ID: PMRREP22069| 183 Pages | 20 Jun 2025 | Format: PDF, Excel, PPT* | Food and Beverages

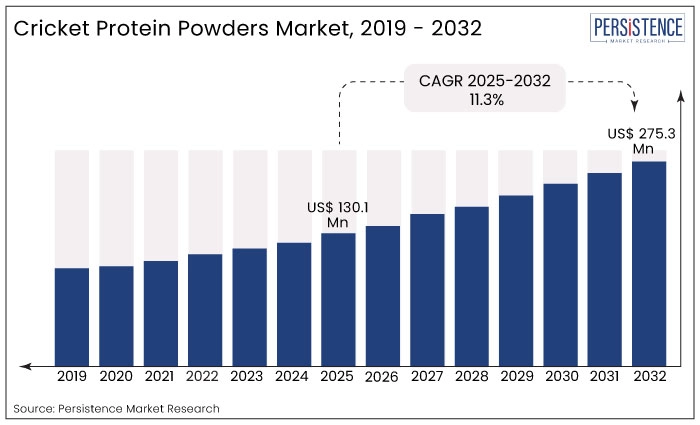

The global cricket protein powders market is estimated to grow from US$ 130.1 million in 2025 to US$ 275.3 million by 2032. The market is projected to record a CAGR of 11.3% during the forecast period from 2025 to 2032.

The consumer appetite for cricket protein is rising due to its high protein content and sustainability. Crickets are an environmentally benign source of protein, as they consume 90% less land, 80% less feed, and emit 80% fewer greenhouse gases.

Protix, a leading producer of insect protein, for example, introduced cricket-based protein powders in October 2023, aiming to enhance functional food applications. The U.S. Food and Drug Administration (FDA) also approved cricket powder for human consumption in the U.S. in June 2023, addressing regulatory challenges. High demand for sustainable protein solutions in energy bars, snacks, and pet food indicates exponential growth potential.

Key Industry Highlights

|

Market Attributes |

Key Insights |

|

Cricket Protein Powder Market Size (2025E) |

US$ 130.1 Mn |

|

Market Value Forecast (2032F) |

US$ 275.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

11.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.7% |

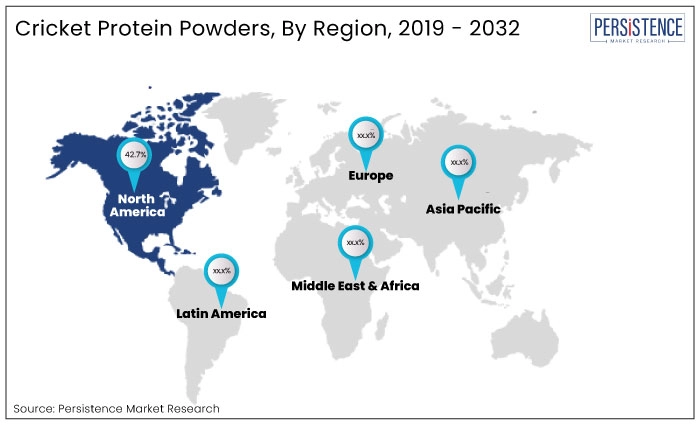

In 2025, North America is set to control around 42.7% of the global cricket protein powders market. This is owing to developments in food technology, fitness fads, and rising consumer awareness of sustainable protein sources.

North America's cricket protein market is anticipated to register a CAGR of 9.2% from 2025 to 2032, driven by its increasing acceptance in mainstream food and beverage applications. The U.S. plays a pivotal role, with companies like Aspire Food Group and Exo Protein extending operations and launching new products. For instance,

Increased research and development and consumer education campaigns are driving market penetration.

In 2025, Europe is likely to hold around 33% of the global market share, driven by consumer demand for sustainable protein alternatives and an increase in flexitarian and plant-based diets. Europe is supporting sustainable food production, with countries such as the U.K., Germany, and the Netherlands leading the way in the use of cricket protein in food and drinks, owing to government efforts and laws.

Europe is further anticipated to record a CAGR of 8.5% between 2025 and 2032. Companies in the region are focusing on developing innovative products like cricket protein bars and snacks to meet the rising demand for health-conscious and sustainable food. For instance,

In 2025, regular cricket protein powder is projected to lead the global market, accounting for 75% share. This is due to its high versatility and ability to blend with various food and beverages. Its neutral taste makes it ideal for sports nutrition, baked goods, protein bars, and shakes. Innovations in processing technology are enhancing the texture and usability of regular-flavored protein powders. For instance,

Growing demand for clean-label and sustainable products has solidified regular flavor as a staple in cricket protein formulations.

In 2025, the conventional cricket protein powder segment is set to hold an 82% market share. This is due to its cost-effective production methods, widespread availability, and ease of integration into several food and beverage applications.

Conventional cricket protein powder finds extensive use in snacks, dietary supplements, and sports nutrition products. It appeals to a broad consumer base seeking affordable yet nutrient-dense protein alternatives.

Insect farming and processing technologies have boosted growth of the cricket protein segment, with companies extending production facilities to meet global demand. Government support in North America and Europe is facilitating research and development into cricket-based products, enhancing market penetration.

Growing consumer interest in sustainable and environmentally friendly protein substitutes, especially among vegetarians and flexitarians, is driving demand for cricket protein powder. Cricket protein, rich in essential amino acids, vitamins, and minerals, has found applications in sports nutrition, dietary supplements, and functional foods. For example,

Innovations in the food and beverage industry are driving market growth across the globe. For instance,

Insect farming technologies like vertical farming and automated processing are improving production efficiency and taste, thereby pushing consumer acceptance in Western markets.

The global cricket powder market recorded a CAGR of 8.7% in the historical period from 2019 to 2024. Demand for cricket protein powders is anticipated to rise gradually as more people become aware of its advantages. As manufacturers raise money for growth plans, the market is anticipated to gain from the rising need for alternative protein sources.

As demand for nutrient-dense, sustainable, and health-promoting cricket protein rises, investors are supporting start-ups. The market is anticipated to gain from the trend of eating more protein, and rising production worldwide might result in lower pricing.

Insect-based start-ups are flourishing in Latin America’s nations, suggesting that the industry may be rising. The market is anticipated to be driven by increased consumption of cricket protein powder as consumer food tastes continue to be dominated by health and nutrition. For example,

Demand for insect protein powders is estimated to record a considerable CAGR of 11.3% during the forecast period between 2025 and 2032.

The high-quality protein, essential amino acids, omega-3 and omega-6 fatty acids, and micronutrients like iron, calcium, and B12 found in cricket protein powder make it a popular choice for sports nutrition. This is because it offers a nutrient-dense and sustainable substitute for conventional protein sources. For instance,

Since cricket protein takes less land, water, and energy to manufacture compared to whey or plant-based proteins, it is becoming popular among athletes.

The use of cricket protein powder is rising in popularity as customers across the world look for sustainable dietary options. For example,

Cricket protein is in line with these ideals, providing a remedy for ailments like asthma and thyroid disorders connected to poor air and water quality. For instance,

The promotion of cricket-based goods by Entomo Farms and Chapul as wholesome and eco-friendly is making these well known. This suggests a change in the way that people across the world consume protein.

Strategic marketing efforts and educational initiatives are required to redefine mindsets and cultural biases to overcome consumer reluctance and acceptance of cricket protein powder. Profitability and competitive pricing in the market depend on controlling the high manufacturing costs.

Achieving economies of scale, enhancing agricultural methods, and streamlining production procedures are a few strategies. Initiatives to reduce costs are also necessary to assure competitive prices in the market and lessen the effect of production-related issues on total profitability.

As evidence of its widespread use of this sustainable protein source, the bakery and snacks sub-segment is set to hold 32.4% of the worldwide cricket protein powders market share in 2025. Health-conscious customers are drawn to cricket protein's high nutritional content, which includes vital amino acids, vitamins, and minerals. As a result, protein-enriched baked goods and functional snacks have become more popular. For example,

In order to increase market share and bolster sustainability, insect protein firms are accelerating growth via research and development, collaborations, and acquisitions. They are also tackling issues with flavor, texture, and functioning. For instance,

The cricket protein powders market is competitive and dynamic, with well-established enterprises and forward-thinking start-ups. Competition increases as customers learn about sustainable protein sources and nutrient-dense substitutes. Improvements in supply chain efficiency, innovative product creation, and successful branding tactics are important elements that contribute to the dynamic economy.

Key market players create unique recipes and taste profiles to differentiate themselves from competitors. They offer diverse product variations to meet dietary needs and preferences. Through creative promotional tactics and understanding consumer demand, they aim to attract health-conscious individuals seeking protein-rich options that align with their lifestyles, capturing their attention.

Key Industry Developments:

The global Cricket Protein Powder market is projected to be valued at US$ 130.1 Mn in 2025.

Rising Consumer Preference for Sustainable Diet Influences the Demand for Cricket Protein Powder.

The Global Cricket Protein Powder market is poised to witness a CAGR of 11.3% between 2025 and 2032.

Start-ups are investing in research and development activities to expand their global presence, presenting a key market opportunity.

Major players in the Global Cricket Protein Powder market include Cricket Flours LLC, Entomo Farms, JR Unique Foods Ltd., Protanica Co. Ltd., Chapul Cricket Protein, Exo Inc., and others

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Nature

By Form

By End User

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author