is currently no approved treatment for cutaneous fibrosis. Since no medicine has been approved to treat cutaneous fibrosis, drug manufacturing companies are evaluating the efficacy and activity of a variety of treatments.

| Attribute | Key Insights |

|---|---|

| Cutaneous Fibrosis Treatment Market Size (2025E) | US$ 732.0 Mn |

| Market Value Forecast (2032F) | US$ 1,173.2 Mn |

| Projected Growth (CAGR 2025-2032) |

7.0% CAGR |

| Historical Market Growth (CAGR 2019 to 2024) | 5.5% |

The global market for cutaneous fibrosis treatment expanded at a CAGR of 5.5% in 2019 to 2024.

Rising cutaneous fibrosis-related disorders are likely to fuel the growth of the cutaneous fibrosis treatment market. The development of fibrosis happens naturally throughout scar formation in wound repair, or as an organic process in pro-fibrotic diseases. Connective tissue fibrosis typically occurs in indications such as keloids, scleroderma, radiation-induced skin fibrosis, and chronic graft-versus-host disease-associated (GVHD) cutaneous fibrosis.

Cutaneous fibrosis is a rather uncommon condition. Due to a lack of understanding among healthcare professionals and the general public, cutaneous fibrosis diagnosis and treatment are usually delayed. Scleroderma and other cutaneous fibrosis-related illnesses are more common in those over the age of 35.

High prevalence and incidence rate of systemic scleroderma disease over the world, is driving cutaneous fibrosis treatment market growth.

Systemic sclerosis treatment had previously been limited to off-label usage of generic drugs from other indications; however, lately, there has been a substantial shift in the market for this condition.

Novel therapeutics for the treatment of cutaneous fibrosis conditions are being developed by several researchers and sponsors.

With more drugs in the pipeline and launching stages, the cutaneous fibrosis treatment market will see decent growth over the coming years.

“Availability of Novel Treatment Options for Cutaneous Fibrosis”

Lack of approved medicines for the treatment of skin diseases represents a major chance for revenue generation within the international market. A relatively giant patient pool in developed countries and an identical patient pool in developing countries is probably going to provide significant revenue generation opportunities.

Although cutaneous fibrosis treatment awareness in developing countries remains severely limited, and the illness is frequently left untreated due to a lack of awareness and the inconvenience of treatments, increasing cutaneous fibrosis treatment awareness within the scleroderma therapeutics market space is being seen.

Knowledge about epidemiology, treatment approach, and diagnostic tests is increasing worldwide, which is, in turn, expected to boost revenue generation. Growing diagnostics in developing countries offer great opportunities for the sale of cutaneous fibrosis treatment drugs in these regions.

“Limited Treatment Options Hurting Market Expansion”

Fibrotic diseases, including cutaneous fibrosis, present significant unmet medical needs due to the lack of approved treatments. Currently, symptomatic management remains the only available option, which does not halt disease progression. If left untreated, cutaneous fibrosis worsens over time, leading to severe complications.

Symptomatic treatment also faces challenges such as low patient compliance, reducing the treatment-seeking rate and negatively impacting the quality of life. These factors hinder market growth.

Furthermore, epidemiological data on cutaneous fibrosis is scarce, often extrapolated from related diseases. This limited data contributes to low disease awareness, particularly in developing regions, where conditions like keloids are frequently overlooked.

The absence of novel therapeutic approaches further restricts effective treatment. Factors such as delayed diagnosis, slow disease progression, and a lack of targeted treatment options continue to pose significant barriers to market expansion.

Why are Cutaneous Fibrosis Treatment Providers Targeting the U.S. Market?

“Frequent FDA Approvals in the U.S. Market”

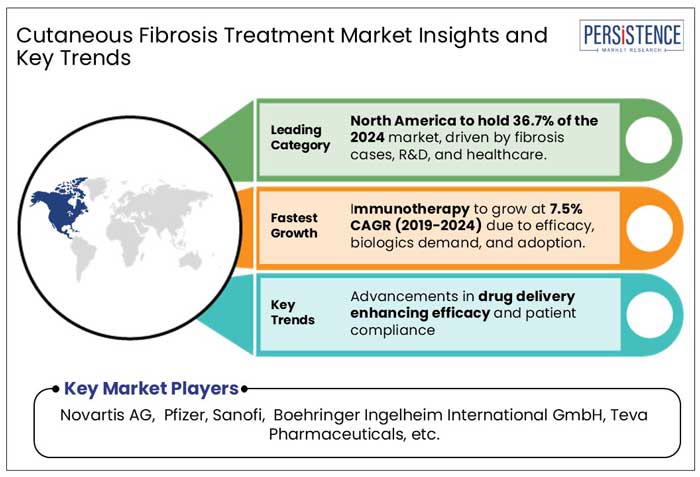

North America held a market share of 36.7% by value in the global cutaneous fibrosis treatment market in 2021, of which, the U.S. accounted for a market share of 88.5%. Higher rates of approval by the U.S. FDA lead to added product launches, making the U.S a high revenue-generating country.

How is Demand for Cutaneous Fibrosis Treatment Shaping Up in Germany?

“Presence of Leading Cutaneous Fibrosis Treatment Drug Manufacturers in Germany”

Europe accounted for 25.8% of the market share in 2024. This high market share is attributed to the presence of several large industry players in European countries like Germany, UK, and Italy, which increases product availability in the region.

With Germany, the United Kingdom, and Italy have the highest rates of systemic scleroderma. The European cutaneous fibrosis treatment market is driven by the high rate of treatment and diagnosis, as well as invested healthcare expenditure.

Why is China Emerging as a Prominent Market for Cutaneous Fibrosis Treatment?

“High Level of Research Activities Ongoing in China”

East Asia contributed 20.1% to the market in 2024. Development of medical infrastructure and strategic planning to collaborate for expansion are key factors that are set to have a positive impact on the growth of this industry in China.

Moreover, with established studies on the global burden of the disease, compiled with the estimates of the burden of skin diseases in China (due to lack of availability of original data), incidence of cutaneous fibrosis as well as related indications within the country present lucrative growth opportunities for market players.

Which Cutaneous Fibrosis Treatment Drug Class is Driving High Market Growth?

“Positive Treatment Outcomes through Immunotherapy Drugs”

By drug class, immunotherapy drugs accounted for a revenue share of 48.6% in 2024.

Immunotherapy drugs, through several available clinical studies, have provided positive outcomes in the treatment of skin, joint, and hand function. Several techniques such as autologous stem cell transplantation have displayed enhanced therapeutic efficiency on the skin, and are set to augment the sales of immunotherapy drugs in the cutaneous fibrosis treatment market.

Which Indication Accounts for Most Demand for Cutaneous Fibrosis Treatment?

“Higher Prevalence Rate of Scleroderma Globally”

Scleroderma accounted for a revenue share of 65.8% in 2024, with the segment projected to hold on to this high market share through 2032 at a CAGR value of 7.0%.

Rising prevalence of systemic scleroderma across the globe is due to several external and internal factors such as genetics, environmental, immune system issues, and others.

The U.S. experiences a high incidence rate of systemic scleroderma across the country, followed by Australia, Europe, and Asia. High prevalence rate of scleroderma and associated indications will promote the growth of the cutaneous fibrosis treatment market over the forecasted years.

Which Route of Administration is Preferred for Cutaneous Fibrosis Treatment?

“Oral Route Continues to Remain Most Preferred”

The oral segment, by route of administration, is driving demand in the market and accounted for 70.2% market share in 2024.

Medication is commonly administered orally since it is the most comfortable and convenient method for patients. Orally-administered medication has a slower onset and a longer, but less potent effect than medications given in other ways. Oral medication is the most common route of drug administration due to its varied benefits.

Manufacturers of cutaneous fibrosis treatment drugs are concentrating their efforts on obtaining regulatory approvals and launching new products to expand their market position.

The market is estimated to increase from US$ 732.0 Mn in 2025 to US$ 1,173.2 Mn in 2032.

The global market is driven by the rising prevalence of various skin conditions, advancements in regenerative therapies, increased research funding, and growing demand for targeted antifibrotic drugs.

The market is projected to record a CAGR of 7.0% during the forecast period from 2025 to 2032.

Novartis AG, Pfizer, Sanofi, Boehringer Ingelheim International GmbH, Horizon Therapeutics USA, Inc., Bristol-Myers Squibb Company, among others are the few leading players

By Drug Class, Immunotherapy is expected to register the fastest CAGR of 7.5% through 2032.

|

Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn |

|

Geographical Coverage |

|

|

Segments Covered |

|

|

Key Companies Covered |

|

|

Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

Cutaneous Fibrosis Treatment Market by Drug Class:

Cutaneous Fibrosis Treatment Market by Route of Administration:

Cutaneous Fibrosis Treatment Market by Indication:

Cutaneous Fibrosis Treatment Market by Distribution Channel:

Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author